HSA Eligibility for Spouses of Medicare Enrollees Because HSA eligibility is determined on the individual level, an individual’s enrollment in Medicare would not affect his or her spouse’s eligibility to establish and contribute funds to his or her spouse’s HSA, even if both spouses are enrolled in the same non-Medicare plan. For example, Spouse 1 and Spouse 2 are enrolled in an HSA-

What happens to my HSA if my spouse has Medicare?

A spouse may continue with their HSA while the other spouse has Medicare, without penalty. Anyone, not just the employer, can contribute to the active HSA account, up to the IRS allowed limits. You both can make contributions to the HSA account despite one spouse having government-funded health insurance.

Can a married couple have a joint HSA account?

HSA Rules for Married Couples Spouses are prevented from having joint HSA accounts (even if the spouses are covered by the same HSA-eligible HDHP). Only one spouse can be listed as the account holder for a given HSA, even though that spouse’s HSA may be used to reimburse the medical expenses of either spouse.

Can I have a health savings account with Medicare?

Unfortunately, some restrictions come along with having a Health Savings Account with Medicare. HSA is only for those enrolled in a high-deductible plan. Since Medicare is not considered an HDHP, enrolling makes you ineligible to contribute to an HSA. Once you enroll in Medicare, it’s illegal to continue to contribute to a Health Savings Account.

How much can I contribute to my spouse's HSA?

But beginning in the year that an HSA-eligible spouse turns age 55, he or she can make a $1,000 catch-up contribution annually. But your spouse must open his or her own Health Savings Account. You or anyone else can contribute to your spouse's account, but you can't make deposits through pre-tax payroll deductions from your paycheck.

Can I use my HSA for my spouse who is on Medicare?

Yes, being eligible to contribute to the HSA is determined by the status of the HSA account holder not the dependents of the account holder. Your spouse being on Medicare does not disqualify you from continuing contributions to the HSA up to the family limit, even if they are also covered by the HDHP.

Can I contribute to my HSA if I'm on Medicare?

Yes. If you are eligible for Medicare but do not actually enroll, you can continue to contribute to your HSA. Once you enroll in any part of Medicare, you will no longer be eligible to contribute to your HSA. Even enrolling in Part A alone will disqualify you from depositing to your HSA.

What happens to my HSA account when I go on Medicare?

Although you can't make any more contributions to your HSA once you're enrolled in Medicare, your HSA will continue to provide tax-free funds to cover medical costs until you use up all the money in your account. You also have the option to use your HSA funds as a regular retirement account after you turn 65.

Can I have an HSA if my spouse has insurance?

My spouse and I have family coverage, can we both open an HSA? Yes. You may both open an HSA however, the total amount that may be contributed to your HSAs is still the contribution limit.

Can I enroll in an HSA if I have Medicare Part A?

If you enroll in Medicare Part A and/or B, you can no longer contribute pre-tax dollars to your HSA. This is because to contribute pre-tax dollars to an HSA you cannot have any health insurance other than an HDHP.

Can you have an HSA account after age 65?

At age 65, most Americans lose HSA eligibility because they begin Medicare. Final Year's Contribution is Pro-Rata. You can make an HSA contribution after you turn 65 and enroll in Medicare, if you have not maximized your contribution for your last year of HSA eligibility.

When should you stop contributing to HSA?

Under IRS rules, that leaves you liable to pay six months' of tax penalties on your HSA. To avoid the penalties, you need to stop contributing to your account six months before you apply for Social Security retirement benefits.

How much can a married couple contribute to an HSA in 2021 over 55?

Spouses with individual HDHPs can contribute up to $3,600 in 2021. If the individual is age 55 or older, an additional $1,000 catch-up contribution can also be contributed. See Catch-up Contributions to learn more.

Who is not eligible for an HSA?

Must be 18 years of age or older. Must be covered under a qualified high-deductible health plan (HDHP) on the first day of a certain month. May not be covered under any health plan that is not a qualified HDHP.

