Medicare supplement plans with foreign travel coverage generally take effect the first of the month after you apply, but the insurance company can activate the plan on a date that coincides with the day you leave the country.

Full Answer

Does Medicare supplement insurance cover international travel?

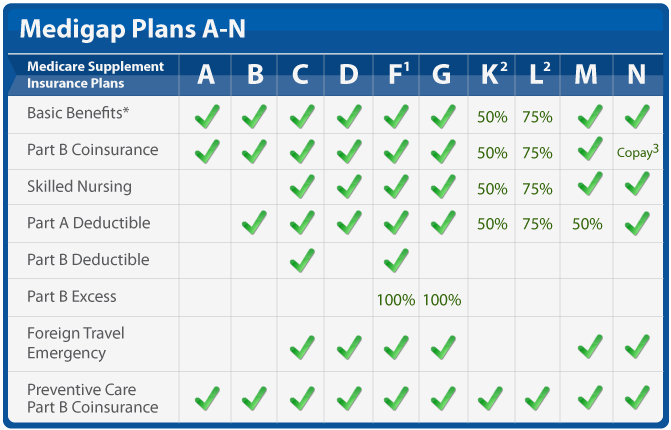

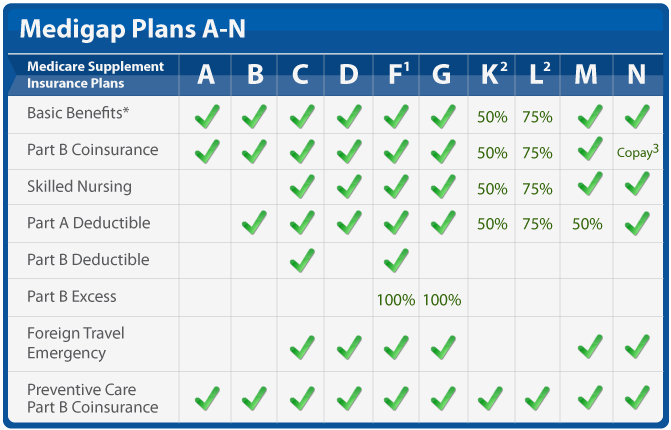

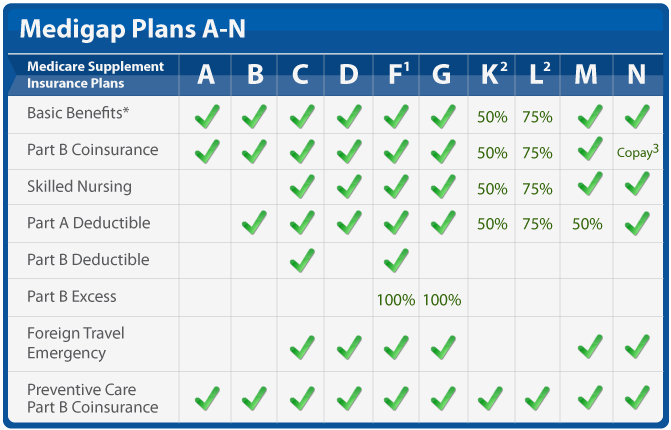

Medicare Supplement Insurance (Medigap) Plans C, D, F, G, M and N provide foreign travel emergency health care coverage. Learn more about Medigap plan options for overseas coverage. Original Medicare (Part A and Part B) won’t typically cover health care or medical supplies you receive in a foreign country.

How do insurers decide which Medicare supplement plans to accept?

Insurance companies decide which Medicare supplement policies to accept while complying with state and federal regulations. They must provide Medicare supplement plans C and F if they offer at least one other Medicare supplement plan. It’s a good idea to know what each Medicare supplement plan covers.

When does my Medicare supplement travel insurance take effect?

Medicare supplement plans with foreign travel coverage generally take effect the first of the month after you apply, but the insurance company can activate the plan on a date that coincides with the day you leave the country.

