Can I have a secondary payer alongside Medicare?

Feb 23, 2021 · of the Medicare Secondary Payer Manual provides guidance on finding other primary payers.) After receiving the primary payer remittance advice, bill Medicare as the secondary payer, if appropriate. MLN Matters: SE21002 Related CR N/A. Page 2 of 3 If you see a beneficiary for multiple services, bill each service to the proper primary payer. ...

How does Medicare work with other insurance?

Step 1: Get a National Provider Identifier (NPI) You must get an NPI before enrolling in the Medicare Program. Apply for an NPI in 1 of 3 ways: Online Application: Get an I&A System user account. Then apply in the National Plan and Provider Enumeration System (NPPES) for an NPI.

How do I respond to a Medicare Secondary claim Development Questionnaire?

Common Circumstances Where Medicare is the Secondary Payer. Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that ...

How do I enroll my provider in the Medicare program?

How Medicare coordinates with other coverage. If you have questions about who pays first, or if your coverage changes, call the Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627). Tell your doctor and other. health care provider. A person or organization that's licensed to give health care.

How do I add a new place to Medicare?

0:3811:30PECOS Enrollment Tutorial – Adding a Practice Location (DMEPOS Only)YouTubeStart of suggested clipEnd of suggested clipHere you can see a summary of information such as the enrollment state the corresponding status ofMoreHere you can see a summary of information such as the enrollment state the corresponding status of the application the specialty type the practice location along with additional information.

How do I change my Medicare practice location?

Remember: if you move your office location, you must complete the appropriate CMS-855/CMS-20134 form to update your Medicare address information. The form must bear a handwritten signature of the physician / non-physician practitioner or of the group / organization's authorized or delegated official.Oct 28, 2021

How do I update my Pecos information?

Sign in to the PECOS system using your CMS Identity and Access login credentials. 2. Select “Account Management” in the middle of the page to update PECOS account information. You can also access your Medicare provider enrollment records here, but you will be redirected to the CMS Identity and Access website.

How do I add an organization to Pecos?

0:3711:41PECOS Enrollment Tutorial – Initial Enrollment for an Organization ...YouTubeStart of suggested clipEnd of suggested clipPage on this screen you'll be shown your employer information as a label and any organizations thatMorePage on this screen you'll be shown your employer information as a label and any organizations that you have access to submit applications on behalf presenter selects the provider.

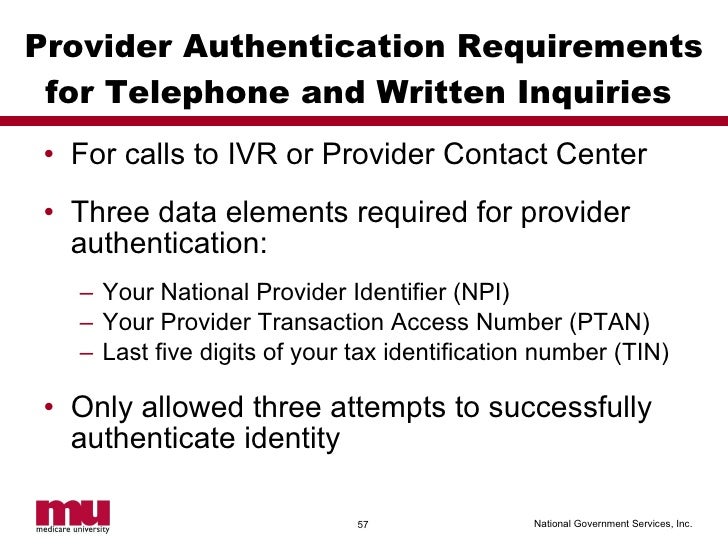

What is Ptan?

A PTAN is a Medicare-only number issued to providers by Medicare Administrative Contractors (MACs) upon enrollment to Medicare.Nov 4, 2020

What is a Pecos provider?

PECOS stands for Provider, Enrollment, Chain, and Ownership System. It is the online Medicare enrollment management system that allows individuals and entities to enroll as Medicare providers or suppliers.Dec 11, 2020

How do providers reassign Medicare benefits?

Providers and suppliers are able to submit their reassignment certifications either by signing section 6A and 6B of the paper CMS-855R application or, if completing the reassignment via Internet-based PECOS, by submitting signatures electronically or via downloaded paper certification statements (downloaded from www. ...

