How is Social Security financed?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $142,800 (in 2021), while the self-employed pay 12.4 percent. In 2019, $944.5 billion (89 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes.

How does social security work with Medicare and CMS?

Social Security works with CMS by enrolling people in Medicare. For more information about applying for Medicare only and delaying retirement benefits, visit Applying for Medicare Only – Before You Decide.

How is Medicare funded?

How is Medicare funded? The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the

What is the difference between social security and Medicare?

Social Security and Medicare are distinct programs serving older and disabled Americans, but they have an important commonality: Social Security handles enrollment for Medicare Part A (hospital insurance) and Part B (medical insurance).

Who pays for Social Security and Medicare?

Employees, employers, and self-employed persons pay social security and Medicare taxes. When referring to employees, these taxes are commonly called FICA taxes (Federal Insurance Contributions Act).

What is Medicare and how is it financed?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7). Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees (1.45 percent each) (accounting for 88 percent of Part A revenue).

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Where does funding for Medicare come from?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Is Medicare subsidized by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.

Did Congress steal from Social Security?

Myth #5: The government raids Social Security to pay for other programs. The facts: The two trust funds that pay out Social Security benefits — one for retirees and their survivors, the other for people with disabilities — have never been part of the federal government's general fund.

How much has Congress borrowed from Social Security?

The total amount borrowed was $17.5 billion.

Did the government borrow from Social Security?

The Social Security Trust Fund has never been "put into the general fund of the government." Most likely this question comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting.

The Taxes You Pay

Social Security taxes are used to pay for Social Security benefits. In addition, a portion of your taxes pays for part of your Medicare coverage. General tax revenues, not Social Security taxes, are used to finance Supplemental Security Income (SSI) payments.

Where Your Taxes Go

The Social Security and Medicare taxes you pay are divided among several trust funds.

How The Trust Funds Work

Every day, tax revenues are deposited in the trust funds. Social Security benefits are paid from these funds, and any money not needed to pay benefits is invested daily in U.S. government bonds.

What Happens To The Reserve Funds

Any Social Security reserves that are not used for payment of benefits or operational expenses (which are consistently less than 1 percent of revenues) are invested only in U.S. government securities--generally considered the safest of all investments--and earn the prevailing rate of interest.

Trust Fund Forecasts

The latest report from the Board of Trustees, released in April 1998, provides mixed news about the future financial condition of Social Security.

Are Social Security Taxes Used For Other Purposes?

A persistent, but false, rumor is that trust fund money has been used for purposes other than Social Security payments or operational expenses.

When will Medicare be sent out to Social Security?

If you're receiving Social Security retirement benefits, SSA will send you a Medicare enrollment package at the start of your initial enrollment period, which begins three months before the month you turn 65. For example, if your 65th birthday is July 15, 2021, this period begins April 1.

What does the SSA do?

In this role, the Social Security Administration (SSA) works with the Centers for Medicare & Medicaid Services (CMS) to inform older Americans about their Medicare sign-up options, process their applications and collect premiums.

How much is Part B insurance in 2021?

In 2021, the Part B premium starts at $148.50 a month and rises with the beneficiary's income. Part B premiums go up in steps for individuals with incomes greater than $88,000 or married couples with joint incomes of more than $176,000.

Can I deduct Medicare premiums from my Social Security?

If you have Medicare Part D ( prescription drug plan) or a Medicare Advantage plan, also known as Medicare Part C , you can elect to have the premiums deducted from your monthly Social Security payment. Updated February 11, 2021.

How Social Security Manages Medicare Enrollment

One key difference between Social Security and Medicare is the eligibility age. Social Security gives you a fixed age for full retirement--67 for most people--with the option to receive benefits earlier at a reduced amount. You can begin collecting reduced payments starting at the age of 62.

How Social Security Determines Medicare Premiums

Another factor in the Social Security Administration (SSA) and Medicare connection is how your premiums are handled. The SSA uses the most recent tax return the IRS provides for you to decide your Medicare premiums.

Final Thoughts

Although Social Security and Medicare are separate programs, they work together. Not only are Medicare premiums deducted from Social Security payments, but SSA also determines how much Social Security income you’ll receive and what your Medicare payments will be.

What percentage of your income is Social Security?

