Some key differences between the two programs include:

- Original Medicare includes Medicare Part A (hospital care) and Part B (medical care) only. People who want prescription...

- You can use original Medicare at any doctor or hospital that accepts the program. Medicare Advantage programs may limit...

- Out-of-pocket costs with Medicare Advantage plans are usually lower.

What is the difference between Medicare and advantage?

Original Medicare: Medicare Advantage: Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams. Plans must cover all of the medically necessary services that Original Medicare covers.

Why are Medicare Advantage plans bad?

Mar 12, 2022 · Under original Medicare, you can get a wide variety of medical services including hospitalizations; doctor visits; diagnostic tests, such as X-rays and other scans; blood work; and outpatient surgery. Under Medicare Advantage, you will get all the services you are eligible for under original Medicare.

Is it better to have Medicare Advantage or Medigap?

Sep 16, 2018 · Another significant difference between Original Medicare vs. Medicare Advantage is that with Medicare Advantage, once you reach a specific limit on out-of-pocket expenses, you pay nothing for your covered health care costs. This limit varies from plan to plan and can change each year, so it’s important to check the plan details before you enroll.

What is the advantage of traditional Medicare?

Feb 15, 2022 · Original Medicare (Medicare Part A and Part B) is the federal health insurance program for people age 65 and older and people younger than 65 who have a qualifying disability or certain medical conditions. Medicare Advantage plans (Medicare Part C) are sold by private insurers as an alternative to Original Medicare and provide at least the same benefits as …

What is one of the main differences between Original Medicare and Medicare Advantage?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Does Medicare Advantage replace Original Medicare?

What is the price difference between Medicare and Medicare Advantage?

| Plan type | Monthly premium |

|---|---|

| Medicare Part D | The cost varies by plan, but the projected 2021 average premium is $42.05, according to the Kaiser Family Foundation (KFF). |

| Medicare Advantage | As with Part D, the cost varies by plan. However, in 2020, the average monthly premium was $25, according to the KFF. |

Can I drop my Medicare Advantage plan and go back to original Medicare?

Who is the largest Medicare Advantage provider?

What is the most popular Medicare Advantage plan?

Do you still pay Medicare Part B with an Advantage plan?

Why does zip code affect Medicare?

Is Medicare Advantage more expensive?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the maximum out-of-pocket for Medicare Advantage plans?

Original Medicare vs. Medicare Advantage: What’S The Difference?

In order to understand the differences between the two programs, it’s important to understand how each one works.Original Medicare, Part A and Part...

Are There Different Types of Medicare Advantage Plans?

Many people like the flexibility that Medicare Advantage plans provide. Unlike Original Medicare, which is the same for everyone, there are several...

How Can I Find Which Medicare Advantage Plans Are Available in My area?

I’m available to help you understand your options. If you prefer, you can request information via email or schedule a phone call at your convenienc...

What is Medicare Advantage?

Under Medicare Advantage, you will essentially be joining a private insurance plan like you probably had through your employer. The most common ones are health maintenance organizations (HMOs) and preferred provider organizations (PPOs). Medicare Advantage employs managed care plans and, in most cases, you would have a primary care physician who would direct your care, meaning you would need a referral to a specialist. HMOs tend to have more restrictive choices of medical providers than PPOs.

What percentage of doctors accept Medicare?

According to the Kaiser Family Foundation, 93 percent of primary physicians participate in Medicare. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

What is Medicare buffet?

If you elect to go with original Medicare, your buffet will include Part A (hospital care), Part B (doctor visits, lab tests and other outpatient services) and Part D (prescription drugs). If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

How to find out what out of pocket costs are?

To help you get an idea of what your out-of-pocket costs would be, you can consult the Centers for Medicare & Medicaid Services’ out-of-pocket cost calculator, which can help you compare your estimated out-of-pocket expenses .

Does Medicare have an annual cap?

Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.

Does Medicare cover dental?

