Tax Deductions Answer: SSA

Social Security Administration

The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …

Full Answer

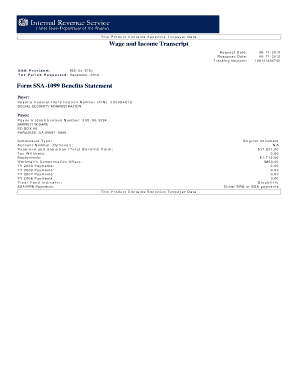

What is a social security 1099 tax form?

A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return.

Does social security go to Part B Medicare?

All Social Security Goes to Part B Medicare; Received SSA-1099 for 2020, but not 2021: How Do the Premiums Get Entered? You can report the social security benefit if you received it, even if you didn't receive the form that reported it. The social security benefit is tax-free income in your case, evidently.

What is a social security 1099 or 1042s benefit statement?

A Social Security 1099 or 1042S Benefit Statement, also called an SSA-1099 or SSA-1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year.

Can I use my Social Security benefits to pay for Medicare?

Your Social Security benefits can be used to pay some of your Medicare premiums. In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits. However, this doesn’t apply to all Medicare premiums.

Where can I find Medicare premiums on SSA-1099?

The net benefits in box 5 of the SSA-1099 is the amount that you received in 2017. Any medicare premiums paid for part B would be entered as an itemized deduction on Schedule A.

Does form SSA-1099 include Medicare premiums?

The SSA-1099 will show the premiums you paid for Part B, and you can use this information to itemize your premiums when you file your taxes. You'll also receive a form from Medicare called a Medicare summary notice.

Does Medicare A and B come out of Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is my Social Security account the same as my Medicare account?

A: They're not the same thing, but they do have many similarities, and most older Americans receive benefits simultaneously from both programs. Social Security, which was enacted in 1935, is a government-run income benefit for retirees who have worked – and paid Social Security taxes – for at least ten years.

Is Medicare Part B taxable income?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is the Medicare Part B deductible?

$233Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Who is eligible for Medicare Part B?

Be age 65 or older; Be a U.S. resident; AND. Be either a U.S. citizen, OR. Be an alien who has been lawfully admitted for permanent residence and has been residing in the United States for 5 continuous years prior to the month of filing an application for Medicare.

What is Medicare Part A and B mean?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

How do I get Plan B Medicare?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Will I be automatically enrolled in Medicare Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How do I check my Medicare account?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

When was the last update for Social Security?

Last Updated: February 22, 2019. Tax season is approaching, and Social Security has made replacing your annual Benefit Statement even easier. The Benefit Statement is also known as the SSA-1099 or the SSA-1042S.

How long does it take to create a Social Security document?

If you don’t have a my Social Security account, creating one is very easy to do and usually takes less than 10 minutes.

Can I get a copy of my SSA 1099?

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI). With a personal my Social Security account, you can do much of your business with us online, on your time, like get a copy of your SSA-1099 form. Visit our website to find out more. See Comments.

Why do you need to look at SSA 1099?

The reason why Social Security recipients need to look closely at Form SSA-1099 is that it plays a key role in letting the IRS know whether your benefits will be subject to tax. In particular, the IRS calculates a figure it calls "combined income," which adds up any wage or salary income you have, as well as investment income, business income, ...

What is the SSA-1099?

But every year during tax season, the Social Security Administration sends out information on Form SSA-1099 to anyone who receives Social Security benefits, and it's important to know what you're supposed to do with this tax form and how it can affect what you owe the IRS. Let's take a closer look at Form SSA-1099 and the key facts you need to know.

How much income is taxed on SSA 1099?

For singles with combined income between $25,000 and $34,000, as much as one-half of your benefits can be subject to income tax, although many will pay lesser amounts. Above $34,000, the maximum amount rises to 85% of the benefits reported on Form SSA-1099.

How much Social Security is taxed?

If you're single and the number is less than $25,000, then none of your Social Security will get taxed. For joint filers, the threshold number is $32,000. Above those amounts, however, some of your benefits will be added to taxable income. For singles with combined income between $25,000 and $34,000, as much as one-half ...

Does SSA 1099 include Medicare?

