The House Budget Resolution for Fiscal Year (FY) 2019 would make cuts to the Medicare, Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

How much will Medicare spending increase between 2019 and 2029?

The House Fiscal Year 2019 Budget and Its Effect on Seniors. The House Budget Resolution for Fiscal Year (FY) 2019 would make cuts to the Medicare, Medicaid and Social Security programs and repeal and replace the Affordable Care Act (ACA), actions which would be harmful to millions of Americans. The House Budget Resolution for FY 2019, introduced by House Budget …

What is the future of Medicare spending?

Dec 01, 2021 · Three such concepts—the financial status of the Medicare trust funds, the impact of Medicare on the Federal budget, and the long-run sustainability of Medicare—are often confused with each other and are sometimes used interchangeably. Each concept is important but needs to be used for its own purpose. This article clarifies the differences ...

Are Medicare costs exceeding projections?

Aug 01, 2019 · 2019 budget includes $2.44 billion for the Department of Health and Welfare’s Medicaid Division on Wednesday. That’s an increase in total funding of $160.3 million, or 7 percent over the current year. State general fund support is …

How has Medicare impacted hospital expenditures?

Jun 19, 2018 · House Republicans offered a budget proposal on Tuesday that would cut mandatory spending by $5.4 trillion over a decade, including $537 billion in cuts to Medicare and $1.5 trillion in cuts to...

How much of the national budget goes to Medicare?

What is the Medicare budget for 2019?

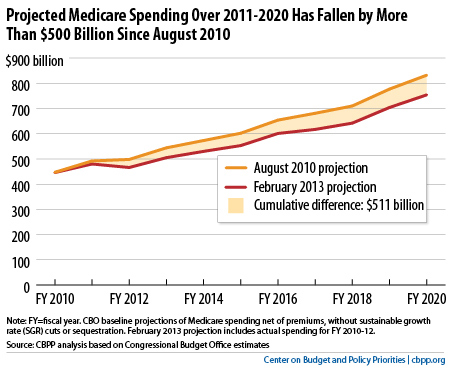

CBO projects net Medicare spending to increase from $630 billion in 2019 to $1.3 trillion in 2029 (Figure 6).Aug 20, 2019

What impact is the Affordable Care Act expected to have on Medicare?

The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.Oct 29, 2020

How much of the US budget goes to Medicare and Medicaid?

NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.Dec 15, 2021

What did the government spend in 2019?

How is US budget spent?

Is Medicare Advantage Part of the Affordable Care Act?

Is Affordable Care Act and Medicare the same thing?

How does the Affordable Care Act affect senior citizens?

How much did the United States spend on healthcare in 2019?

Who pays for healthcare in the US 2019?

How much does the US spend on Medicare and Social Security?

When was the 2019 budget approved?

The House Budget Resolution for FY 2019, introduced by House Budget Committee Chairman Steve Womack (R-AR), was approved by the House of Representatives Budget Committee on June 21, 2018. This budget proposes drastic cuts in federal spending for programs of importance to most low- and middle-income Americans while protecting nearly $2 trillion in ...

How much is the budget resolution for Medicare?

Medicare. The budget resolution proposes $537 billion in cuts to Medicare which would be achieved by ending traditional Medicare and increasing health care costs for beneficiaries. Chairman Womack’s plan assumes savings for the federal government by privatizing Medicare and shifting costs to Medicare beneficiaries.

How many people would lose Medicaid coverage?

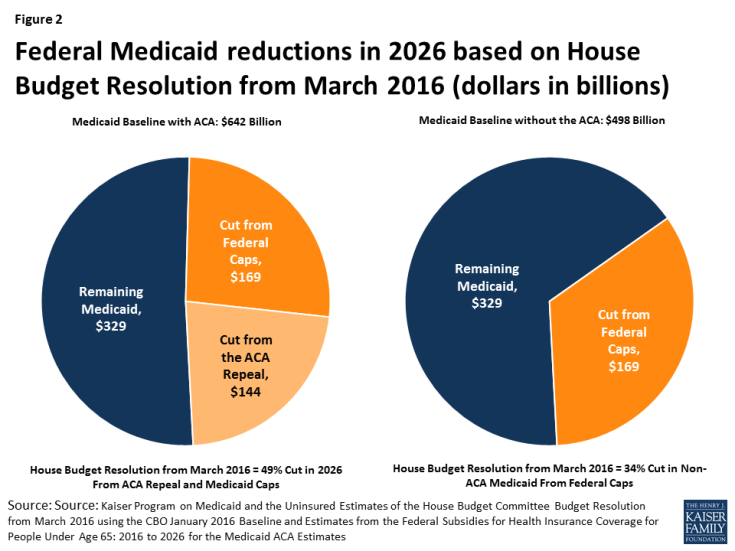

Preventing low-income adults from receiving access to health care services. Repealing the Medicaid expansion would result in 14-17 million people losing coverage. In total, the House budget resolution would cut $1.5 trillion from Medicaid and “other programs.”.

What would happen if the ACA was repealed?

By assuming enactment of the ACA repeal, the House budget resolution would destroy the current Medicaid program and slash benefits for low-income individuals. These changes would be detrimental to seniors and others who rely on Medicaid.