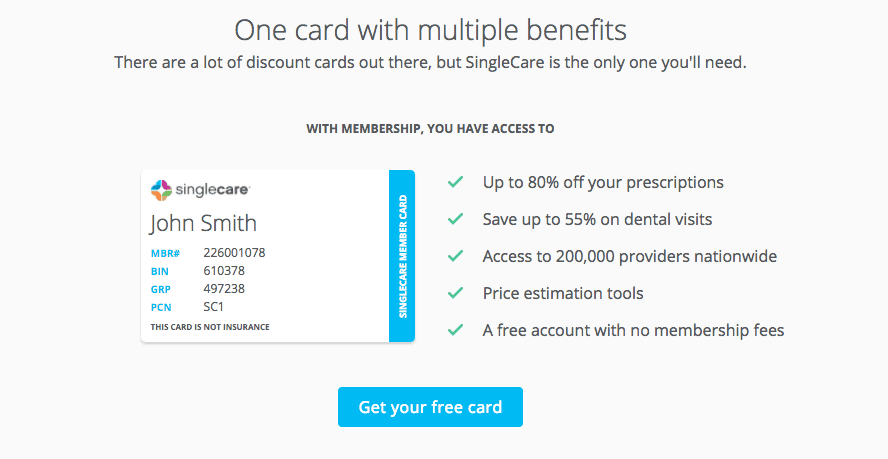

What is a health savings account?

A Health Savings Account is a savings account in which money can be set aside for certain medical expenses. As you get close to retiring, it’s essential to understand how Health Savings Accounts work with Medicare.

What is HSA 2021?

Medicare and Health Savings Accounts (HSA) Home / FAQs / General Medicare / Medicare and Health Savings Accounts (HSA) Updated on June 9, 2021. There are guidelines and rules you must follow when it comes to Medicare and Health Savings Accounts. A Health Savings Account is a savings account in which money can be set aside for certain medical ...

What is the excise tax on Medicare?

If you continue to contribute, or your Medicare coverage becomes retroactive, you may have to pay a 6% excise tax on those excess contributions. If you happen to have excess contributions, you can withdraw some or all to avoid paying the excise tax.

Can you withdraw money from a health savings account?

Once the money goes into the Health Savings Account account, you can withdraw it for any medical expense, tax-free. Additionally, you can earn interest, your balance carries over each year, and this can become an investment for a retirement fund. Unfortunately, some restrictions come along with having a Health Savings Account with Medicare.

When does family HSA coverage start?

Family coverage begins on the 2nd of the month. Not eligible to contribute for that month, but can contribute going forward. Note that they have the option to make this up this missed month using the Last Month Rule . In all of the above examples, HSA coverage exists but due to other factors, the individual has a $0 contribution limit ...

Is a child a dependent on HSA?

Child is a dependent. Husband and wife have HSA eligible insurance. Wife has an FSA at work, which also covers the spouse, violating the “Other coverage” clause. (Note – in 2018 there was legislative discussion of changing this FSA rule.) Family coverage begins on the 2nd of the month.

Can a wife contribute to an HSA if she has only one child?

If only the wife and child are covered by the HSA insurance, a strange situation develops since the wife is not HSA eligible. Based on the IRS rules in Form 969, at least one eligible individual is required to contribute to the HSA:

Can Medicare affect HSA?

Note that Medicare can retroactively affect your HSA coverage. Either way, the IRS test for contribution is called HSA eligibility. It contains 4 rules which are: If any of the above are violated, the individual is not HSA eligible and they cannot open or contribute to an HSA.

Can adult children fund HSA?

Of course, they would need those funds, or you would need to contribute it for them. Note that this is the scenario discussed in Your Adult Children can Fund their HSA. However, note that the parent’s could not fund the HSA in this scenario.

Can a child contribute to HSA if they are not 55+?

