Do premiums count towards out of pocket maximum?

May 16, 2020 · The out-of-pocket maximum is also known as the out-of-pocket limit. This is the maximum amount that the policy holder will be expected to pay out-of-pocket each year. Once a person meets their maximum, your Medicare Advantage provider is responsible for paying 100 percent of the total medical expenses. Having an out-of-pocket maximum offers protection for …

Is there a cap on out of pocket for Medicare?

What is the out-of-pocket maximum for Medicare Advantage Plans? The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

Does Medicare have a standard "out-of-pocket maximum"?

Maximum out-of-pocket limit All Medicare Advantage Plans must set an annual limit on your out-of-pocket costs, known as the maximum out-of-pocket (MOOP). This limit is high but it may protect you from excessive costs if you need a lot of care or expensive treatments.

Should you buy a Medigap or Medicare Advantage plan?

Nov 21, 2018 · A Medicare Advantage out of pocket maximum is a limit on the amount you will pay out of pocket before your covered medical expenses are paid for the rest of the calendar year. In 2018, the Medicare Advantage out of pocket maximum was $6,700. Some Medicare Advantage plans may have lower out of pocket maximums, for example $4,900.

Does Medicare have a maximum out of pocket limit?

Under current rules, there is no Medicare out of pocket maximum; if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

What are the rules for Medicare Advantage?

Medicare rules allow Medicare Advantage plans to credit the following costs toward your out-of-pocket maximum: 1 Copayments or coinsurance amounts for doctor visits, emergency room visits, hospital stays, and covered outpatient services 2 Copayments or coinsurance for durable medical equipment and prosthetics 3 Copayments or coinsurance for laboratory and diagnostic imaging services 4 Copayments or coinsurance for skilled nursing facility stays 5 Copayments or coinsurance for home health care

How does Medicare Advantage work?

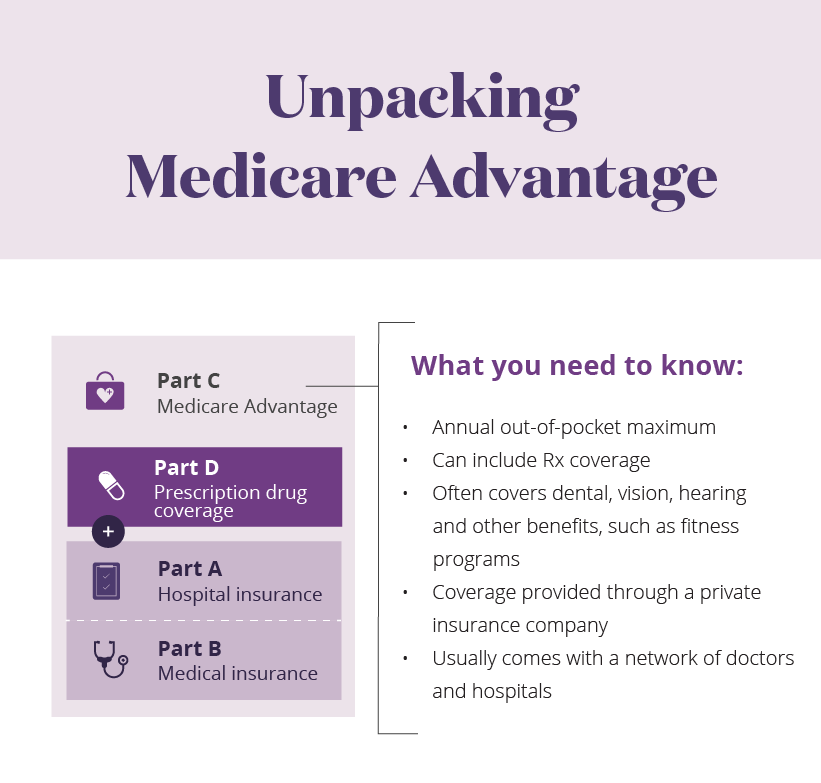

Medicare Advantage plans work differently than Original Medicare. Medicare Advantage plans are actually offered by private insurance companies approved by Medicare, and after they meet the Medicare minimum requirements for coverage, these companies are free to set their own premiums, benefits, and cost-sharing structures. ...

