How to avoid Medicare Part B excess charges?

Some recent studies have put the national percentage around 5% of instances where doctors charge “excess charges”. Keep in mind, even if a doctor does charge them, they are limited to 15% of the Medicare-approved payment schedule. Situations that are usually seen as having a higher incidence of Part B Excess charges are visits to a specialist.

What is part B excess charges?

Nov 17, 2021 · Most physicians, health care providers and medical suppliers accept Medicare assignment, so Part B excess charges are not that common. In 2015, 93 percent of primary care physicians accepted Medicare assignment. 1. An example of Medicare Part B excess charges. The following example illustrates how Part B excess charges can work.

How much can doctors charge Medicare?

Jan 20, 2022 · How Common Are Medicare Excess Charges? Medicare excess charges are uncommon, mainly because most health care providers accept Medicare assignment. Just 1% of non-pediatric physicians have opted out of Medicare, according to 2020 statistics. In Alaska, Colorado and Wyoming, this figure is slightly higher at 2%.

What is a Plan B excess charge?

Sep 16, 2021 · Medicare Part B excess charges are not common. Once in a while, a beneficiary may receive a medical bill for an excess charge. Doctors that don’t accept Medicare as full payment for certain healthcare services may choose to charge up to 15% more for that service than the Medicare-approved amount.

How often are there Medicare excess charges?

Some recent studies have put the national percentage around 5% of instances where doctors charge “excess charges”. Keep in mind, even if a doctor does charge them, they are limited to 15% of the Medicare-approved payment schedule.

How common are excess charges?

How Common Are Medicare Excess Charges? Medicare excess charges are uncommon, mainly because most health care providers accept Medicare assignment. Just 1% of non-pediatric physicians have opted out of Medicare, according to 2020 statistics.Jan 20, 2022

Do most doctors charge excess charges?

Most physicians, health care providers and medical suppliers accept Medicare assignment, so Part B excess charges are not that common. In 2015, 93 percent of primary care physicians accepted Medicare assignment.Nov 17, 2021

How can I avoid excess Medicare charges?

You can avoid having to pay Part B excess charges by seeing only Medicare-approved providers. Medigap Plan F and Medigap Plan G both cover Part B excess charges.

Can a doctor charge more than Medicare allows?

A doctor is allowed to charge up to 15% more than the allowed Medicare rate and STILL remain "in-network" with Medicare. Some doctors accept the Medicare rate while others choose to charge up to the 15% additional amount.

What states allow Medicare Part B excess charges?

Most states, with the exception of those listed below, allow Medicare Part B excess charges:Connecticut.Massachusetts.Minnesota.New York.Ohio.Pennsylvania.Rhode Island.Vermont.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does New York state allow Medicare excess charges?

New York is one of the few states that does not allow excess charges. Regardless of which carrier you decide to go with, the letter plan benefits will all be the same. Any plan that allows excess charges won't apply to residents in New York.Jan 11, 2022

Does CT allow Medicare excess charges?

Fortunately, Connecticut does not allow excess charges or billing from doctors that are non par. Some Medicare supplement plans cover excess charges. That benefit is not necessary in CT and should not factor into deciding which plan you should choose.

Is Medicare going to end?

Medicare is running out of money. According to the latest projections from the Congressional Budget Office (CBO), the program's Part A hospital insurance trust fund will be exhausted in 2024. That's just three years away, before the end of President Joe Biden's first term.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Does Plan G cover excess charges?

Like Medigap Plan F, Plan G also covers “excess charges.” Doctors who don't accept the full Medicare-approved amount as full payment can charge you up to 15% more than the Medicare-approved amount for services or procedures.

How Common Are Medicare Part B Excess Charges?

Doctors that charge Part B Excess charges, in most parts of the country, are relatively uncommon. Some recent studies have put the national percent...

What States Prohibit Medicare Part B Excess Charges?

As previously mentioned, there are some states that prohibit Part B Excess charges altogether. In these states, doctors are not allowed to implemen...

How to Avoid Medicare Part B Excess Charges?

