- Both Medicare and Medicaid are government-sponsored health insurance plans.

- Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults.

- Funding for Medicare is done through payroll taxes and premiums paid by recipients.

- Medicaid is funded by the federal government and each state.

- Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis.

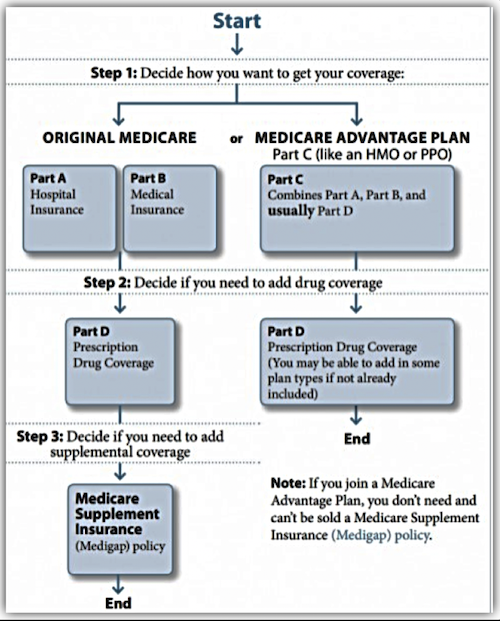

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care.

How does the federal government funds Medicaid?

The federal government guarantees matching funds to states for qualifying Medicaid expenditures; states are guaranteed at least $1 in federal funds for every $1 in state spending on the program.

Who pays Medicare or Medicaid?

Medicare pays first, and Medicaid [Glossary] pays second. Medicaid never pays first for services covered by Medicare.It only pays after Medicare, employer group health plans, and/or Medicare Supplement (Medigap) Insurance have paid.

What does Medicare, Medicaid pay to providers?

Under managed care, the state pays a fee to a managed care plan for each person enrolled in the plan. In turn, the plan pays providers for all of the Medicaid services a beneficiary may require that are included in the plan’s contract with the state.

Will Medicare and Medicaid pay for treatment?

This week we highlight cases that ask the Supreme Court to consider, among other things, whether Florida’s Medicaid agency can recoup the cost of past medical expenses from a tort victim’s settlement fund that is intended to pay for future medical care ...

Where does the money come from to pay for Medicare?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

How is Medicaid funded in the US?

The primary source of funding for the non-federal share comes from state general fund appropriations. States also fund the non-federal share of Medicaid with “other state funds” which may include funding from local governments or revenue collected from provider taxes and fees.

Is Medicare federally funded or state funded?

Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

How is Medicare funded and administered?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How is medical funded?

Medi-Cal is California's Medicaid health care program. This program pays for a variety of medical services for children and adults with limited income and resources. Medi-Cal is supported by federal and state taxes.

Is Medicare paid for by the government?

Is Medicare funded by the state or federal government? Medicare is a federal program, and as a result, the vast majority of Medicare funding comes from the federal government. However, state governments do make a small contribution for enrollees who qualify for both Medicare and Medicaid.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Who administers funds for Medicare?

the U.S. TreasuryMedicare is funded through two trust funds held by the U.S. Treasury. Funding sources include premiums, payroll and self-employment taxes, trust fund interest, and money authorized by the government.

Who controls Medicare premiums?

The State of California participates in a buy-in agreement with the Centers for Medicare and Medicaid Services (CMS), whereby Medi-Cal automatically pays Medicare Part B premiums for all Medi-Cal beneficiaries who have Medicare Part B entitlement as reported by Social Security Administration (SSA).

How much does Medicare cost the federal government?

$776 billionMedicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending.

What is Medicare funded by?

Medicare is funded by federal tax revenue, payroll tax revenue (the Medicare tax), and premiums paid by Medicare beneficiaries. The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised.

When will Medicare run out of money?

The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised. Medicare is a federally run health insurance program that serves seniors and people living with certain disabilities. There are four parts of Medicare, each of which covers different types of health care expenses.

How does Medicare Part B get paid?

Medicare Part B (outpatient insurance) is paid through the SMI Trust Fund. The fund gets money from the premiums paid by Medicare Part B and Part D beneficiaries, federal and state tax revenue, and interest on its investments.

What is the surtax for Medicare 2021?

