_located_on_the_Davis-Monthan_Air_Force_Base_in_Tucson%2C_Ariz.jpg/220px-thumbnail.jpg)

When do I enter the coverage gap for Medicare Part D?

Once you and your plan have spent $4,020 on covered drugs in 2020, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What is a Medicare Part D donut hole or coverage gap?

You will enter your 2022 Medicare Part D prescription drug plan's Donut Hole or Coverage Gap if the retail value of your formulary drug purchases exceeds your plan's Initial Coverage Limit (ICL) .

What is the final phase of Medicare Part D coverage?

Once you reach the $6,350 threshold in 2020, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastrophic coverage phase, you only pay a small coinsurance or copayment for your covered prescription drugs for the remainder of the year. Do all Medicare Part D plans have a donut hole?

What is a Medicare drug plan coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs.

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Is the Medicare Part D donut hole going away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Is the Medicare Part D donut hole going away?

Key Takeaways. The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

What will the donut hole be in 2022?

$4,430For example, in 2022 the coverage gap — or donut hole — begins once you reach your plans Part D initial coverage limit of $4,430 in prescription costs. While you're in the coverage gap, you'll pay 25% coinsurance for covered generic drugs and 25% coinsurance for covered brand-name drugs.

Does the donut hole reset each year?

While in Catastrophic Coverage you will pay the greater of: 5% of the total cost of the drug or $3.95 for generic drugs and $9.85 for brand-name drugs. You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

Will there be a Medicare donut hole in 2022?

Q: Are there changes in the Medicare Part D prescription drug coverage for 2022? A: Yes. The maximum deductible will be slightly higher, and the upper and lower thresholds for the “donut hole” will change again.

How do I avoid the Medicare Part D donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Does the donut hole go away in 2020?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs. Your coinsurance in the donut hole is lower today than in years past, but you still might pay more for prescription drugs than you do during the initial coverage stage.

How do I get out of the donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the deductible for Medicare Part D in 2022?

$480This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What is the Medicare Part D donut hole?

The Medicare Part D “donut hole” is a temporary coverage gap in how much a Medicare prescription drug plan will pay for your prescription drug cost...

What happens in the donut hole coverage gap in 2020?

Once you enter the donut hole in 2020, your Part D plan’s coverage becomes more limited. In 2020, you’ll pay no more than 25 percent of the price f...

What happens when the donut hold goes away in 2020?

Once you reach the $6,350 threshold in 2020, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastr...

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

Is the Donut hole going away?

The “donut hole” isn’t really going away, because Medicare Part D still has four payment stages. The “donut hole” is the third stage, and you move through the Part D payment stages based on how much you, your plan, and others on your behalf have paid for your drugs during the year.

Does a catastrophic plan pay for out of pocket drugs?

You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year. Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits.

When did Medicare Part D coverage gap start?

