Answer If you have Medicare you cannot use ObamaCare's Marketplace or buy non-Medicare insurance, even if you only have Part A or Part B. Anyone who has access to Medicare must choose from Original Medicare and supplemental Medicare options.

Full Answer

Can I sign up for Medicare Part A only?

Although permissible to sign up for Medicare Part A only, this only comes recommended when group insurance provides medical coverage equal to Part B, or better. Some retirees continue under insurance from an employer or union when first becoming eligible for Medicare.

Can I get Medigap If I have only Medicare Part A?

This is true even if you have only Medicare Part A or only Part B. If you want coverage designed to supplement Medicare, you can find out more about Medigap policies. You can also learn about other Medicare options, like Medicare Advantage Plans.

Do I have to pay for Medicare as I get It?

You typically pay a portion of the costs for covered services as you get them. Under Original Medicare, you don’t have coverage through a Medicare Advantage Plan or another type of Medicare health plan. Refer to Medicare glossary for more details.

Can I receive Obamacare coverage if I have Medicare?

If so, would needs to be done to receive Obamacare Coverage ASAP. If you have Medicare you cannot use ObamaCare's Marketplace or buy non-Medicare insurance, even if you only have Part A or Part B. Anyone who has access to Medicare must choose from Original Medicare and supplemental Medicare options.

Can a patient have Medicare Part A only?

Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

What does it mean to have Medicare Part A only?

Medicare Part A only pays for room and board in a hospital if the hospice medical team orders short-term inpatient stays for pain or other symptom management.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Can you be denied coverage of Medicare Part A?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

Does Medicare Part A cover surgery?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare Part A cover ambulance?

Part A covers hospital costs, including the ER, but doesn't cover the cost of an ambulance. Medicare Part A doesn't require referrals for specialists, so the specialists you may see in an emergency room will typically be covered. Most people don't pay for Medicare Part A.

Do I need insurance if I have Medicare?

If you have Medicare. Medicare isn't part of the Health Insurance Marketplace®, so if you have Medicare coverage now you don't need to do anything.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Does Medicare pay for hospital stay?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

What is a common reason for Medicare coverage to be denied?

Medicare's reasons for denial can include: Medicare does not deem the service medically necessary. A person has a Medicare Advantage plan, and they used a healthcare provider outside of the plan network. The Medicare Part D prescription drug plan's formulary does not include the medication.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Who is not eligible for Medicare Part A?

Why might a person not be eligible for Medicare Part A? A person must be 65 or older to qualify for Medicare Part A. Unless they meet other requirements, such as a qualifying disability, they cannot get Medicare Part A benefits before this age. Some people may be 65 but ineligible for premium-free Medicare Part A.

What does BCRC do?

The BCRC will gather information about any conditional payments Medicare made related to your settlement, judgment, award or other payment. If you get a payment, you or your lawyer should call the BCRC. The BCRC will calculate the repayment amount (if any) on your recovery case and send you a letter requesting repayment.

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

What is conditional payment?

A conditional payment is a payment Medicare makes for services another payer may be responsible for. Medicare makes this conditional payment so you won't have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

What extra benefits does Medicare not cover?

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services )

How to get free health insurance counseling?

Contact your local State Health Insurance Assistance Program (SHIP) to get free personalized health insurance counseling. SHIPs aren’t connected to any insurance company or health plan.

What is the difference between policies with the same letter sold by different companies?

Price is the only difference between policies with the same letter sold by different companies.

Do you pay monthly premiums for Part B?

Most plans have a monthly premium that you pay in addition to your Part B premium. You’ll also pay other costs when you get prescriptions.

How to qualify for Medicare premium free?

