You can apply for Original Medicare in New York by contacting the Social Security Administration, either by phone or online. If you are already receiving Social Security benefits, you will be automatically enrolled. 4 Need help choosing a Medicare plan?

Full Answer

How easy is it to apply for Medicare?

- Go to Medicare’s online Medigap finder.

- Enter your zip code.

- Get a more accurate price by entering your age, gender and tobacco use.

- Review the basic costs and benefits of different Medigap plans.

- Once you find a plan you like, click “View Policies."

- Review the different insurance companies that offer policies for that plan.

What information do I need to apply for Medicare?

What do you need to bring when applying for Medicare?

- Birth certificate. ...

- Proof of U.S. ...

- Your Social Security card (if already receiving SSA benefits) If you are already receiving benefits from Social Security or the Railroad Retirement Board, you may be required to supply your ...

- Health insurance information. ...

- Tax information. ...

- Military documents. ...

- Part B enrollment application. ...

How to choose a Medicaid plan in NY?

Choosing a Medicaid Managed Care Plan To find out if you’re eligible for Medicaid, which provides free health insurance coverage to qualifying New Yorkers, visit the NY State of Health, the Official Health Plan Marketplace. If you qualify, the next step is to select a Managed Care Plan. You have 10 days to choose a health plan.

How and when do I apply for Medicare?

- Log into your MyMedicare.gov account and request one.

- Request a replacement Medicare card online.

- Call or visit your local Social Security Administration office.

How do you qualify for Medicare in NY?

You can qualify for Medicare if you are age 65 or older and/or if you have certain disabilities or End-Stage Renal Disease (ERSD).

What are the eligibility requirements to apply for Medicare?

Be age 65 or older; Be a U.S. resident; AND. Be either a U.S. citizen, OR. Be an alien who has been lawfully admitted for permanent residence and has been residing in the United States for 5 continuous years prior to the month of filing an application for Medicare.

What is the income limit for Medicare in NY?

Qualified Medicare Beneficiary (QMB): The income limit is $1,063 a month if single and $1,437 a month if married. QMB pays for Part A and B cost sharing, Part B premiums, and – if a beneficiary owes them – it also pays their Part A premiums.

What is the income limit to qualify for Medicaid in NY?

View coronavirus (COVID-19) resources on Benefits.gov....Who is eligible for New York Medicaid?Household Size*Maximum Income Level (Per Year)1$18,0752$24,3533$30,6304$36,9084 more rows

Can I get Medicare without Social Security?

Even if you don't qualify for Social Security, you can sign up for Medicare at 65 as long you are a U.S. citizen or lawful permanent resident.

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple. These programs include all the ones listed below except Supplemental Security Income (SSI).

Is Medicare based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How does Medicare determine your income?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is the lowest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

Can you own a home and get Medicaid in NY?

In New York, an applicant for Medicaid cannot own more than approximately $16,000 in assets. (Bank accounts, annuities, cash value of life insurance policies, etc., are counted.) While the Medicaid recipient is living in his or her home, it will be exempt.

About Medicare in New York

Medicare beneficiaries in New York enjoy a variety of Medicare offerings, from the federal option of Original Medicare, Part A and Part B, to plans...

Types of Medicare Coverage in New York

Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are...

Local Resources For Medicare in New York

Medicare Savings Programs in New York: Programs in New York can assist beneficiaries in paying for things like their monthly premiums. Usually in o...

How to Apply For Medicare in New York

To apply for Medicare in New York, you must be a United States citizen or legal permanent resident of at least five continuous years. You’re genera...

Who Is Eligible for Medicare in New York?

You may have Medicare eligibility in New York if you’re a U.S. citizen or a permanent legal resident who has lived in the U.S. for more than five years and one or more of the following applies to you: 3

How Does Medicare Work in New York?

If you’ve established that you are eligible for Medicare, it’s time to review your choices. You can opt for the government’s “Original Medicare” or choose an all-in-one plan from a private insurance company.

How Can I Apply for Medicare in New York?

You can apply for Original Medicare in New York by contacting the Social Security Administration, either by phone or online. If you are already receiving Social Security benefits, you will be automatically enrolled. 4

How long do you have to be a resident of New York to qualify for Medicare?

How to apply for Medicare in New York. To apply for Medicare in New York, you must be a United States citizen or legal permanent resident of at least five continuous years. You’re generally eligible when you are 65 or older, but you may qualify under 65 through disability or having certain conditions. You’ll be enrolled automatically as soon as ...

How many Medicare Supplement plans are there?

Medicare Supplement, also called Medigap, features up to 10 plans, each with a letter designation (A, B, C, D, F, G, K, L, M, N). Plan benefits within each letter category do not change, no matter where the plan is purchased;

What is Medicare Part A and Part B?

Original Medicare, Part A and Part B, refers to federal Medicare coverage. Medicare Part A (hospital insurance) and Part B (medical insurance) are available in any state in the U.S. Medicare Advantage, Part C, refers to plans offered by private health insurance companies with Medicare’s approval.

Does New York have Medicare?

About Medicare in New York. Medicare beneficiaries in New York enjoy a variety of Medicare offerings, from the federal option of Original Medicare, Part A and Part B , to plans offered by Medicare-ap proved insurance companies such as Medicare Advantage, Medicare Part D (prescription coverage), and Medicare Supplement insurance plans.

Does Medicare Part B cover vision?

These plans must cover at least what Original Medicare , Part A and Part B does, but can also include additional benefits, like vision, dental, and prescription drug coverage. You continue paying your monthly Medicare Part B premium when you’re enrolled in a Medicare Advantage plan along with any premium charged by the Medicare Advantage plan chosen.

What is the number to call for Medicaid in NYC?

Those living in the five boroughs of NYC, whose cases are administered by the Human Resources Administration (HRA) office can call the HRA Infoline at 1 (718) 557-1399 or the HRA Medicaid Helpline at 1 (888) 692-6116.

How do I get a copy of my 1095-B for 2020?

If you need a copy of your 1095-B for Tax Year 2020, you can request it: By Phone - call 1-800-541-2831 or.

What is Medicare for ALS?

Medicare is a federal health insurance program for: people age 65 or older, people under age 65 with certain disabilities, and. people of all a ges with End-Stage Renal Disease/ES RD (permanent kidney failure requiring dialysis or a kidney transplant) or Amyotrophic Lateral Sclerosis/ALS.

What happens if you are enrolled in managed care in a new county?

If you are currently enrolled in a managed care plan that is not offered in the new county, your local department of social services will notify you so that you can choose a new plan. If your Medicaid is with the Marketplace, (NY State of Health), it is important that you update your account with your new address.

What is a 1095-B?

The tax form you received, Form 1095-B, represents health coverage you received in Medicaid, Child Health Plus (CHP) or Essential Plan (EP) for part or all of the past year.

Do you have to apply for medicaid if you are 65?

You may be required to apply for Medicare as a condition of eligibility for Medicaid. Medicare is a federal health insurance program for people age 65 and for certain people with disabilities, regardless of income. When a person has both Medicare and Medicaid, Medicare pays first and Medicaid pays second.

How to get a baby card in New York?

To request a card for your unborn baby, you will need to contact your local department of social services or if your case is with the Marketplace, (NY State or Health), at 1 (855) 355-5777 and notify them that you are pregnant and what your anticipated due date is .

How to apply for medicaid?

How to Apply. To apply for Medicare, contact your local Social Security Administration (SSA) office. To apply for Medicaid, contact your state’s Medicaid agency. Learn about the long-term care Medicaid application process. Prior to applying, one may wish to take a non-binding Medicaid eligibility test.

How old do you have to be to qualify for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old. For persons who are disabled or have been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis), there is no age requirement. Eligibility for Medicare is not income based. Therefore, there are no income and asset limits.

How much does Medicare Part B cost?

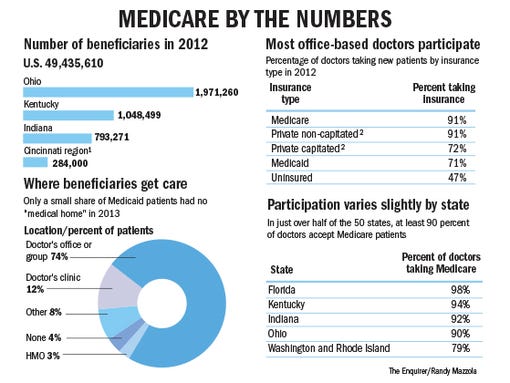

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

What is Medicare and Medicaid?

Differentiating Medicare and Medicaid. Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program ...

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

Does Medicare cover out-of-pocket expenses?

Persons who are enrolled in both Medicaid and Medicare may receive greater healthcare coverage and have lower out-of-pocket costs. For Medicare covered expenses, such as medical and hospitalization, Medicare is always the first payer (primary payer). If Medicare does not cover the full cost, Medicaid (the secondary payer) will cover the remaining cost, given they are Medicaid covered expenses. Medicaid does cover some expenses that Medicare does not, such as personal care assistance in the home and community and long-term skilled nursing home care (Medicare limits nursing home care to 100 days). The one exception, as mentioned above, is that some Medicare Advantage plans cover the cost of some long term care services and supports. Medicaid, via Medicare Savings Programs, also helps to cover the costs of Medicare premiums, deductibles, and co-payments.

Does Medicaid cover nursing home care?

Medicaid also pays for nursing home care, and often limited personal care assistance in one’s home. While some states offer long-term care and supports in the home and community thorough their state Medicaid program, many states offer these supports via 1915 (c) Medicaid waivers.

What is extra help for Medicare?

Extra Help from Medicare comes in two levels – full and partial. All levels of Extra Help provide a Low Income Subsidy (LIS) with reduced co-payments for approved drugs. Drug co-payments are as low as $9.20 for brand or $3.70 for generic drugs in 2021 when enrolled in a Part D drug plan.

What is a SEP in Medicare?

a Medicare Special Enrollment Period (SEP) so that a new member may enroll in a Part D drug plan at any time during the year; a Medicare one-time plan change per calendar year for existing members; co-payment assistance after the Medicare Part D deductible is met, if the member has one.

What happens if you don't enroll in Medicare Part D?

If a member is not enrolled in a Medicare Part D drug plan, the member will not have any prescription coverage from EPIC or receive any EPIC benefits. Because EPIC is a State Pharmaceutical Assistance Program, EPIC can provide: a Medicare Special Enrollment Period (SEP) so that a new member may enroll in a Part D drug plan at any time during ...

What is the maximum amount of extra help for 2021?

In 2021, those with an annual income level of up to $19,320 (single) or $26,130 (married) may qualify for full or partial Extra Help. Resources (such as savings, CDs, IRAs, stocks, bonds – not ones's home or car) can be no more than $14,790 (single) and $29,520 (married). If assets are higher, those individuals may qualify for a Medicare Savings ...

Do you have to pay EPIC fees for Medicare?

Those approved for full Extra Help, a Medicare Savings Program or a Medicaid Spenddown do not have to pay any EPIC fees. EPIC will continue to pay Medicare Part D plan premiums for LIS members, and those with Full LIS in enhanced plans or Medicare Advantage plans up to the basic amount ($42.27 per month in 2021) after Medicare premium subsidization.