Are Pecos and Nppes the same?

Accordingly, CMS uses enrollment systems, including the Medicare Provider Enrollment, Chain, and Ownership System (PECOS) and the National Plan & Provider Enumeration System (NPPES), to manage provider information and identifiers.

How do you reassign benefits in Pecos?

1. The User will go to the PECOS web site at https://pecos.cms.hhs.gov, enter their I&A User ID and Password, and select "Log In." Page 2 2. The User selects "My Associates." Page 3 3. The User selects "View Enrollments" beside the application where they need to add or remove a reassignment of benefits.

What is Pecos Medicare requirement?

CMS developed PECOS as a result of the Patient Protection and Affordable Care Act. The regulation requires all physicians who order or refer home healthcare services or supplies to be enrolled in Medicare.

Is Ptan the same as Medicare ID?

The Provider Transaction Access Number (PTAN) is your unique Medicare identification number. This number is assigned to providers once their enrollment has been approved.Aug 20, 2020

How do I upload documents to Pecos?

1:414:56Uploading Documentation in Internet-Based PECOS - YouTubeYouTubeStart of suggested clipEnd of suggested clipFirst log in to internet-based Pecos enter the user ID and password. Then select the login buttonMoreFirst log in to internet-based Pecos enter the user ID and password. Then select the login button next select the my associates. Button next select the view enrollments.

What is conditional payment?

A conditional payment is a payment Medicare makes for services another payer may be responsible for.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

What are the responsibilities of an employer under MSP?

As an employer, you must: Ensure that your plans identify those individuals to whom the MSP requirement applies; Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer; and.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

What age does GHP pay?

Individual is age 65 or older, is covered by a GHP through current employment or spouse’s current employment AND the employer has 20 or more employees (or at least one employer is a multi-employer group that employs 20 or more individuals): GHP pays Primary, Medicare pays secondary. Individual is age 65 or older, ...

How to change Medicare enrollment after getting an NPI?

Before applying, be sure you have the necessary enrollment information. Complete the actions using PECOS or the paper enrollment form.

How to get an NPI for Medicare?

Step 1: Get a National Provider Identifier (NPI) You must get an NPI before enrolling in the Medicare Program. Apply for an NPI in 1 of 3 ways: Online Application: Get an I&A System user account. Then apply in the National Plan and Provider Enumeration System (NPPES) for an NPI.

How to request hardship exception for Medicare?

You may request a hardship exception when submitting your Medicare enrollment application via either PECOS or CMS paper form. You must submit a written request with supporting documentation with your enrollment that describes the hardship and justifies an exception instead of paying the application fee.

What are the two types of NPIs?

There are 2 types of NPIs: Type 1 (individual) and Type 2 (organizational). Medicare allows only Type 1 NPIs for solely ordering items or certifying services. Apply for an NPI in 1 of 3 ways:

How long does it take to become a Medicare provider?

You’ve 90 days after your initial enrollment approval letter is sent to decide if you want to be a participating provider or supplier.

What is Medicare Part B?

Medicare Part B claims use the term “ordering/certifying provider” (previously “ordering/referring provider”) to identify the professional who orders or certifies an item or service reported in a claim. The following are technically correct terms:

What is Medicare revocation?

A Medicare-imposed revocation of Medicare billing privileges. A suspension, termination, or revocation of a license to provide health care by a state licensing authority or the Medicaid Program. A conviction of a federal or state felony within the 10 years preceding enrollment, revalidation, or re-enrollment.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

How old do you have to be to be covered by a group health plan?

Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization that shares a plan with other employers with more than 20 employees between them.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

Is ESRD covered by COBRA?

