If you do not qualify for premium-free Part A coverage, the monthly premium is currently either $274 or $499 per month, depending on how much work history you have. When it comes to Part B coverage, everyone pays a premium for it. The premium for Part B coverage is currently $170.10 per month.

Full Answer

How much will Medicare cost me at age 65?

Mar 08, 2020 · You are eligible for Medicare and premium-free Part A, if you or your spouse paid federal taxes for 40 quarters. If you do not have 40 quarters, you may be eligible to purchase Part A coverage. This costs $458.00 per month if you have less than 30 quarters. If you paid federal taxes for 30 – 39 quarters, the monthly premium for Part A is $252.00.

Does Medicare automatically start at 65?

Oct 20, 2018 · Medicare eligibility before age 65. If you’re under 65 years old, you might be eligible for Medicare: If you receive disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board (RRB) for at least 24 months in a row. If you have amyotrophic lateral sclerosis (ALS, also called Lou Gehrig’s disease)

Does one get Medicare benefits automatically at age 65?

Part A Premium. If you’re not eligible for premium-free Part A, you can still buy Part A. In 2021 the premiums charged for Medicare Part A are 259 USD or 471 USD, subject to how long you or your spouse worked for and paid Medicare charges. If you decide not to purchase Medicare Part A, you can opt to purchase Part B.

Are you automatically enrolled in Medicare at age 65?

How to sign up for Medicare. If you are not automatically enrolled in Medicare because of your disability, you can sign up for Medicare coverage in a few different ways: Apply online on the Social Security website. Visit your local Social Security office. Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778)

Does everyone get Medicare Part A for free?

How do I get my $144 back from Medicare?

Do I have to pay for Medicare Part A?

How much does Medicare cost at age 62?

He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.Feb 15, 2022

Is Medicare Part A and B free?

Why is my Part B premium so high?

Does Medicare Part A come out of your Social Security check?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How much does Medicare take out of Social Security?

What is the maximum income to qualify for Medicare?

What is the earliest age you can get Medicare?

Do you automatically get Medicare with Social Security?

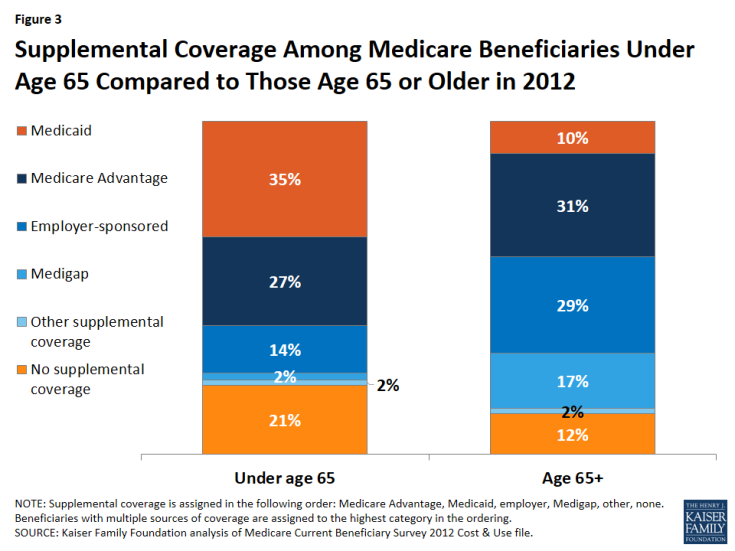

Medicare Eligibility Before Age 65

If you’re under 65 years old, you might be eligible for Medicare: 1. If you receive disability benefits from Social Security or certain disability...

How to Apply For Medicare Part A and Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If you’ve been receiving disability benefits from Social Security or the Railroad Reti...

Medicare Eligibility For Medicare Advantage (Part C) Before 65

After you’re enrolled in Original Medicare, you may choose to remain with Original Medicare (Medicare Part A and Part B) or consider enrollment in...