For the first part, similar to Social Security taxes, an employee pays 1.45 percent of their wages, and the employer will match that amount. There is no wage ceiling for this tax. The second part of Medicare taxes applies to any wages received beyond a threshold amount (recently $200,000) in a calendar year.

Full Answer

How does Medicare with social security work?

Medicare with Social Security: How Does It Work? Medicare and Social Security are federally managed benefits that you’re entitled to based on your age, the number of years you have paid into the system, or if you have a qualifying disability.

What are the Social Security and Medicare taxes an employee must pay?

In addition to paying income tax, an employee must contribute to Social Security and Medicare taxes, which are critical to funding these federal benefits programs. The employee shares this obligation with the employer. The employer withholds Social Security and Medicare taxes from the employee’s paycheck and sends them directly to the IRS.

Do self-employed pay into Social Security and Medicare?

Self-employed people pay into Social Security and Medicare through a different tax, called SECA (Self-Employment Contributions Act) and collected via their annual federal tax returns. They pay both the employer and employee shares. FICA and SECA taxes do not fund Supplemental Security Income (SSI) benefits.

What is Social Security tax and how does it work?

Social Security tax, like Medicare tax, is designed to help support the millions of retired Americans. This tax pays for federal disability and retirement benefits. Both employers and employees must pay Social Security Tax.

How were Social Security and Medicare similar?

Both programs are primarily funded by payroll taxes, which are split evenly between employees and employers (self-employed workers pay both portions, but can deduct half of the self-employment tax from their business income).

What is the relationship between Social Security and Medicare taxes?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Is Social Security and Medicare the same account?

Who do I contact - Social Security or Medicare? Social Security offers retirement, disability, and survivors benefits. Medicare provides health insurance. Because these services are often related, you may not know which agency to contact for help.

Is federal income tax the same as Social Security and Medicare?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

Why do I pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

Which of the following is a difference between Social Security and Medicare quizlet?

In the U.S, Social Security is a social insurance program created to aid individuals in retirement or those that have become disabled. Medicare is a social insurance program focused on providing medical insurance to individuals 65 or older, or who meet specific criteria.

What do Medicare Medicaid and Social Security have in common quizlet?

What do Medicare, Medicaid, and Social Security have in common? They are all entitlement programs.

Is Social Security and Medicaid the same thing?

Medicaid only provides medical benefits. Social Security provides a direct cash payment. 3. For both programs, your disability must substantially harm your ability to work.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax. 1.

What is Social Security tax used for?

Key Takeaways. Social Security taxes fund the retirement, disability, and survivorship benefits that millions of Americans receive each year from the Social Security Administration. In 2021, the Social Security tax rate is 12.4%, divided evenly between employers and employees, on a maximum wage base of $142,800.

Is Medicare a federal tax?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

Who reviewed Medicare and Social Security?

Medically reviewed by Alana Biggers, M.D., MPH — Written by S. Behring on May 13, 2020. Medicare and Social Security are federally managed benefits that you’re entitled to based on your age, the number of years you have paid into the system, or if you have a qualifying disability. If you’re receiving Social Security benefits, ...

What is Social Security?

Social Security is a program that pays benefits to Americans who have retired or who have a disability. The program is managed by the Social Security Administration (SSA). You pay into Social Security when you work. Money is deducted from your paycheck each pay period.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

When will I get Medicare if I am already on Social Security?

You’ll get Medicare automatically if you’re already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, you’ll be enrolled in Medicare three months before your 65th birthday. You’ll also be automatically enrolled once you’ve been receiving SSDI for 24 months.

What is Medicare Part A?

Medicare Part A (hospital insurance). Part A covers services such as hospital stays, long-term care stays, and hospice care.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

Do you pay Medicare on your wages?

However, you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

What is the Medicare tax rate?

The Medicare tax is 2.9% – 1.45% for employees and employers on all employee earnings with no limit.

Why are FICA taxes called payroll taxes?

FICA taxes are called payroll taxes because they are based on income paid to employees. FICA taxes have two elements that are withheld from employee paychecks and paid by employees: Social Security (Old-Age, Survivors and Disability Insurance or OASDI) and. Medicare. 1 .