Image: IRS. Form SSA-1099 can also include supplemental information. For instance, if you're on Medicare, then your monthly Part B premiums will typically get deducted directly from your benefits. A description of that withholding will appear in the box marked Description of Amount in Box 3.

Is it too late to pay taxes on Social Security?

Planning to reduce taxable Social Security income. By the time you get Form SSA-1099, it's usually too late to do anything to reduce the amount of Social Security income that you'll pay tax on.

How much do you owe taxes on Social Security?

Depending on the amount of alternate income that you have in retirement and your filing status, you could owe taxes on up to 85% of your Social Security benefits. If you receive Social Security or Social Security Disability Insurance (SSDI) income, you will also receive a Form SSA-1099 from the government. This form tells you the total amount of ...

What is taxable income on a 1040?

Taxable Income – Other sources of income as listed on your Form 1040 covering taxable pensions, wages, dividends, and interest. This is the total of most of the income boxes in lines 7-21 of your Form 1040 with the exception of non-taxable portions of tax-exempt interest, IRA distributions, and pensions and annuities (lines 8b, 15a, and 16a, ...

Do you pay estimated taxes quarterly?

Any estimated tax payments are made quarterly, just like self-employment taxes. Note: At the state level, Social Security benefits often enjoy tax-free status. You will need to consult the laws in your state to verify if you owe any state tax obligations on your Social Security benefits. To avoid paying taxes pre-emptively on your Social Security ...

Is Social Security subject to higher tax?

Assuming that everything else in your life rises with inflation, then more and more people are having a greater percentage of their Social Security subject to tax and are in an exceptionally higher tax bracket. There haven't been any changes, even with the new tax law, about raising the thresholds.

Is SSA taxable if you are married?

Anything over the base amount may be taxable. The base amounts are $32,000 for married filing jointly and $25,000 for all other filing statuses, with one exception. If your status is married filing separately and you lived with your spouse at any time during the tax year, all of your SSA/SSDI benefits are taxable.

How many credits do you need to work to get Medicare?

You’re eligible to enroll in Medicare Part A and pay nothing for your premium if you’re age 65 or older and one of these situations applies: You’ve earned at least 40 Social Security work credits. You earn 4 work credits each year you work and pay taxes.

How much is Medicare Part B in 2021?

Your Part B premiums will be automatically deducted from your total benefit check in this case. You’ll typically pay the standard Part B premium, which is $148.50 in 2021. However, you might have a higher or lower premium amount ...

What is Medicare Part C and Part D?

Medicare Part C and Part D. Medicare Part C (Medicare Advantage) and Medicare Part D (prescription drug coverage) plans are sold by private companies that contract with Medicare. Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services.

How long do you have to be married to get Social Security?

You were married for at least 9 months but are now widowed and haven’t remarried.

Why do people pay less for Part B?

Some people will pay less because the cost increase of the Part B premium is larger than the cost-of-living increase to Social Security benefits. You might also be eligible to receive Part B at a lower cost — or even for free — if you have a limited income.

Can I use my Social Security to pay my Medicare premiums?

Can I use Social Security benefits to pay my Medicare premiums? Your Social Security benefits can be used to pay some of your Medicare premiums . In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits.

Does Medicare cover prescription drugs?

Medicare Part D plans cover prescription drugs. Part C and Part D plans are optional. If you do want either part, you’ll also have multiple options at various price points. You can shop for Part C and Part D plans in your area on the Medicare website.

Does Medicare Part A cover hospitalization?

En español | Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit. Medicare Part A, which covers hospitalization, is free for anyone who is eligible ...

Does Social Security deduct Medicare premiums?

In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is a claim number?

The claim number is the social security number under which a claim is filed or benefits are paid. If you are an SSI beneficiary, your claim number is your nine-digit Social Security Number (SSN) (000-00-0000) followed by two letters such as EI, DI, DS, DC.

Do you have to notify Social Security of a change in your record?

You must notify the Social Security Administration of any event affecting your eligibility for, or amount of, benefit payment (See � 133.2 and � 133.1 ). The office or telephone service center that you notify will make the change to your record or forward the information to the program service center. We will ask for your Social Security claim ...