10 Ways You Can Save on Your Medicare Premiums

- Enroll on time. Many people are automatically enrolled in original Medicare ( Part A and Part B ). However, others...

- Find out if you’re eligible for premium-free Part A. Knowing if you’ll have to pay a monthly premium for Part A can...

- Report when your income goes down. Some parts of Medicare are associated with an...

- Enrolling on time, reporting changes in income, and shopping around for plans can all help to lower your Medicare premiums.

- Programs like Medicaid, Medicare savings plans, and Extra Help can help cover your healthcare costs.

- Individual states may also have programs to help cover these costs.

How can I save money on my Medicare coverage?

One way to potentially save money on your Medicare coverage is to simply shop around and compare available Medicare Advantage plans in your area. Call today to speak with a licensed insurance agent to learn more about a plan that could fit your health care needs.

How can I reduce my Medicare premiums?

1 Have Medicare Surcharges Reassessed. Most people pay a standard rate for Medicare. ... 2 Get Medicare Advantage Part B Premium Reduction. Everyone must pay a premium for Part B. ... 3 Get a Medicare Low-Income Subsidy. ... 4 Deduct Medicare Premiums from Your Taxes. ... 5 Use Your HSA to Pay Your Medicare Premiums. ...

How does an advantage plan reduce Medicare premiums?

Some advantage plans have a built-in premium reduction. Your policy pays a portion of the Part B premium, and you pay the rest. Having an Advantage plan with this option will reduce your overall Medicare premium costs.

How do I Pay my Medicare bill online?

Sign up for Medicare Easy Pay. Check if your bank offers an online bill payment service to pay electronically from your savings or checking account. Mail your payment by check, money order, credit card, or debit card (using the coupon on your bill) Get details about these payment options.

/GettyImages-1249785306-6a969e2e22f344f6afb18d52b508c768.jpg)

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Do Medicare premiums decrease with income?

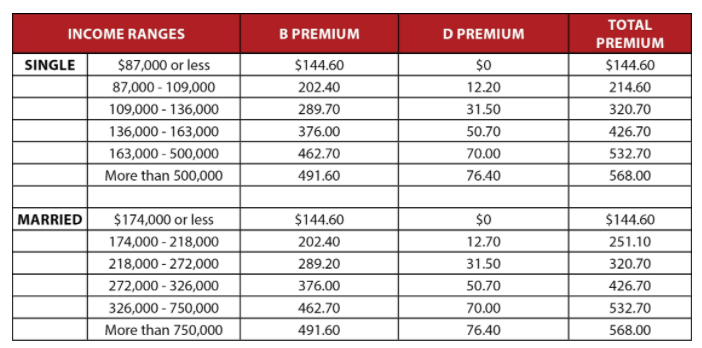

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

How much should I budget for Medicare premiums?

Generally, you pay 20% of the Medicare-approved amount for most Part B covered services after you have paid an annual deductible. (The standard deductible is $233 for 2022.)

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Why is my Medicare premium so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

What does the average retiree pay for Medicare?

The Center for Medicare and Medicaid Services estimates that the average monthly premium will be $19 in 2022, down from $21.22 in 2021.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How to avoid late penalties on Medicare?

Avoid Late Penalties by Signing Up When First Eligible. While avoiding penalties doesn’t directly reduce Medicare premiums, it does prevent them from becoming higher. You can sign up for Medicare three months before your 65th birthday month. You then have a seven-month-long Initial Enrollment Period. There’s a financial motive to enroll ...

What is Social Security premium based on?

That means your premium is based on your modified adjusted gross income from two years prior. You can ask the Social Security Administration to re-evaluate your premium if your income lowers because of a life-changing event. Examples of life-changing events include retirement, divorce, and the death of your spouse.

Why do people delay enrolling in Medicare?

Some people delay enrolling in Medicare because they have other insurance that’s cheaper or has other advantages. Those advantages won’t matter if your plan doesn’t count as “creditable coverage” and you have to pay a late enrollment penalty.

Is Medicare tax free?

It’s best to get advice from a professional about ways to grow your income tax-free. Medicare rules change from year to year, and so do the plans available in your area. It makes good financial sense to contact an agent every year to compare your options.

Can you change your Medigap plan at another time?

If you try to join a Medigap plan at another time, health issues can raise your premium. There are also yearly opportunities to change your advantage or Part D plans. These give you a chance to compare options and choose one with a lower cost.

Do you pay Medicare if you are a high income taxpayer?

Most people pay a standard rate for Medicare. If you’re a high-income taxpayer, you pay more. If your income is more than $88,000 for individuals or $176,000 for married couples, you’ll have a higher premium or an Income Related Monthly Adjustment Amount .In assessing IRMAA, Medicare doesn’t look at your current income.

Can you get extra help if you don't qualify for medicaid?

