Other examples of how Medicare supplement plans work with Medicare include:

- All plans include coverage for blood work at varying levels; Plan K covers it 50 percent and Plan L covers it at 75 percent. ...

- If you have to endure a lengthy hospital stay, a Medicare supplement plan can save you money. ...

- Medicare supplement plans don’t cover routine dental or vision care, hearing aids, glasses, private nursing or long-term care. ...

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

Are Medicare supplement plans worth it?

Medicare Supplement plans are worth it; doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest. Our team of experts is ready to answer your questions are share the most popular Medigap plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

What is the best Medicare supplement insurance plan?

- United Healthcare: 26%

- Humana: 18%

- BCBS plans: 15%

- CVS (Aetna): 11%

- Kaiser Permanente: 7%

- Centene: 4%

- Cigna: 2%

- Other companies: 18%

How to choose the best Medicare supplement plans?

How to choose the best Medicare supplement plans. The best Medicare supplement plan for you will depend on which Original Medicare parts you need filled and the cost of the plan.You should choose the supplement policy that provides the best benefits for you and fills in the coverage gaps where you expect to spend the most on health care.

What is the difference between Medicare Advantage and supplemental plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

How is Medicare supplemental paid?

Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare.

What do Medicare Supplement plans offer?

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

Does a Medicare Supplement plan pay after Medicare?

These dollar amounts are for 2021, and all standardized Medicare Supplement insurance plans generally cover these costs for up to a year after Medicare benefits are exhausted. However, before receiving benefits under Medicare Part A, you need to pay your Part A deductible (in 2021, $1,484 for each benefit period).

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Is there a deductible for Medicare supplemental insurance?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is plan F better than plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What are the advantages and disadvantages of Medicare supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I switch from Medicare Advantage to Medicare supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

How many Medicare Supplement Plans are there?

These plans cover more than just out-of-pocket costs from Medicare and may provide additional benefits for some people. Currently, 10 Medicare supplement plans are available. These are:

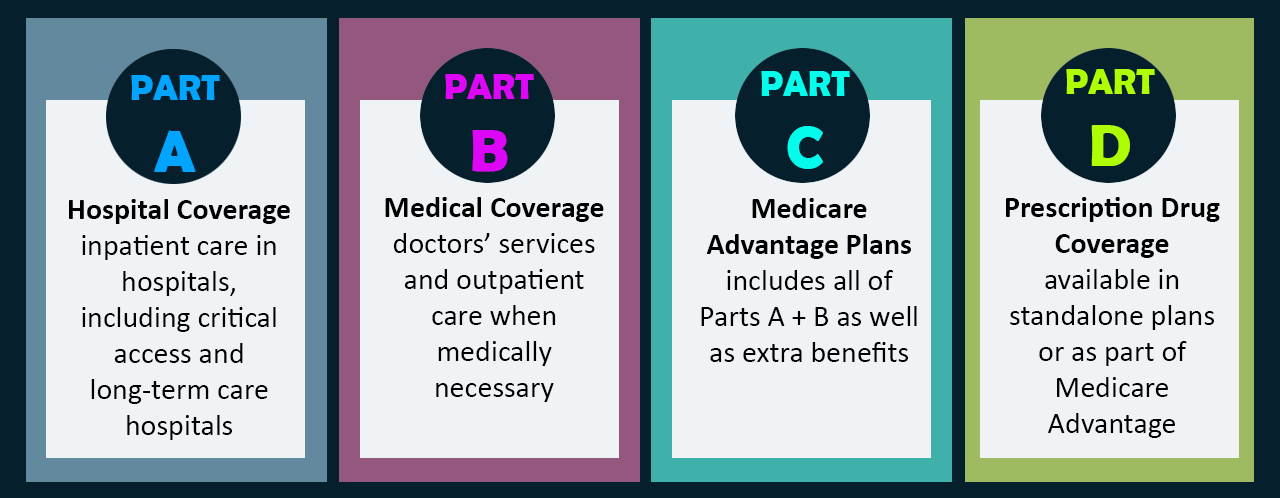

What is Medicare Advantage Plan?

People use Medicare Advantage plans as an alternative to Medicare parts A and B. Private companies sell and administer them, just as they do Medicare supplement plans. They provide bundled plans that may cover more than separate Medicare plans, such as dental or vision care.

