- Make a List of Your Medications. Before you start your search for Medicare Part D plans, make a list of the prescription medications that you take.

- Find Medicare Part D Prescription Drug Plans Available in Your Area. ...

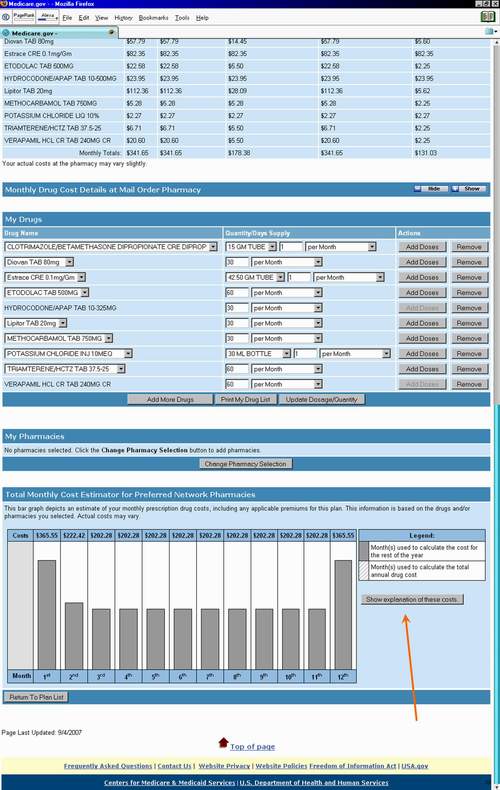

- Compare Part D Drug Plan Costs. Once you can see which Medicare Part D plans are available to you, you can begin your price comparison.

- Review Plan Details and make your selection. Now that you have an idea about which Medicare Part D Prescription Drug Plans may be the most cost-effective, there are a ...

Full Answer

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

What is the cheapest Medicare Part D plan?

which is as good or better than what Part D would provide. Medicare contracts with private plans to offer drug coverage under Part D. There are two ways to enroll in Part D. You can purchase a stand-alone Part D plan or enroll in a Medicare Advantage plan ...

What is the cheapest Medicare Part D?

- Be aged 65 years or over

- Have Original Medicare

- Aged younger but have a qualifying disability or condition

- Have end-stage renal disease that requires dialysis or a kidney transplant

How to compare Part D plans?

Compare Medicare Part D Plans 2020. Most insurers release new plans and change-of-coverage notices in the fall for the upcoming plan year. The 2020 plans are generally listed in Part D plan finder tools by October, so you should already have access to the most current information for this year when you’re ready to shop.

Which Medicare Part D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How do I shop for Medicare Part D?

Use Medicare.gov to find plans. Because plans can change each year and because new plans become available each year, it makes sense to shop for the best Part D coverage for you during each annual Medicare open enrollment period (Oct. 15 to Dec.

What is the difference between basic and enhanced Part D plans?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

Can I add Medicare Part D at anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Who has the cheapest Medicare Part D plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

What is the problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

How long does it take for Medicare Part D to take effect?

Coverage begins the following January 1. For people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long. It begins 3 months prior to the month you become eligible for Medicare Part A or B, includes the month you become eligible and ends 3 months later.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Are all Medicare Part D plans the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

Key Takeaways

If you're shopping around for Medicare Part D drug plan, you should consider several things other than costs.

Expert Help to Understand Medicare Plan Options

Did you know that Medicare isn’t free, which means you need to consider plan coverage and prices before you enroll? Or that if you don’t enroll on time during your initial enrollment period, you could face a penalty? Navigating your Medicare selection needs and priorities may feel overwhelming.

How Do I Find Medicare Coverage That Works For My Needs

There are two types of private Medicare plans you might consider, depending on your eligibility, plan availability and your specific needs:

How To Choose A Medicare Plan

As you enter your elderly years, Medicare can loom over your healthcare decision making. When can you get it? And once you can acquire it, how do you choose a Medicare plan thats best for you? There are lots of questions that come with choosing a Medicare plan, but first, lets get into the most basic question: what exactly is Medicare?

Medicares Part D Benefit Is Complex But Simple Shopping Strategies Can Potentially Save Enrollees Thousands Of Dollars Each Year

Medicare enrollees have from October 15 through December 7 to shop around for a new Part D plan for the following year.