If you have a high income, you may have to pay a surtax (an extra tax) called the Additional Medicare Tax. The surtax is 0.9% of your income and when you start paying it depends on your income and filing status. The table below has the thresholds for the Additional Medicare Tax in 2021. Filing status.

What is the Medicare trust fund?

The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’ s investments.

How much will Medicare pay in 2021?

All workers pay at least 1.45% of their incomes in Medicare taxes. In 2021, Medicare Part B recipients pay monthly premiums of between $148.50 to $504.90. Most people qualify for premium-free Part A, but those who don’t will have premiums worth up to $471.

How many people will be covered by Medicare in 2020?

The future of Medicare funding. As of July 2020, Medicare covers about 62.4 million people, but the number of beneficiaries is outpacing the number of people who pay into the program. This has created a funding gap.

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

Can you spend down on medicaid?

Medicaid spenddown. Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid . The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

How does Medicare get money?

Medicare gets money from two trust funds : the hospital insurance (HI) trust fund and the supplementary medical insurance (SMI) trust fund. The trust funds get money from payroll taxes, as allowed by the Federal Insurance Contributions Act (FICA) enacted in 1935.

How much is Medicare spending in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion. This article looks at the ways in which Medicare is funded. It also discusses changes in Medicare costs.

How much is the Medicare deductible for 2020?

A person enrolled in Part A will also pay an inpatient deductible before Medicare covers services. Most recently, the deductible increased from $1,408 in 2020 to $1,484 in 2021. The deductible covers the first 60 days of an inpatient hospital stay.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is SMI trust fund?

The SMI trust fund covers the services offered by Medicare Part B, a portion of Part D, and some of the Medicare program’s administrative costs. Medicare Part B includes outpatient services, such as doctor’s visits, lab tests, certain cancer screenings and preventative care, and ambulance transport.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

How much will Part D premiums be in 2021?

The adjusted monthly fee for 2021 ranges from $12.30 to a maximum of $77.10.

How much of the federal government is funding Medicaid expansion?

The federal government provided additional funds to states undergoing Medicaid expansion, paying 100 percent of Medicaid expansion costs through 2016 and 90 percent of those costs through 2020. All states, whether or not they participate in Medicaid expansion, continue to receive federal funding from these three sources:

How much does Medicaid pay for health care?

According to the American Hospital Association, hospitals are paid only 87 cents for every dollar spent by the hospital to treat people on Medicaid. 2

What is the GOP's plan for 2020?

Healthy Adult Opportunity. The GOP aims to decrease how much federal money is spent on Medicaid. The 2020 Fiscal Year budget 6 proposed cutting Medicaid by $1.5 trillion over the next decade but the budget failed to pass.

When did the FMAP increase?

The Affordable Care Act increased the enhanced FMAP for states from October 1, 2015 through September 30, 2019. It did so by 23 percentage points but did not allow any state to exceed 100%. For Fiscal Year 2020, the enhanced matching rates will be lower.

How much does the federal government match for Medicaid?

For every $1 a state pays for Medicaid, the federal government matches it at least 100%, i.e., dollar for dollar. The more generous a state is in covering people, the more generous the federal government is required to be. There is no defined cap, and federal expenditures increase based on a state's needs.

Which states have 50% FMAP?

Alaska, California, Colorado, Connecticut, Maryland, Massachusetts, Minnesota, New Hampshire, New Jersey, New York, North Dakota, Virginia, Washington, and Wyoming are the only states to have an FMAP of 50% for Fiscal Year 2020 (October 1, 2019 through September 30, 2020). All other states receive a higher percentage of Medicaid funds from ...

Who is excluded from Medicaid expansion?

Specifically, adults on Medicaid expansion or adults less than 65 years old without disabilities or long-term care placement needs would be affected. Pregnant women and low-income parents would be excluded. States could require asset tests for these individuals, propose work requirements, and/or require cost-sharing.

What is the difference between Medicare and Medicaid?

When you have dual enrollment, Medicare is your primary insurance that covers any costs first. Medicaid is your secondary payer. Every state has different benefits for people who qualify under dual eligibility, so it’s important that you check with your local Medicaid office.

Does Medicaid cover dental care?

Medicaid can cover a large variety of healthcare services like behavioral health for substance abuse and mental health or dental care. Medicaid also has a robust cost-sharing program that helps cover any out of pocket costs for economically disadvantaged participants.

Can seniors get medicaid?

