Medicare Part A covers hospital expenses, skilled nursing facilities, hospice

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

What is the difference between Medicare Part an and Part B?

Summary:

- Both Medicare Part A and B are federally funded plans that come with different coverages.

- Part A is free, and the patients need not pay a premium for the coverage. People have to pay some premium for availing themselves of the Part B coverage.

- Part A can be called hospital insurance whereas Part B can be termed as medical insurance.

Should I get Medicare B?

Therefore, it is recommended that you enroll in Medicare Part B in addition to your VA benefits. If you wait to enroll in Part B when you are first eligible, you will likely experience gaps in coverage and incur a penalty for each 12-month period you were without Medicare Part B coverage.

Does everyone pay the same for Medicare Part B?

Most beneficiaries pay the same amount for Medicare Part B. However, those in a higher-income bracket do pay more as well as those in a lower income bracket may get assistance with paying their Part B premium. No, eligibility for Part B is not based on income. How much is taken out of your Social Security check for Medicare?

What are the four types of Medicare?

Medicare coverage is broken down into four different parts:

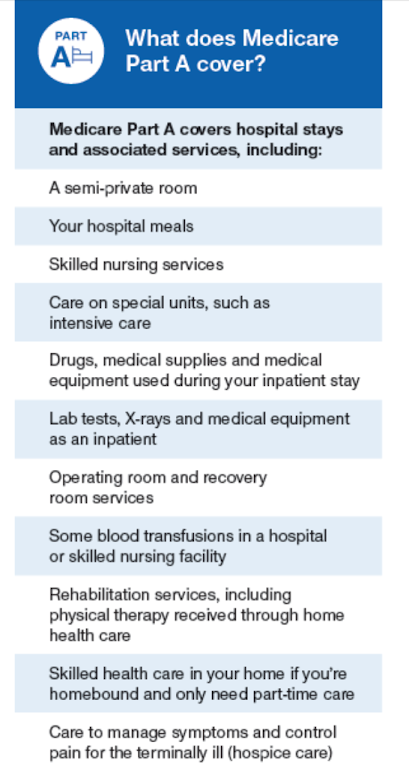

- 1. Medicare Part A: Hospital insurance Medicare Part A is one half of Original Medicare, the health insurance managed by the federal government, and is hospital insurance. ...

- 3. Medicare Part C: Medicare Advantage plans Many people opt for Medicare Part C, also known as a Medicare Advantage plan, rather than Original Medicare. ...

- 4. ...

What is the difference between Medicare and Medicare Part B?

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.

What is Medicare Part A and B mean?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

Do I need both A and B Medicare?

If you're eligible for premium-free Part A, you should enroll in Part A and Part B when you turn 65. If you have Marketplace coverage and you are getting the reduced premium or tax credit, it will stop once your Medicare Part A starts. You won't need this coverage once Medicare begins.

Is Original Medicare the same as Part B?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

Which service is not covered by Part B Medicare?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

Medicare Part A—Hospital Insurance

Before jumping into the difference between Medicare A and B, let us explain each of these parts individually. Medicare Part A is designed to cover...

Medicare Part B—Medical Insurance

Medicare Part B is designed to cover medical needs that do not involve the hospital and are considered medically necessary as defined by the federa...

Take Note—You May Need to Sign Up For Both Medicare Parts A and B

Sometimes, people need to sign up for both Medicare Part A and Part B. The following are instances in which you should sign up for both parts: 1. Y...

Are There Alternatives to Medicare Parts A and B?

Yes. If you are still working, you could stay on your employer’s insurance plan. However, be aware that you may pay a penalty if you later enroll i...

HealthMarkets and Medicare

If you’re interested in what Medicare Advantage plans have to offer, give us a call. One of our thousands of licensed insurance agents can talk you...

What is Medicare Part A and Part B?

Enrollment. Takeaway. Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor’s visits and other aspects of outpatient medical care. These plans aren’t competitors, but instead are intended to complement each other ...

How much does Medicare Part B cost?

If you enrolled in Medicare during the open enrollment period and your income did not exceed $88,000 in 2019, you’ll pay $148.50 a month for your Medicare Part B premium in 2021.

What are the expenses for Medicare 2021?

For 2021, these expenses include: Quarters worked and paid Medicare taxes. Premium. 40+ quarters.

What is the Medicare deductible for 2021?

The annual deductible for 2021 is $203.

What is the deductible for Medicare Part B 2021?

The annual deductible for 2021 is $203. If you do not sign up for Medicare Part B in your enrollment period (usually right around when you turn age 65), you may have to pay a late enrollment penalty on a monthly basis.

How much is the 2021 Medicare premium?

Costs in 2021. most pay no monthly premium, $1,484 deductible per benefit period, daily coinsurance for stays over 60 days. $148.50 monthly premium for most people, $203 annual deductible, 20% coinsurance on covered services and items.

How old do you have to be to qualify for Medicare?

Eligibility. For Medicare Part A eligibility, you must meet one of the following criteria: be age 65 or older. have a disability as determined by a doctor and receive Social Security benefits for at least 24 months. have end stage renal disease.

What is Medicare Part B?

Medicare Part B is known as “medical insurance” because it covers doctor visits and medical care outside the hospital. Like with Medicare Part A, treatment must be determined as medically necessary or preventative to be covered by Medicare Part B. While Part A is required for some people on disability or those receiving other forms ...

How much does Medicare pay for covered services?

