A Medicare Advantage special needs plan (SNP) caters to a group of people with specific needs. These plans often work with people who have similar or related disabilities, such as dementia, autoimmune disease, or diabetes.

Full Answer

Do Medicare Advantage plans include drug coverage?

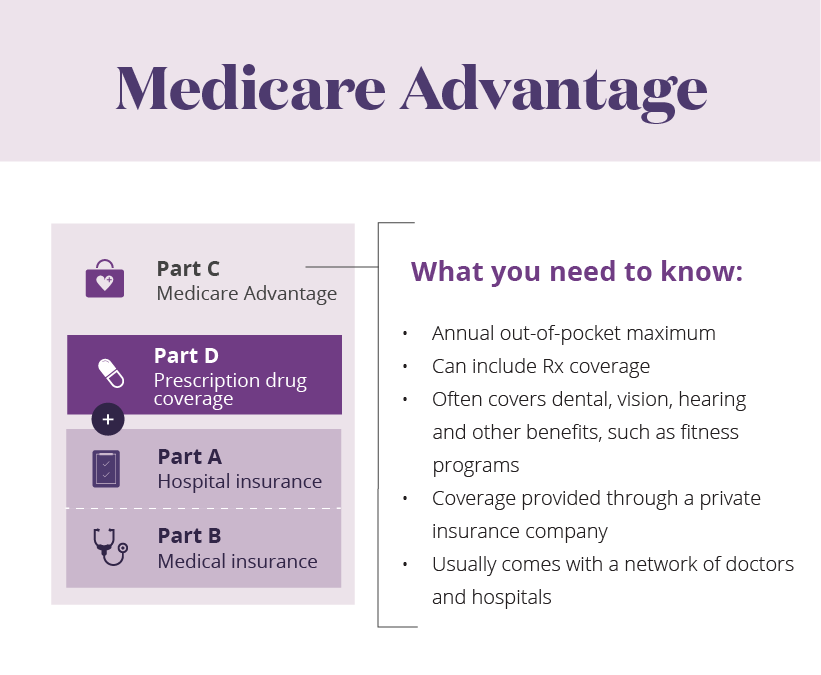

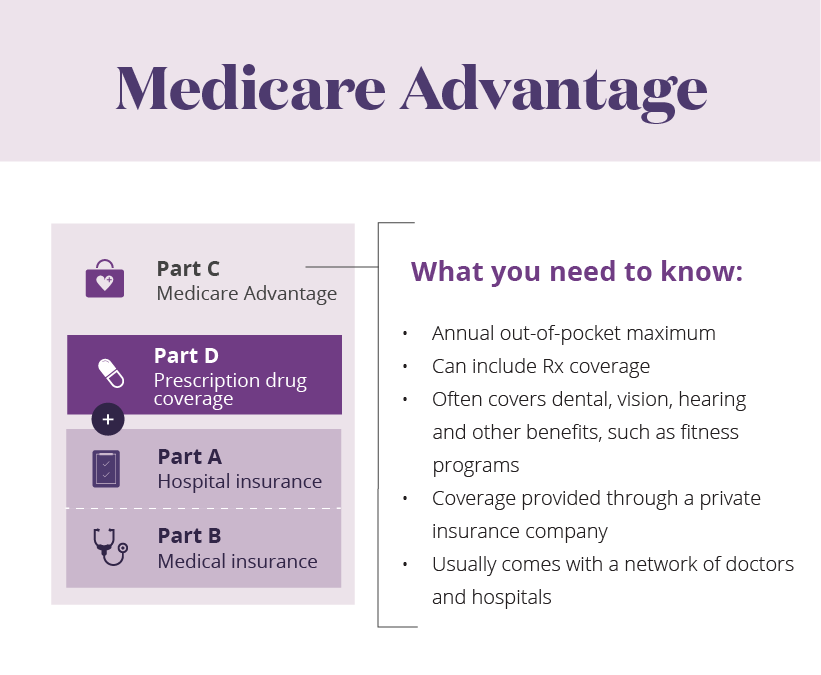

Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services.

What are the pitfalls of Medicare Advantage plans?

Pitfalls of Medicare Advantage Plans. Also known as Part C, these plans, which private insurers provide as an alternative to traditional Medicare, must provide the coverage required by Medicare at the same overall cost level. However, what they pay can differ depending upon your overall health.