Many seniors in the United States have dual eligibility for Medicare and Medicaid benefits. Generally, this means that you have enrolled in Medicare, but that you qualify for Medicaid as well due to your income.

Is Medicaid a secondary insurance?

Secondary Insurance. Medicaid can fill in the gap as a secondary insurance to Medicare. Any services you have that Medicare pays for like hospital care, doctor’s visits, skilled nursing facility care, or home care, Medicare will pay for as the primary payer.

Does Medicaid pay cost sharing?

Medicaid can pay any cost-sharing charges you have. This help will depend on your income level. If the level is low enough, you could qualify for the Qualified Medicare Beneficiary (QMB) Medicare Savings Program. If you enroll in QMB, you won’t have to pay Medicare cost-sharing fees.

Does Medicare help with prescription drugs?

Prescription drugs are some of the biggest expenses people on Medicare face, and Medicaid can help. People who meet the eligibility requirements for dual enrollment in Medicare and Medicaid automatically get enrolled in the Extra Help program.

Who pays for medicaid?

The Medicaid program is jointly funded by the federal government and states. The federal government pays states for a specified percentage of program expenditures, called the Federal Medical Assistance Percentage (FMAP) .

Can states fund Medicaid?

States must ensure they can fund their share of Medicaid expenditures for the care and services available under their state plan. States can establish their own Medicaid provider payment rates within federal requirements, and generally pay for services through fee-for-service or managed care arrangements.

How is Medicaid funded?

The Medicaid program is jointly financed by the federal and state governments with contributions governed by the FMAP formula that has remained largely unchanged over the program’s 50 year history. The federal/state matching arrangement provides a financing structure that is responsive to changes in enrollment and program needs, enabling states to adjust program expenditures in response to economic and policy changes. A program as large as Medicaid will always be a focus of budget scrutiny at the state and federal levels. Changes to Medicaid’s financing structure would have implications for states, the federal government and beneficiaries which would warrant careful analysis.

Who is funding the Medicaid program?

The Medicaid program is jointly funded by states and the federal government. There has been renewed interest in how Medicaid is financed in light of the additional federal financing for the Medicaid expansion under the Affordable Care Act (ACA) as well as ongoing budget discussions at the federal level. This brief reviews how the Medicaid program ...

What is Medicaid DSH?

DSH, or “disproportionate share” hospitals are hospitals that serve a large number of Medicaid and low-income uninsured patients. 9 In many states, DSH payments have been crucial to the financial stability of “safety net” hospitals. Federal DSH payments totaled $16.4 billion in FFY 2013. 10 While states have considerable discretion in determining the amount of DSH payments to each DSH hospital, their discretion is bounded by two caps – one at the state level, and the other at the facility level. At the state level, the total amount of federal funds that each state can spend on DSH is specified in an annual DSH allotment for each state. While there have been some special adjustments, the DSH allotments are generally calculated based on the previous year’s allotment increased by inflation but then subject to a cap of 12 percent of the total amount of Medicaid expenditures under the state plan that fiscal year. When the DSH caps were originally set, they locked in variation across states in DSH spending. At the facility level, Medicaid DSH payments are limited to 100 percent of the costs incurred for serving Medicaid and uninsured patients that have not been compensated by Medicaid (Medicaid shortfall).

What is a DSH payment?

DSH, or “disproportionate share” hospital payments are another source of financing available to hospitals that serve a large number of Medicaid and low-income uninsured patients; in many states, these DSH payments have been crucial to the financial stability of “safety net” hospitals.

How does Medicaid affect the state budget?

While Medicaid is the third largest domestic program in the federal budget following Medicare and Social Security, the program plays a unique role in state budgets. As a result of the joint financing structure, Medicaid acts as both an expenditure and the largest source of federal revenue in state budgets. Unlike at the federal level, states are required to regularly balance their budgets, making decisions about spending across programs as well as how much revenue to collect. Balancing these competing priorities creates an ever present tension. Unlike other programs, state spending on Medicaid brings in federal revenues due to its financing structure. The implementation of the major ACA coverage expansions in 2014 led to higher enrollment and total overall spending growth in Medicaid; however, with full federal financing of the expansion, state Medicaid spending grew at a slower pace. Early evidence from states that have adopted the Medicaid expansion also indicates there are state budget savings both within Medicaid budgets and outside of Medicaid.

What is Medicaid in economic downturn?