Can I get Medicare supplement insurance if I retire in another country?

If you decide to retire in a foreign country, you will not be eligible for Medicare supplement insurance. You will have to buy insurance from an agent or exchange in that country.

What states does Medicare cover?

Original Medicare typically only covers you in the 50 U.S. states, the District of Columbia and the following territories: 1 Puerto Rico 2 U.S. Virgin Islands 3 Guam 4 American Samoa 5 Northern Mariana Islands

What is included in a Medigap plan?

Medigap Plans with Foreign Benefits. Each of the 6 Medigap plans currently available that include coverage of foreign emergency care also include the following coverage: Medicare Part A coinsurance and hospital costs. Medicare Part B coinsurance and copayments. First three pints of blood needed for a blood transfusion.

Does Medicare cover medical services on cruise ships?

You experience a medical emergency while traveling the most direct route between Alaska and another state without unreasonable delay, and the closest hospital to your proximity is located in Canada. Medicare may also cover medically necessary services on a cruise ship.

Does Medicare cover travel insurance?

Certain Medicare Supplement Insurance (Medigap) plans do offer some coverage for foreign travel emergency health care. Medigap Plans C, D, F, G, M and N each provide foreign travel emergency care coverage, which you should keep in mind as you travel overseas.

How long can you go without health insurance if you don't pay for Part B?

If you fail to pay for Part B while abroad, when you move back to the U.S. you may go months without health coverage. This is because you may have to wait until the General Enrollment Period (GEP), which runs January 1 through March 31 each year, with coverage starting July 1.

Does Medicare cover medical expenses when you live abroad?

Although Medicare does not typically cover medical costs you receive when you live abroad, you still need to choose whether to enroll in Medicare when you become eligible or to turn down enrollment. This requires considering: Whether you plan to return to the U.S.

Can you go without Medicare if you are abroad?

If you fail to pay for Part B while abroad, when you move back to the U.S. you may go months without health coverage.

How much is the lifetime maximum for medical insurance?

There is a lifetime maximum benefit of $50,000, which means if you end up with medical bills over $50,000, you will be responsible for all bills over that amount. Finally, you are responsible for the first $250. After that, the plan’s foreign travel coverage will kick in.

How much is coinsurance for a lifetime?

There is also a $250 deductible to be aware of. If you're concerned about the coinsurance, lifetime maximum benefit of $50,000, or the deductible, ask your travel agent about your options.

Does Medicare cover medical expenses on a ship?

In some cases, Medicare may cover medically necessary health care services you get on board a ship within the territorial waters adjoining the land areas of the U.S. Medicare won't pay for health care services you get when a ship is more than 6 hours away from a U.S. port.

Does Medicare Advantage have the same coverage as Original Medicare?

By law, Medicare Advantage plans must provide at least the same coverage as Original Medicare, so you would be covered in the rare circumstances we mentioned at the beginning of this article. However, beyond that, your coverage (or lack of coverage) will be determined by your individual plan.

Does Medicare cover travel when you are out of the country?

Original Medicare (Parts A and B) does not cover you when you are out of the country, but you do have options for foreign travel coverage.

Does Medicare Supplement Plan G cover international travel?

Medicare Supplement Plan G helps cover international travel, as do plans C, D, F, M, and N. However, Plan G is our most popular plan, which is why so many clients ask about Plan G specifically. Plan G will pay 80% of medically necessary emergency care when you're traveling internationally. You'll pay the remaining 20% coinsurance.

What services does Medicare pay for?

Medicare will only pay for Medicare-covered services received in a foreign hospital in the 3 specific situations mentioned above. These Medicare-covered services include: 1 Part A – Inpatient hospital care 2 Part B – Emergency and non-emergency ambulance and doctor services rendered immediately before and during your covered inpatient hospital stay in a foreign hospital. However, if you get an ambulance and doctor services outside the hospital after your covered hospital stay ends, Medicare generally will not pay for those services. Also, if Medicare doesn’t cover your hospital stay, Medicare will not pay for the services rendered in a foreign hospital either. For example, Medicare will not cover health care services you get in Canada after your covered Canadian inpatient hospital stay is over.

