What is Qualified Medicare Beneficiary (QMB) Program?

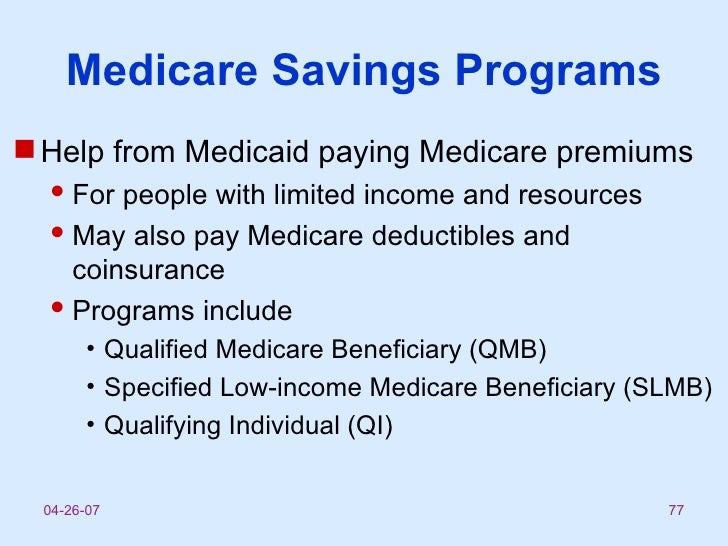

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay yo...

Who is eligible for Qualified Medicare Beneficiary (QMB) Program?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page...

How do I apply for Qualified Medicare Beneficiary (QMB) Program?

To apply call your state Medicare Program.It's important to call or fill out an application if you think you could qualify for savings—even if your...

How can I contact someone?

For more information, please visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. Visit the Medicare.gov...

What is QMB in Medicare?

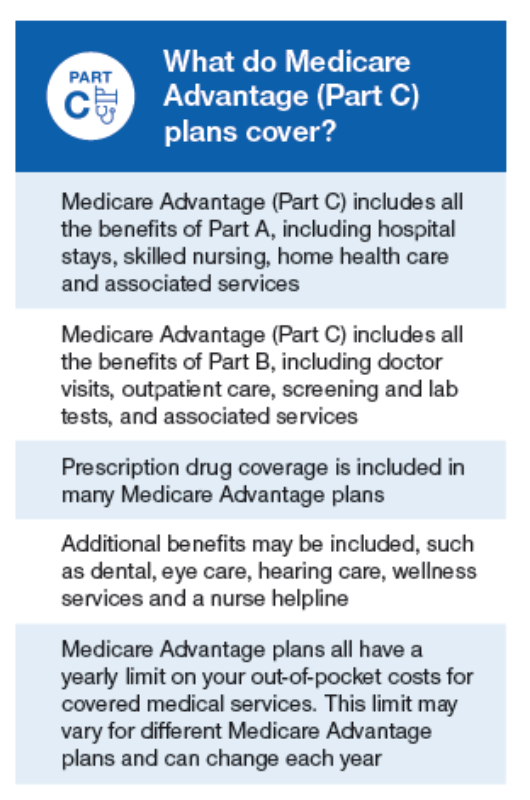

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare. Savings Programs that allows you to get help from your state to pay your Medicare. premiums. This Program helps pay for Part A premiums, Part B premiums, and. deductibles, coinsurance, and copayments.

What is the income limit for QMB?

Who is eligible for Qualified Medicare Beneficiary (QMB) Program? In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page: Individual monthly income limit $1,060. Married couple monthly income limit $1,430. Individual resource limit $7,730.

What is the number to call for Medicare?

1-800-633-4227. Additional Info. Qualified Medicare Beneficiary. Managing Agency. U.S. Department of Health and Human Services. Check if you may be eligible for this benefit. Check if you may be eligible for this benefit. Expand Quick Info Section. Benefit Categories >.

How to contact Medicare by phone?

For more information, please visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227) . TTY users can call 1-877-486-2048. Visit the Medicare.gov Helpful Contacts page to locate a contact near you. 1-800-633-4227. Receive an email when this benefit page is updated: Subscribe to this Benefit.

What is QMB in Medicare?

