| Total Medicare beneficiaries • Aged • Di ... | 61.2 million • 52.6 million • 8.7 millio ... |

| Part A (Hospital Insurance, HI) benefici ... | 60.9 million • 52.2 million • 8.7 millio ... |

| Part B (Supplementary Medical Insurance, ... | 56.1 million • 48.2 million • 7.9 millio ... |

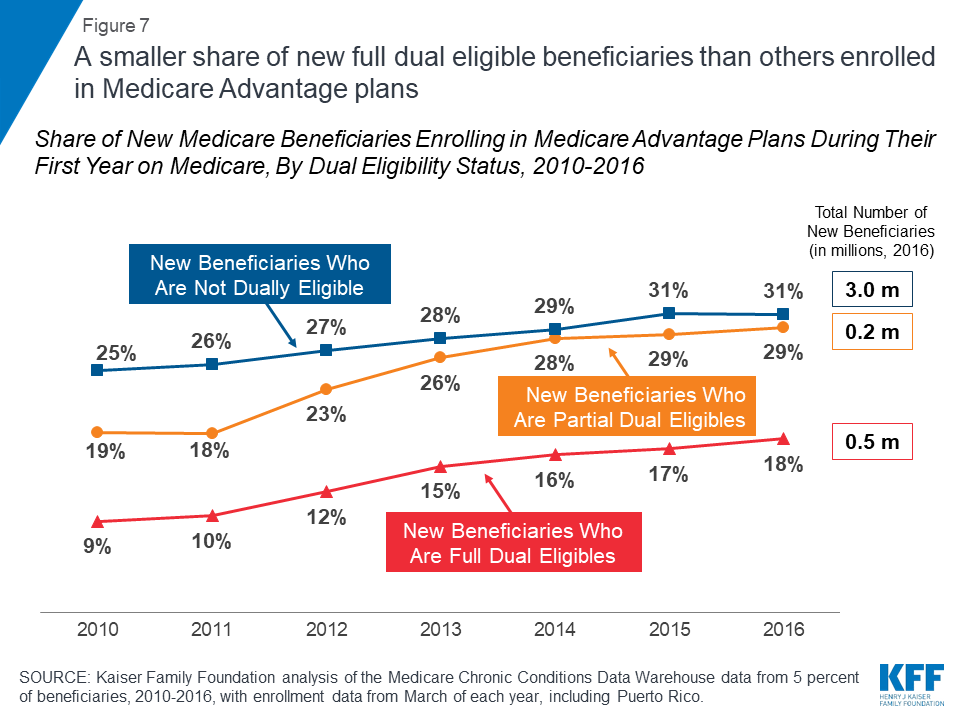

| Part C (Medicare Advantage) beneficiarie ... | 22.2 million |

| Part D (Prescription Drug Benefit) benef ... | 47.2 million |

What is beneficiaries Services Medicare?

Beneficiary Services Medicare is a health insurance program designed to assist the nation's elderly to meet hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

What happens if a Medicare beneficiary has other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What is covered under Medicare Part A?

Medicare covers many health services, including inpatient and outpatient hospital care, physician services, and prescription drugs (Figure 2). Medicare benefits are organized and paid for in different ways: Part A covers inpatient hospital stays, skilled nursing facility (SNF) stays, some home health visits, and hospice care.

How many Medicare beneficiaries are exposed to Medicare’s cost-sharing requirements?

These 6 million beneficiaries are fully exposed to Medicare’s cost-sharing requirements and lack the protection of an annual limit on out-of-pocket spending, unlike beneficiaries enrolled in Medicare Advantage.

Does Medicare cover beneficiaries?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

What does Medicare Part A cover for beneficiaries?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Are most Medicare beneficiaries automatically enrolled?

Original Medicare enrollment Most Medicare beneficiaries are automatically enrolled in Original Medicare, Part A and Part B. You're generally enrolled automatically the month you turn 65 if you're receiving Social Security Administration (SSA) or Railroad Retirement Board (RRB) benefits.

Does Medicare cover family members?

Medicare is individual insurance, not family insurance, and coverage usually does not include spouses and children. Unlike other types of insurance, Medicare is not offered to your family or dependents once you enroll. To get Medicare, each person must qualify on their own.

Whats the difference between Medicare Part A and B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

What part of Medicare is automatic?

