How can I avoid paying the Medicare levy surcharge?

Join any nib Hospital cover before 1 July and maintain it for the full financial year to avoid paying the Medicare Levy Surcharge. Any nib Hospital cover with an excess of $750 or less for singles, and $1500 or less for couples, families and single-parent families will help you avoid the surcharge.

What is the Medicare levy surcharge (MLS)?

The Medicare Levy Surcharge (MLS) is a levy paid by Australian tax payers who do not have private hospital cover and who earn above a certain income. The surcharge aims to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system.

Who is considered a dependant for Medicare levy surcharge purposes?

any of your student children who are under 25 years of age. For more information about who is considered a dependant for MLS purposes, you can refer to the ATO's Medicare Levy Surcharge page. The surcharge is calculated at the rate of 1% to 1.5% of your income for Medicare Levy Surcharge purposes.

What is the Medicare levy and who has to pay it?

Generally, the Medicare Levy (2% of your taxable income) must be paid by all Australian residents receiving free health care ( Medicare ), unless you qualify for a reduction or exemption.

What is Medicare surcharge?

The Medicare Levy Surcharge (MLS) is a levy paid by Australian tax payers who do not have private hospital cover and who earn above a certain income. The surcharge aims to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system.

What is the maximum amount of hospital insurance?

From 1 April 2019, the maximum permitted excesses for private hospital insurance is $750 for singles and $1,500 for couples/families (i.e. if multiple hospital claims are made in a single year, the excess paid by you cannot exceed $750/$1,500). The following types of health insurance do not provide an exemption:

What is the surcharge for 2021?

The surcharge levels applicable to 30 June 2021* are: Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the thresholds are increased by $1,500 for each child after the first. *The income thresholds are indexed and will remain the same to 30 June 2023.

What is general treatment cover?

General treatment cover without hospital cover; Overseas Visitors Cover or Overseas Student Health Cover; or. Cover held with non-registered insurers, such as international insurers. I have reciprocal Medicare benefits and earn over the surcharge threshold.

What is the taxable income for MLS?

a single person with an annual taxable income for MLS purposes greater than $90,000; or. a family or couple with a combined taxable income for MLS purposes greater than $180,000. The family income threshold increases by $1,500 for each dependent child after the first; and do not have an approved hospital cover with a registered health insurer.

Can you have hospital cover for part of the year?

Cover for part of the year and suspension of cover. If you have held hospital cover for part of the year, then you will have a partial exemption from the MLS. You will have to pay the surcharge to account for the days that which you did not hold hospital cover.

Do you have to pay hospital surcharge if you have dependents?

If your partner or one of your dependents is not covered, you will pay the surcharge.

Who does the Medicare Levy Surcharge apply to?

The Medicare Levy Surcharge (MLS) is a tax applied to people who earn above $90,000 as a single and $180,000 as a single parent, couple or family and don't have an appropriate level of Hospital cover.

Don't I get taxed anyway?

The simple answer is yes, most Australian taxpayers are charged the Medicare Levy. This is our contribution to supporting the public healthcare system.

How to avoid the Medicare Levy Surcharge?

If you are currently or are likely to pay the MLS, join any ING Health Insurance Hospital cover before 1 July and maintain it for the full financial year to avoid paying the MLS.

What is Medicare levy surcharge?

365. A Medicare levy surcharge may apply if you, your spouse and all your dependants did not maintain an appropriate level of private patient hospital cover for the full income year. Use the number of days listed at A to help you complete the Medicare levy surcharge question on your tax return. See also:

What is included in a private health insurance statement?

It will include the number of days that your policy provided the appropriate level of private health hospital cover, as shown below. Number of days this policy provides an appropriate level ...

What is the income threshold for MLS?

The base income threshold (under which you are not liable to pay the MLS) is: $90,000 for singles. $180,000 (plus $1,500 for each dependent child after the first one) for families. However, if you had a spouse for the full year, you do not have to pay the MLS if: your family income exceeds the $180,000 ...

How much is a single person liable for MLS?

you may be liable for MLS for the number of days you were single – if your own income for MLS purposes was more than the single surcharge threshold of $90,000. you may be liable for MLS for the number of days you had a spouse or dependent children – if your own income for MLS purposes was more than the family surcharge threshold of $180,000 ...

What happens if you change your circumstances during the year?

If circumstances for yourself, your spouse or your dependent children change at any time during the year, you may become liable to pay the MLS. Changes in circumstances may relate to your: income. spouse.

Can you reduce your income for MLS?

If you meet the following conditions, you can reduce income for ML S purposes by any taxed element of the super lump sum, other than a death benefit, that does not exceed your (or your spouse's) low rate cap: you (or your spouse) received a super lump sum.