The Qualified Medicare Beneficiary ( QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

Can a QMB payer pay Medicare?

Billing Protections for QMBs. Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items ...

What is QMB in Medicare?

Takeaway. The Qualified Medicare Beneficiary (QMB) program is one of the four Medicare savings programs. The QMB program helps those with limited income and resources pay for costs associated with Medicare parts A and B (original Medicare). To enroll in the QMB program, you must be eligible for Medicare Part A and meet certain income ...

What are the eligibility criteria for QMB?

QMB eligibility. There are three different eligibility criteria for the QMB program. These include Medicare Part A eligibility, income limits, and resource limits. You can receive QMB benefits whether you have original Medicare (parts A and B) or a Medicare Advantage plan.

What is QMB program?

The QMB program helps you pay for Medicare costs if you have lower income and resources. It’s estimated that more than 1 in 8 Medicare beneficiaries were enrolled in the QMB program in 2017.

How much is the extra help for Medicare Part D 2021?

copays for prescriptions. Some pharmacies may still charge a small copay for prescriptions that are covered under Part D. For 2021, this copay is no more than $3.70 for a generic drug and $9.20 for each brand-name drug that is covered. Extra Help only applies to Medicare Part D.

What is the income limit for QMB 2021?

For 2021, the monthly income limits for the QMB program are: Individual: $1,094 per month. Married: $1,472 per month. Monthly income limits are higher in Alaska and Hawaii. Because of this, people living in these states may still be eligible for the QMB program, even if their monthly incomes are higher.

What is the enrollment process for Social Security?

The enrollment process requires you to fill out a short application form. The Social Security Administration (SSA) has a model form that can be found here. However, the form that you’ll actually fill out may be slightly different, depending on your state.

Does QMB increase monthly income?

The monthly income limit for the QMB program increases each year. That means you should still apply for the program, even if your income goes up slightly.

When a person gets medical care, should they tell their healthcare provider they have QMB coverage?

When a person gets medical care, they should tell their healthcare provider they have QMB program coverage. They should also show the provider their Medicare and QMB program cards.

How to get a refund from QMB?

Generally, if a person gets a bill they believe the QMB program should cover , they can get a refund. There are 3 ways a person can get help: Contact Medicare at 800-MEDICARE. Medicare will contact the healthcare provider and confirm the QMB program covers the individual and refund any payments already made.

What are the eligibility criteria for Medicare Part A?

Individuals must fulfill the following eligibility criteria: have or be eligible for Medicare Part A. live in the state where they are applying for the QMB program. have limited income, savings, and resources.

What is a QMB?

Medicare helps people with limited income and savings pay for their healthcare costs through Medicare Savings programs (MSPs). The Qualified Medicare Beneficiary (QMB) program is one of four available MSPs. In this article, we look at the QMB program, what it covers, and the income and resource limits. We also explain eligibility and enrollment ...

Why did Medicare develop these programs?

Medicare developed these programs to help Medicare beneficiaries with low income pay their healthcare costs.

What is Medicare Part D?

Medicare established this program to help people to pay for their Medicare Part D prescription drug coverage. It offers financial assistance for premiums, deductibles, and other associated prescription drug costs.

How to get my Medicare summary notice?

Show their Medicare Summary Notice (MSN) to the provider. The notice confirms a person is in the program. A person can get their MSN by logging in to their MyMedicare.gov account.

What does QMB mean in Medicare?

QMB stands for “Qualified Medicare Beneficiary” and is a cost assistance program designed to help individuals who are eligible for both Medicare and Medicaid, a circumstance that is known as “dual eligibility.”

How to apply for QMB?

To apply for the QMB program, contact your state Medicaid program . Please not that if your income or financial resources are close to the totals listed above, you should still apply, as you may potentially be eligible.

What is QMB insurance?

The QMB program helps pay for the full cost of Medicare Part A and Part B premiums along with complete coverage of deductibles, copayments and coinsurance. QMB offers the most comprehensive coverage of the programs available to dual-eligible beneficiaries.

Can a QMB provider charge other Medicare beneficiaries?

Federal law prohibits providers from billing beneficiaries enrolled in the QMB program for any such costs. This law even pertains to non-participating providers, who are allowed to charge other Medicare beneficiaries more for care.