Part BYou automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Does everyone automatically get Medicare Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

In which two parts of Medicare is enrollment generally automatic?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

Can I add someone to my Medicare?

On your homepage, select My card. You'll see your current Medicare card. Select Add someone to my card. You'll see information about how we can help people with family and domestic violence concerns.

Is Medicare only individual or family?

individual planMedicare is an individual plan (there is no family plan). However, you may be eligible for Medicare based on your spouse's work history -- even if you are not eligible on your own. You and your spouse's Medicare coverage might not start at the same time.

Can a Medicare plan have dependents?

Medicare is individual insurance, not family insurance, and coverage usually does not include spouses and children. Unlike other types of insurance, Medicare is not offered to your family or dependents once you enroll. To get Medicare, each person must qualify on their own.

What happens when Medicare beneficiaries have other health insurance?

When a Medicare beneficiary has other insurance (like employer group health coverage), rules dictate which payer is responsible for paying first. Please review the Reporting Other Health Insurance page for information on how and when to report other health plan coverage to CMS.

What is Medicare for seniors?

Medicare is a health insurance program designed to assist the nation's elderly to meet hospital, medical, and other health costs. Medicare is available to most individuals 65 years of age and older.

What is the CMS?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that manages Medicare. When a Medicare beneficiary has other health insurance or coverage, each type of coverage is called a "payer.". "Coordination of benefits" rules decide which one is the primary payer (i.e., which one pays first). To help ensure that claims are paid ...

How long does it take for Medicare to pay a claim?

When a Medicare beneficiary is involved in a no-fault, liability, or workers’ compensation case, his/her doctor or other provider may bill Medicare if the insurance company responsible for paying primary does not pay the claim promptly (usually within 120 days).

Does Medicare pay a conditional payment?

In these cases, Medicare may make a conditional payment to pay the bill. These payments are "conditional" because if the beneficiary receives an insurance or workers’ compensation settlement, judgment, award, or other payment, Medicare is entitled to be repaid for the items and services it paid.

How to contact Medicare.org?

Call us at (888) 815-3313 — TTY 711 to speak with a licensed sales agent.

Does QMB cover Medicare?

It means that your state covers these Medicare costs for you, and you have to pay only for anything that Medicare normally does not cover. QMB does not supplement your Medicare coverage but instead ensures that you will not be precluded from coverage because you cannot afford to pay the costs associated with Medicare.

What is QMB in Medicare?

The Qualified Medicare Beneficiary ( QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

Can a QMB payer pay Medicare?

Billing Protections for QMBs. Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items ...

What are the characteristics of Medicare?