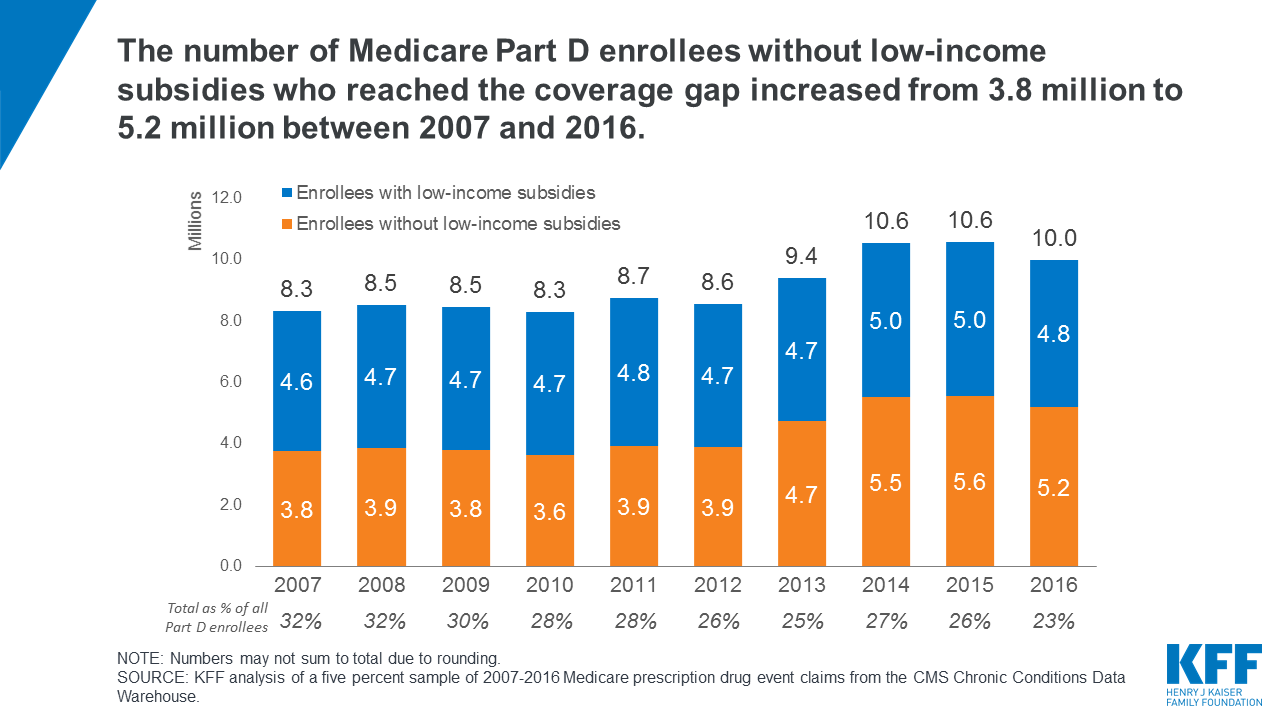

Under the original design of the Medicare Part D benefit, created by the Medicare Modernization Act of 2003, when Part D enrollees’ total drug spending exceeded the initial coverage limit (ICL), they entered a coverage gap. Enrollees who did not receive low-income subsidies ...

What is the Medicare coverage gap?

As of 2019, Medicare beneficiaries enrolled in Part D prescription drug plans will no longer be exposed to a coverage gap, sometimes called the “donut hole”, when they fill their brand-name medications. The coverage gap was included in the initial design of the Part D drug benefit in the Medicare Modernization Act of 2003 in order to reduce ...

What is the out of pocket spending threshold for 2020?

Between 2019 and 2020, the annual out-of-pocket spending threshold—the amount beneficiaries must spend before the coverage gap ends and catastrophic coverage begins—is projected to increase by $1,250. This is due to the expiration of the ACA provision that slowed the growth rate of this threshold between 2014 and 2019.

How did the ACA phase out the coverage gap?

The Affordable Care Act (ACA) included a provision to phase out the coverage gap by gradually reducing the share of total drug costs paid by non-LIS Part D enrollees in the coverage gap, from 100 percent before 2011 to 25 percent in 2020. The ACA required plans to pay a gradually larger share of total drug costs, and also required drug manufacturers to provide a 50 percent discount on the price of brand-name drugs in the coverage gap, beginning in 2011. The ACA stipulated that the value of this discount would count towards a beneficiary’s annual out-of-pocket spending.

How much did Part D drug spending increase?

With total Part D drug spending increasing over time and more non-LIS beneficiaries reaching the coverage gap, the aggregate discount that Part D enrollees have received on brand-name drugs has also increased—from $2.2 billion in 2011 to $5.7 billion in 2016.

When did the ACA require drug companies to pay a 50 percent discount on the price of brand name drugs?

The ACA required plans to pay a gradually larger share of total drug costs, and also required drug manufacturers to provide a 50 percent discount on the price of brand-name drugs in the coverage gap, beginning in 2011.

Will the BBA change the coverage gap?

There are efforts underway in Congress to modify the coverage gap changes made by the BBA, while also preventing the upcoming steep increase in the out-of-pocket spending threshold. The effort to modify the BBA changes would reallocate payer liability in the coverage gap, motivated in part by pharmaceutical industry concerns about the requirement that they provide a larger discount on brand-name drugs starting in 2019. In addition, there is some concern that the reduced share of brand-name drug costs paid by plans in the coverage gap will weaken their financial incentive to manage enrollees’ costs once they cross the initial coverage limit and enter the coverage gap phase of the benefit.

What is Medicare Part D coverage gap?

Period of consumer payment for prescription medication costs. The Medicare Part D coverage gap (informally known as the Medicare doughnut hole) is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member ...

When will the Medicare doughnut hole close?

From 2017 to 2020, brand-name drug manufacturers and the federal government will be responsible for providing subsidies to patients in the doughnut hole.

What is LIS in Medicare?

The Low-Income Subsidy (LIS), also known as "Extra Help" provides additional cost-sharing and premium assistance for eligible low-income Medicare Part D beneficiaries with incomes below 150% the Federal Poverty Level and limited assets. Individuals who qualify for the Low-Income Subsidy (LIS) or who are also enrolled in Medicaid do not have a coverage gap.

How much does Medicare pay for a donut hole?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 25% co-pay on generic drugs purchased while in the Coverage Gap (receiving a 75% discount). For example: If you reach the 2020 Donut Hole, and your generic medication has a retail cost of $100, you will pay $25. The $25 that you spend will count toward your TrOOP ...

How much is Medicare Part D 2020?

The 2020 Medicare Part D standard benefit includes a deductible of $435 (amount beneficiaries pay out of pocket before insurance benefits kick in) and 25% co-insurance, up to $6,350.

What percentage of Medicare Part D enrollees in 2007 were not eligible for low income subsidies?