Do you have to be on Medicare to qualify for QMB?

You must be eligible for both Medicare and Medicaid to be eligible for QMB benefits. While Medicare’s eligibility requirements are federally mandated, each state may set its own qualifying restrictions for Medicaid.

Does QMB cover Medicaid?

The QMB improper billing protection even extends to health care providers who do not accept Medicaid. That means QMB members may receive care from a provider who does not accept Medicaid and still receive protection from deductibles, copayments and coinsurance.

Does QMB cover out of pocket costs?

QMB enrollees face no out-of-pocket costs for care that is covered by Medicare Part A or Part B that is administered at a Medicare-approved facility by an approved provider. States do have the right to impose their own laws related to QMB that may override federal regulations, but any costs to the beneficiary would be minimal.

What is QMB in Medicare?

The Qualified Medicare Beneficiary ( QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

What is Medicare Competitive Bidding Program?

Medicare Competitive Bidding Program for Durable Medical Equipment and Coordination of Benefits for Beneficiaries Eligible for Medicare and Medicaid ( Dual Eligibles)

Can a pharmacy bill Medicare Part A?

Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items and services.

Is QMB being wrongly billed?

Despite the federal law, our July 2015 study (Access to Care Issues Among QMBs) (PDF) found that those in the QMB program were still being wrongly billed and that confusion about billing rules continued. We have taken several steps since to help Medicare providers and beneficiaries better understand the QMB protections, including through many of the resources below.

Key Takeaways

If you receive Social Security or Railroad Retirement Benefits for at least four months before you turn 65, you’ll automatically be enrolled into Medicare Part A Medicare Part A, also called "hospital insurance," covers the care you receive while admitted to the hospital, skilled nursing facility or other inpatient services.

Will I Automatically Be Enrolled in Medicare When I Turn 65?

Are you approaching 65? You might get Medicare Part A and Part B automatically. It all depends on whether you’re receiving Social Security benefits or not.

Checking Your Medicare Application Online

Many Americans retire when they turn 65 and are not yet collecting Social Security benefits. If you keep working until 65, you’ll need to submit a Medicare application. Start by finding the Medicare application on the Social Security website. The application process is completely free, and you can fill out the entire application online.

How Soon Does Medicare Coverage Start?

Your Medicare coverage start date depends on your age and when you enrolled in Medicare. If you enroll:

FAQs

The best time to enroll in Medicare is during your Initial Enrollment Period (IEP). This seven-month period starts three months before the month you turn 65, and ends three months after your birth month. If you enroll before your birthday, your Medicare coverage starts on the first day of the month you turn 65.

How to enroll in QMB?

To enroll in the QMB program, you first need to be enrolled in Medicare Part A. The next step is to review your income and assets to see if you fall below the limits set by Medicare. But remember there are exceptions to those limits, and you’re encouraged to apply even if your income or assets exceed them.

How to apply for QMB?

To apply for the QMB program, you’ll need to contact your state Medicaid office. You can check online to find your state’s office locations, or call Medicare at 800-MEDICARE. The documentation you’ll need varies by state, but your application process will likely include submissions of identification, proof of Medicare coverage, and financial information.

What is QMB program?

Since the QMB program aims to help individuals with low income, it places limits on the monthly income and financial resources available to you. If you exceed these limits, you may not be eligible for the program. Generally, participation is limited to individuals who meet the federal poverty level.

How long does it take to get a QMB denial?

Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal. Enrollment in any of the MSPs must be renewed each year. Even when your QMB is active, you may at times be wrongfully billed for items or services that it covers.

What is Medicare for older adults?

Medicare is meant to provide affordable healthcare coverage for older adults and other individuals in need. Even so, out-of-pocket costs can add up.

Can you be wrongfully billed for QMB?

Even when your QMB is active, you may at times be wrongfully billed for items or services that it covers. Contact Medicare for any billing problems. Be sure to carry documentation of your participation in the QMB program and show it to your providers.

Do you have to be a resident to qualify for QMB?

You must be a resident of the state in which you’re applying for the QMB program, and you must already be enrolled in Medicare Part A. Assets that aren’t counted when you apply for the QMB program include: your primary home.