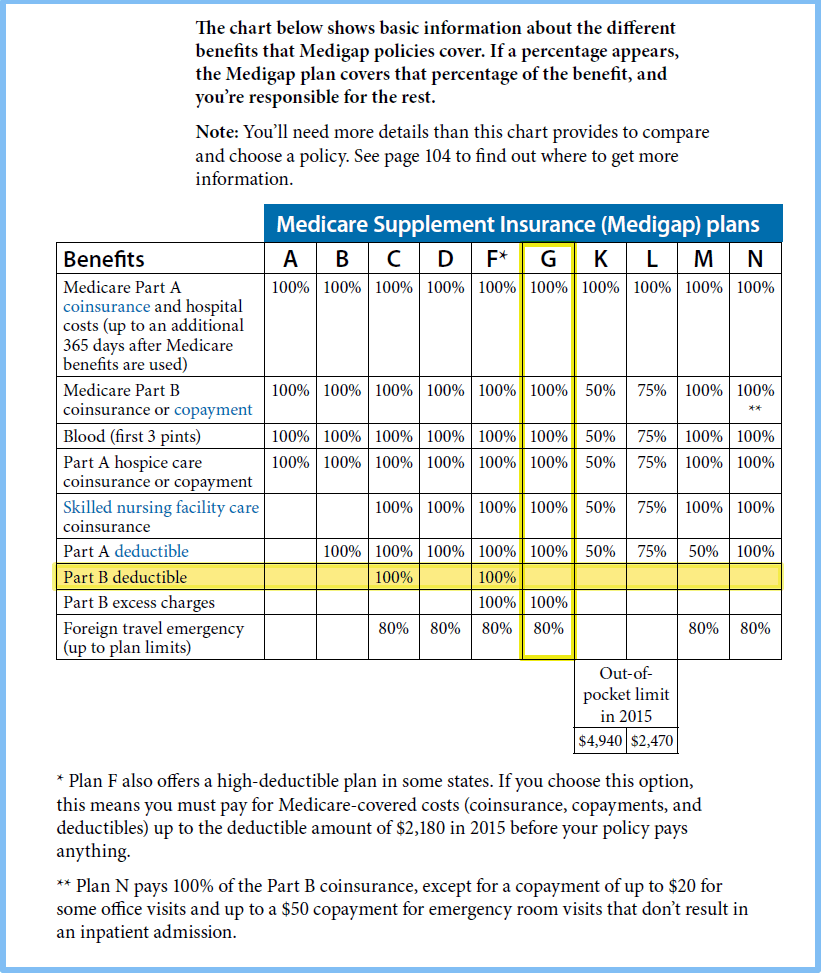

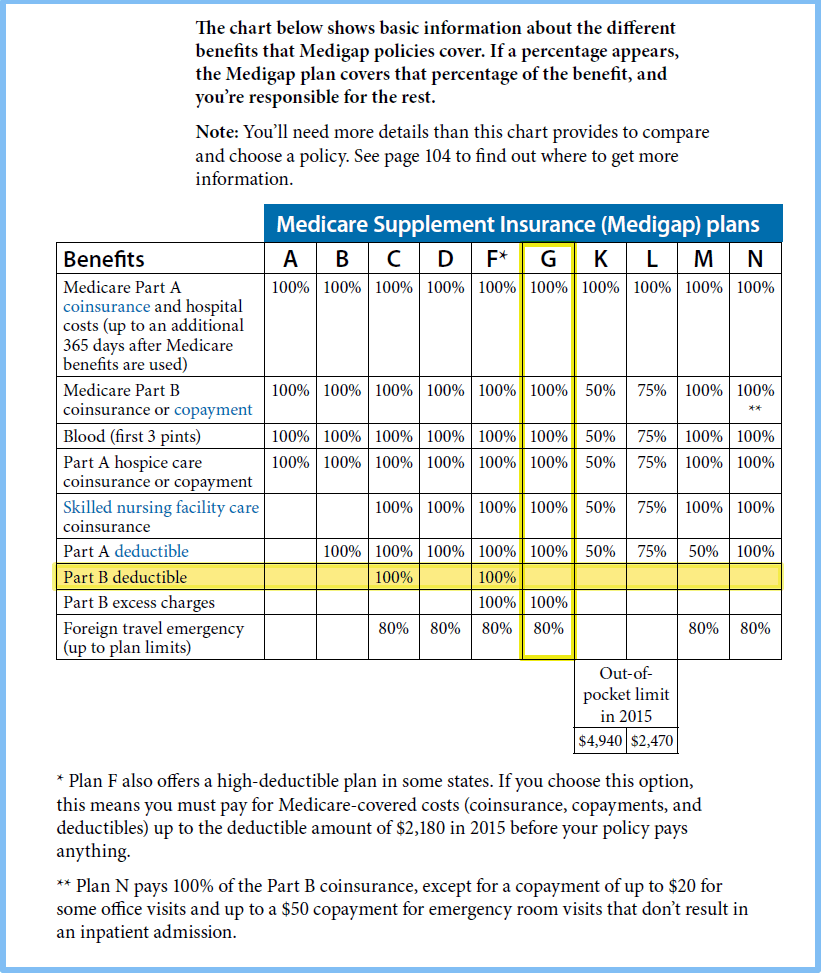

Medicare Supplement Plan G covers:

- Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out

- Part A deductible ($1,556 in 2022)

- Part A hospice care coinsurance or copayment

- Part B coinsurance or copayment

- Part B excess charges

- Blood (the first three pints needed for a transfusion)

- Skilled nursing facility coinsurance

Full Answer

Is Plan G the best Medicare supplement plan?