The most common forms of gap coverage cover generic drugs only. Among Medicare Part D enrollees in 2007 who were not eligible for the low-income subsidies, 26 percent had spending high enough to reach the coverage gap. Fifteen percent of those reaching the coverage gap (four percent overall) had spending high enough to reach ...

What is the gap between insurance and consumer?

The gap is reached after shared insurer payment - consumer payment for all covered prescription drugs reaches a government-set amount, and is left only after the consumer has paid full, unshared costs of an additional amount for the same prescriptions.

What happens after you meet your Part D deductible?

After you meet your Part D deductible, you enter the initial coverage period. During this phase, you pay a copayment (flat fee) or coinsurance (percentage) for your covered medications. Copayment and coinsurance amounts will vary by plan. Many plans will feature different amounts for generic and brand name drugs.

When did the Medicare donut hole go away?

Did the Medicare Donut Hole Go Away in 2020? The Medicare Donut Hole closed in 2019 for brand name drugs and disappeared in 2020 for generic drugs. Learn how this may affect your Part D costs.

What happens when the donut hole goes away in 2020?

What happened when the donut hole went away in 2020? Once you reach the $6,550 threshold in 2021, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastrophic coverage phase, you only pay a small coinsurance or copayment for your covered prescription drugs for the remainder of the year.

What happened to the Medicare donut hole in 2020?

What happened in the donut hole coverage gap in 2020? The Medicare donut hole coverage gap shrunk to its final cost level in 2020. We'll explain more below about what this means for your coverage. The Medicare donut hole is one of four coverage levels (coverage periods) that are in a Part D prescription drug plan.

How can Medicare help avoid the donut hole?

Medicare beneficiaries may be able to help themselves avoid the donut hole by choosing less expensive generic drugs over brand-name drugs when possible, shopping for prescription drug discounts, buying drugs in bulk through mail-order services and utilizing Medicare Extra Help (see below).

What is the maximum deductible for Medicare 2021?

In 2021, the maximum deductible allowed by law is $445 for the year. Some Medicare prescription drug plans have a $0 deductible. After you meet your plan deductible, you enter the initial coverage period.

How much will generic drugs cost in 2021?

Once you and your plan combine to spend $4,130 for drugs during the calendar year in 2021, ...

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .

Overview

The Medicare Part D coverage gap (informally known as the Medicare doughnut hole) is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member of a Medicare Part D prescription-drug program administered by the United States federal government. The gap is reached after shared insurer payment - consumer payment for all covered prescription drugs rea…

Details

In 2006, the first year of operation for Medicare Part D, the doughnut hole in the defined standard benefit covered a range in true out-of-pocket expenses (TrOOP) costs from $750 to $3,600. (The first $750 of TrOOP comes from a $250 deductible phase, and $500 in the initial coverage limit, in which the Centers for Medicare and Medicaid Services (CMS) covers 75 percent of the next $2,000.) In the first year of operation, there was a substantial reduction in out-of-pocket costs an…

2020 Medicare Part D Standard Drug Benefit

The following table shows the Medicare benefit breakdown (including the donut hole) for 2020.

The costs shown in the table above represent the 2020 defined standard Medicare Part D prescription drug plan parameters released by the Centers for Medicare and Medicaid Services (CMS) in April 2017. Individual Medicare Part D plans may choose to offer more generous benefits but must meet the minimum standards established by the defined standard benefit.

Low Income Subsidy

The Low-Income Subsidy (LIS), also known as "Extra Help" provides additional cost-sharing and premium assistance for eligible low-income Medicare Part D beneficiaries with incomes below 150% the Federal Poverty Level and limited assets. Individuals who qualify for the Low-Income Subsidy (LIS) or who are also enrolled in Medicaid do not have a coverage gap.

To qualify for the LIS, Medicare beneficiaries must qualify for full Medicaid benefits, be enrolled i…

Impact on Medicare beneficiaries

The U.S. Department of Health and Human Services estimates that more than a quarter of Part D participants stop following their prescribed regimen of drugs when they hit the doughnut hole.

Every Part D plan sponsor must offer at least one basic Part D plan. They may also offer enhanced plans that provide additional benefits. For 2008, the percentage of stand-alone Part D (PDP) plans offering some form of coverage within the doughnut hole rose to 29 percent, up from 15 percen…

Phase-out

The Affordable Care Act (ACA), which was passed in 2010, ensured that the coverage gap or, so-called "doughnut hole", would be closing for patients on Medicare Part D. From 2017 to 2020, brand-name drug manufacturers and the federal government will be responsible for providing subsidies to patients in the doughnut hole.

In an effort to close the coverage cap, in 2010, the Affordable Care Act provided a $250 rebate c…

External links

• cms.gov, the official website of the Centers for Medicare and Medicaid Services

• Medicare.gov — the official website for people with Medicare

• How Stuff Works – Medicare