Does Part D cover prescriptions?

Part D plans will not cover any prescription drugs that purchased outside of the U.S. You must live in the U.S. in order to qualify for Part D. You must also live in your Part D plan’s area in order to receive service.

Does Medicare cover foreign travel?

Medicare Part D does not cover the cost of drugs purchased outside the U.S. Some Medigap policies offer the benefit of foreign travel emergency benefits. Because of this, will pay 80% of the bill once the yearly deductible has been met. For expats, the easiest way to get Medicare coverage is to come back to the U.S. for medical services.

Is Medicare Part B free?

However, Medicare Part B is not free; it comes with a monthly premium. Unless you continued to pay Part B premiums while you were abroad, you will not be covered by Part B upon your return. In addition, you will face an enrollment penalty in which premiums increase by 10% for each year you were not enrolled in Part B.

Does Medicare cover expats?

If an expat chooses to return back to the U.S., Medicare Part A does cover them. This covers inpatient hospital care. Part A is “free” (citizens pay Social Security tax through their working life to receive this benefit during retirement). Anyone over 65+ who is eligible for Social Security can benefit from Part A.

Is a foreign hospital closer to home?

You live in the U.S., and the foreign hospital is closer to your home than the nearest U.S. hospital that can treat your illness or injury, regardless of whether it’s a medical emergency.

Does Medicare cover Canadian hospital stays?

For example, Medicare will not cover health care services you get in Canada after your covered Canadian inpatient hospital stay is over. Remember, if you are only enrolled in Part A (and not Part B), Medicare will only pay for Part A Medicare-covered services in a foreign hospital. You will not have Part B coverage in a foreign hospital.

What is Medicare Supplement Insurance?

Your Medicare supplement insurance application determines your eligibility for open enrollment or guaranteed issue rights. When you complete an application for Medicare supplement insurance with foreign travel coverage, fill out the form carefully and thoroughly. If an insurance agent fills out an application on your behalf, ...

When does Medicare take effect?

Medicare supplement plans with foreign travel coverage generally take effect the first of the month after you apply, but the insurance company can activate the plan on a date that coincides with the day you leave the country. If your insurance company is unwilling to begin your Medicare supplement plan on a specific date, ...

What is secondary travel insurance?

Secondary travel medical insurance guarantees your foreign travel medical bills are paid after your Medicare supplement plan, or any other foreign travel coverage you have pays its share.

What is primary travel medical insurance?

Primary travel medical coverage pays foreign travel medical claims up to your policy limit so you can use the primary travel medical insurance for a claim amount that would exceed your Medicare supplement plan limit. Secondary travel medical insurance: A secondary policy is also available to purchase in combination with a Medicare supplement plan.

What is the difference between Medicare Supplement Plan F and Supplement Plan N?

Medicare supplement plan F is a high-deductible option for foreign travel , and you are required to pay Medicare-covered costs up to $2,240 before your supplemental plan pays anything . Medicare supplement plan N provides full Part B coinsurance coverage, except copayments up to $20 for some office visits and up to $50 copayments for emergency room ...

What is the maximum amount of Medicare coverage for a lifetime?

When you aren’t traveling outside of the U.S., this insurance can be used in conjunction with Medicare Part A (hospital insurance) and Part B (medical insurance) and have a lifetime coverage limit of $50,000. Source: Getty.

Which states have foreign travel insurance?

Massachusetts: You can obtain foreign travel emergency coverage if you purchase the state’s Supplement 1 plan. Minnesota: The Extended Basic plan offers up to 80 percent of medical coverage if you are in a foreign country and 80 percent of international emergency care. Wisconsin: The core Medicare supplement plan does not include foreign travel ...