Is Medicare Advantage a private insurance?

Medicare Advantage plans are actually offered by private insurance companies approved by Medicare, and after they meet the Medicare minimum requirements for coverage , these companies are free to set their own premiums, benefits, and cost-sharing structures.

What is the maximum amount you can pay out of pocket for Medicare?

In 2018, the Medicare Advantage out of pocket maximum was $6,700. Some Medicare Advantage plans may have lower out ...

What are some examples of out of pocket expenses?

Examples of costs that generally count towards your out of pocket maximum would include for example: Other copayments that generally count towards your out of pocket maximum include emergency room copayments, coinsurance for X-rays and radiology, copayments for outpatient rehabilitation, and coinsurance for durable medical equipment.

What is Medicare premium?

What is a Medicare premium? A Medicare premium is amount you pay to have Medicare coverage, whether or not you use covered services. Most types of Medicare coverage may charge you a monthly premium, including Medicare Part B (Original Medicare), Medicare Part D, Medicare Supplement plans, and Medicare Advantage plans.

Do you pay Medicare Part A or B?

Most types of Medicare coverage may charge you a monthly premium, including Medicare Part B (Original Medicare), Medicare Part D, Medicare Supplement plans, and Medicare Advantage plans. Most people don’t pay a Medicare Part A premium. Some Medicare Advantage plans have monthly premiums as low as $0. If you pay more than $0, for example $104 ...

What is coinsurance in health insurance?

Any care you get out of network, including doctor visits and hospital stays. A coinsurance you pay for a prescription drug. The cost for a cosmetic procedure or other type of service not covered by your plan. Medical bills you paid in a previous year.

Is there an out of pocket maximum for Medicare?

In Medicare Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered. In Medicare Part B, you pay a monthly premium and a deductible, but there is a limit beyond that to what Medicare covers.

Does Medicare have a limit on out of pocket costs?

There is no limit on out-of-pocket costs in original Medicare (Part A and Part B). Medicare supplement insurance, or Medigap plans, can help reduce the burden of out-of-pocket costs for original Medicare. Medicare Advantage plans have out-of-pocket limits that vary based on the company selling the plan.

How much of Medicare is spent on out of pocket?

More than a quarter of all Medicare recipients spend about 20 percent of their annual income on out-of-pocket costs after Medicare reimbursements. People lower income or complex health conditions are likely to pay the most.

What is Medicare out of pocket?

Medicare out-of-pocket costs are the amount you are responsible to pay after Medicare pays its share of your medical benefits. In Medicare Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

Does Medicare cover hospitalization?

Generally, Medicare Part A covers hospitalization costs. Most people will not pay a Medicare Part A premium, as they’ve paid into the program during their working years through income taxes.

How much is Medicare Part A 2021?

Medicare Part A costs include your share of expenses for any inpatient treatments or care. In 2021, the Part A deductible is $1,484.

What is the Medicare Part A deductible for 2021?

Medicare Part A costs include your share of expenses for any inpatient treatments or care. In 2021, the Part A deductible is $1,484. Once you’ve paid this amount, your coverage will kick in and you’ll only pay a portion of your daily costs, based on how long you’ve been in the hospital.

What Is an Out-of-Pocket Maximum?

An out-of-pocket maximum, or out-of-pocket spending limit, is a predetermined amount of money that serves as your spending limit for costs such as copays, coinsurance and deductibles for covered care in a given year.

What Is the Medicare Advantage Out-Of-Pocket Maximum in 2021?

Although Medicare Advantage plans are sold by private insurance companies, they must follow certain rules and regulations set forth by the Centers for Medicare and Medicaid Services (CMS), which is the federal department that runs the Medicare program.