While Medicare will cover most of your medical needs, there are some things the program typically doesn't pay for -— like cosmetic surgery or routine dental, vision and hearing care. But there are also differences between what services you get help paying for.

Does MA have a copay for doctor visits?

But instead of paying the 20 percent coinsurance amount for doctor visits and other Part B services, most MA plans have set copay amounts for a physician visit , and typically that means lower out-of-pocket costs than original Medicare. MA plans also have an annual cap on out-of-pocket expenses.

What is the difference between Medicare and Medicare Advantage?

Medicare Advantage is that the Medicare Advantage program is administered by private insurance companies approved by Medicare to offer benefits. This means that premiums are set by the individual insurance companies and can vary depending on the plan you choose ...

What are the different Medicare Advantage plans?

Some of the popular ones include: Health Maintenance Organizations (HMOs).

How many people are enrolled in Medicare Advantage in 2017?

In 2017, about one-third of all Medicare beneficiaries are enrolled in Medicare Advantage plans according to CMS. If you have Medicare coverage or are approaching Medicare eligibility, you may have questions about which program is right for you.

Does Medicare Advantage cover hospice?

Medicare Advantage plans must offer all the same coverage as Original Medicare (except for hospice care, which is still covered under Part A), but they are able to offer additional benefits to their members.

Does Medicare cover prescription drugs?

Original Medicare generally does not include coverage for prescription drugs, except those medications that must be administered by a medical professional, such as chemotherapy and certain types of injections, for example.

Does Medicare Advantage include Part D?

For example, many Medicare Advantage plans also include Medicare Part D prescription drug coverage, so you get all your Medicare benefits in one convenient plan.

Can you still be in Medicare Advantage?

Remember, if you enroll in a Medicare Advantage plan, you’re still in the Medicare program, which means you have all the same rights and protections as you have under Original Medicare.

How to compare Medicare Advantage plans?

Compare Medicare Advantage plans that may be available in your area and speak with a licensed insurance agent who can help you sign up for a Medicare Advantage plan that’s right for you. Compare Medicare Advantage plans in your area. Compare Plans. Or call. 1-800-557-6059.

How much does Medicare Advantage pay for a day after day 90?

After that, you pay $0 coinsurance for days 1-60, $371 per day for das 61-90 and $742 per day for each lifetime reserve day after day 90. After your lifetime reserve days are used, you are responsible for paying all costs. Medicare Advantage plan coinsurance amounts vary depending on the specific plan you enroll in.

How much is coinsurance for Medicare?

If you’re enrolled in Original Medicare you typically pay a 20 percent Part B coinsurance for covered services after you meet your Part B deductible, and Medicare pays the remaining 80 percent. For inpatient hospital stays in 2021, you first have to meet your Part A deductible for the benefit period.

How long do you have to be on Medicare before you turn 65?

You will typically be automatically enrolled in Original Medicare if one or more of the following applies to you: You get benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65. You’ve been getting disability benefits for at least 24 months.

How much will Medicare pay in 2021?

If you do have to pay a Part A premium, you could pay up to $471 a month in 2021.

What is Medicare Part A and Part B?

Original Medicare (Medicare Part A and Part B) is the federal health insurance program for people age 65 and older and people younger than 65 who have a qualifying disability or certain medical conditions. Medicare Advantage plans (Medicare Part C) are sold by private insurers as an ...

When do you have to enroll in Medicare Advantage?

Some people are automatically enrolled in Original Medicare three months before their 65th birthday , and some people must manually sign up for Medicare.

What is the maximum out of pocket spending for Medicare?

This was to discourage private insurance from taking advantage of their beneficiaries. For Medicare Advantage plans, those limits are set at $6,700 for in-network services when you are on a Health Maintenance Organization (HMO) plan and $10,000 for in- and out-of-network services combined when you are on a Preferred Provider Organization (PPO) plan. Monthly premiums are excluded from that amount as are any services that would not be covered by Original Medicare. Unfortunately, that means any spending on supplemental benefits does not count towards your cap. Spending on prescription medications, even if they are included in your Medicare Advantage plan, are also considered separately. After you spend the full amount in out of pocket expenses, your Medicare Advantage plan will be responsible for any additional costs over the remainder of the year. Original Medicare does not have an out of pocket spending limit.