What are the different types of Medicare Advantage plans?

Medicare Advantage Plans: HMO, PPO, Private Fee-for-Service, Special Needs Plans, HMO Point of Service Plans, Medical Savings Account Plans. Medical Savings Account (MSA) Plans, a type of Medicare Advantage Plan, may cover Medicare services, extra benefits, but not prescriptions.

What should I look for when choosing a Medicare Advantage plan?

Prospective Medicare Advantage customers should research plans, copays, out-of-pocket costs, and eligible providers. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B.

Why do seniors opt for Medicare Advantage?

How to contact Medicare Advantage?

What are the benefits of Medicare Advantage 2021?

What are the rules for Medicare?

What is the benefit for homebound seniors in 2021?

When does Medicare open enrollment start?

Does Medicare cover supplemental benefits?

See more

Which of the following are examples of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Who benefits most from Medicare?

People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

How popular are Medicare Advantage plans?

All that marketing seems to be working. Recently, 42 percent of Medicare beneficiaries were enrolled in Advantage plans, up from 31 percent in 2016, according to data from the Kaiser Family Foundation. Those numbers include 50 percent of Black and 54 percent of Hispanic enrollees vs. 36 percent of whites in 2018.

What benefits come with Medicare Advantage?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

What kind of health insurance do wealthy people get?

umbrella insuranceFor wealthy people, it's especially important to make sure they are fully covered, because they typically have a lot of assets to protect. As a result, many high-income people buy a special type of insurance called umbrella insurance.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

What percentage of people on Medicare have Medicare Advantage?

42 percentIn 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).

What is the difference between Original Medicare and Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What is not covered by Medicare Advantage plans?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

Does Medicare Advantage cover cataract surgery?

Medicare Advantage (MA) plans, as an alternative to Original Medicare, also cover cataract surgery. MA plans provide the same benefits as Original Medicare does, so if a service is covered under Original Medicare, in this case, cataract surgery, it is also covered under a MA plan.

Does Medicare Advantage pay Part B premium?

Medicare Advantage (MA) plans cover the benefits associated with both Medicare Part A and Part B (except for hospice care, which Part A covers) and may come with a monthly premium for coverage; however, you must also continue to pay your Part B premium.

What is Medicare Advantage?

A Medicare Advantage Private-Fee-for-Service plan with no network limitation and a low-cost stand-alone Part D plan.

How much is David's Medicare Advantage plan?

Because David's plan has an out-of-pocket maximum of $3,500 in 2021 for the year, once his out-of-pocket costs reach that number, his Medicare Advantage plan will be responsible for all the costs for the remainder of the plan year.

How much does Juanita pay for Medicare?

Juanita's monthly premium costs will be $297.50 total. Now that we have that number, let's add Juanita's two prescription drugs.

Do you have to be an AARP member to enroll in Medicare Supplement Plan?

You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Is Alexa on Medicare?

Medicare Advantage (without prescription drug coverage) Alexa just turned 65 and is retiring from her job as a banker. She lives in Hawaii and doesn’t really enjoy traveling out of the state. Alexa is very healthy. She doesn’t have any major health conditions Alexa is also a veteran and has VA benefits.

Does Medicare cover Juanita's prescription?

A Medicare supplement insurance plan covers most of Juanita's out-of-pocket costs with Original Medicare, but Juanita's prescription drug costs are not covered by her Medicare supplement insurance plan. She will have to look at the cost-sharing terms for her Part D plan to determine additional monthly out-of-pocket costs.

Does Karen have Medicare?

Karen's Medicare coverage only works for health care items and services covered by Medicare Part A and Part B. Karen will be responsible for any out-of-pocket costs that are not covered by Medicare Part A or Part B per Original Medicare cost-sharing terms.

What should prospective Medicare Advantage customers research?

Prospective Medicare Advantage customers should research plans, copays, out-of-pocket costs, and eligible providers.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

How to see how a Medicare Advantage Plan cherry picks its patients?

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

What is Medicare Supplement?

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

Why is it difficult to get urgent care?

One may have difficulty getting emergency or urgent care due to rationing.

Does Medicare Advantage plan have a $0 premium?