There are several ways to avoid Part B Excess Charges. The most obvious, of course, is to live in a state that prohibits them (see list above).Beyo...

What is a Part B excess charge?

"Excess Charges" is a term that applies to original Medicare, or original Medicare with a Supplement Insurance Plan (Medigap).

What is Medicare Assignment?

Medicare assignment is an agreement that a provider makes with Medicare.

Other reasons to choose providers who accept Medicare Assignment

Providers who accept Medicare Assignment agree to only collect your Part B deductible at the time of service. Most providers will wait for Medicare to pay its share before they bill you. Nonparticipating providers can collect payment in full upfront.

How Common are Medicare Part B Excess Charges?

As I stated earlier, in most parts of the country, Part B Excess charges are rare.

What states prohibit Part B Excess Charges?

There are eight states where providers are prohibited from charging Part B excess fees. If you live in one of these eight states, you won't have to worry about excess charges unless you get services in a state that allows them.

What is excess charge in Medicare?

Medicare Part B “Excess Charges” is a term that you might encounter with Medicare Supplement , or Medigap, plans. These are charges that a doctor adds above and beyond the Medicare-approved amount for a procedure or service. Ok, so do you know what this actually means and how it affects you, the Medicare recipient?

How much can a doctor bill for Medicare?

However, in most states doctors, surgeons, specialists etc are allowed to bill 15% above Medicare’s approved amount for medical procedures. If you don’t have a Medigap plan that has the Part B Excess Charges benefit you would need to pay out of pocket that 15% above the allowable rate.

Do you have to worry about Part B excess charges?

However if you live in Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont, you do not have to worry about Part B Excess Charges.

Can you get a Medigap plan if you get hit by a car?

Now of course if you have a stroke or get hit by a car it’s not even possible to ask that question and that’s why it is very important to have a Medigap plan to cover that benefit. There are some Medigap plans that will protect you from paying excess charges, and then some Medigap plans that won’t.

Who can make excess charges under Medicare?

Any health care provider who accepts Medicare as a form of insurance (but doesn’t accept assignment) and is offering a service or item covered under Part B reserves the right to make excess charges. This can include: Laboratories. Other medical test providers. Home health care companies.

What is Medicare Part B excess charge?

What is a Medicare Part B excess charge? An excess charge happens when you receive health care treatment from a provider who does not accept the Medicare-approved amount as full payment. In these cases, a provider can charge you up to 15% more than the Medicare-approved amount. There are some ways you can avoid paying Part B excess charges, ...

What is Plan G?

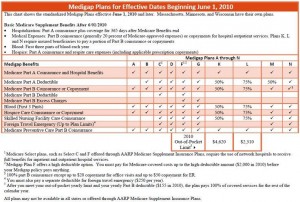

Plan G. Such a benefit allows you to freely visit Medicare providers without worry if they are participating or non-participating providers. Any excess charges they file will be picked up by your Medigap plan. You can use the chart below to compare the types of standardized Medigap plans and the benefits they offer.

How much does Medicare charge for non-participating doctor?

You visit a non-participating doctor and receive treatment that carries a Medicare-approved amount of $300. If the doctor is does not accept Medicare assignment, they are allowed to charge up to 15 percent more than that amount. If the provider charges you the full 15 percent Part B excess charge, your total bill for the service will be $345.

What is Part B insurance?

Part B covers doctor’s appointments and other types of outpatient care along with durable medical equipment. Part B excess charges will only occur if you visit a provider or a DME supplier who doesn’t accept Medicare assignment. Any health care provider who accepts Medicare as a form of insurance (but doesn’t accept assignment) ...

What does DME mean in Medicare?

When a doctor, health care provider or a supplier of durable medical equipment (DME) accepts Medicare assignment, it means that the Medicare-approved amount as full payment . The Medicare-approved amount is the amount of money that Medicare has determined it will reimburse a provider for a given service or item.

Does Medicare Part A cover out of pocket expenses?