If child is an eligible individual, family contribution applies (no 55+) but must go into eligible individual’s (child’s) HSA. If child is not an eligible individual, no contribution limit seems to apply.

Why is it important to have a health savings account?

Health savings accounts can be an effective way to invest in the future. They decrease your overall tax burden and allow you to invest and grow your savings. It can be especially important to have these funds available once you retire and are more likely to have a fixed income.

What is an HSA account?

Health savings accounts are one way to put aside money for any medical expenses you may have now or in the future. This includes future Medicare out-of-pocket expenses. Not everyone is eligible for an HSA. First and foremost, you must be enrolled in a qualifying high-deductible health plan.

What are non-Medicare expenses?

Non-Medicare expenses that qualify include premiums for long-term care insurance and over-the-counter medications (but only if you get a written prescription for them). 2 Keep in mind that monthly premiums for Medicare Supplement plans do not qualify under HSA rules.

How long do you have to fund your HSA before you sign up for Medicare?

For this, you need to understand the Medicare calendar . You become eligible for Medicare when you turn 65 years old (enrollment starts three months before and ends three months beyond your birth month).

How long do you have to sign up for Medicare if you leave your job?

You can delay Medicare enrollment using the Special Enrollment Period if your employer hires at least 20 full-time employees. In that case, you have eight months to sign up for Medicare from the time you leave your job or lose your employer-sponsored coverage, whichever comes first.

How long does it take to get Medicare if you are on Social Security?

Likewise, someone who is on Social Security Disability Insurance (SSDI) will be automatically enrolled in Medicare after 24 months (2 years). Everyone else has to apply for Medicare on their own. Although Medicare eligibility begins at 65 years old, the current retirement age for Social Security is 67.

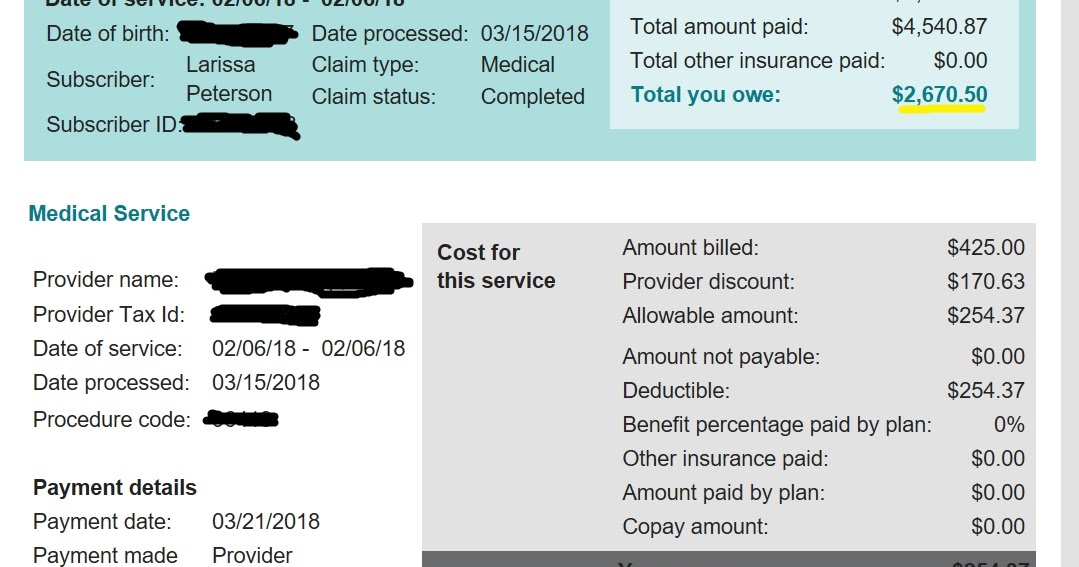

How much did Medicare cost in 2016?

Medicare costs add up quickly. An analysis by the Kaiser Family Foundation noted that the average Medicare beneficiary spent $5,460 out of pocket for health care in 2016. 1 .