What are requirements for Medicare Part B?

Eligibility for Medicare Part BYou are 65 or older.You have been on Social Security Disability Insurance (SSDI) for two years.You have end-stage renal disease (ESRD).

Does everyone automatically get Medicare Part B?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can you be turned down for Medicare Part B?

Once you have signed up to receive Social Security benefits, you can only delay your Part B coverage; you cannot delay your Part A coverage. To delay Part B, you must refuse Part B before your Medicare coverage has started.

Is Medicare Part B based on income?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How long does it take to get Medicare Part B after?

Most Medicare provider number applications are taking up to 12 calendar days to process from the date we get your application. Some applications may take longer if they need to be assessed by the Department of Health. We assess your application to see if you're eligible to access Medicare benefits.Dec 10, 2021

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

Is Medicare Part B worth the cost for federal retirees?

Overall, we see far less expense for retirees in BCBS Basic compared to BCBS Standard, and with Basic there is an additional benefit of a partial Part B premium reimbursement. Medicare Advantage Eligibility—By joining Part B, federal retirees gain access to Medicare Advantage (MA) plans offered by a few FEHB carriers.Nov 14, 2021

Can I drop my employer health insurance and go on Medicare?

You can drop your employer's health plan for Medicare if you have large employer coverage. When you combine a Medigap plan with Medicare, it's often more affordable for you and your spouse.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Are Medicare Part B premiums going up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

What is covered by Medicare Part B?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

How long do you have to be in Medicare to get Medicare Part B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

Why don't people enroll in Medicare Part B?

And some people choose not to enroll in Medicare Part B, because they don’t want to pay for medical coverage they feel they don’t need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage.

How much does Medicare pay if you make less than $500,000?

Individuals who earn more than $163,000 but less than $500,000 per year will pay $462.70 in Medicare Part B premiums per month. If you earn $500,000 per year or more, your Medicare Part B premium will be $491.60 per month. These amounts reflect individual incomes only.

How much is Medicare Part B in 2021?

That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month. You’ll also have an annual deductible of $203 in 2021 (an increase from the $198 deductible in 2020).

What is the number to call for Medicare?

1-800-810-1437 TTY 711. If you are about to turn 65 and need information regarding the various portions of Medicare, then you’ve come to the right place. We know how overwhelming all of the information regarding Medicare can be. And we want to help you choose a plan that meets your individual needs.

How much does a person make on Part B?

If you earn more than $109,000 and up to $136,000 per year as an individual, then you’ll pay $289.20 per month for Part B premiums. If you earn more than $136,000 and up to $163,000 for the year as a single person, you’ll pay $376.00 per month for Part B premiums.

What is Medicare Part B?

Medicare Part B insures a wide array of medical services, particularly those that do not require an overnight hospital stay. In combination with hospital insurance of Part A, this forms comprehensive Original Medicare health coverage. Near a person’s 65th birthday, Americans can enroll in Part B and pay premiums for it.

How does Medicare Part B work?

Medicare Part B gets its operating revenues in part from the premium payments from eligible recipients. In essence, the penalty helps to balance out healthcare costs on a large population scale over years or even decades of paying into Medicare.

Why is Part B late?

The Part B late penalty exists for several reasons. For one, funding gives reason to penalize late enrollees. Those that do not accept Part B right away end up not paying into the pool of funding through premiums like the rest of the population of Medicare beneficiaries.

What is the penalty for signing up for Part B?

To be precise, the following terms describe signing up late for Part B: The Part B penalty adds 10 percent of the Part B premium for life, multiplied by the number of full years you were eligible for Part B, but opted not to have it. The Part B late penalty exists for several reasons.

How many quarters of work do you have to pay for Social Security?

Social Security measures taxed work history to determine if someone has to pay for Part A, with 40 quarters amounting to about 10 years of work. If the total required working credits remain unmet, an enrollee can get Part A at a reduced premium of $259 upon having worked 30-39 of the 40 work credits.

What happens if you pass on Part B?