How many people are on Medicare in 2018?

More than 59 million people were on Medicare in 2018. Forty million of those beneficiaries chose Original Medicare for their healthcare needs. 2 . Access to a broader network of providers: Original Medicare has a nationwide network of providers.

How did the government try to decrease expenditures from the Medicare Trust Fund?

In an attempt to decrease expenditures from the Medicare Trust Fund, the government tried to shift the cost of care to the private sector. Insurance companies contract with the government to be in the Medicare Advantage program, and the government pays the plan a monthly stipend for each beneficiary that signs up.

When is Medicare open enrollment?

Whether you are new to Medicare or are looking to change your plan during the Medicare Open Enrollment Period (October 15 - December 7) , you have an important decision to make. Is Original Medicare or Medicare Advantage the right choice for you? To understand your choices, you need to understand how they differ.

Does Medicare Supplement cover medical bills?

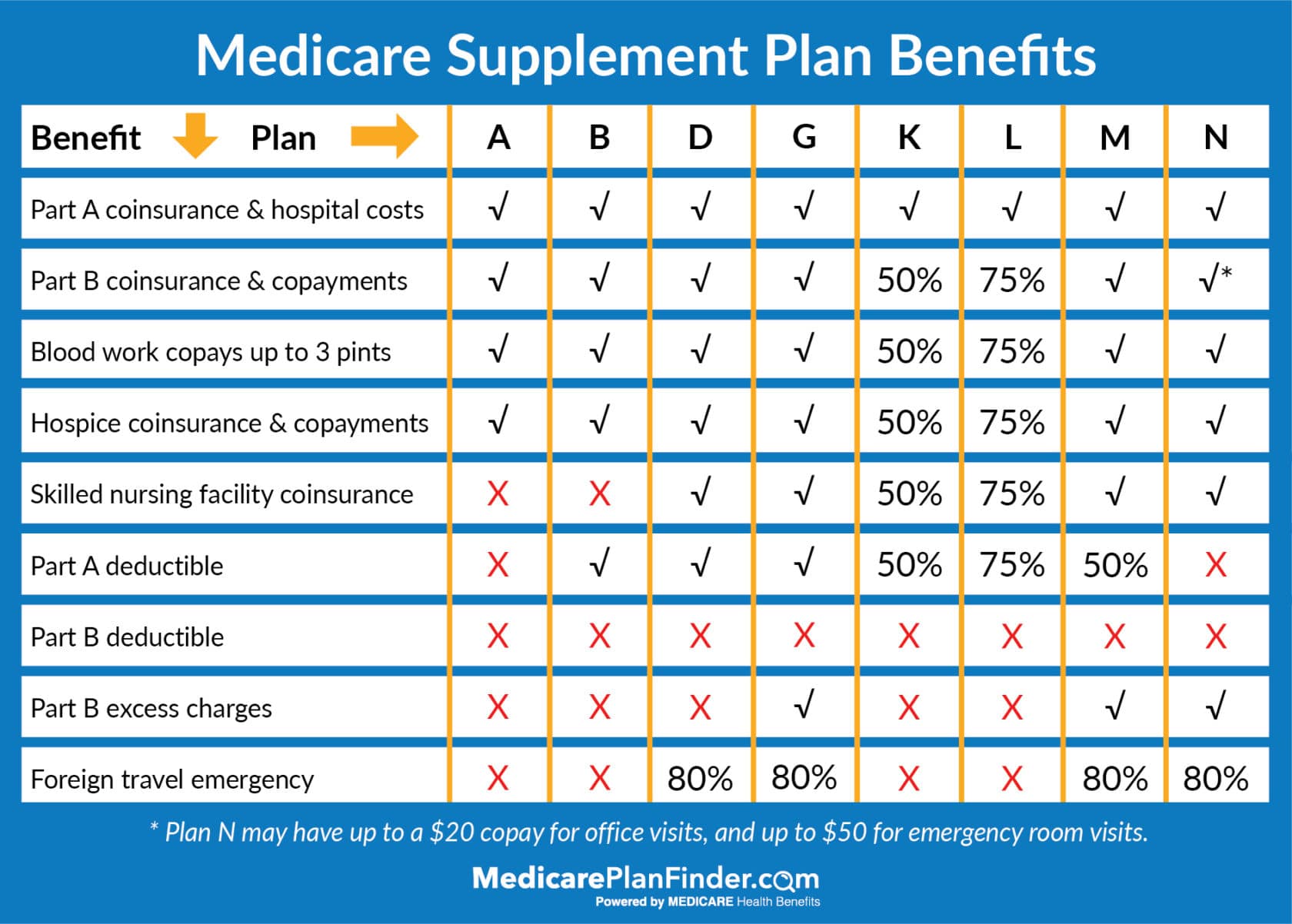

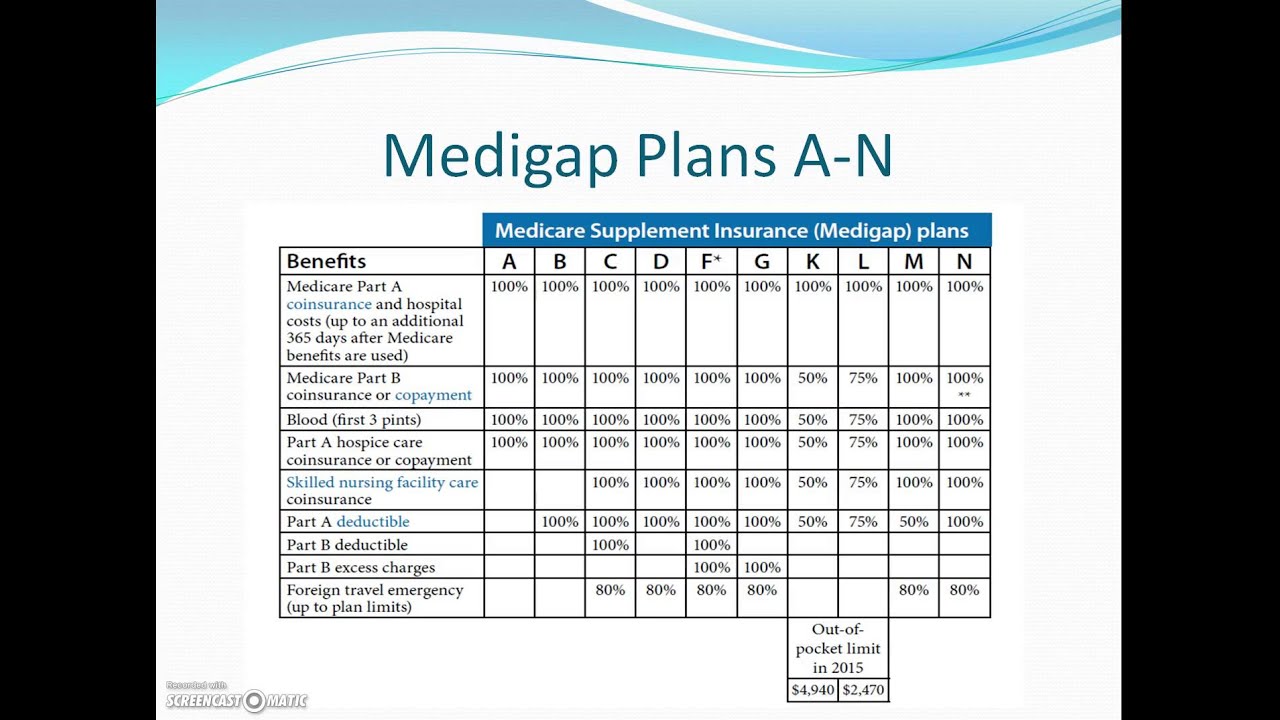

That's where a Medicare Supplement plan, also known as a Medigap plan, can come into play. These supplement plans do not cover health care directly but help to pay off any costs Original Medicare leaves on the table, i.e., deductibles, coinsurance, copays, and even emergency care in a foreign country.