To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child. To receive premium-free Part A, the worker must have a specified number of quarters of coverage (QCs) and file an application for Social Security or Railroad Retirement Board (RRB) benefits. The exact number of QCs required is dependent on whether the person is filing for Part A on the basis of age, disability, or End Stage Renal Disease (ESRD). QCs are earned through payment of payroll taxes under the Federal Insurance Contributions Act (FICA) during the person's working years. Most individuals pay the full FICA tax so the QCs they earn can be used to meet the requirements for both monthly Social Security benefits and premium-free Part A.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

When do you have to apply for Medicare if you are already on Social Security?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B. People living in Puerto Rico who are eligible for automatic enrollment are only enrolled in premium-free Part A.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;

What if I already have Medicare, and someone tries to sell me a Marketplace plan?

It’s against the law for someone who knows that you have Medicare to sell you a Marketplace plan.

What is Medicare health plan?

Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan. Medicare health plans include all Medicare Advantage Plans, Medicare Cost Plans, and Demonstration/Pilot Programs.

What is the health insurance marketplace?

The Health Insurance Marketplace is designed for people who don’t have health coverage. If you have health coverage through Medicare, the Marketplace doesn't affect your Medicare choices or benefits. This means that no matter how you get Medicare, whether through.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

When does Medicare enrollment end?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday month.

When is open enrollment for Medicare?

During the Medicare Open Enrollment Period (October 15–December 7) , you can review your current Medicare health and prescription drug coverage to see if it still meets your needs. Take a look at any cost, coverage, and benefit changes that'll take effect next year.

Can you change your Medicare coverage with a PACE plan?

, you won’t have to make any changes to your current Medicare coverage. If you have family and friends without health coverage, point them to HealthCare.gov to learn about enrolling through the Marketplace.

What are the benefits of Medicare?

Expanded Medicare benefits for preventive care, drug coverage 1 Medicare benefits have expanded under the health care law – things like free preventive benefits, cancer screenings, and an annual wellness visit. 2 You can also save money if you’re in the prescription drug “donut hole” with discounts on brand-name prescription drugs.

How long do you have to sign up for Part B?

During the 8-month period that begins the month after the job or the coverage ends, whichever happens first.

Do private insurance companies report prescription drug coverage?

But all private plans offering prescription drug coverage, including Marketplace and SHOP plans, must report to you in writing if their prescription drug coverage is creditable each year.

Is Medicare part of the Marketplace?

Changing from the Marketplace to Medicare. Medicare isn’t part of the Health Insurance Marketplace®, so if you have Medicare coverage now you don’t need to do anything. The Marketplace won’t affect your Medicare choices or benefits. No matter how you get Medicare, whether through Original Medicare or a Medicare Advantage Plan (like an HMO or PPO), ...

Does the Shop Marketplace cover my spouse's health insurance?

Yes. Coverage from an employer through the SHOP Marketplace is treated the same as coverage from any job-based health plan. If you’re getting health coverage from an employer through the SHOP Marketplace based on your or your spouse’s current job, Medicare Secondary Payer rules apply. Learn more about how Medicare works with other insurance.

Is Medicare Advantage changing?

Yes. The Medicare Advantage program isn’t changing as a result of the health care law. Learn more about Medicare Advantage plans.

Does Medicare Part B meet the Medicare Part B requirement?

But having only Medicare Part B (Medical Insurance) doesn’t meet this requirement.

What is Medicare drug plan?

These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What do you give when you join a Medicare plan?

When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

How to compare Medicare Advantage plans?