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states.

Find Medicare Part D Prescription Drug Plans Available In Your Area

After youve listed out your medications, you can beginlooking for the Medicare Part D plans that are available in your area. Using anonline tool that displays Part D plans from multiple carriers may make thisstep easier.

What Do Medicare Part D Plans Cover

Medicare drug plans from any insurer must meet the same standards as Medicare. This means that they all have to cover certain categories of drugs laid out by Medicare, but they can pick and choose which exact drugs to cover. If your exact brand of the drug isnt covered, a similar option will be.

How To Buy Your Part D Plan

Medicare Part D plans cover outpatient prescription drugs. Choose from a standalone plan or drug coverage included in a Medicare health plan. Which ones right for you?

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Part D drug plan?

A Part D plan may also feature restrictions around certain prescriptions. These restrictions are intended to address drug safety and manage prescription drug costs . You'll usually see these drug restrictions on the higher pricing tiers in a drug plan. Here are some common ones:

What to do before enrolling in Part D?

Before you enroll in a Part D prescription drug plan , find out which plans are available in your area and whether they cover your prescriptions. Compare their overall cost and look for a plan that:

What to do if Part D isn't working?

If your Part D plan isn't working for you, there's hope. Each September, plans send out an Annual Notice of Change letter. This letter lets you know about plan changes for the upcoming year, such as cost increases or drugs being added or removed from the plan (or switched to a different pricing tier). Read the Annual Notice of Change letter carefully to see if it makes sense to keep or switch your plan. You can change plans during open enrollment.

What is Medicare Part D?

Medicare Part D Plans are offered by private insurance companies approved by Medicare, which means that each company sets its own cost structure. There are three elements to consider in comparing plan costs: The monthly premium, the yearly deductible, and the coinsurance or copayment structure. Unless you get your prescription drug coverage ...

What is the good news about Medicare Part D?

The good news is that you may have a lot of options when it comes to choosing a Medicare Part D plan. Here’s what you need to know when you are selecting a health insurance provider for your Medicare Part D plan.

When does Medicare change?

Benefits, premiums and/or copayments/co-insurance may change on January 1 of each year. The Formulary, pharmacy network, and/or provider network may change at any time. You will receive notice when necessary.

Do you have to pay a deductible on Medicare Part D?

Unless you get your prescription drug coverage through a Medicare Advantage plan, you’ll generally pay a separate monthly premium to your insurance company for Medicare Part D. Your plan may also have an annual deductible, although many plans do not. A deductible is the amount you pay out of pocket before the plan begins to pay.

Does Medicare cover prescription drugs?

All plans must cover certain prescription drugs and certain classes of prescription drugs as required by Medicare. Beyond that, companies may choose to cover other medications, as well. The list of prescription drugs covered by a Medicare Part D Plan is called a “formulary.”.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

How many days are there to make Medicare choices?

That’s day one of the 54 days when Americans 65 and older have to make their Medicare choices for 2018. These choices could save you hundreds, perhaps thousands of dollars a year and could well determine the quality of your health care, and your health, for years to come.

How much is Medicare Advantage premium?

The Centers for Medicare and Medicaid Services (CMS) says the average Medicare Advantage premium is expected to be about $30 a month for 2018, a slight dip from 2017. CMS also is predicting that enrollment in MA plans will reach an all-time high next year of 20.4 million people.

How much does Medicare cover for hospital stays?

There are many other costs you need to cover under Medicare. For example, Medicare Part A covers 100 percent of the first 60 days of a hospital stay. But for original Medicare enrollees, you must cover a deductible for each hospital stay. In 2017 that deductible was $1,316.

What is the difference between Medicare Part A and Medicare Part B?

Original Medicare comprises two parts: Medicare Part A, which provides coverage for most costs related to hospital stays , and Medicare Part B, which covers doctor visits, lab work, outpatient services and preventive care. Part A is free to most people who qualify ...

What happens if you don't enroll in Part D?

If you choose not to enroll in Part D when you're first eligible, you likely will pay a penalty when you do sign up, unless you’ve had creditable drug coverage from another source. One challenge: Part D plans vary widely. For example, two plans may have very different copays for the same drug.

When did Medicare Part C start?

So in 1997 it created Medicare Part C, or what is known today as Medicare Advantage plans.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.