How many states have expanded Medicaid?

Thirty-two states have expanded their Medicaid programs. The House budget resolution would repeal the Medicaid expansion in the ACA. This proposal would hurt states and low-income individuals by: Eliminating billions of federal dollars to states to provide their residents with health care and financial protection.

What is the House budget resolution?

The House budget resolution assumes savings from redesigning the Medicare benefit by combining the Part A and Part B deductibles and making changes to supplemental insurance (Medigap) policies, changes that would likely increase costs for people with Medigap policies.

How much will the deficit be reduced by the House budget resolution?

The House budget resolution assumes repeal of the Affordable Care Act (ACA) and adopts the reforms included in the House-passed “American Health Care Act” (AHCA) that would reduce the federal deficit by $204.1 billion between fiscal year 2018 and fiscal year 2027.

What is the GOP budget for 2019?

House Republicans offered a budget proposal on Tuesday that would cut mandatory spending by $5.4 trillion over a decade, including $537 billion in cuts to Medicare and $1.5 trillion in cuts to Medicaid and other health programs. On Medicare, the budget would move ...

How much will the federal government spend in 2028?

Non-defense discretionary spending, which covers most of the federal government’s activities, would drop from the $597 billion to $555 billion by 2028. Meanwhile, defense spending would climb from $647 billion this year to $736 billion in 2028. Democrats lambasted the plan for unrealistic assumptions, including the repeal ...

Did the Senate have to adopt a budget to repeal Obamacare?

But that is a long way off at this point. The Senate would have to adopt a budget as well to unlock the process, and GOP leaders have indicated they have moved on from ObamaCare repeal for now. The budget also proposes $2.6 trillion in reductions to other mandatory spending programs, including welfare and other anti-poverty programs.

Will Obamacare be repealed without Democratic votes?

The budget also sets up a fast-track process known as reconciliation that could allow ObamaCare repeal to pass without Democratic votes in the Senate . But that is a long way off at this point.

Is the Affordable Care Act repeal real?

Its repeal of the Affordable Care Act and extreme cuts to health care, retirement security, anti-poverty programs, education, infrastructure, and other critical investments are real and will inflict serious harm on American families,” said Rep. John Yarmuth. (D-Ky.), the ranking member on the House Budget committee.

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

What is Medicare recurring?

Recurring Publications. Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program ...

What percentage of prescriptions were brand name drugs in 2015?

In 2015, brand-name specialty drugs accounted for about 30 percent of net spending on prescription drugs under Medicare Part D and Medicaid, but they accounted for only about 1 percent of all prescriptions dispensed in each program.

Why did Medicare drop in 2009?

According to a Kaiser Family foundation study, the number of firms offering retirement health benefits (including supplements to Medicare) dropped from a high of 66% in 1988 to 21% in 2009 as healthcare costs have increased . In addition, those companies offering benefits are much more restrictive regarding eligibility, often requiring a combination of age and long tenure with the company before benefits are available. In addition, retirees who have coverage may lose benefits in the event of a corporate restructuring or bankruptcy, as healthcare benefits do not enjoy a similar status to pension plans.

How did Medicare help offset declining hospital revenues?

One of the impetuses for Medicare was to offset declining hospital revenues by “transforming the elderly into paying consumers of hospital services.” As expected, the demographics of the average patient changed; prior to 1965, more than two-thirds of hospital patients were under the age of 65, but by 2010, more than one-half of patients were aged 65 or older.

What is Medicare akin to?

Medicare is akin to a home insurance program wherein a large portion of the insureds need repairs during the year; as people age, their bodies and minds wear out, immune systems are compromised, and organs need replacements. Continuing the analogy, the Medicare population is a group of homeowners whose houses will burn down each year.

What is the average age for a person on Medicare?

According to research by the Kaiser Family Foundation, the typical Medicare enrollee is likely to be white (78% of the covered population), female (56% due to longevity), and between the ages of 75 and 84. A typical Medicare household, according to the last comprehensive study of Medicare recipients in 2006, had an income less than one-half of the average American household ($22,600 versus $48,201) and savings of $66,900, less than half of their expected costs of healthcare ($124,000 for a man; $152,000 for a woman).

What were the new treatments and technologies that Medicare provided?

The development and expansion of radical new treatments and technologies, such as the open heart surgery facility and the cardiac intensive care unit, were directly attributable to Medicare and the new ability of seniors to pay for treatment.

How many elderly people are without health insurance?

Today, as a result of the amendment of Social Security in 1965 to create Medicare, less than 1% of elderly Americans are without health insurance or access to medical treatment in their declining years.

How many hospital beds have fallen since 1965?

As a consequence, the number of hospital beds across the nation has fallen by 33% from 1965.

What are the concerns of single payer healthcare?

Two primary concerns of a single-payer healthcare system are the methods it would use to pay providers and set their payment rates, both of which would directly affect government spending, national healthcare spending, and providers' revenues. The impact on providers' revenues would, in turn, affect their incentives to deliver services, the CBO said.

How many people are uninsured in 2018?

The benefits of a single-payer system include a substantial reduction in the number of people without health insurance. About 29 million people under the age of 65 were uninsured in an average month in 2018, according to estimates by CBO and the staff of the Joint Committee on Taxation.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.