- Pick the best Medicare Supplement plan based on your coverage needs. ...

- Find the best Medicare Supplement plan for your budget. To find the best Medicare Supplement plan for your budget, it’s important to understand how these plans are priced.

- Sign up during your Medicare Supplement Open Enrollment Period. Of course, there is no one plan that is the “best” Medicare Supplement plan. ...

- Find out if the insurance companies offers discounts. As you can tell, many things can affect the cost of Medicare Supplement insurance. ...

- Know when you have guaranteed-issue rights. You typically have guaranteed-issue rights during your Medicare Supplement Open Enrollment Period. ...

Full Answer

How to choose the best Medicare supplement plan?

Aug 17, 2021 · The best time to choose a Medigap plan is generally when you first sign up for Medicare, when you won't have to go through medical underwriting. As you select from the available plans, consider your personal priorities and needs, such as help paying for skilled nursing care or coverage during foreign travel.

How to choose the perfect Medicare plan?

Medicare Supplement plans, also known as Medigap, are health insurance plans provided by private companies to provide coverage for health services not covered by Original Medicare. If you're looking for more information on Medicare Supplement plans, give the experts a call at Turning 65 Solutions.

Can I use any doctor with a Medicare supplement plan?

The first step in choosing the right Medicare Supplement plan for you is to make a list of all the drugs (and dosages) that you currently take and expect to be taking in the coming year. Try also to estimate the medical care (visits to specialists, etc) you expect to receive the next year as this will help you to select the right plan.

How to select a Medicare supplement or Medicare Advantage plan?

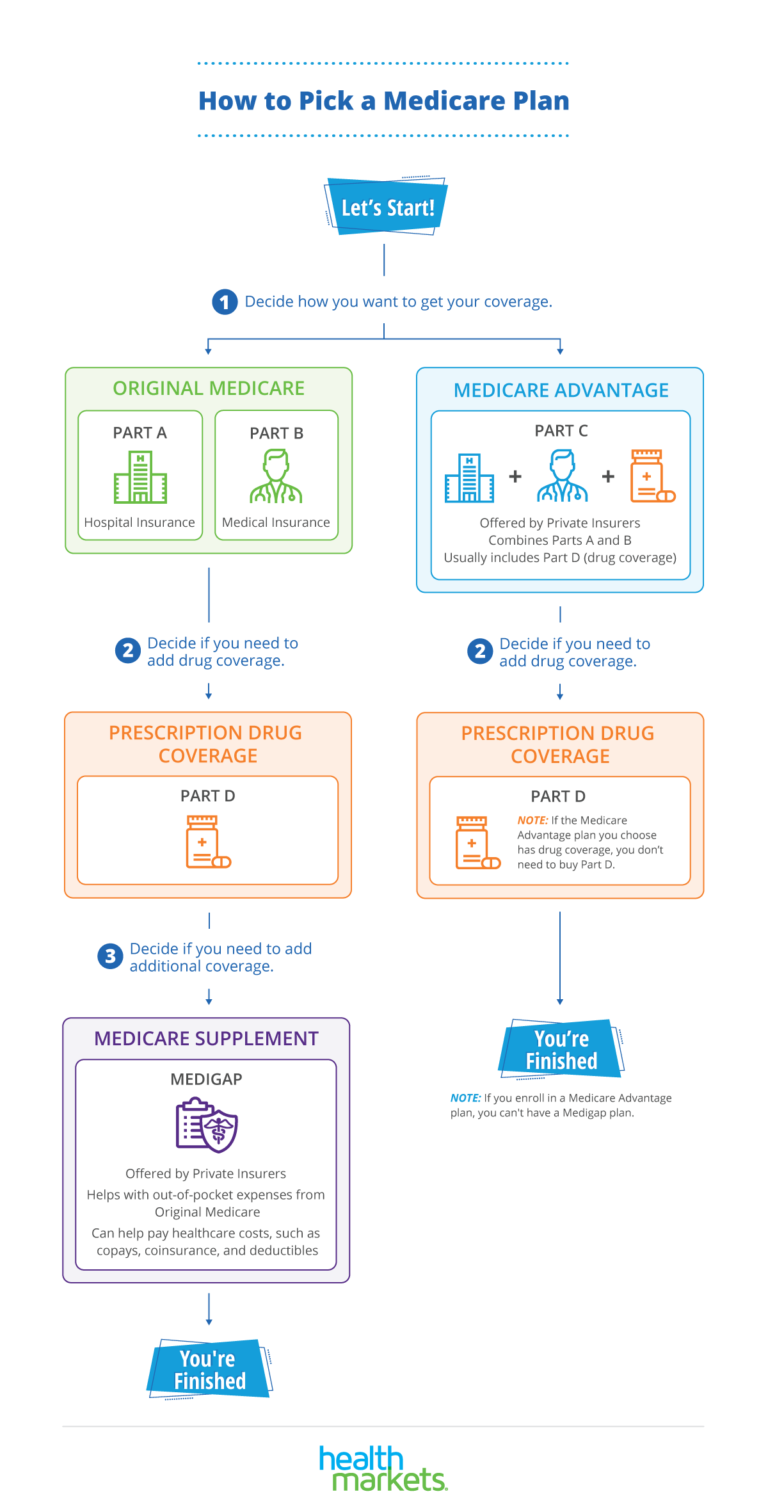

When you first enroll in Medicare and during certain times of the year, you can choose how you get your Medicare coverage. There are 2 main ways to get Medicare: Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the difference between a Plan F and Plan G for Medigap policies?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

What is a Medicare plan G?

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.Jan 24, 2022

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does Plan G have a deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Does Medicare Plan G cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

Does Plan G cover prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.Sep 29, 2021

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

What is the best Medicare Supplement Insurance Plan?

If you’re looking for minimal coverage, the best Medicare Supplement Insurance plan to consider might be Plan A, which offers the most basic level of coverage. If you prefer more coverage, Plans F* and G cover nearly all of the available benefits. Plans K and L may be the best Medicare Supplement Insurance plans for those want a yearly ...

When do you sign up for Medicare Supplement?

This is the six-month period that starts the first month you’re 65 or over , and enrolled in Medicare Part B.

What is issue age rated?

Issue-age rated: premiums are based on your age when you enroll and don’t go up as you get older. Community-rated: all plan members pay the same premium, regardless of their age. Attained-age rated: premiums are based on your current age, so your premium costs rise as you get older.

Is Medicare Supplement insurance one size fits all?

The truth is that when it comes to Medicare Supplement insurance there is not a one-size-fits-all solution. The best Medicare Supplement Insurance plan for you depends on your needs and budget. Here are five steps to help you find the best Medicare Supplement Insurance plan for your situation.

Is a plan available in all areas?

All plans are not available in all areas and are subject to plan limitations and applicable laws, rules, and regulations. The general information in this article is not intended to fully explain any specific plan. Please see the official plan documents for more complete information about any specific plan.

Does Medicare Supplement Insurance come with a monthly premium?

Medicare Supplement Insurance plans typically come with a monthly premium. However, insurance companies that sell Medicare Supplement Insurance coverage may price their plans differently. As you’re deciding on the best Medicare Supplement Insurance plan for your financial situation, keep in mind that insurance companies may use three types ...

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.