How AARP Medicare Supplement Plans Work

- You can receive care anywhere in the United States.

- You can see any provider who accepts Medicare.

- You don’t need a referral to see a specialist.

- You can sign up during your Initial Enrollment Period. ...

- You can combine your Medicare Supplement plan with a Medicare Part D prescription drug plan.

Full Answer

How does Medicare work with AARP?

- Great name recognition — seniors trust AARP

- A+ Better Business Bureau rating for both AARP and UnitedHealthcare

- In 2019, UnitedHealthcare was ranked the “World’s Most Admired Company” in the Insurance and Managed Care category by Fortune magazine

- Offers the most popular Medicare Supplements: F, G, and N

Does AARP offer the best Medicare supplemental insurance?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your...

What is Medicare complete with AARP?

- Various health insurance policies that meet your needs and your budget, now or in the future.

- Possibility of hiring a personal doctor without restricting the network under the condition that doctors accept patients as part of the AARP Medicare plan.

- Insurance is also available when you travel anywhere in the United States.

Does AARP offer medical insurance?

Who Does Aarp Use For Health Insurance? In spite of AARP not providing insurance through United Healthcare, AARP offers medical insurance plans at its locations. In addition to Part D prescription drug coverage, Medigap is also available. According to its ...

Is AARP good for Medicare?

They're some of the best Medicare Supplement plans available, and they're also the most popular plans, with about 32% of Medicare Supplement subscribers having an AARP/UnitedHealthcare plan. Insurance policyholders must be AARP members, and you can join during your insurance application if you're not already a member.

Who Pays First Medicare or AARP?

En español | Medicare almost always pays first when people are retired, enrolled in Medicare, and entitled to one or more other types of health benefits. Usually retiree benefits from former employers or unions, or other forms of supplemental coverage, such as Medigap insurance, pay second.

What is the monthly premium for AARP Medicare Supplement?

What Are the Best Medicare Supplement Plans Available in 2021Plan APlan NAARP Premium Estimate$92.11$99.73Part A deductible-100%Part A coinsurance and hospital costs100% after deductible100%Part A hospice coinsurance or copay100%100%7 more rows•Oct 21, 2020

How much is AARP Medicare Advantage plan?

About 7 out of 10 of AARP's Medicare Advantage plans offer $0 premiums. Of AARP plans that have a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $112.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

Does AARP own UnitedHealthcare?

UnitedHealth Group not only owns UnitedHealthcare, it also owns one of the country's largest PBMs, OptumRx, with whom AARP also has a revenue-generating, branded prescription drug plan.

What is the difference between AARP and UnitedHealthcare?

Although AARP is not an insurance company, it offers healthcare insurance plans through United Healthcare. The plans include Medicare Part D prescription drug coverage and Medigap. United Healthcare is a nationwide health insurance company, with reported 2019 revenue of $242.2 billion.

Does AARP cover Medicare Part B deductible?

AARP Medicare Supplement Plan B Plan B covers each of the benefits offered under Plan A. Additionally, it covers 100% of your Medicare Part A deductible. In 2020, the Part A deductible is $1,408.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is Medigap insurance?

A: Medigap is private insurance that covers out-of-pocket expenses in the Original Medicare program. (If you are under age 65 and have Medicare due to disability, see the next Q&A in this section, because the rules are different for your situation.) — Read Full Answer.

Does Medicare cover all medical expenses?

A: Medicare does not cover all your health care costs. It requires you to pay premiums, deductibles and copays, which vary according to the type of Medicare coverage you choose and, in some cases, your income. — Read Full Answer. Q: I want to be sure I understand the Part D “doughnut hole” or coverage gap.

How does AARP work? Elaborated as follows

AARP provides information, education, research, advocacy, and community services through a national network of local chapters and experienced volunteers.

How old do you need to be to join AARP?

Although the retirement age in the United States is usually 65-67 years old, AARP allows you to join a group before the age of 65, which means you can even get discounts and resources before your retirement age. Associate members aged 50 and above are open to young people.

AARP members are as follows as How does AARP work?

The AARP Foundation is a non-profit, non-profit organization designed to help people aged 50 and above who are at economic and social risk. Provide counseling and guidance to children and the AARP Institute, which supports its donated pension funds.

Criticisms of the American Association of Retired Persons

The American Association of Retired Persons is one of the most powerful lobbyists in the United States. Through its efforts, its influence in Washington, DC, and state capitals often attracts attention.

Decide If AARP Is Right for You Or Not?

Being intentional approximately the way you spend your cash is especially critical as you are close to retirement due to the fact you won’t be operating withinside the equal capability and won’t earn as much.

Is AARP worth it?