Medicare Part B pays 80% of costs for covered services, leaving beneficiaries to pay the remaining 20% of Part B expenses out of pocket.

How much is the 2020 Medicare premium?

For 2020, the monthly premium is $458 (up from $437 in 2019). 1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 (up from $1,364 in 2019) to cover hospital inpatient care. 2.

How old do you have to be to get Medicare Part A?

To be eligible for Medicare Part A for free, you must be over age 65 and meet one of the following requirements: You or your spouse paid Medicare taxes while employed with the government. You are eligible for Social Security or Railroad Retirement Board benefits but haven’t started collecting them yet.

What is nursing home care?

Hospital care, including long-term care facilities and inpatient rehab. Nursing home care, but only if the beneficiary requires more than custodial care. Skilled nursing facility care, including meals, supplies, and nurse-administered injections.

What is hospice care?

Hospice, which is care aimed at making terminally ill individuals as comfortable as possible after they decide they no longer want to pursue treatment for their illness.

Is Medicare Part B mandatory?

While Part A is required for some people on disability or those receiving other forms of government aid, Medicare Part B is not mandatory for these people. However, you may incur late enrollment penalties if you don't sign up when you're first.

What is Medicare Part B?

Medicare Part B is offered by the U.S. government to help cover the costs of doctor visits and outpatient services. Medicare Part C is offered by private companies. It includes Medicare Part B along with Part A and often Part D. Medicare Part C can also include services not offered by Medicare, such as vision and dental.

What percentage of Medicare does Part B cover?

For other costs like copays and coinsurance, you’ll pay 20 percent of the Medicare-approved rate until you reach your deductible. Part B only covers services approved by Medicare and does not include extras like vision, hearing, or dental coverage.

What are the different parts of Medicare?

The four parts of Medicare are: Part A: hospital services. Part B: outpatient services. Part C: Medicare Advantage. Part D: prescription drugs. Part B is a portion of your healthcare ...

Does Medicare Advantage have a deductible?

Your Medicare Advantage plan’s premiums, deductibles, and services can change annually. A Part C plan will bundle all of your part A and part B coverage, along with several extra services, into an all-in-one plan.

How much is Medicare Part B 2021?

Part B. A person must pay a monthly premium for Medicare Part B. The premiums usually change each year, but for 2021, the standard premium is $148.50. In addition, Part B has a 2021 deductible of $203. A 20% coinsurance for most Medicare-approved services will apply after a person has paid the deductible.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare Part D?

Medicare Part D covers prescription drugs. Specific rules usually apply to both. Medicare is the federal government’s insurance coverage for those aged 65 years and over or with certain medical conditions. Medicare packages have different parts that cover various aspects of medical treatment. Parts B and D are examples of this coverage.

What is a formulary in a health plan?

The plans must provide a listing, known as a formulary, of prescription drugs. A formulary must cover at least two drugs in each commonly prescribed category. Examples of these categories include medications to treat blood pressure and those for diabetes.

How much is Part D insurance in 2021?

Some plans offer comprehensive prescription drug coverage. In 2021, the average Part D monthly premium is $33.06, which is a 1% increase from 2020, according to the Kaiser Family Foundation.

What is Part D insurance?

Part D: This part covers prescription drugs. The federal government requires that all people aged 65 years and over have prescription drug coverage equal to the basic policy that insurance companies offer. Private companies administer Part D plans.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is Medicare insurance?

Medicare. Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients. Patients pay part of costs through deductibles for hospital and other costs.

Do you pay for medical expenses on medicaid?

Patients usually pay no part of costs for covered medical expenses. A small co-payment is sometimes required. Medicaid is a federal-state program. It varies from state to state. It is run by state and local governments within federal guidelines.

Is Medicare a federal program?

Small monthly premiums are required for non-hospital coverage. Medicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

What is Medicare Part A?

Medicare Part A covers costs for inpatient hospital care, while Part B covers most outpatient and preventive care. Learn more about the costs for Parts A and B, also known as Original Medicare.

When does the benefit period end for Medicare?

With Medicare Part A, a benefit period starts on the first day of admission for inpatient care and ends when the enrollee hasn't received inpatient hospital care or inpatient care at a skilled nursing facility for 60 consecutive days.

How much does Medicare pay for coinsurance?

Enrollees pay no coinsurance for the first 60 days of an inpatient stay. For days 61 to 90, the coinsurance amount is $352 ...

What is deductible in Medicare?

A deductible is the amount of money a beneficiary must pay before his or her Medicare benefits kick in. So what is the difference between Medicare Part A and Part B when it comes to deductibles?

How many credits do you need to get Medicare?

Because the funds for Medicare come from payroll taxes, a beneficiary typically needs to earn at least 40 credits to receive Part A coverage without having to pay a premium. 40 credits is equivalent to working and paying Medicare taxes for 10 years. For individuals with 30-39 work credits, the Part A premium is $252 for 2020.

How much is the 2020 Part B deductible?

The Part B deductible is $198 for the year in 2020. Once a beneficiary meets this deductible, their Part B coverage kicks in and they are typically responsible for a 20% coinsurance/copayment for their Part B-covered services for the rest of the year.

How much is the 2020 Part A premium?

For individuals with 30-39 work credits, the Part A premium is $252 for 2020. Individuals with fewer than 30 credits pay a monthly premium of $458. Premium-free Part A is available to adults who are at least 65 years old and meet one of the following requirements: