If you are collecting Social Security Disability Insurance (SSDI

Social Security Disability Insurance

Social Security Disability Insurance is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide income supplements to people who are physically restricted in their ability to be employed because of a notable disability. SSD can be supplied on either a temporary or permanent basis, usually directly correlated to …

How do I get a Medicare card if I'm on disability?

People who qualify for Social Security Disability benefits should receive a Medicare card in the mail when the required time period has passed. If this does not happen or other questions arise, contact the local Social Security office. WHAT MEDICARE BENEFITS ARE AVAILABLE FOR PEOPLE WITH DISABILITIES?

How do I apply for my spouse's disability benefits?

Applying for Spousal Disability Benefits If your husband or wife's disability claim has already been approved, call the Social Security Administration (SSA) at (800) 772-1213 to apply for the spouse's SSDI benefit.

Is Medicare free for disability recipients?

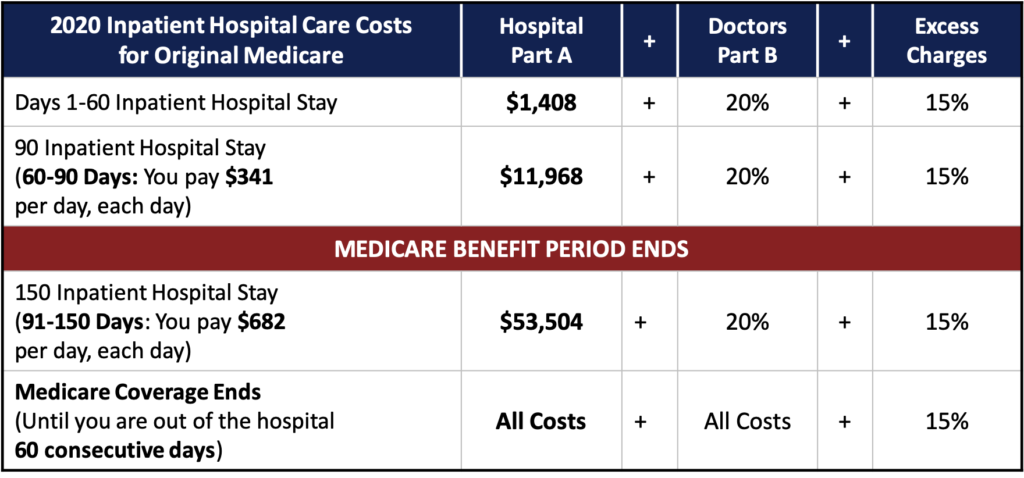

Medicare isn't free for most disability recipients though. There are premiums, deductibles, and copays for most parts of Medicare, and the costs go up every year. Here are the new figures for 2021, and how you can get help paying the costs.

How much does a disabled spouse get from Social Security disability?

If the disabled worker is still living, a spouse generally receives 50% of the disabled worker’s primary insurance amount (the amount of the husband or wife’s monthly SSDI check), although if the disabled worker’s children are collecting benefits at the same time, the spouse’s benefit can be reduced.

Can I add my wife on Medicare?

The answer is no. Medicare is individual insurance, so spouses cannot be on the same Medicare plan together. Now, if your spouse is eligible for Medicare, then he or she can get their own Medicare plan.

Is my spouse eligible for Medicare if she never worked?

A non-working spouse can receive premium-free Medicare part A as long as the other partner is at least 62 years old and has satisfied Medicare's work requirements. For example, John is 65 years old and has never worked or paid Medicare taxes.

How does Medicare work for married couples?

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

Is my spouse eligible for Medicare when I turn 65?

Your spouse is eligible for Medicare when he or she turns 65. Your eligibility for Medicare has no impact on the date that your spouse is eligible for Medicare. Continue reading for more answers to your questions about Medicare, individual health insurance, and coverage options for your spouse after you enroll.

How do I apply for spousal Medicare benefits?

Form SSA-2 | Information You Need to Apply for Spouse's or Divorced Spouse's Benefits. You can apply: Online, if you are within 3 months of age 62 or older, or. By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

What happens to my wife when I go on Medicare?

Your Medicare insurance doesn't cover your spouse – no matter whether your spouse is 62, 65, or any age. But in some cases, a younger spouse can help you get Medicare Part A with no monthly premium. Traditional Medicare includes Part A (hospital insurance) and Part B (medical insurance).

When can a spouse claim spousal benefits?

You must have been married at least 10 years. You must have been divorced from the spouse for at least two consecutive years. You are unmarried. Your ex-spouse must be entitled to Social Security retirement or disability benefits.

Can a husband and wife be on the same Medicare Advantage plan?

Medicare Advantage: what about my spouse? Medicare Advantage plans don't cover both you and your spouse together under one policy. Just as Medicare Part A and Part B cover each Medicare beneficiary separately, you can't share a Medicare Advantage plan with your spouse.

Can a younger spouse get Medicare?

Traditional Medicare includes Part A (hospital insurance) and Part B (medical insurance). To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 (or any age under 65), he or she could only qualify for Medicare by disability.

When can a spouse receive Medicare?

age 65When you turn age 62 and your spouse is age 65, your spouse can usually receive premium-free Medicare benefits. Until you're age 62, your spouse can receive Medicare Part A, but will have to pay the premiums if they don't meet the 40 quarters of work requirement.

Can I put my partner on my Medicare card?

On your homepage, select My card. You'll see your current Medicare card. Select Add someone to my card. You'll see information about how we can help people with family and domestic violence concerns.

Can I get Medicare if I never worked?

You can still get Medicare if you never worked, but it will likely be more expensive. Unless you worked and paid Medicare taxes for 10 years — also measured as 40 quarters — you will have to pay a monthly premium for Part A. This may differ depending on your spouse or if you spent some time in the workforce.

How old do you have to be to get Medicare?

In a case such as this, you must be at least 62 years old.

How long do you have to work to qualify for Medicare?

In the United States, as soon as you turn 65 you are eligible for Medicare benefits if you are citizen or have been a legal resident for five years or more and have worked for at least 40 quarters (10 years) paying federal taxes.

Can you get Medicare at different ages?

If you and your spouse are different ages, you will likely become eligible at different times. Primary Medicare recipients and their non-insured spouses are entitled to the same benefits under Medicare if both have reached the age of 65.