During economic downturns, individuals lose jobs, incomes decline and more people qualify and enroll in Medicaid which increases program spending at the same time as state revenues decline, making it difficult for states to match rising expenditures.

How does the economy affect Medicaid?

The economy has a strong effect on Medicaid enrollment and therefore spending. Medicaid spending and enrollment are affected by a number of factors – health care inflation, policy changes, etc. However, one of the largest drivers of Medicaid spending and enrollment trends is changes in economic conditions. Medicaid is a countercyclical program. During economic downturns, individuals lose jobs, incomes decline and more people qualify and enroll in Medicaid which increases program spending. As economic conditions improve, Medicaid enrollment and spending growth tend to slow.

What is Medicare insurance?

Medicare. Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients. Patients pay part of costs through deductibles for hospital and other costs.

Do you pay for medical expenses on medicaid?

Patients usually pay no part of costs for covered medical expenses. A small co-payment is sometimes required. Medicaid is a federal-state program. It varies from state to state. It is run by state and local governments within federal guidelines.

Is Medicare a federal program?

Small monthly premiums are required for non-hospital coverage. Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Funding

Cost

- Medicaid is not exactly known for being generous when it comes to paying for health care. According to the American Hospital Association, hospitals are paid only 87 cents for every dollar spent by the hospital to treat people on Medicaid. The National Investment Center (NIC) reported that, on average, Medicaid pays only half of what traditional Med...

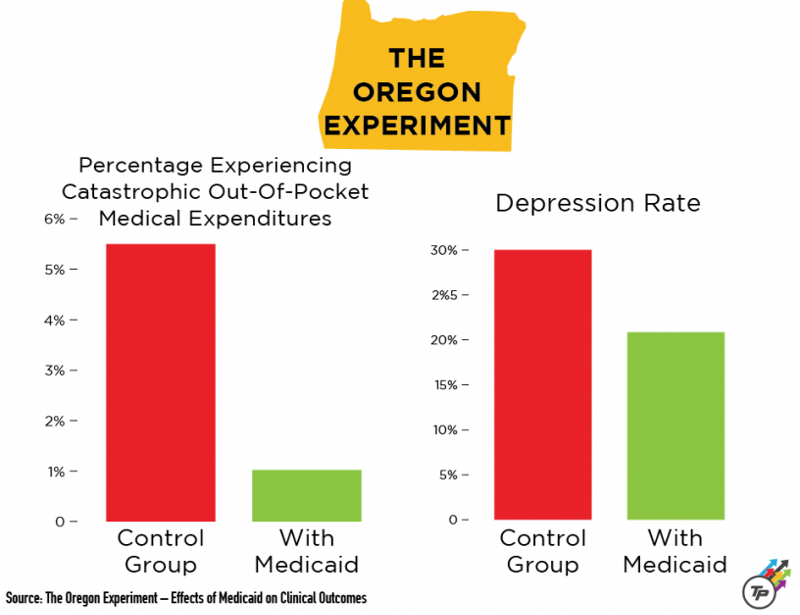

Effects

- Hospitals that care for more people on Medicaid or for people that are uninsured, in the end, are reimbursed far less than facilities that operate in areas where there are more people covered by private insurance. Between 2000 and 2018, at least 85 rural hospitals closed their doors to inpatient care due to low reimbursement rates and other financial concerns.

Causes

- To even out the playing field, Disproportionate Share Hospital (DSH) payments came into effect. Additional federal funds are given to the states to divide amongst eligible hospitals that see a disproportionate number of people with little to no insurance. The idea was to decrease the financial burden to those facilities so that they could continue to provide care to individuals with …

Economy

- Notably, Mississippi has the lowest per capita income level with a 2020 FMAP of 76.98 percent. This means the federal government pays for 76.98 percent of the state's Medicaid costs, contributing $3.34 for every $1 the state spends.

Results

- The Affordable Care Act increased the enhanced FMAP for states from October 1, 2015 through September 30, 2019. It did so by 23 percentage points but did not allow any state to exceed 100 percent. For Fiscal Year 2020, the enhanced matching rates will be lower. The Healthy Kids Act will allow an increase in the enhanced FMAP by 11.5 percent, again not to exceed 100 percent to…

Benefits

- The services covered by enhanced matching rates are seen as valuable because they may help to decrease the burden of healthcare costs in the future. In that way, paying more money upfront is seen as a worthy investment.