Diagnosed with End-Stage Renal Disease (ESRD) and covered by a group health plan or COBRA plan; Medicare becomes the primary payer after a 30-day coordination period. Receiving coverage through a No-Fault or Liability Insurance plan for care related to the accident or circumstances involving that coverage claim.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

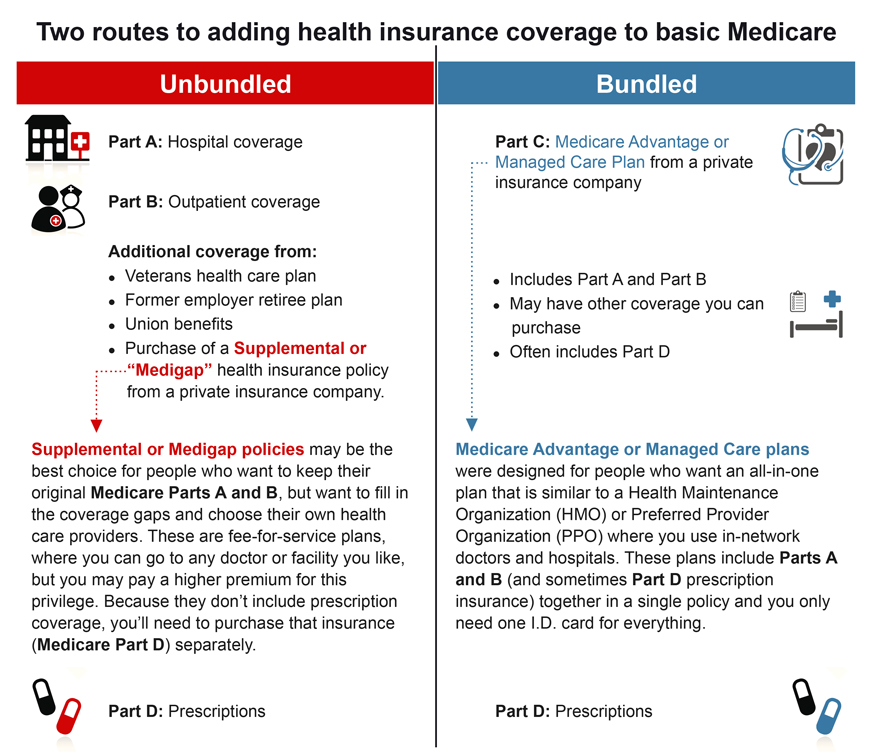

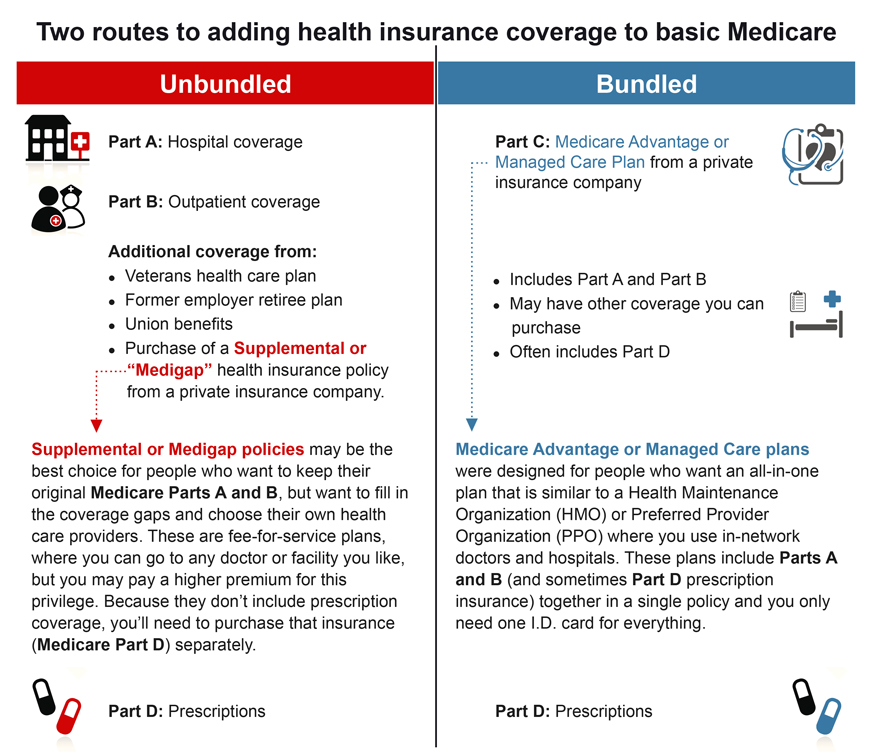

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How to ensure correct payment of Medicare claims?