Do Medicare Part D Prescription Drug Plans Have an Out-Of-Pocket Maximum in 2021?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what’s called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

Medicare Supplement Insurance (Medigap) Can Help Cover Out-of-Pocket Costs

As previously mentioned, Medicare Part A and Medicare Part B do not have an out-of-pocket maximum. Technically speaking, beneficiaries who have Original Medicare coverage are responsible for a potentially very high amount of out-of-pocket costs (such as deductibles and copays) in a year.

How to Get Help With Your Coverage

Out-of-pocket maximums and other Medicare costs can sometimes be complicated and confusing. For further help understanding your Medicare expenses, call 1-800-MEDICARE (1-800-633-4227).

Understanding Medicare Advantage Premiums

Medicare beneficiaries have to pay a premium for Part B medical insurance. Those who choose Medicare Advantage also have to pay premiums. The monthly cost of premiums depends on the specific plan you choose, as well as the type of plan.

Medicare Advantage Out-of-Pocket Maximums

Each Medicare Advantage plan must cap the amount a person pays annually for covered services. This figure is different from a deductible. A traditional health insurance deductible is the amount you must pay before some coverage kicks in. An out-of-pocket maximum prevents you from paying excessive medical costs. Some states set specific limits.

What is Medicare premium?

A premium is the amount you pay monthly or annually to have the plan, whether or not you receive services. Some Medicare Advantage plans have premiums as low as $0 but you must continue to pay your Medicare Part B premium.

What is a deductible for Medicare?

A deductible is the amount you must pay out of pocket for health care before your plan begins to pay. For example, if your deductible is $1,000, you could pay $1,000 out of pocket before you plan begins to cover your health care costs. Some Medicare Advantage plans have $0 annual deductibles.

Does Medicare Advantage cover hospice?

Medicare Advantage plans must cover everything that Original Medicare (Part A and Part B) cover with the exception of hospice care, which is still covered by Part A. Unlike Original Medicare, Medicare Advantage plans have out of pocket limits, capping what you spend yearly on covered medical services. Medicare Advantage plans may save you money ...

What is coinsurance and copayment?

Coinsurance and copayment is the amount you pay every time you see a doctor or use a service. Coinsurance is usually a percentage and a copayment is a set dollar amount. For example, you could pay a $15 copayment every time you visit the doctor.

Does Medicare have an out-of-pocket limit?

FYI: It's true that Original Medicare Part A and Part B do not have a limit on how much a beneficiary can spend out-of-pocket. However, those who have a Medigap policy (Medicare supplement insurance) don't have to worry.

What is the maximum amount you can pay for PPO?

PPO plans also have a limit of $11,300 in- and out-of-network combined. Only Medicare-covered services count toward the out-of-pocket limit. Services not usually covered by Medicare, such as hearing, vision, and non-emergency transportation, and prescription medications are not counted in the limit.

Can you enroll in Medicare Advantage if you have kidney disease?

For the first time, those diagnosed with end-stage renal disease (ESRD) or kidney failure will be able to enroll in a Medicare Advantage plan. Previously, if someone who had elected Medicare Advantage was diagnosed with ESRD, he could continue with the coverage. However, those with the condition could not enroll in a plan.

Does Medicare cover vision?

Only Medicare-covered services count toward the out-of-pocket limit. Services not usually covered by Medicare, such as hearing, vision, and non-emergency transportation, and prescription medications are not counted in the limit. Each plan determines its maximum out-of-pocket limit and the limit can change every year.

What is 20% coinsurance?

Any policy sold in the country covers the 20% Part B coinsurance. Plus, optional benefits can protect a beneficiary from other costs, such as the hospital deductible and skilled nursing facility copayment for days 21-100.

Is Medicare a national insurance?

Medicare is a national health insurance program that covers millions of people and involves an even greater number of healthcare providers and services. Its size alone invites confusion and misinformation. Find out if you can identify Medicare fact from fiction.