How does Medicare supplement insurance work with Medicare?

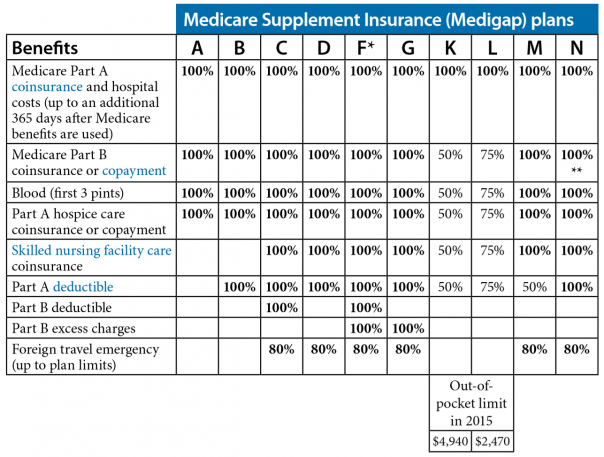

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people new to Medicare can no longer cover the Part B deductible.

How do Medicare bill providers get paid?

After a health care provider treats a Medicare patient, the provider sends a bill to Medicare that itemizes the services received by the beneficiary. Medicare then sends payment to the provider equal to the Medicare-approved amount for each of those services.

Do states pay for supplemental payments to physicians?

Some states also make supplemental payments to physicians, typically those employed by state university hospitals.

How do I buy a Medicare supplement plan?

When buying a Medicare Supplement Plan, you have two basic routes: buy directly from an insurance company or go through a broker. Going to an insurance company you already trust can be an appealing option. You'll typically find the best rates for that particular insurer.

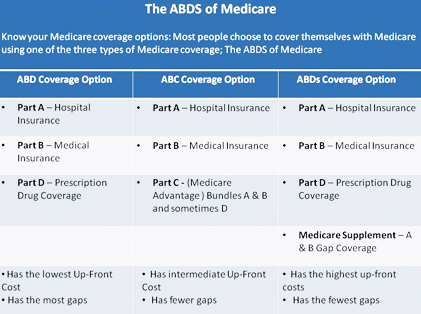

How are Medicare supplements divided?

Supplemental insurance plans are divided into categories with an alphabetic label. Medigap plans in tiers A through K provide the highest cost sharing benefits, while plans K through N plans provide less cost coverage.

Does Medicare Supplement go by income?

Medicare Advantage premiums are primarily based on the services offered within a plan, not a policyholder's income. Not all Medicare Advantage plans have premiums; these plans are usually the same price as Original Medicare.

Do all Medicare supplements pay the same?

Medicare Supplement insurance plans are sold by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare. Different Medicare Supplement insurance plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles.

Who pays for Medigap?

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What income is used to calculate Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the difference between Medigap and Medicare supplemental plans?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

Are Medicare Supplement plans regulated by the federal government?

The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

What is the best supplemental insurance for Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you buy a Medigap and Medicare?

If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How does Medicare billing work?

1. Medicare sets a value for everything it covers. Every product and service covered by Medicare is given a value based on what Medicare decides it’s worth.

What does it mean when a provider accepts a Medicare assignment?

“Accepting assignment” means that a doctor or health care provider has agreed to accept the Medicare-approved amount as full payment for their services.

What percentage of Medicare is coinsurance?

For example, the patient is responsible for 20 percent of the Medicare-approved amount while Medicare covers the remaining 80 percent of the cost. A copayment is typically a flat-fee that is charged to the patient.

What happens if a provider doesn't accept Medicare?

If a provider chooses not to accept assignment, they may still treat Medicare patients but will be allowed to charge up to 15 percent more for their product or service. These are known as “excess charges.”. 3.

Does Medicare cover out of pocket expenses?

Some of Medicare’s out-of-pocket expenses are covered partially or in full by Medicare Supplement Insurance. These are optional plans that may be purchased from private insurance companies to help cover some copayments, deductibles, coinsurance and other Medicare out-of-pocket costs.

Is Medicare covered by coinsurance?

Some services are covered in full by Medicare and the patient is left with no financial responsibility. But most products and services require some cost sharing between patient and provider.This cost sharing can come in the form of either coinsurance or copayments. Coinsurance is generally measured in a percentage.

How does accepting assignment affect Medicare?