Does Medicare Advantage have a restricted network?

Best of all, that network is not restricted based on where you live like it is with Medicare Advantage. All you need to do is pick a doctor that takes Medicare. If you find a doctor that accepts assignment too, meaning they also agree to the Medicare Fee Schedule that is released every year, even better.

Can you change your Medicare plan during open enrollment?

If you find that the plan you have chosen does not work in your favor, you can always make a change during Medicare Open Enrollment the following year.

What is the difference between Medicare Advantage and Original?

There is one very important difference between Original Medicare vs Medicare Advantage, however. Medicare Advantage plans have a maximum out-of-pocket limit or MOOP. Once you hit your MOOP, you pay nothing for covered healthcare for the rest of that calendar year.

Why do people use Medicare Advantage plans?

Medicare Advantage plans appeal to many people because they are convenient. Since most plans have Part D included you don’t have to have a separate card for the pharmacy. These plans also often appeal to people who have low medical usage.

What is the MOOP for Medicare Advantage 2021?

In 2021, the mandatory MOOP for Medicare Advantage is $7,550, although many plans choose to set theirs much lower. In 2021, only about 20% of Medicare Advantage had the mandatory MOOP of $7,550. This means that many plans offer a lower MOOP, which is good for you.

How much does Medicare Advantage pay for doctor visits?

Medicare Advantage enrollees usually pay a copayment when they get healthcare. This is usually between $10 and $20 for doctor visits and up to $75 for emergency room and urgent care visits. There is often a tiered copayment system for prescription drugs.

Why is it so hard to give a snapshot of your Medicare Advantage plan?

It’s difficult to give a snapshot of your costs with a Medicare Advantage plan because each one is different . Each company that offers a plan can choose what to charge for premiums, deductibles, and copayment amounts.

Why do people choose Original Medicare and Medigap?

Other people choose Original Medicare and Medigap because they want very predictable back-end costs. They want the peace of mind that comes from knowing exactly how much they will spend on a hospital stay or chronic illness. They buy for convenience and don’t mind spending a bit more to gain peace of mind.

How much will Medicare cost in 2021?

For 2021, the average Medicare Advantage plan premium is about $21 a month. About 96% of Medicare beneficiaries have access to at least one zero premium depending on where they live.

What are the different types of Medicare Advantage plans?

Plans vary by type with Medicare Advantage. Popular plans include HMOs, PPOs and PFFS.

How does Medicare cost vary?

Medicare costs vary based on your income and what plan you choose.

What is a Medigap plan?

A Medigap plan is a supplemental insurance plan that you get from a private company to pay costs for you that aren’t covered in Original Medicare. These costs may include deductibles, co-payments and medical services received outside of the US. Medigap is an add-on for Original Medicare only and does not work with Medicare Advantage. Many people require supplemental coverage because they only receive the basic services under Original Medicare and are paying high out-of-pocket costs. Medigap tries to shrink the coverage gap, but you also have to pay another premium and deductible to have this supplemental coverage. Medigap doesn’t cover long-term care, dental, vision, hearing and wellness programs. They also do not cover prescription drugs in most cases. Medigap policies have a premium. If you frequently need services that are not provided in Original Medicare but don’t want to switch to Medicare Advantage, Medigap may be the best choice. However, these plans are only available to people who already have Part A and Part B. If you are currently on Medicare Part C, you won’t qualify for Medigap. There are standard Medigap plans that range from A through N (excluding E, H, I and J, which are no longer sold). If you choose Medigap plans, you still pay a premium. You’ll pay a premium for Medigap and a premium for Part B. The total cost of your plan will depend on the private company. It also depends on your age and location. If you pay your premiums on time, you can always renew your Medigap policy.