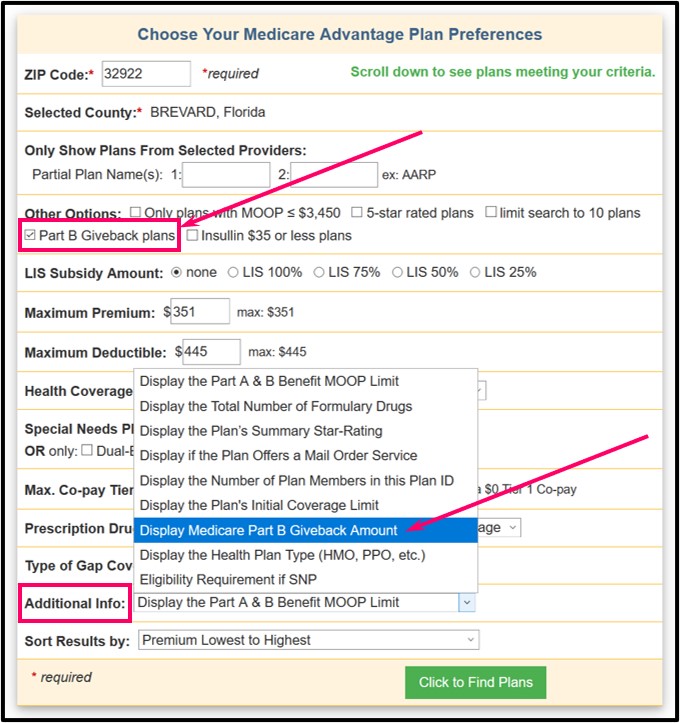

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP).

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

What to do if you have questions about your current health insurance?

Talk to your current plan if you have questions about what will happen to your current health coverage.

Medicare As An Automatic

In some cases, Medicare is an automatic. For instance, Medicare.gov says that if you receive benefits via either Social Security or the Railroad Retirement Board (RRB) for more than four months before turning 65, you automatically receive Medicare Part A (hospital insurance) and Part B (medical insurance).

Choosing the Private Insurance Option

If none of these situations apply to you and you want to use private insurance instead, it’s important to understand that there is only a seven-month window in which you can apply for Medicare benefits, according to Medicare.gov.

Using Medicare With Other Insurances

You can also have both Medicare and private insurance to help cover your health care expenses. In situations where there are two insurances, one is deemed the “primary payer” and pays the claims first. The other becomes known as the “secondary payer” and only applies if there are expenses not covered by the primary policy.

What if I want Medicare prescription drug coverage?

If you’re enrolled in Medicare Part A and/or Part B, you can likely sign up for a Medicare Part D Prescription Drug Plan . There are two types of Medicare plans that provide Medicare Part D prescription drug coverage:

How do I enroll in a Medicare plan that provides prescription drug coverage?

The enrollment requirements are a little different for a stand-alone Medicare Part D Prescription Drug Plan than for a Medicare Advantage Prescription Drug plan.

How long can you go without prescription drug coverage?

You might want to make sure you don’t go without creditable prescription drug coverage for more than 63 days in a row to avoid paying a late-enrollment penalty if you later switch to a Medicare Prescription Drug Plan.

What is the formulary for Medicare?

Each Medicare Prescription Drug Plan has a list of covered prescription drugs, called a formular y. The formulary may change at any time. You will receive notice from your plan when necessary. The prescription drugs on the formulary are grouped into different tiers (or categories). The higher tiers include the more expensive medications, while the lower tiers list the more affordable prescription drugs.

How long does Medicare enrollment last?

During the seven-month Medicare Initial Enrollment Period, which typically begins three months before the month you turn 65, includes your birthday month, and ends three months after that month. If you qualify for Medicare due to disability, in most cases your Initial Enrollment Period is also a seven-month period (your 22nd through 28th month of receiving Social Security disability benefits).

Can you have Medicare Part D if you have a prescription?

You might have prescription drug coverage that’s not part of Medicare – for example, through an employer or union group health plan. If your prescription drug coverage is at least as good, on average, as standard Medicare Part D prescription drug coverage (that is, your coverage is considered “creditable”), you can generally keep it. You might want to make sure you don’t go without creditable prescription drug coverage for more than 63 days in a row to avoid paying a late-enrollment penalty if you later switch to a Medicare Prescription Drug Plan.

Do you have to be enrolled in Part A or Part B for Medicare Part D?

Stand-alone Medicare Part D Prescription Drug Plans: you need to be enrolled in Part A and/or Part B.