How do I submit SSA-44?

How do I request an Irmaa adjustment?

What is a SSA-44 form?

How do I notify Medicare of income change?

How do I appeal Irmaa online?

How do you calculate modified adjusted gross income for Irmaa?

What qualifies as a life changing event for Medicare?

What is a form 44?

What is modified AGI for Medicare?

Can you submit SSA forms online?

What is the income related monthly adjustment amount?

How does Medicare determine your income?

How to submit SSA 44?

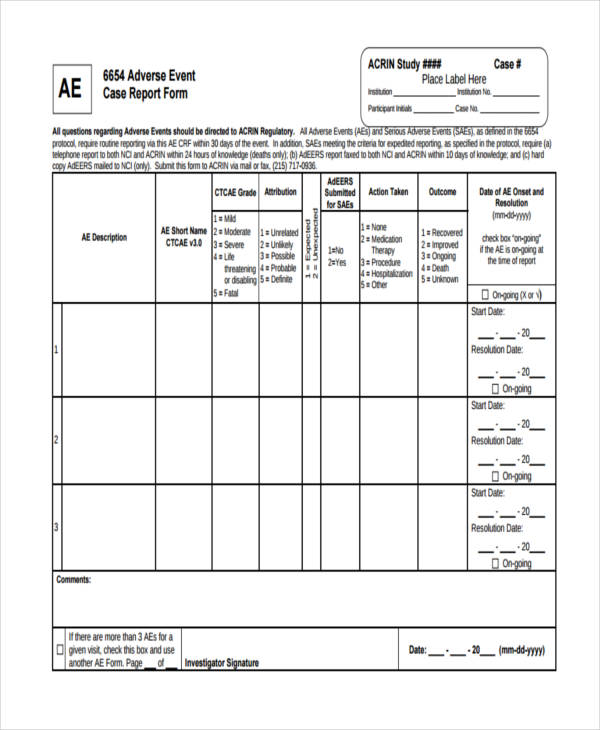

How to submit Form SSA 44. Once you have completed your Social Security Form SSA44, you are now ready to sign. Make sure you verify the content of your information to ensure they are correct. Also, you’ll need to make sure that you have all your documents with you, including: The evidence of your life-changing event.

How to contact Social Security about a life changing event?

If you have more than one life-changing event, you should not use form SSA 44. Instead, you should contact Social Security at 1-800-772-1213. In Step 2, you’ll need to indicate which tax year your income was reduced by the life-changing event.

What is SSA 44?

The SSA-44 is used to notify the Social Security Administration (SSA) of changes to your income that may result in a change in your Medicare premiums. The SSA 44 form is called “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event”. They all refer to the same SSA 44 form. Typically, when you enroll in Medicare part B, ...

What is a life changing event form?

Life changing event form. They all refer to the same SSA 44 form. Typically, when you enroll in Medicare part B, the premiums you’ll need to pay are a function of your income. The more income you earn, the higher your premiums (and vice versa). When you are required to pay a higher premium, you will be asked to pay an income-related monthly ...

Is SSA 44 the same as Medicare Part B?

They all refer to the same SSA 44 form. Typically, when you enroll in Medicare part B, the premiums you’ll need to pay are a function of your income. The more income you earn, the higher your premiums (and vice versa). When you are required to pay a higher premium, you will be asked to pay an income-related monthly adjustment amount (IRMAA).

Is SSA 44 an appeal form?

All aspects related to the change in your Medicare premiums are managed using SSA form 44. The Form SSA44 is technically not an appeal form. Rather, it’s a request that you make so the SSA can consider certain events in your life that can impact your Medicare premium calculation.

What is the purpose of SSA 44?

What is the purpose of Form SSA-44. When you experience a life-changing event resulting in your income going down, you can use the Social Security Form SSA 44 to request a reduction in your income-related monthly adjustment amount. In other words, if you notice that your premiums of Medicare part B or prescription drug coverage include ...

What is Medicare based on?

If you have a Life Changing Event, you might be able to! When you enroll in Medicare, the premium you pay is based on your income from ALL sources. Typically, Medicare looks back at your tax return from two years ago to determine your monthly premiums.

Can you use your past income to lower Medicare premiums?

A reduction of income, due to a Work Stoppage or Work Reduction , are the most common Life Changing Events (LCEs) you can potentially use to lower your Medicare premiums NOW .

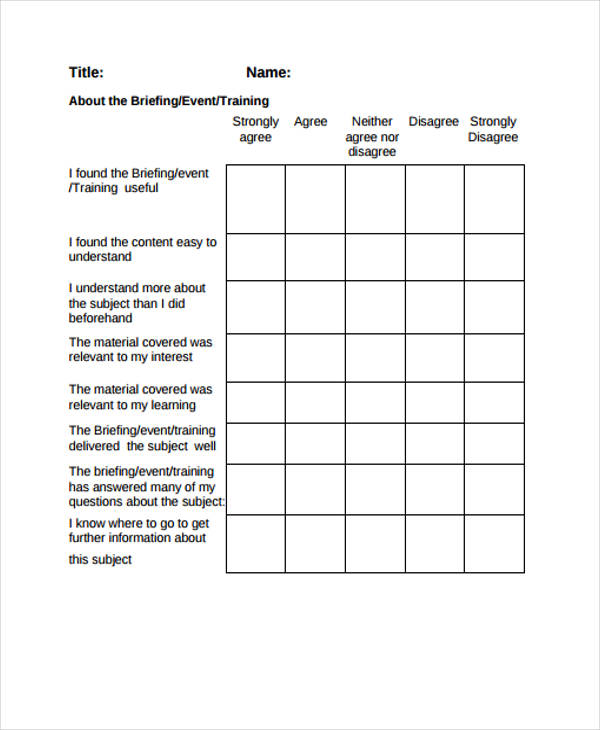

What is the step 3 for filing taxes?

Select your tax filing status (i.e. Single, Married Filing Joint, Married Filing Separate) - Step 3: Only necessary if your income will be in an even lower income range than referenced in Step 2. Otherwise, you can leave Step 3 blank.

Can a beneficiary request a new initial determination after an LCE?

1. A beneficiary may request a new initial determination any time after an LCE and a significant reduction in MAGI has occurred. The LCE may have occurred at any time in the past. 2.

Can a beneficiary give a second tax year estimate?

The beneficiary also has the option to give a second tax year estimate for the next premium year if the LCE also affects it. If he or she gives an estimate for the current premium year, but not for the next premium year, use the current year estimate for the next premium year.

When is Part B determination effective?

the new initial determination for Part B is effective January (or the first month of Part B entitlement) of the current year. The new initial determination for IRMAA-D is effective January (or the prescription drug coverage start date, if later).

What is the Social Security form 1839?

We are required by section 1839(i) of the Social Security Act to ask you to give us the information on this form . This information is needed to determine if you qualify for a reduction in the income-related adjustment to your Medicare Part B premium. In order for us to determine if you qualify, we need to evaluate information that you provide to us about your modified adjusted gross income. Although the responses are voluntary, if you do not provide the requested information we will not be able to consider a reduction in your Medicare Part B premium.

What line do you report tax exempt interest on a 1040?

On IRS form 1040, tax-exempt interest income is the amount you expect to report on line 8b.