As this non-exhaustive list of copays demonstrates, out-of-pocket costs will quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. “The best candidate for Medicare Advantage is someone who's healthy," says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. "We see trouble when someone gets sick." 3

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Why Do People Leave Medicare Advantage Plans?

While there are many reasons someone may choose to leave their policy, we’re going to discuss the top 3 reasons beneficiaries leave their Medicare Advantage plan. Hopefully, this insight will help you during your Medicare journey.

Why do people leave Medicare?

Other Potential Reasons Beneficiaries Leave Medicare Advantage Plans. While the reasons above are the most popular reasons people leave their plans, there may be other factors. Some other common reasons to leave Advantage coverage include: Your health care services may end up costing you quite a bit more. Some Medicare Advantage plans aren’t as ...

Is Medicare Advantage financially stable?

Some Medicare Advantage plans aren’t as financially stable and end coverage unexpectedly. Emergency care may be hard to come by. Some policies have strict rules to follow to get coverage. Health care while traveling can be hard to get. Plans that provide Part D coverage may limit specific high-cost prescriptions.

Is Medicare Advantage for profit?

Researchers find that Medicare Advantage contracts with high disenrollment rates are more likely to be for-profit and small. These plans also have a disproportionate amount of low-income and disabled enrollees.

Does Medicare cover dental?

Medicare doesn’t cover dental. But, some emergency jaw services may have coverage through Medicare. Often, Medicare Advantage plans are considered “ all-in-one ” plans because they include dental and vision coverage. But, your policy may only cover preventative services. With these limits, you could end up footing the bill for dental care ...

Is Part C coverage inclusive?

Most commonly, the policy isn’t as inclusive as they thought. When you look at the surface of a Part C policy, it seems simple enough—covering things like dental, vision, gym memberships, and more. But just because it covers the services, doesn’t mean that coverage is comprehensive. Usually, it’s better to buy a policy that covers you adequately. ...

Can copays add up quickly?

The list of copays above proves that your costs can add up quickly. If you were to get seriously ill, these prices could skyrocket depending on the care you need. While you may only have a $0 premium with your Advantage plan, your costs could far outweigh that.

What is Medicare Advantage?

A Medicare Advantage private fee-for-service (PFFS) plan is private insurance. These plans are different from PPO and HMO plans in that the plan rules vary greatly from plan to plan. Each plan has its own reimbursement rates and copays. Some important things to consider include:

What is Medicare Advantage Special Needs Plan?

A Medicare Advantage special needs plan (SNP) caters to a group of people with specific needs. These plans often work with people who have similar or related disabilities, such as dementia, autoimmune disease, or diabetes. You must seek care from in-network providers unless there is an emergency, you have end-stage renal disease and need dialysis outside of the coverage area, or you travel outside of the area the plan covers and need urgent care. Some other considerations include:

What is Medicare Advantage Health Maintenance Organization?

A Medicare Advantage health maintenance organization (HMO) offers care within a network of providers. Except in certain emergency situations, you must seek care from one of the network's preferred providers. Some important things to know about these plans include:

What is a PPO plan?

A Medicare Advantage preferred provider organization (PPO) offers discounts for choosing providers within the plan's preferred provider network. In some cases, there may not be coverage for other providers until you reach your deductible. In other cases, the copay for choosing an out-of-network provider may be significantly higher. Some other important facts about PPO plans include:

What Is Medicare Advantage?

Medicare Advantage is an all-in-one plan choice alternative for receiving Medicare benefits. You may also hear it referred to as Medicare Part C. This plan is bundled with Medicare Part A and Part B and usually includes Part D, which provides prescription drug coverage. Medicare pays private insurance companies to administer the benefits of Medicare Advantage plans they sell.

How many Medicare Advantage plans are there in 2021?

adults age 65 and older. But picking the right plan can be complicated—nationwide, insurance providers offered a total of 3,550 different Medicare Advantage plans in 2021 alone [1]. What’s more, finding the right insurance plan is highly personalized to the individual. Only by providing your ZIP code and demographic information can you see a list of plans for which you’re eligible, and even then, you’re likely comparing the details of approximately 30 plans.

What is the donut hole in Medicare?