Medigap plans provide coverage for many of the out-of-pocket expenses Medicare Part A and Part B (Original Medicare) don’t cover. These costs can include deductibles, coinsurance, copayments and more. There are 10 standardized Medigap plans available in most states.

What is Medicare Part B excess charge?

Doctors who do not accept Medicare assignment may charge you up to 15 percent more than what Medicare is willing to pay. This amount is known as a Medicare Part B excess charge. You are responsible for Medicare Part B excess charges in addition to the 20 percent of the Medicare-approved amount you already pay for a service.

How much does Medicare pay?

Medicare pays 80 percent, then you receive a bill for the remaining 20 percent. Doctors who are not Medicare-approved can ask you for full payment up front. You will be responsible for getting reimbursed by Medicare for 80 percent of the Medicare-approved amount of your bill.

What is a Medigap Plan F?

The two Medigap plans that cover Part B excess charges are: Medigap Plan F. Plan F is no longer available to most new Medicare beneficiaries.

What happens if a doctor doesn't accept Medicare?

Your doctor doesn’t accept assignment. If you instead go to a doctor who doesn’t accept Medicare assignment, they might charge you $345 for the same in-office test. The extra $45 is 15 percent over what your regular doctor would charge; this amount is the Part B excess charge. Instead of sending the bill directly to Medicare, ...

What is Medicare Part B?

Medicare Part B is the part of Medicare that covers outpatient services, such as doctor visits and preventive care. Medicare Part A and Medicare Part B are the two parts that make up original Medicare. Some of the services Part B covers include: flu vaccine. cancer and diabetes screenings. emergency room services.

How much does a general practitioner charge for an in-office test?

Your doctor accepts assignment. Your general practitioner who accepts Medicare might charge $300 for an in-office test. Your doctor would send that bill directly to Medicare, rather than asking you to pay the entire amount. Medicare would pay 80 percent of the bill ($240).

Can a doctor accept Medicare?

Not every medical professional accepts Medicare assignment. Doctors who accept assignment have agreed to accept the Medicare-approved amount as their full payment. A doctor who doesn’t accept assignment may charge you up to 15 percent more than the Medicare-approved amount. This overage is known as a Part B excess charge.

What is Medicare Part B excess charge?

This means they accept the Medicare-approved amount as full payment for services that Medicare beneficiaries receive.

Why is it important to understand Medicare Part B excess charges?

Medicare Part B excess charges can trouble unsuspecting beneficiaries, but you don’t need to face these unnecessary and often expensive charges. Taking proactive steps can make sure you’re never charged more than you expect for your medical care.

How much does Medicare charge for an echocardiogram?

How Medicare Excess Charges Work. Let’s say you need an echocardiogram to check your heart function. A doctor who accepts assignment from Medicare may charge $100 for the procedure. They would receive $80 from Medicare and send you the bill for the Part B coinsurance amount of $20.

What is a Medigap Supplement Plan?

Get a Medigap supplement plan that covers Part B excess charges. Plan F and Plan G are the only two Medigap plans that cover these extra charges. Plan F health insurance is no longer available to new beneficiaries, but everyone can buy Plan G.

What to do if you don't accept Medicare?

If they do, you won’t face Medicare Part B excess charges. If they don’t accept Medicare reimbursement for payment, ask whether you’ll receive an excess charge.

What is 20% coinsurance?

This 20% is your Medicare Part B coinsurance. Doctors who don’t accept assignment may charge a Medicare Part B excess charge, which could be up to 15% more than the amount Medicare approved for the cost of that specific service or piece of medical equipment.

How much does Medicare cover in 2021?

It’s important to note that Part B excess charges do not count towards your annual Part B deductible, which is $203 in 2021.

What is Medicare excess charge?

Medicare excess charges are also known as balance-billing. Today, over 96% of U.S. doctors choose to participate with Medicare and agree only to charge the amount Medicare has approved for the service.

What is the Medicare Overcharge Measure?

The Medicare Overcharge Measure prohibits providers from charging beneficiaries excess charges. Currently, eight states are prohibited from charging excess fees due to the MoM law. If you live in one of these eight states, you’ll never have to worry about excess charges.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Can a doctor charge more for Medicare than the full amount?