To ensure correct payment of your Medicare claims, you should: Respond to Medicare Secondary Claim Development Questionnaire letters in a timely manner. Tell the BCRC about any changes in your health insurance due to you, your spouse, or a family member’s current employment or coverage changes.

What is Medicare reporting?

Reporting Other Health Insurance. If you have Medicare and other health insurance or coverage, each type of coverage is called a "payer.". When there is more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay.

What is the insurance that pays first called?

The insurance that pays first is called the primary payer . The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer. The secondary payer only pays if there are costs the primary insurer didn't cover.

What is a COB in Medicare?

The Medicare Coordination of Benefits (COB) program wants to make sure Medicare pays your claims right the first time, every time. The Benefits Coordination & Recovery Center (BCRC) collects information on your health care coverage and stores it in your Medicare record.

What is a secondary claim development questionnaire?

The Medicare Secondary Claim Development Questionnaire is sent to obtain information about other insurers that may pay before Medicare. When you return the questionnaire in a timely manner, you help ensure correct payment of your Medicare claims.

What is black lung insurance?

If you are receiving black lung benefits, workers' compensation benefits, or treatment for an injury or illness for which another party could be held liable, or are covered under automobile no-fault insurance; and. If you have other health insurance or coverage based upon a family member's current employment.

Is Medicare a secondary payer?

You. Medicare may be your secondary payer. Your record should show whether a group health plan or other insurer should pay before Medicare. Paying claims right the first time prevents mistakes and problems with your health care plans. To ensure correct payment of your Medicare claims, you should:

How does Medicare and Tricare work together?

Medicare and TRICARE work together in a unique way to cover a broad range of services. The primary and secondary payer for services can change depending on the services you receive and where you receive them. For example: TRICARE will pay for services you receive from a Veteran’s Administration (VA) hospital.

How does Medicare work with employer sponsored plans?

Medicare is generally the secondary payer if your employer has 20 or more employees . When you work for a company with fewer than 20 employees, Medicare will be the primary payer.

What is FEHB insurance?

Federal Employee Health Benefits (FEHBs) are health plans offered to employees and retirees of the federal government, including members of the armed forces and United States Postal Service employees. Coverage is also available to spouses and dependents. While you’re working, your FEHB plan will be the primary payer and Medicare will pay second.

How long can you keep Cobra insurance?

COBRA allows you to keep employer-sponsored health coverage after you leave a job. You can choose to keep your COBRA coverage for up to 36 months alongside Medicare to help cover expenses. In most instances, Medicare will be the primary payer when you use it alongside COBRA.

How much does Medicare Part B cover?

If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If you have a secondary payer, they’d pay the $20 instead. In some cases, the secondary payer might not pay all the remaining cost.

What is primary payer?

A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments. When you become eligible for Medicare, you can still use other insurance plans to lower your costs and get access to more services. Medicare will normally act as a primary payer and cover most ...

What is the standard Medicare premium for 2021?

In 2021, the standard premium is $148.50. However, even with this added cost, many people find their overall costs are lower, since their out-of-pocket costs are covered by the secondary payer. Secondary payers are also useful if you have a long hospital or nursing facility stay.

What is the MA number for EVS?

EVS is operational 24 hours a day, 365 days a year at the following number: 1-866-710-1447 -Required.

Do you need to complete 17-17B?

Required. Note: Completion of 17-17b is only required for Lab and Other Diagnostic Services.

Who must first bill the other insurance company before Medical Assistance will pay the claim?

If a recipient is covered by other insurance or third party benefits such as Worker’s Compensation, CHAMPUS or Blue Cross/Blue Shield, the provider must first bill the other insurance company before Medical Assistance will pay the claim. PROPER COMPLETION OF CMS-1500.

Submitting MSP Claims via FISS DDE or 5010

All MSP claims submitted via FISS DDE or 5010 must report claim adjustment segment (CAS) information. In FISS DDE, the CAS information is entered on the "MSP Payment Information" screen (MAP1719), which is accessed from Claim Page 03 by pressing F11. This is in addition to the normal MSP coding information.

Correcting MSP Claims and Adjustments

Return to Provider (RTP): MSP claims may be corrected out of the RTP file (status/location T B9997). However, providers must ensure that claim adjustment segment (CAS) information is reported on the "MSP Payment Information" screen (MAP1719), accessed from Claim Page 03 by pressing F11.