People with Medicaid automatically qualify for the Extra Help subsidy. However, you can obtain Extra Help, even if you don’t qualify for Medicaid. When your income is low, a subsidy can help reduce Medicare premiums and other costs.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare for seniors?

Medicare is a federally funded program that provides health insurance to people aged 65 or older. Younger people with end stage renal disease, and with certain disabilities may also qualify for Medicare. Medicare has several parts:

How much will Extra Help pay in 2021?

In 2021, a person with Extra Help pays a maximum of $3.70 for each generic medication or $9.20 for brand-name drugs. If an individual’s annual income is below $19,140, and they have less than $14,610 in resources, they may qualify for Extra Help.

How much is Part B insurance in 2021?

A person must pay the premium for Part B, which is $148.50 each month in 2021. The premium may be higher, depending on a person’s income. For 2021, the Part B deductible is $203 per year. After a person has paid the deductible, they generally pay 20% coinsurance of approved amounts.

What is the state health insurance program?

State Health Insurance Assistance Program (SHIP) The government funds SHIP. It provides free counseling by trained and unbiased volunteers who are experts in Medicare. A person can ask questions about any aspect of Medicare, including how to lower their healthcare costs and make any complaints or appeals.

What is a Medigap plan?

Medigap. Medigap is a supplemental Medicare insurance that may help a person save on some original Medicare costs, such as copays, deductibles, and coinsurance. Private companies administer 10 different types of Medigap plans. A person can compare the various policies and their coverage using this online tool.

What is Medicare Plan Finder?

The Medicare Plan Finder is an online tool that can help a person compare plans and coverage options and find potential savings. A person can access the tool on a tablet, smartphone, or desktop computer.

How long can you go without Medicare?

But for each 12-month period you go without Medicare coverage despite being eligible, you’ll be hit with a penalty that raises your Part B premium cost by 10 percent.

How much is Medicare Part B 2021?

The standard premium for Medicare Part B is $148.50 per month in 2021 – but that assumes you’re not a higher earner. Those with higher income levels are subject to higher premium costs.

Is Medicare Part A free for 2021?

July 13, 2021. facebook2. twitter2. While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here’s how you can pay less for them. 1.

What are the options for Medicare?

Medicare beneficiaries have two options for receiving Medicare prescription drug benefits: enrolling in a Medicare Advantage plan that offers prescription drug coverage or enrolling in a Medicare Part D prescription drug plan.

What to consider when choosing Medicare?

When choosing which Medicare coverage option fits your needs, you may want to consider the premium, or the monthly or yearly cost of being enrolled in the plan. It’s also important to consider all of the other costs that you might encounter along the way.

What happens if you don't sign up for Medicare?

If you don’t sign up for certain types of Medicare coverage when you first become eligible for them, you may incur late enrollment fees in the future if you eventually decide to enroll.

Is preventive care covered by Medicare?

There are a lot of preventive services that are covered in full by Medicare. By taking advantage of these tests and screenings, you can potentially catch a health complication in its earliest stages.

Should I Change My Medicare Supplement Company?

The first concept to understand before changing companies, is that all Medicare Supplement plans are standardized. Medicare pre-designed 10 Medicare Supplement Plans and identified them all with letters, so that it’s easy for you, the consumer, to shop and find the best price.

Are There Any Risks Changing My Medicare Supplement Company?

There are two potential pitfalls to be conscious of when contemplating switching insurance companies:

When Can I Switch My Medicare Supplement Plan?

A common misconception is that you need to wait until the Annual Enrollment Period (AEP) (October 15 – December 7) to change your Medicare Supplement coverage. Good news, you can actually change your Medicare Supplement plan ANY time during the year, with the exception of passing medical underwriting.

A Real-Life Client Example

Here is a real-life example from one of Medicare Hero’s clients, where we helped saved them $636 annually on their Medicare Supplement Plan. As you can see in this video, this client loved their coverage, but didn’t love the rate increases year-after-year. Her monthly premiums for a Medicare Supplement Plan G were as follows:

How Do I Change My Medicare Supplement Insurance Company?

The process of switching your Medicare Supplement Company is relatively straight-forward and we’d be more than happy to help you!

Medicaid

Medicaid is a joint federal/state program that helps with medical costs for some people with limited income and resources.

Medicare Savings Programs

State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs.

PACE

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

Lower prescription costs

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

Programs for people in U.S. territories

Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

Find your level of Extra Help (Part D)

Information for how to find your level of Extra Help for Medicare prescription drug coverage (Part D).

Insure Kids Now

The Children's Health Insurance Program (CHIP) provides free or low-cost health coverage for more than 7 million children up to age 19. CHIP covers U.S. citizens and eligible immigrants.

/GettyImages-1249785306-6a969e2e22f344f6afb18d52b508c768.jpg)