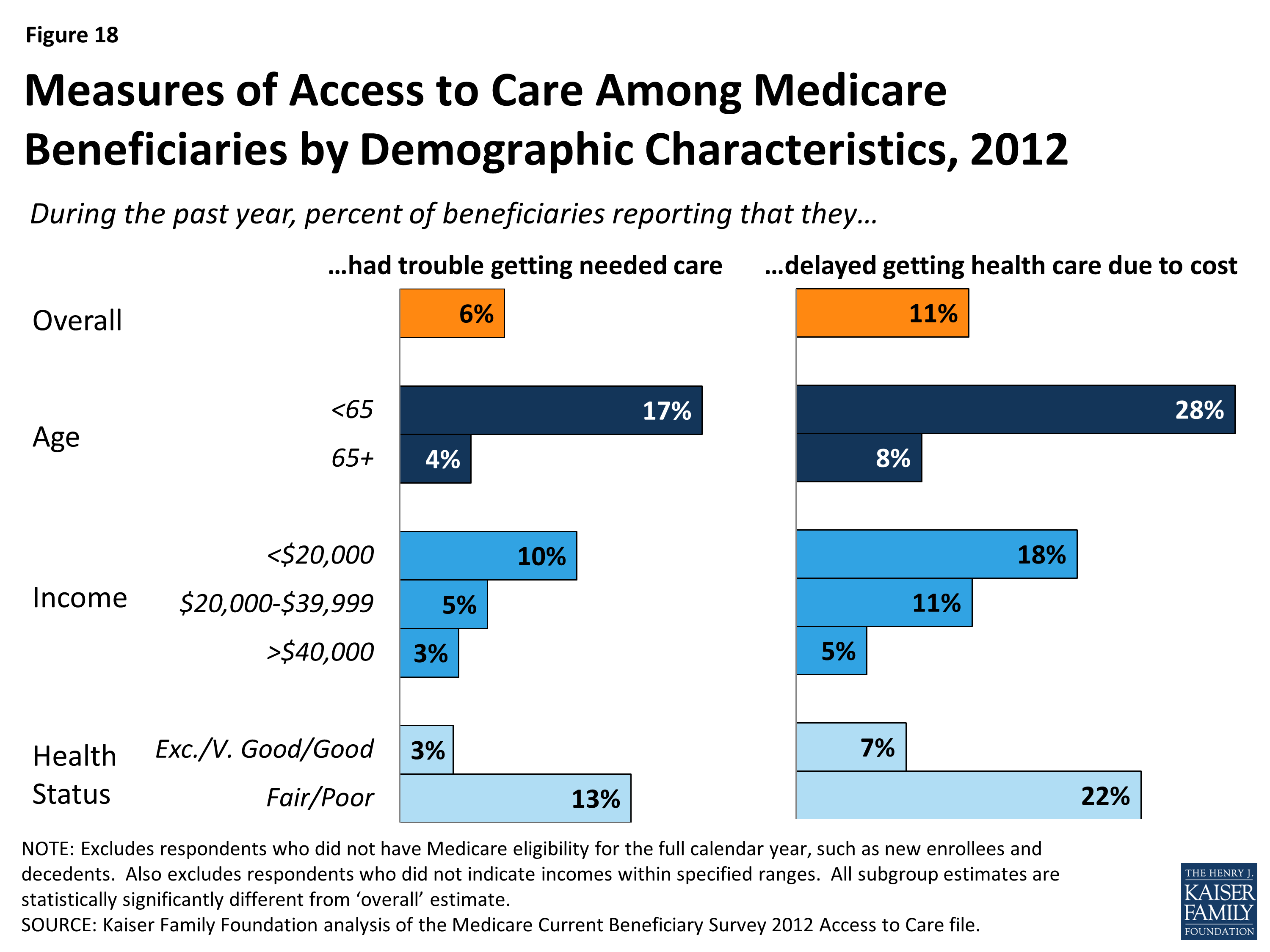

Characteristics of People on Medicare. Many people on Medicare live with health problems, including multiple chronic conditions and limitations in their activities of daily living, and many beneficiaries live on modest incomes. In 2016, nearly one third (32%) had a functional impairment; one quarter (25%) reported being in fair or poor health;

How long does it take to get Medicare?

People under age 65 who receive Social Security Disability Insurance (SSDI) payments generally become eligible for Medicare after a two-year waiting period, while those diagnosed with end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS) become eligible for Medicare with no waiting period.

What is the deductible for Part B?

Part B covers physician visits, outpatient services, preventive services, and some home health visits. Many Part B benefits are subject to a deductible ($185 in 2019), and, typically, coinsurance of 20 percent.

What is Medicare payment and delivery system reform?

Policymakers, health care providers, insurers, and researchers continue to debate how best to introduce payment and delivery system reforms into the health care system to tackle rising costs, quality of care, and inefficient spending.

How much is the Part B premium?

Beneficiaries with incomes greater than $85,000 for individuals or $170,000 for married couples filing jointly pay a higher, income-related monthly Part B premium, ranging from 35% to 85% of Part B program costs, or $189.60 to $460.50 per person per month in 2019.

Does Medicare have a deductible?

Medicare provides protection against the costs of many health care services, but traditional Medicare has relatively high deductibles and cost-sha ring requirements and places no limit on beneficiaries’ out-of-pocket spending for services covered under Parts A and B.

When did Medicare expand?

The program was expanded in 1972 to cover certain people under age 65 who have a long-term disability. Today, Medicare plays a key role in providing health and financial security to 60 million older people and younger people with disabilities. The program helps to pay for many medical care services, including hospitalizations, physician visits, ...

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How much is Medicare Part A deductible?

– Initial deductible: $1,408.

What is Medicare Advantage?

Medicare Advantage (MA): Eligibility to choose a MA plan: People who are enrolled in both Medicare A and B, pay the Part B monthly premium, do not have end-stage renal disease, and live in the service area of the plan. Formerly known as Medicare+Choice or Medicare Health Plans.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).