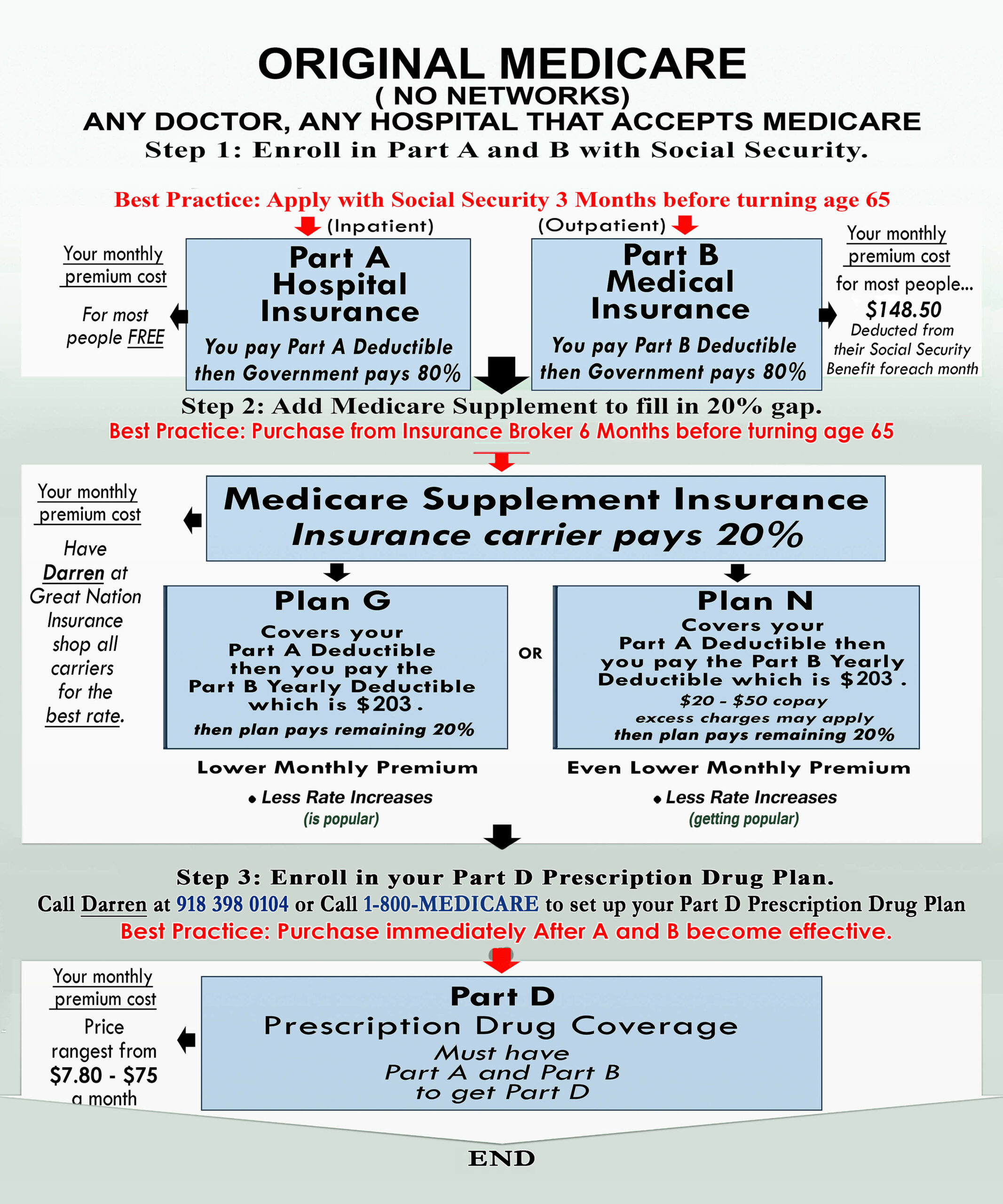

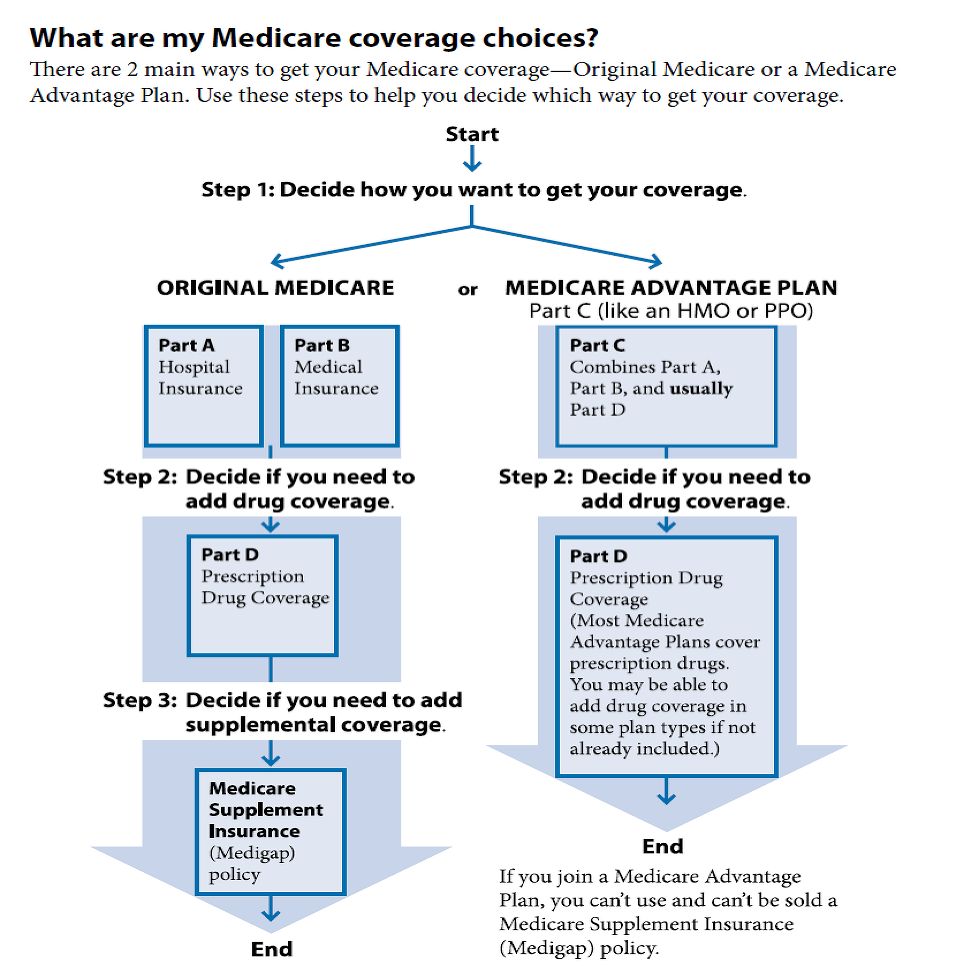

Do you have to enroll in Medicare Part B or D?

If you wish to sign up for Medicare Part B (Medical Insurance), and/or Part D (prescription drug insurance), you must enroll separately during your initial enrollment period, Open Enrollment or during Special Enrollment Period to avoid paying late enrollment penalties.

How long can you get Medicare after you have been disabled?

Indefinite Access to Medicare. Even after the eight-and-one-half year period of extended Medicare coverage has ended, working individuals with disabilities can continue to receive benefits as long as the individual remains medically disabled.

How long do you have to wait to get Medicare?

There is a five month waiting period after a beneficiary is ...

What are the requirements for Medicare for ESRD?

The requirements for Medicare eligibility for people with ESRD and ALS are: ALS – Immediately upon collecting Social Security Disability benefits. People who meet all the criteria for Social Security Disability are generally automatically enrolled in Parts A and B.

How long does Medicare coverage last?

Medicare eligibility for working people with disabilities falls into three distinct time frames. The first is the trial work period, which extends for 9 months after a disabled individual obtains a job.

How long do you have to wait to collect Social Security?

There is a five month waiting period after a beneficiary is determined to be disabled before a beneficiary begins to collect Social Security Disability benefits. People with ESRD and ALS, in contrast to persons with other causes of disability, do not have to collect benefits for 24 months in order to be eligible for Medicare.

What is covered by Medicare?

Coverage includes certain hospital, nursing home, home health, physician, and community-based services. The health care services do not have to be related to the individual’s disability in order to be covered.

Why should beneficiaries not be denied coverage?

Beneficiaries should not be denied coverage simply because their underlying condition will not improve.

People who have a qualifying disability can sign up for Medicare before they turn 65

Even if you're not 65, you may qualify for Medicare if you qualify for Social Security Disability Insurance (SSDI) from the Social Security Administration (SSA) or disability benefits from the Railroad Retirement Board (RRB).

How to apply for Medicare if you have a disability

Before you can apply for Medicare you must first be approved for disability benefits through either the SSA or RRB. Once you're approved, and after you receive those benefits for 24 months, you're automatically enrolled in Medicare Part A and Part B during month 25.

Do you have to take Medicare Part B?

You do not have to enroll in Part B, but there are a few things to consider before deciding to delay enrollment.