Along with income taxes, you’ll see the following amounts on your pay stub as a percentage of your income: Social Security: 6.2%. Medicare: 1.45% for most, 2.35% for incomes of $200,000 or more. Your employer will also contribute to Medicare, but that won’t affect your paycheck. 3.

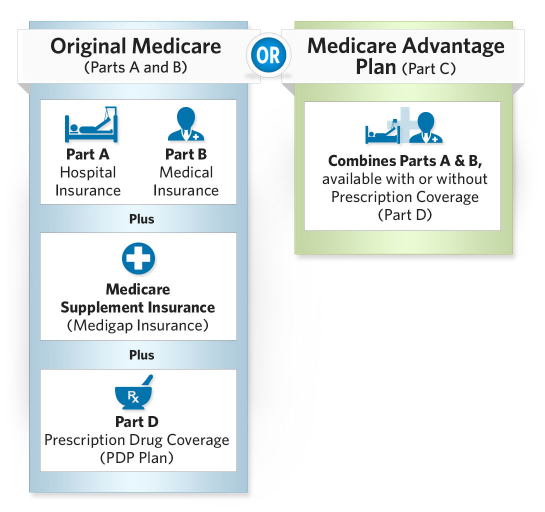

What is Medicare Supplement?

Medicare Supplement (Medigap) is an optional add-on that pays for the “gaps” in Parts A and B, such as deductibles, coinsurance, and excess charges. Recipients customize their coverage by choosing either Original Medicare (Parts A and B) or Medicare Advantage.

What is disability income insurance?

Disability income insurance. Like Social Security disability benefits, this insurance pays out if you become disabled and can’t work. Your Social Security benefits won’t be affected by any additional disability coverage you have. But look your policy over carefully.

How many credits do you need to retire?

For retirement benefits you must earn six credits (1.5 years) during your lifetime, regardless of age. But for disability, you must have earned credits recently—how recently and how many credits depends on your age.

How old do you have to be to get Social Security?

The amount also depends on your age when you begin receiving your Social Security checks. Full Social Security retirement age is between 65 and 67, depending on when you were born. 1. You can receive benefits as early as 62, but the amount could be 25% to 30% lower.

What age do you have to be to get Medicare?

Medicare: You must be 65 or older. Social Security: Qualification age is a moving target. You can begin taking partial benefits at age 62, but your checks could be 25% or 30% lower.1 The full qualification age is between 65 and 67, depending on when you were born. Full Social Security retirement benefits.

What is Part B insurance?

Part B covers routine medical services such as doctor visits, lab testing, preventative care, and durable medical equipment (DME). Part C (Medicare Advantage) is an alternative way of receiving both Parts A and B all in one plan. Many plans also cover prescription drugs.

How much money has Social Security taken in?

Treasury. Throughout its history, Social Security generally has taken in more money than it paid out, generating a reserve that totaled $2.9 trillion at the end of 2019.

What percentage of Social Security will be paid in 2021?

In 2021, 12.4 percent of income up to $142,800 goes into the Social Security pot. Job holders and their employers split the contribution at 6.2 percent each; self-employed people pay both shares. That money goes into two Social Security trust funds, called Old-Age and Survivors Insurance and Disability Insurance.

What percentage of Medicare income goes to trust funds?

FICA and SECA taxes also are set aside for Medicare. Payroll taxes amounting to 2.9 percent of earnings go into separate trust funds that subsidize the federal health-care program for older and disabled people. Updated February 11, 2021.

How much is FICA tax?

In 2019, those taxes — called FICA for people with wage-earning jobs and SECA for the self-employed — brought in nearly $945 billion, accounting for 89 percent of Social Security's revenue, according to the 2020 annual report from Social Security's board of trustees.

Will Social Security be depleted by 2035?

The latest trustees’ report projects that the reserve will be depleted by 2035. That does not mean Social Security is going “broke,” as the situation sometimes is described. If reserves are exhausted, the Social Security programs will continue to pay benefits out of their annual tax revenue.

Is Social Security a savings plan?

Keep in mind. Social Security is not a savings plan. What you pay into the system does not go into an account for your retirement. Workers in each generation finance Social Security payments for their retired elders and other beneficiaries. Down the road, their benefits will be paid for in turn by younger workers.