Passing on Part B can cause a penalty later on when resuming Part B, or starting it for the first time. A late penalty for Part B exists, determined by the amount of time you could have had Part B, or coverage just as good, but you opted not to have any coverage.

Can you get Part B coverage for taxes?

There will be a significant difference in the costs of Parts A depending on the number of years worked while paying taxes. Generally, citizens aged 65 can get Part B coverage.

When do you get Medicare Part A and Part B?

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

How old do you have to be to get Medicare?

If you are age 65 or older, you are generally eligible to receive Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) if you are a United States citizen or a permanent legal resident who has lived in the U.S. for at least five years in a row.

What happens if you refuse Medicare Part B?

If you refuse it, you don’t lose your Medicare Part B eligibility. However, you may have to wait for a valid enrollment period before you can enroll . You may also have to pay a late enrollment penalty for as long as you have Medicare Part B coverage.

How long do you have to work to pay Medicare?

You or your spouse worked long enough (40 quarters or 10 years) while paying Medicare taxes. You or your spouse had Medicare-covered government employment or retiree who has paid Medicare payroll taxes while working but has not paid into Social Security. Normally, you pay a monthly premium for Medicare Part B, no matter how many years you’ve worked.

Is Medicare available to everyone?

Medicare coverage is not available to everyone. To receive benefits under this federal insurance program, you have to meet Medicare eligibility requirements. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

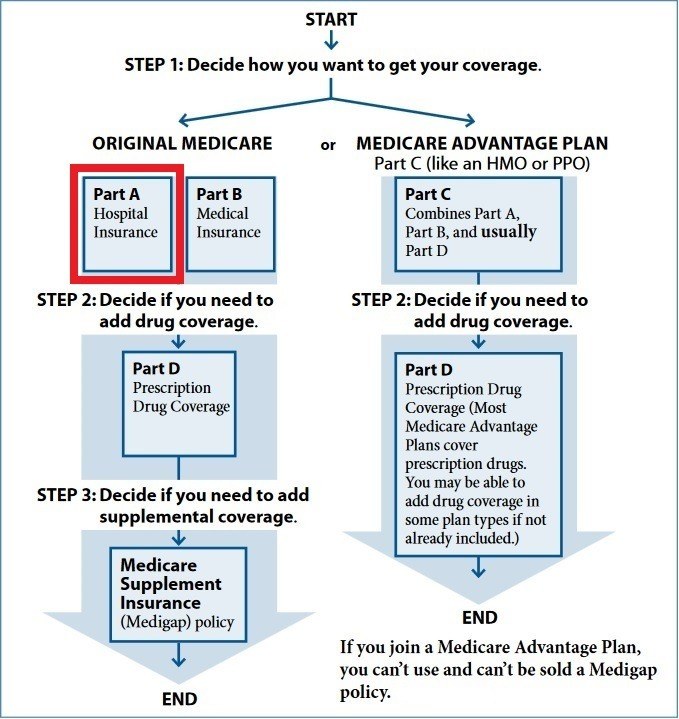

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How to enroll in Medicare Part A and Part B?

If you have end-stage renal disease (ESRD), and you would like to enroll in Medicare Part A and Part B, you will need to sign up by visiting your local Social Security Office or calling Social Security at 1-800-772-1213 (TTY users 1-800-772-1213). If you worked for a railroad, please contact the RRB to enroll by calling 1-877-772-5772 ...

How old do you have to be to get Medicare?

As you might know, the Medicare eligibility age is 65, and to be eligible you have to be an American citizen or legal permanent resident of at least five continuous years.

What is ESRD in Medicare?

ESRD is permanent damage to the kidneys that requires regular dialysis or a kidney transplant. If you’re eligible for Medicare because of any of these circumstances, you may receive health insurance through Medicare Part A (hospital insurance) and Medicare Part B (medical insurance), which make up Original Medicare.

Does Medicare cover vision?

For example, Original Medicare doesn’t include prescription drug coverage or routine dental/vision care, but a Medica re Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans. Hopefully, you now have a better idea how Medicare eligibility works if you’re under 65.