What is Medicare Part A and B?

Medicare parts A and B, which would serve as the primary payer, administer their coverage first . Afterward, Medigap coverage takes over to fund the out-of-pocket costs of treatment and any other agreed costs, such as treatment received outside the United States on some Medigap plans.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What does "no" mean in Medicare Supplement?

“Yes” under a plan letter means that it covers 100% of the benefit. “No” under a plan letter means that it does not cover that benefit.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. This article explains how Medicare supplement plans work, how to find one, and how to work out which plan is best.

Does Medicare cover all of the costs?

A person can choose to enroll in Medicare parts A and B. However, these may not cover all healthcare costs. People with Medicare will still have to pay different deductibles and coinsurances based on the type of care they receive. Medicare supplement plans can help a person reduce out-of-pocket costs on Medicare parts A and B. ...

Why is Medicare Supplement important?

If you choose the original Medicare option, Medicare supplement plans are important because these plans add an extra element, or boost, to your main coverage by paying for gaps for stand-alone prescription drug plans, employer group health coverage and other retiree benefits. Original Medicare will pay first, followed by the payment by ...

How many Medicare supplement plans are there?

How Medicare supplement insurance plans work with Medicare plans. There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits:

What are the benefits of Medicare?

There are up to 10 standardized plans available – labeled A, B, C, D, F, G, K, L, M and N – that cover anywhere from four to nine of these benefits: 1 Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) 2 Medicare Part B coinsurance, copayment 3 First three pints of blood for a medical procedure 4 Part A hospice care coinsurance or copayment 5 Skilled nursing facility care coinsurance 6 Part A deductible 7 Part B deductible 8 Part B excess charges 9 Foreign travel emergencies

How much does coinsurance cost for hospitalization?

For example, coinsurance for hospitalization costs $335 per day for days 61-90. Beyond day 90, the cost is $670 until a lifetime reserve is met, in which case you must pay the rest of the costs. Keep in mind you must pay your Medicare Part A deductible ($1,340 for 2018) before receiving these benefits. Medicare supplement plans don’t cover routine ...

How long does Medicare cover hospital coinsurance?

Medicare Part A coinsurance for hospital costs (up to an additional 365 days after Medicare benefits are used) Keep in mind, all 10 Medicare supplement plans cover the coinsurance and 100 percent of hospital costs for Medicare Part A, but after that, plans differ in what they cover. For example, only Medicare supplement plans C and F cover ...

Does Medicare Supplement Insurance require a doctor to be listed?

Every Medigap policy must be clearly identified as “Medicare Supplement Insurance.”. Medicare SELECT plans require you to only use doctors and hospitals in provider networks. This is an important factor if your doctor is not listed and you prefer to remain with that doctor’s service.

Do you have to leave Medicare first?

If you have a Medicare Advantage Plan, you must leave it first before your new Medicare supplement (Medigap) policy begins; apply for the Medigap plan first before you leave your other plan. Buy a Medigap policy from an insurance company licensed in your state to sell them.

What are Medicare Supplement Plans?

Medicare Supplement plans, also known as Medigap, are supplement insurance plans that work with Original Medicare Part A and Part B.

Who Regulates Medicare Supplement Plans?

Although Medicare Supplements (Medigap) plans are sold by private insurance companies, the federal government (CMS) regulates each plan’s design in terms of coverages offered.

How Does Medicare Supplement Plans Work?

While there are 10 Medigap plans to choose from in all but three states, each plan, although different from the next, works in the same manner. Medicare would pay its share and then the Medicare Supplement Plan would pay its share.

Which Medicare Supplement Plans Provide the Best Coverage?

Having multiple Medigap plans to choose from enables the policy shopper to select a plan that will best meet their individual needs and their individual budget. It’s also important to keep in mind that the Medigap Plan you select will have a monthly premium charge over and above your Medicare Part B premium.

What are High-Deductible Medicare Supplement Plans?

There are two high-deductible Medicare Supplement Plans available. High deductible Plan F and Plan G both have a regular version and a “high-deductible” version. Since the policyholder is agreeing to accept more out-of-pocket expenses for their annual healthcare expenses, the insurance company offers the plan at a lower monthly premium.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How does Original Medicare work?

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them.

How does Medicare Advantage work?

Medicare Advantage bundles your Part A, Part B, and usually Part D coverage into one plan. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).