How to apply for Social Security disability benefits

If you worked long enough and paid Social Security taxes on your earnings, you're eligible to qualify for SSDI or Supplemental Security Income (SSI). While these two programs are different, they both provide or pay benefits to those who have disabilities.

What information do you need to apply for disability?

Preparing ahead of time to complete the disability benefits application can help make the process smoother and quicker. There is a variety of information and documentation you'll need in order to complete the application.

Don't forget the Initial Enrollment Period

Even if you're automatically enrolled in Part A and Part B, you'll want to be sure you know when your Initial Enrollment Period (IEP) is. During your IEP, you can join, switch, or drop a Medicare health plan, a Medicare Advantage plan (Part C), or a Medicare Part D prescription drug plan.

Other ways to qualify for Medicare before turning 65

There are other ways you can qualify for Medicare prior to your 65th birthday.

How long do you have to wait to get Medicare if you have Social Security Disability?

Social Security Disability Insurance (SSDI) & Medicare coverage. If you get Social Security Disability Income (SSDI), you probably have Medicare or are in a 24-month waiting period before it starts. You have options in either case.

What is SSI disability?

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

Can I enroll in a Medicare Marketplace plan if I have Social Security Disability?

You’re considered covered under the health care law and don’t have to pay the penalty that people without coverage must pay. You can’t enroll in a Marketplace plan to replace or supplement your Medicare coverage.

Can I keep my Medicare Marketplace plan?

One exception: If you enrolled in a Marketplace plan before getting Medicare, you can keep your Marketplace plan as supplemental insurance when you enroll in Medicare. But if you do this, you’ll lose any premium tax credits and other savings for your Marketplace plan. Learn about other Medicare supplement options.

Can I get medicaid if I have SSDI?

You may be able to get Medicaid coverage while you wait. You can apply 2 ways: Create an account or log in to complete an application. Answer “ yes” when asked if you have a disability.

Can I get medicaid if I'm turned down?

If you’re turned down for Medicaid, you may be able to enroll in a private health plan through the Marketplace while waiting for your Medicare coverage to start.

Does a Non-Working Spouse Qualify for Medicare?

Regardless of your work status or that of your spouse, you may qualify for Medicare if you are a U.S. citizen or legal resident for at least five years and are 65 years old (or are younger but have a qualifying disability ).

Can You Get Medicare If You Have Never Worked?

As outlined above, you may still get Medicare even if you have never worked a day in your life. You may even potentially qualify for premium-free Part A, provided that your spouse has paid Medicare taxes for at least 40 quarters and meets all other Medicare eligibility requirements. Those 40 quarters do not need to be consecutive.

How Does a Spouse Sign Up for Medicare?

Anyone who is eligible for Medicare but isn’t receiving Social Security retirement benefits at least four months before they turn 65 may need to sign up for Medicare manually by visiting their local Social Security office or by calling the Social Security Administration at 800-325-0778 to confirm their eligibility.

What If the Working Spouse Is Not Yet 65 Years Old?

A non-working spouse can receive premium-free Medicare part A as long as the other partner is at least 62 years old and has satisfied Medicare’s work requirements.

Where Can I Get More Information About My Medicare eligibility?

If you have lingering questions about the Medicare eligibility of yourself or your spouse, call 1-800-MEDICARE (1-800-633-4227) to speak to a Medicare representative.

How old do you have to be to get Medicare Part A?

You must be at least 62 years old and eligible for Social Security benefits before your spouse can enroll, because his or her qualification is based on your work record.

Why is there no Medicare premium?

There’s no premium for it because your Medicare tax dollars go into the hospital insurance trust fund, which then finances Medicare Part A benefits for eligible individuals.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What happens if you have both health insurance and one turns 65?

If you both are covered by your employer health insurance, and one of you turns 65, you’ll have decisions to make about Medicare. In this case, it will depend on the employer and their rules around covered dependents of Medicare age.