What is the IRS Publication 15?

IRS Publication 15 (Circular E) has a table listing all the special rules for various types of services and payments for federal income tax withholding, FICA taxes, and FUTA tax.

What is FICA tax?

Dotdash. There are certain taxes on income that everyone has to pay, and FICA (Federal Insurance Contributions Act) taxes for Social Security and Medicare are at the top of the list. Employers must withhold these taxes from employee paychecks and pay them to the IRS. FICA taxes are called payroll taxes because they are based on income paid ...

How much is FICA tax?

The total FICA tax is 15.3% based on an employee's gross pay. The employer and employee each pay 7.65%. Here is a breakdown of these taxes: Within that 7.65%, the OASDI (Old Age, Survivors, and Disability program, AKA, Social Security) portion is 6.2%—up to the annual maximum wages subject to Social Security.

When did self employment start paying taxes?

Self-Employment Tax. FICA taxes were set up by the Federal Insurance Compensation Act (FICA) in the 1930s, first to fund the Social Security benefits program, and later, the Medicare program. A separate program, called the Self-employment Contributions Act (SECA) of 1954, requires self-employed individuals to pay Social Security ...

Is FICA withheld from self employed?

Some payments to certain individuals are not subject to FICA taxes. For example, the income of self-employed business owners is not withheld under the FICA system, but there is a different law requiring the payment of these taxes, called the Self Employed Contributions Act (SECA). 2 . Payments to your child under age 18 who is working in your ...

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

When does Medicare tax apply?

All income is subject to Medicare taxation, but the Additional Medicare Tax does not apply until after your income reaches a certain threshold: $200,000 for individual taxpayers in 2021 and 2022. 3 1

How are FICA taxes paid?

How FICA Taxes Are Paid. You, the employee, pay half the FICA taxes, which is what you see deducted on your pay stub. Your employer must match these amounts and pay the other half to the government separately at regular intervals. 1 2.

What is the purpose of FICA tax?

The bulk of the FICA tax revenue goes to funding the U.S. government's Social Security trusts. These trusts are solely designated to fund the programs administered by the Social Security Administration, including: Retirement benefits. Survivor benefits.

Where does FICA money go?

The remainder of FICA tax money collected from your paycheck and from your employer goes to the Medicare program, which funds healthcare costs for older people and younger Americans with disabilities. The Medicare taxes collected from current wage earners and their employers are used to pay for hospital and medical care costs incurred by current Medicare beneficiaries. Any excess tax revenue is accounted for in a designated Medicare trust fund.

What is the ACA premium tax rate?

It works out to a rate of 0.9%, and employers do not have to match it, but it's not applicable to all taxpayers.

How much will Social Security be taxed in 2021?

You—and your employer—would pay the Social Security tax on only the first $142,800 in 2021 if you earned $143,000, for example. That remaining $200 is Social Security tax-free. The Social Security tax will apply again on January 1 of the new year until your earnings again reach the taxable minimum.

What is the minimum wage for Social Security in 2021?

Earnings to $200,000 in 2021. Employees are no longer required to pay the Social Security tax in a given year when their earnings hit the contribution and benefits base, often referred to as the “taxable minimum.”.

Why do Medicare and Social Security go hand in hand?

Social Security and Medicare taxes go hand in hand. One reason for this is because the taxable wages for these two taxes are generally the same. The taxable wages for Social Security and Medicare taxes are defined below:

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

What is the Social Security tax limit for 2017?

Social Security tax limit for 2017 is $7,886.40. One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

What are the big amounts that come out of our paychecks?

Some big amounts that come out of our paychecks are for Social Security and Medicare taxes. How are they calculated? Read on for a complete guide.

How much is Bob's semi monthly salary?

Example: Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. Bob gets a semi-monthly auto allowance of $1,000. He has a medical deduction of $1,500, and he contributes 10% of his income to his 401k.

Is there a cap on Medicare taxes?

There is no Medicare cap, and employers are required to withhold an additional Medicare Tax of 0.9% for wages over $200,000. Now that we’ve covered Social Security and Medicare taxes, we’ll tackle state taxes in our next segment. Bookmark ( 0) Please login to bookmark. Username or Email Address.