Most Medicare drug plans have a coverage gap called the “donut hole,” which means there’s a temporary limit on what the drug plan will cover. “A person gets limited coverage while in the ‘donut hole.’ whether on a Medicare Advantage plan or a separate Part D plan,” says Antinea Martin-Alexander, founder of Advocate Insurance Group in South Carolina. “The individual will pay no more than 25% of the cost of the medication in the donut hole until a total out of $6,550 in out of pocket expenses is reached. There are different items that contribute to the out-of-pocket expenses while in the donut hole: any yearly drug deductible you may have, copays for any and all your medications, what the manufacturer’s discount is on that medication and what the insurance company pays for that medication,” she says.

What is included in Aetna?

Many plans include additional benefits, such as dental, vision, hearing, lifestyle and transportation coverage, as well as coverage for certain over-the-counter health items like cold medicine. A meals program that provides prepared food after you spend time in the hospital or a skilled nursing facility to further support your recovery may also be included in coverage. With an A.M. Best rating of A and a J.D. Power ranking of 795, Aetna maintains a strong reputation for financial credibility and customer satisfaction in the insurance industry. If you live in one of the 44 states Aetna covers, consider their plans for which you’re eligible.

Does Cigna offer telehealth?

Cigna also prioritizes the availability and use of telehealth to make it easier for its customers to access the care they need. And for no extra cost, the company provides additional perks, from behavioral and emotional support services to medication therapy management to health and wellness discounts. Cigna has plans with monthly premiums and physician copays starting at $0 per month and specialist copays as low as $5 per month. Depending on your specific eligibility, you can choose from a HMO plan, PPO plan or SNP to end up with coverage that best fits your circumstances.

What happens if you use an out-of-network provider?

If you use an out-of-network provider, your costs may be higher or not covered and may go toward your out-of-pocket limit.

When does Medicare open enrollment end?

1. If you’re already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or Original Medicare during the Medicare Advantage open enrollment period, which starts on Jan. 1 and ends on March 31 annually. You can only make one switch during that time period.

What is EOB in Medicare?

The Medicare drug plan EOB includes all drugs covered by a particular drug plan. It doesn’t include information on drugs or supplies covered by Part A and/or Part B (Original Medicare) or covered by a Medicare health plan (like a Medicare Advantage Plan).

Do you need to have deductibles clearly presented?

Plan deductibles must be clearly presented, so the enrollee can track their progress toward satisfying their required deductibles. Both plan level and service category deductibles must be clearly identified.

Why do seniors opt for Medicare Advantage?

Many seniors opt for Medicare Advantage over original Medicare because of the additional benefits associated with it . Dental care, vision screenings, and hearing aids, for example, are all non-covered services under Original Medicare, whereas Medicare Advantage plans commonly pick up their tab. And supplemental benefits are making Medicare ...

How to contact Medicare Advantage?

See whether you’re eligible for Medicare Advantage supplemental benefits. Talk now with a licensed Medicare advisor at 1-844-309-3504.

What are the benefits of Medicare Advantage 2021?

These perks include masks, thermometers, and hand sanitizer. Meanwhile, in 2021: 98% of Advantage plans will offer vision plans. 94% will cover hearing services.

What are the rules for Medicare?

Here’s what that means, under Medicare rules: 1 You have at least one condition that’s either life-threatening or that significantly impairs your function; 2 You have a high risk of hospitalization or negative health consequences; and 3 You require intensive coordination for your healthcare.

What is the benefit for homebound seniors in 2021?

Meanwhile, in 2021: Benefits for homebound seniors and those with mobility issues will also be more widely available in 2021, with 57% of Advantage plans offering meal delivery (up from 23% in 2018) and 47% offering transportation to medical appointments.

When does Medicare open enrollment start?

If you are interested in pursuing these new benefits, it pays to assess your choices during the Medicare Advantage open enrollment period, which runs from January 1 through March 31. During this window, people who are already enrolled in Medicare Advantage can switch to a different Advantage plan, including one that offers the new supplemental benefits (note that only one plan change is allowed during this window, as opposed to the fall enrollment window, when multiple plan changes are allowed).

Does Medicare cover supplemental benefits?

That’s because insurers offering Advantage plans now have the flexibility to include more supplemental benefits – services that Original Medicare does not cover. Some of these new benefits relate to quality of life more so than treating an actual medical condition.