First, it affects the rates that the provider will charge for a given diagnostic code since accepting assignment also means accepting Medicare's schedule of reimbursements ( or up to 15% higher if a provider chooses). The other big impact is on the claims side.

What does it mean when a provider accepts an assignment?

The term for this is that a provider accepts "assignment" which essentially means that the provider is in Medicare's network. This has two major impacts.

Does Medicare supplement work with Medigap?

First, it's important to understand how Medicare itself deals with providers and secondly, how Medigap supplements coordinate with Medicare itself. The first point depends on the status of the particular provider (doctor or hospital) in question. If the provider participates with Medicare, the claims process can be pretty smooth and coordinated.

Does Medicare pay you up front?

If you paid up front, Medicare typically would reimburse you accordingly. A non-assignment provider might request the excess amount up front (up to 15% higher than what Medicare allows). These providers may file a claim on your behalf to Medicare in these situations.

Does Medicare Supplement Plan pay for a procedure?

We have to be careful here. For a given medical procedure, if Medicare deems that it is not covered, the Medicare supplement plan will also not pay. The supplement looks to Medicare to determine what is eligible and then pays accordingly.

Does Medicare pay part of a covered benefit?

Medicare will pay part of a covered benefit and the supplement will pay all or part of the remaining claim. You will then get an Explanation of Benefits or an EOB showing what the total amount was, what Medicare and supplement paid, and your responsibility if any for that particular claim.

Do you have to pay for medical services up front?

Let's see how this works since most providers do accept Medicare. When you use medical services at these providers, you generally do not have to pay up front although more and more providers are requiring a Medicare member's potential cost sharing up front depending on the plan.

What is DSH payment?

These additional payments fall into two categories: disproportionate share hospital (DSH) payments, which help offset hospital uncompensated care costs, and UPL (upper payment limit) supplemental payments, which are intended to make the difference between fee-for-service payments and the amount that Medicare would have paid for the same service.

What is the origin of UPL payments?

The origins of UPL payments. From enactment, Medicaid hospital payment policies mirrored Medicare’s and, using a process known as retrospective cost reimbursement, states reimbursed hospitals for their reported costs of providing care. Changes were made in statute and regulation over time that weakened the link between Medicare and Medicaid.

What is separate UPL?

Separate UPLs apply to three separate ownership categories (governmentally operated, non-state governmentally operated, and private) for each provider type. Some states also make supplemental payments to physicians, typically those employed by state university hospitals.

What are the institutions subject to the UPL requirement?

The institutions subject to the UPL requirement are hospitals (separated into inpatient services and outpatient services), nursing facilities, intermediate care facilities for persons with intellectual disabilities (ICFs/ID), and freestanding non-hospital clinics.

What changes were made to the Medicare and Medicaid system?

Changes were made in statute and regulation over time that weakened the link between Medicare and Medicaid. This provided states with more flexibility in determining payment rates but necessitated a new measure by which to assess the reasonableness of Medicaid payment rates.

When did the FFS start?

Federal regulations, first promulgated in 1981, prohibit federal financial participation for Medicaid fee-for-service (FFS) payments in excess of an upper payment limit, intended to prevent Medicaid from paying more than Medicare would pay for the same services.

Is UPL the same as Medicaid?

UPL payments are subject to the same broad federal requirements as most Medicaid payments. If a state makes UPL payments, the payment methodology must be documented in the Medicaid state plan, subject to CMS approval.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

How long has Aetna been around?

Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.

What is the role of a Medigap insurer?

A Medigap insurer’s only role is to pay bills, bills that Medicare has already approved.

What is Medicare crossover?

After that, Medicare uses a system called “crossover” to electronically notify your Medigap insurance company that they have to pay the part of the remainder (the gaps) that your Medigap policy covers.

How does Medicare and Medigap work?

Medicare and Medigap work together smoothly to pay for your medical bills. It’s done automatically and usually without any input from you; that’s how Medigap policies work. That ease-of-use is a big appeal of owning a Medigap policy. Your doctors are in charge of your medical care. They know that Medicare’s rules require ...

How often does Medicare send out EOB?

To help you monitor that, every three months Medicare will mail you an Explanation of Benefits (EOB) that summarizes all the bills they approved and paid on your behalf. You can also create an online Medicare account and view your bills there.

What is Medicare's rule for MRI?

They know that Medicare’s rules require that any procedure or treatment, such as surgery, a blood test or MRI, that the order is medically necessary. That means it is necessary to diagnose and treat a medical condition.