Can my spouse get cobra insurance?

Your employer may offer COBRA coverage for your spouse if you retire. Your spouse may choose to buy individual health insurance until he or she turns 65.

Can a spouse and spouse have Medicare?

The answer is no. Medicare is individual insurance, so spouses cannot be on the same Medicare plan together. Now, if your spouse is eligible for Medicare, then he or she can get their own Medicare plan. But, what’s interesting is that there are some things to think about in regards to your non-working spouse and Medicare.

How long after Social Security disability is Medicare free?

You are eligible for Medicare two years after your entitlement date for Social Security disability insurance (SSDI). (This is the date that your backpay was paid from; see our article on when medicare kicks in for SSDI recipients ). Medicare isn't free for most disability recipients though.

How to save money on Medicare?

You can often save money on Medicare costs by joining a Medicare Advantage plan that offers coverage through an HMO or PPO. Many Medicare Advantage plans don't charge a monthly premium over the Part B premium, and some don't charge copays for doctor visits and other services.

How much is the Part D premium for 2021?

Part D Costs. Part D premiums vary depending on the plan you choose. The maximum Part D deductible for 2021 is $445 per year, but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help).

How much does Medicare cost if you have a low Social Security check?

But some people who have been on Medicare for several years will pay slightly less (about $145) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more. If your adjusted gross income is over $88,000 (or $176,000 for a couple), the monthly premium can be over $400.

Does Medicare go up every year?

There are premiums, deductibles, and copays for most parts of Medicare, and the costs go up every year. Here are the new figures for 2021, and how you can get help paying the costs.

Is Medicare expensive for disabled people?

Medicare can be quite expensive for those on disability who aren't fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well.

How old is a divorced spouse when receiving SSDI?

If the disabled worker dies but was receiving SSDI benefits when he died, a divorced spouse is entitled to benefits in either of the following circumstances: The surviving divorced spouse is 60 years old or older. The surviving divorced spouse is disabled and between 50 and 60.

How much disability benefits do I get if I'm still living?

If the disabled worker is still living, a spouse generally receives 50% of the disabled worker's primary insurance amount (the amount of the husband or wife's monthly SSDI check), although if the disabled worker's children are collecting benefits at the same time, the spouse's benefit can be reduced. The total of the spouse's benefit and the children's benefit cannot be greater than the maximum family benefit, which is generally 150% of the disabled worker's monthly SSDI benefit. (Note that the benefits paid to a divorced spouse based on being over 60 or disabled are not counted toward the maximum family benefit and won't affect a current spouse's or child's benefits. However, benefits paid to a divorced spouse who is collecting a mother's or father's benefit are counted toward the maximum family benefit.)

What happens if a disabled person dies while receiving Social Security?

In addition, if a disabled worker dies while receiving Social Security benefits, the surviving spouse will receive a death benefit worth several hundred dollars if the surviving spouse was living in the same household.

How long can a spouse be married?

Spouses married for at least a year, divorced spouses who were married at least 10 years, and surviving spouses can be entitled to benefits based on the earnings record of the disabled spouse (or disabled ex-spouse).

What happens if a spouse gets divorced and remarried?

If a surviving divorced spouse gets remarried before age 60, however, Social Security benefits will be deni ed (unless the spouse was between 50 and 60 and disabled at the time of marriage). If the surviving divorced spouse gets divorced after age 60 (or age 50 if disabled), the Social Security Administration (SSA) will ignore the marriage.

How old is a spouse on Social Security?

If a spouse was married for at least a year to a disabled worker who died while receiving Social Security disability benefits, the surviving spouse can get benefits in either of these circumstances: The surviving spouse is 60 years old or older. The surviving spouse is disabled and between 50 and 60.

How old do you have to be to get SSDI?

If an ex-spouse was married for at least ten years to a disabled worker who is collecting SSDI, the divorced spouse can get benefits if he or she is 62 years old or older.