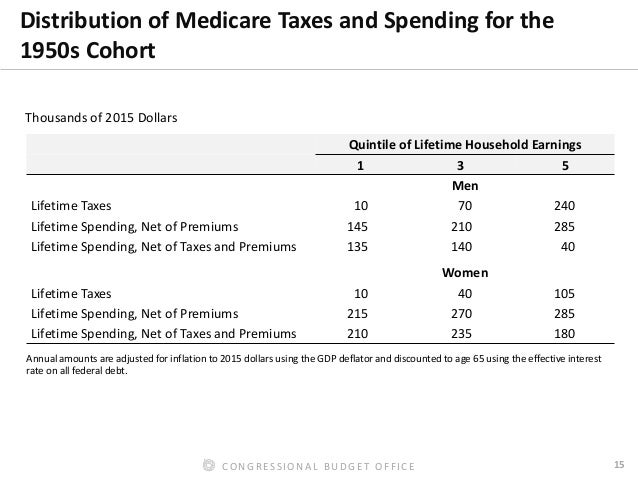

Abstract

Implicit taxes are present in many government programs and can create substantial work disincentives. The implicit tax created by Social Security is the payroll tax used to fund the retirement portion of Social Security minus the present value of the incremental retirement benefits associated with the earnings.

I. Introduction

The idea of implicit taxes originates from the most basic of economic principles—that marginal effects are often more important determinants of behavior than average effects. Any means-tested benefit involves an implicit tax because it is phased out as income or wealth increases.

II. The Implicit Taxes on Social Security and Medicare

As described above, the implicit tax on earnings created by Social Security depends on the manner in which benefits are determined. Social Security benefits are paid out in the form of an inflation-indexed life annuity. The computation of a worker’s initial monthly benefit begins with the worker’s entire history of covered earnings.

III. An Alternative Set of Policies That Reduce the Implicit Taxes from Social Security and Medicare on Older Workers

In the previous section, we described how Social Security and Medicare impose implicit taxes on those with long careers and those 65 and over. In this section, we describe a set of policies that result in substantially lower implicit taxes in both programs.

IV. Estimating Labor Market Consequences of Reducing Implicit Taxes from Social Security and Medicare on Older Workers

In our previous discussion, we described the implicit taxes arising from Social Security and Medicare. These costs create a tax wedge that has distortionary effects, resulting in changes in the equilibrium quantity of labor. This argument is valid regardless of whether the employer or the employee bears the costs of this distortion.

V. Conclusions

It is likely that the work discouragement of older Americans was not fully appreciated in the original design of these programs. However, given the long-term budget issues facing the U.S. economy (primarily caused by the cost of health care), policies that discourage older individuals from working need to be reexamined.

Endnotes

This research was supported by the U.S. Social Security Administration through grants 10-P-98363-1-03 and 10-P-98363-1-04 to the National Bureau of Economic Research as part of the SSA Retirement Research Consortium.

What percentage of Social Security is FICA?

FICA taxes also provide a chunk of Medicare’s budget. Most workers have FICA taxes withheld directly from their paychecks. These deductions claim 6.2 percent of an employee’s gross pay for Social Security, up to an income threshold commonly termed “maximum taxable earnings.”.

What is the maximum amount of income for Medicare in 2021?

In 2021, the threshold is $142,800 ; any earnings above that are not subject to Social Security taxes. The limit is adjusted annually based on national changes in wage levels. There is no comparable earnings maximum for Medicare; the 1.45 percent Medicare tax included in FICA is levied on all of your work income.

Does FICA pay for SSI?

FICA and SECA taxes do not fund Supplemental Security Income (SSI) benefits. Those are paid out of general tax revenues (although the program is administered by the Social Security Administration). Updated December 24, 2020.

Is FICA a part of Medicare?

No, but they are closely connected. FICA, the Federal Insurance Contributions Act, refers to the taxes that largely fund Social Security retirement, disability, survivors, spousal and children’s benefits. FICA taxes also provide a chunk of Medicare’s budget.