How to find out what Medicare plan is right for you?

If you think you need a little extra help, finding a licensed sales agent, who can help you determine what plan is right for you, is as simple as calling our toll free number and speaking to a licensed, Medicare professional. Or, if you would prefer to obtain some additional information from a government resource, you can always visit Medicare.gov for more details.

What is Medicare Part A?

Medicare Part A provides services for hospital, nursing and hospice care. Medicare Part B provides services for physician care, labs, tests and durable medical equipment. Medicare Part D covers medical prescriptions and is purchased through commercial insurance providers. Under Original Medicare, providers carry the bulk of service responsibilities. They bill and are generally paid within 14 days of providing service. This is known as “Fee for Service” (FFS). FFS is a single-payer plan administered by the federal government. Once you turn 65 or after 24 months of receiving Social Security for a disability, you are automatically enrolled in Medicare. However, you have the option of choosing Medicare Part C (Medicare Advantage).

How much is Medicare Advantage 2019?

Medicare Advantage payments were increased by 3.4% for 2019, which is more than the anticipated 1.84% that was projected. Thankfully, the premiums for 2020 are decreasing for many carriers. The Affordable Care Act made more than $200 billion in cuts to Medicare Advantage payments that will be phased in each year.

How many stars are Medicare Advantage plans?

Medicare Advantage plans are offered through private health insurance companies and must be approved by Medicare. They are also rated from one to five stars with five stars being an excellent plan. For all of Your Tomorrows FIND THE RIGHT MEDICARE PLAN TODAY. Compare Plans ›.

Medicare vs. Medicare Advantage: The Basics

If you have original Medicare, the goverment directly pays for your Medicare benefits. In contrast, with Medicare Advantage plans, you receive your benefits from private medical insurance companies that Medicare has approved. There are several types of Medicare Advantage Plans:

Medicare vs. Medicare Advantage: Differences

Both Medicare and Medicare Advantage will fund most basic health costs, including doctor's visits and hospital stays. The specific cost of each plan, as well as the out-of-pocket copays and other costs, vary. Some key differences between the two programs include:

Why Choose Medicare Advantage?

Medicare Advantage plans must offer benefits comparable to original Medicare. The government regulates these plans, ensuring that they meet certain basic care requirements. The costs and copays for various services, however, may be different. For some people, Medicare Advantage is a better choice. You might choose Medicare advantage because:

What benefits do you get with Medicare Advantage?

When enrolled in Medicare Advantage, you will receive your Part A and Part B benefits through your Medicare Advantage plan except for hospice care, which you will continue to receive through Part A.

What is Medicare Part A and Part B?

Medicare Part A covers hospital insurance, and Part B covers medical insurance. By law, Medicare Advantage plans (which are sold by private insurance companies) are required to provide the same benefits as Original Medicare. When enrolled in Medicare Advantage, you will receive your Part A and Part B benefits through your Medicare Advantage plan ...

Does Medicare Advantage replace Original Medicare?

Does Medicare Advantage replace Original Medicare? In a way, yes. This guide explains more about the relationship between Medicare Advantage and Original Medicare.

Does Medicare Advantage have a premium?

Some Medicare Advantage plans come with $0 premiums, though $0 premium plans may not be available in all areas.

Does Medicare Advantage have dental coverage?

Some plans may also offer benefits not found in Original Medicare, such as coverage for dental, hearing, vision, and other benefits. To sum it all up: With a Medicare Advantage plan, your Original Medicare coverage remains intact but you receive your Original Medicare benefits from your Medicare Advantage plan (except hospice care).