Dec 03, 2021 · Medicare Supplement Plan G covers: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out Part A deductible ($1,556 in 2022) Part A hospice care coinsurance or copayment Part B coinsurance or copayment Part B excess charges Blood (the first three pints needed for a transfusion)

Which Medicare supplement plan should I Choose?

Dec 12, 2019 · Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help cover certain health care costs, such as deductibles, coinsurance, and copayments. Without a supplement plan, you’d have to pay those expenses yourself. Some people call Medicare supplement plans “Medigap” because they “fill in the gaps” that exist in Medicare.

Does plan G cover Medicare deductible?

Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

What is the best Medicare supplement insurance plan?

Summary: Medicare Supplement Plan G is one of the most popular Medicare Supplement plans. This plan covers: Medicare Part A coinsurance and hospital costs; Medicare Part B coinsurance or copayment; Blood (first 3 pints) Part A hospice care coinsurance or copayment; Skilled nursing facility care coinsurance; Part A deductible; Part B excess charges

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Supplement Plan G?

Medicare Supplement Plan G – What does it cover? Plan G is a great option if you’re looking for a plan that has comprehensive benefits and low out of pocket costs.#N#All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company.

What does Plan G cover?

Plan G covers Skilled Nursing and rehab facility stays and also Hospice care.

What is Medicare Plan G?

December 12, 2019. Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help cover certain health care costs, such as deductibles, coinsurance, and copayments. Without a supplement plan, you’d have to pay those expenses yourself. Some people call Medicare supplement plans “Medigap” because they “fill in ...

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

Who is Kathryn Stewart?

Kathryn Anne Stewart. Kathryn Anne Stewart is a freelance writer who covers the intersection of health and money. She has written for Johns Hopkins Medicine, Weight Watchers, Newsmax Magazine, Franklin Prosperity Report, and the National Hemophilia Foundation, often crafting clear explanations of complex topics.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

Does Medigap Plan G cover Part B?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

Can I switch Medicare Supplement Plans?

You can enroll in or switch Medicare Supplement plans at other times, but the insurance companies can deny you or charge you more based on your health. Most Medigap plans are standardized across the nation. However, if you live in Massachusetts, Minnesota, or Wisconsin, different types of plans are available.

What is Medicare Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, we can probably help you on premiums by looking ...

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

Does Frank have a medicare plan?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year. The specialist bills Medicare, which pays 80% share of the bill except for the $203 outpatient deductible, which is billed to Frank.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

What is the Medicare Supplement Plan G deductible for 2021?

With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

How much does Medicare Supplement Plan G cover?

Up to three pints of blood for medical procedures each year. Medicare Supplement Plan G also covers 80% of medical care you receive while traveling outside the U.S., up to your plan’s limits.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a popular and comprehensive MedSup plan. Here's why it may be the best MedSup plan for you. Medicare Part G — or Plan G — is one of the most popular Medicare Supplement plans available. Plan G sits just behind Plan F in terms of popularity among American Medicare enrollees who want a bit more coverage.

What is the deductible for Medicare Part B 2020?

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, you’ll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy. Also, Plan G usually doesn’t cover prescription drugs.

Do you pay Medicare Part B premium?

You pay your monthly Medicare Part B premium. If you receive benefits from Social Security, the Railroad Retirement Board or the Office of Personnel Management, your premium will be automatically deducted from your benefit payment. You also pay the monthly premium for your Plan G policy.

What is the difference between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cover that cost. Of course, the Part B deductible is just $198 this year, but a buck is a buck, right? However, MedSup Plan G premiums tend to be cheaper than Plan F premiums.

Does Medicare Supplement Plan G cover prescriptions?

Also, Plan G usually doesn’t cover prescription drugs. Some MedSup policies used to, but that’s no longer the case. For that, you need to enroll in Medicare Part D. Finally, Medicare Supplement Plan G also won’t cover any of these costs: Dental care. Eye care, including glasses. Hearing aids.

What is Medicare Supplement Plan G?

Takeaway. Medicare Supplement Plan G covers your portion of medical benefits (with the exception of the outpatient deductible) covered by original Medicare. It’s also referred to as Medigap Plan G. Original Medicare includes Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). Medigap Plan G is one of the most popular of 10 ...

What is Medicare Part G?

Medigap Plan G is one of the most popular of 10 available plans because of its broad coverage, including coverage for Part B excess charges. Keep reading to learn more about Medicare Part G and what it covers.

How to find a Medicare supplement?

One method of finding a Medicare supplement insurance plan that fits your needs is through the “Find a Medigap policy that works for you” Internet search application. These online search tools are set up by the U.S. Centers for Medicare & Medicaid Services (CMS).

What is a Medigap policy?

Medigap policies, such as Medicare Supplement Plan G, help cover healthcare costs that aren’t covered by original Medicare. These policies are: A Medigap policy is for only one person. You and your spouse each need an individual policy.

What states have Medigap?

Medigap in Massachusetts, Minnesota, and Wisconsin. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies are standardized differently than in other states. The policies are different, but you have guaranteed issue rights to buy a Medigap policy.

Does Medicare Supplement Plan G cover coinsurance?

Some Medigap policies also pay the deductible. Coverage with Medicare Supplement Plan G includes: Part A coinsurance and hospital costs after Medicare benefits are used up (up to an additional 365 days): 100 percent. Part A deductible: 100 percent.