Only you can answer this question if you know How does AARP works? but if you often eat out, travel frequently, and want various medical and financial resources to help you solve your retirement and money problems, then the answer is likely to be yes.

How much does Medicare pay for days 61 to 90?

For days 61 to 90, the plan pays the $371 per day that Medicare does not cover. Days 91 and beyond are covered at $742 per day while using your 60 lifetime reserve days. Once the lifetime reserve days are used, Plan A continues to pay for all Medicare-eligible expenses that would not otherwise be covered by Medicare for an additional 365 days.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

What is covered by Plan B after day 100?

After day 100, you are responsible for all skilled nursing care costs. Plan B also covers the first three pints of blood and, for hospice care, any co-payment and co-insurance Medicare may require for outpatient drugs and inpatient respite care. 3 .

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

How much does Plan B pay?

For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days. After the lifetime reserve days are used, Plan B continues to pay 100% of Medicare-eligible expenses for an additional 365 days. After that period, you are responsible for all costs. If you have been in the hospital for at least three days ...

Does AARP provide Medicare Supplement?

AARP Medicare Supplement Plans are provided through UnitedHealthcare Insurance Company. For seniors who are concerned that their Medicare plan may not provide all the health insurance coverage they need, these plans are available to supplement their Medicare coverage.

Can Medicare cover non VA?

With Medicare, you're covered if you need to go to a non-VA provider. This is an especially important point to consider if you live some distance from the nearest VA facility. You may be subject to penalties in the future.

Is VA health coverage the same for everyone?

VA health coverage isn’t set in stone and isn’t the same for everyone. The VA assigns enrollees to different priority levels according to various factors, such as income and whether they have any medical condition that derives from their military service.

Is VA coverage less expensive than Medicare?

VA coverage for prescriptions is typically less expensive than Medicare Part D drug plans, and you won’t be hit with late penalties if you lose VA coverage in the future, provided that you sign up with a Part D plan within two months of that coverage ending.

Is Medicare and VA separate?

The Medicare and VA systems are entirely separate, with no coordination of benefits between them. You would use your VA identity card at VA facilities and your Medicare card anywhere else. You'll find more information at the VA website on how VA care works with other insurance . Return to Medicare Q&A Tool main page >>.

Does Medicare cover VA?

Having both Medicare and VA benefits greatly widens your coverage. VA coverage pays for medical services if you go to a VA hospital or doctor. If you need to go elsehwere, you'll probably end up having to pay the full cost yourself, even in emergencies. With Medicare, you're covered if you need to go to a non-VA provider.

What is the GRP number for Medicare?

Policy form No. GRP 79171 GPS-1 (G-36000-4). In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Not connected with or endorsed by the U.S. Government or the federal Medicare program. This is a solicitation of insurance.

What is Medicare Supplement?

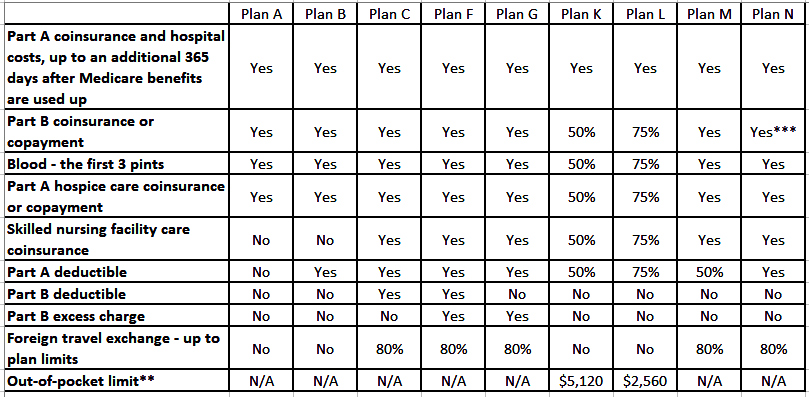

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits.

Does Medicare Supplement work with Medicare?

Medicare Supplement insurance plans work with Original Medicare (Parts A & B) to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do you have to have Medicare Part B to get tricare?

Most people with TRICARE, who become Medicare eligible and get Medicare Part A, must also have Medicare Part B to be able to remain eligible. Part D is not required to maintain eligibility.

Does Tricare work with Medicare?

TRICARE For Life may work with Original Medicare (Parts A & B), a Medicare Advantage plan or a Part D prescription drug plan. However, you may want to think carefully about whether you need Medicare drug coverage. TRICARE For Life includes a prescription drug benefit, so you may not need Part D.

Is tricare for life a creditable benefit?

This allows you to sign up without paying the Part D late enrollment penalty. When you have TRICARE For Life and Medicare, you won’t receive a TRICARE wallet card.