Is a super contribution deductible?

if you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

How much is Medicare tax if you don't have private hospital cover?

If this sounds like you, you could be up for $900 or more in extra tax if you don’t have the right level of Hospital cover!

How much does a nib hospital cover?

Any nib Hospital cover with an excess of $750 or less for singles , and $1500 or less for couples, families and single-parent families will help you avoid the surcharge.

Can you avoid surcharges on hospital cover?

A: That’s the start of the new financial year so, if you take out hospital cover part-way through a financial year, you will only avoid the surcharge for the period you held suitable hospital cover for.

How to avoid Medicare levies?

How to avoid the Medicare Levy Surcharge. You can avoid the MLS by having an "appropriate level" of private hospital insurance. That means any hospital policy which has an excess of $750 or less for singles, or $1,500 or less for couples and families. Travel insurance with medical cover isn't considered appropriate. Here's the best bit though.

What is Medicare surcharge?

The Medicare Levy Surcharge is a tax for Aussies earning over $90K – avoid it with a $17 a week hospital policy. Nicola Middlemiss. &.

What is Medicare levy?

The Medicare Levy Surcharge is a tax designed to encourage high earners to take out private hospital cover in order to ease the burden on the public system. You'll be automatically taxed an extra 1%, 1.25% or 1.5% of your income if you earn over $90,000 a year (or $180,000 as a couple or family) and don't have private hospital insurance.

How much tax do you pay on Medicare if you don't have private insurance?

If you earn over $90,000 a year or $180,000 as a couple, and you don't have private hospital insurance, you'll be hit with the Medicare Levy Surcharge (MLS). It's an additional tax of between 1% and 1.5% of your income. If you're earning just over $90,000, that's a monthly tax of at least $75.

When is the surcharge payable for health insurance?

Important: The surcharge is payable for every day you don't have private health insurance within a financial year. It means you'll still be taxed even if you buy a policy at some point during the year but not before 1 July.

How much is Medicare tax?

How much is the Medicare Levy Surcharge? The dollar cost of the Medicare Levy Surcharge is at least $75 a month for people who earn over $90,000 and don't have private hospital cover. However, it could be much more if you're earning well above $90,000.

The challenge of funding Medicare

As with all healthcare systems, funding Medicare since its inception has proved to be a challenge. The initial Medicare levy of 1% was insufficient as demand, improved treatment, and increased life expectancy have put pressure on the system.

How much is the Medicare Levy Surcharge?

As we have stated, the amount of MLS you’ll pay is dependent on how much you earn, either on your own if you’re single, or as a family.

How to avoid the Medical Levy Surcharge

The government originally designed the MLS to encourage high earners to take out private healthcare and therefore ease the burden on Medicare, making it more effective and accessible for low earners who cannot afford private care.

The benefits of private healthcare

Even if private healthcare costs more than you would save by avoiding the MLS, there are some good reasons why it may still be worth taking out.

Get in touch

At bdhSterling, we have a wealth of experience in helping clients with all aspects of their financial planning.

What is Medicare levy?

Separate to the Medicare Levy, the Medicare Levy surcharge (MLS) is an additional tax of between 1 to 1.5% levied on those earning above the threshold who do not maintain a sufficient level of Private Hospital cover.

What happens if you don't have health insurance?

If you don’t have (and maintain) private hospital cover by the time you turn 30, you may have to pay a Lifetime Health Cover loading. Also, if you don’t have private health insurance and your annual taxable income is over $90,000 (for singles) and $180,000 (for families), then you may also have to pay the Medicare Levy Surcharge.

How much is MLS tax?

The rate at which the MLS is paid ranges from 1 to 1.5% of your taxable income, total reportable fringe benefits, and any amount in which a family trust distribution tax has been paid. When considering Private Health Cover its good to be aware that the Medicare Levy Surcharge (MLS) often exceeds the cost of you taking out private hospital cover.

When will Medicare tax rebates be effective?

You can read more about the Medicare Levy Surcharge on the ATO website . Rebate percentages are effective for payments made from 1 April 2019 and are indexed annually. The income tiers will remain the same until 30 June 2023. For more information, visit ato.gov.au.

Does private hospital cover Medicare?

Maintaining a sufficient level of Private hospital cover will help you avoid paying the Medicare Levy Surcharge. All of our Hospital and bundled Hospital and Extras covers will allow you to avoid paying the surcharge. However, if you don't have Private Hospital cover, you may have to pay an extra 1-1.5% on top of your levy.

What is Medicare surcharge?

It’s a tax penalty for higher income earning Australians who do not have private hospital cover but earn over a certain taxable income.

When is Medicare tax surcharge automatically applied?