Doctors that don’t accept Medicare as full payment for certain healthcare services may choose to charge up to 15% more for that service than the Medicare-approved amount. Below, we’ll explain how excess charges work and what you can do to avoid them.

What is excess charge in Medicare?

An Excess Charge is defined as the difference between Medicare’s approved billing amount for a service and what your doctor actually charges. Currently, the very popular Medigap Plan G and Medigap Plan F are the only plans that cover excess charges when a doctor bills you above the Medicare allowable.

How many doctors accept Medicare?

Currently, 96% of doctors accept Medicare assignment. The remaining 4% can charge what they want, up to the legal limits. However, most non-participating doctors will accept the Medicare allowable amount if your Medigap Plan doesn’t cover excess charges.

How much can a non-participating doctor charge?

In fact, in some states, billing for any excess charges is illegal. In the remaining states, the limit is 9.25% (based on a 15% legal limit applied to Medicare’s reduced allowable of 5% to non-participating providers).

Can a participating doctor bill you above the Medicare allowable?

This approved amount is known as the Medicare allowable. Participating physicians can not bill you above the Medicare allowable.

Can a non-participating doctor bill you?

Non-participating doctors have different agreements with Medicare. At their discretion, on a case-by-case basis, they can bill you above the Medicare allowable. This amount is called an excess charge. There are rules regarding how much above the allowable non-participating doctors can charge you. In fact, in some states, billing for any excess ...

Which states prohibit Medicare from charging higher than the Medicare allowable rate?

The following states passed laws prohibiting healthcare providers from charging Medicare beneficiaries anything higher than the Medicare allowable rate: Connecticut. Minnesota.

What does it mean when a provider accepts Medicare assignment rates?

When a provider accepts Medicare assignment rates, it means that provider won’t bill you above the Medicare-allowable rate by a participating provider. Providers who don’t participate in Medicare can bill you up to 15% more than the Medicare allowable amount at their discretion. This additional amount is considered a Part B excess charge.

How much does a dermatologist bill for a $400 procedure?

If the Medicare allowable charge for this procedure is $400, the dermatologist could bill you $460. Assuming you’ve met your Part B deductible already, your out-of-pocket costs for the procedure would be $140. This is your 20% coinsurance amount of $80 plus the 15% Part B excess charges of $60. With a participating provider, your out-of-pocket ...

How many primary care providers accept assignment?

Statistics suggest that as many as 95% of primary care providers accept assignment. A slightly smaller number of specialist physicians accept it as well. Not all nonparticipating providers will add Part B excess charges if you don’t have a Medigap plan, so you may only rarely see Part B excess charges. That said, however, there is no limit on the ...

How to protect yourself from excess charges?

The easiest way to protect yourself from excess charges is to only use physicians who accept Medicare assignment. Then you know you will never be billed more than Medicare allows for your healthcare services. It’s always a good idea to ask your doctor if he or she accepts assignment before you make an appointment.

What states have Medigap Plan N?

Minnesota. Ohio. Pennsylvania. Rhode Island. Vermont. Massachusetts. New York. People in these states then, might also consider Medigap Plan N, which has similar benefits to Plan G. One big difference is that Plan N does not cover excess charges, so the premiums for Plan N are lower.

What happens if a doctor doesn't accept Medicare?

Also, if you see a doctor who accepts Medicare assignment, but Medicare doesn’t accept the claim for the service billed, the doctor can charge you more than Medicare’s approved price.

What Is Medicare Part B?

Medicare Part B is a section of Medicare for outpatient services. This would include things like a visit to the doctor for preventative care.

What Are Medicare Part B Excess Charges?

Not all medical providers accept Medicare and doctors that do accept it are saying they agree to accept the Medicare-approved amount as payment.

Avoiding Medicare Part B Excess Charges

You should never assume that a medical provider is going to accept Medicare.

Do You Have More Medicare Questions?

Medicare has a lot of rules to remember and follow, so it can be confusing to handle it on your own.