This is automatically applied when your tax return is processed at the end of each financial year. Could you be paying the. Medicare Levy Surcharge? The Medicare Levy Surcharge (MLS) is a tax affecting singles with a taxable income over $90,000, and couples/families with a taxable income over $180,000, and don't have hospital cover.

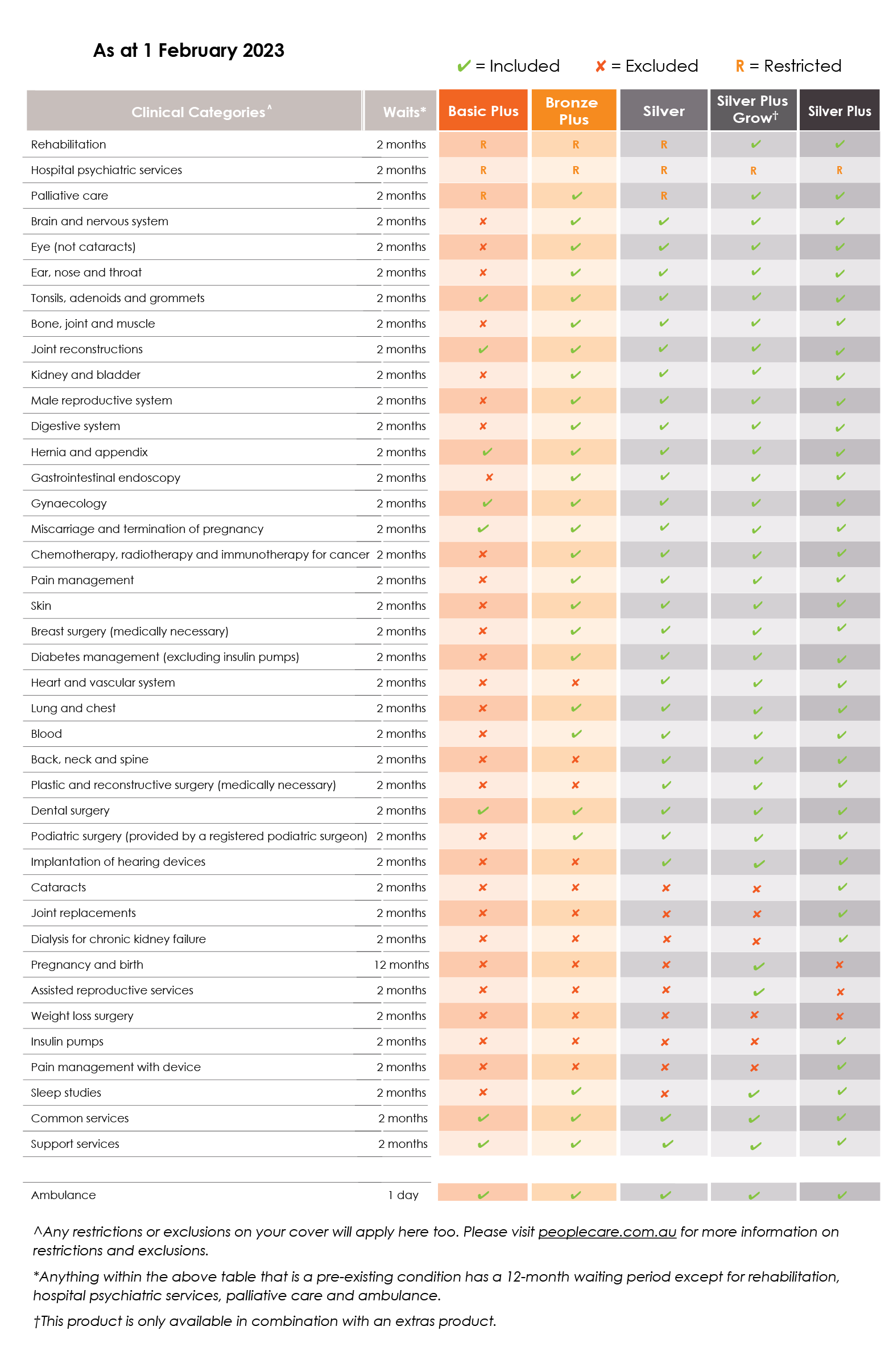

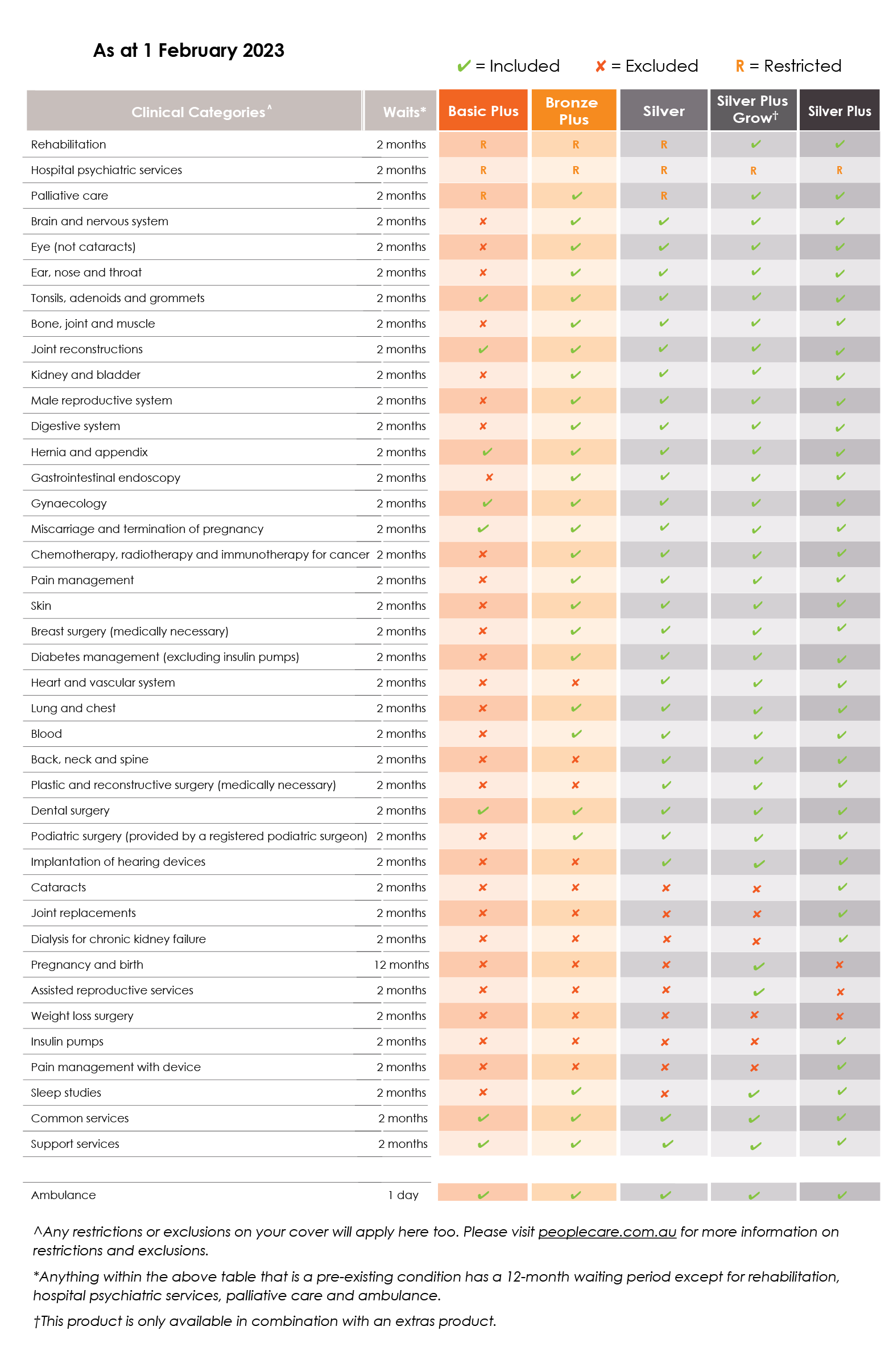

How many levels of private health insurance are there?

Private cover is available in four levels – basic, bronze, silver and gold.

Is private hospital insurance compulsory in Australia?

While private hospital insurance isn’t compulsory in Australia, if you don’t have it and are a higher income earner, you could face a tax penalty through the Medicare Levy Surcharge. So, what exactly is the Medicare Levey Surcharge and how does it work?

Is Medicare mandatory in Australia?

However, unlike the MLS, which is for higher income earners only, the Medicare Levey is compulsory for all Australian taxpayers, regardless of total taxable income (with some exemptions). The Medicare Levy helps fund our world-class public health system to which all Australian taxpayers are required to contribute two per cent ...

Is private health insurance equal?

However, not all basic private health insurance policies are equal – or indeed eligible. Be sure to shop around and do your sums to ensure the policy you choose is appropriate and will leave you in a better financial position than it would to pay the MLS at the end of the financial year.

Can you get a partial exemption from MLS?

But before you rush out and get yourself an eligible basic health insurance policy before the end of the financial year to avoid paying the MLS, take note: If you’ve held hospital cover for only part of the tax year, then you’ll only have partial exemption from the MLS.