Do Medicare patients get treated differently?

Outpatient services are charged differently, with the patient typically paying 20% of the Medicare-approved amount for each service.Mar 23, 2021

What are the advantages of having Medicare?

Pros of MedicareMedicare Provides Coverage to Millions. ... Medicare Costs Very Little Every Month. ... Medicare Advantage Plans Offer Additional Coverage. ... Medicare Has Led to Prescription Innovations. ... Medicare Has Resulted in Increased Medical Standards. ... Medicare Costs a Huge Amount to Administrate.More items...•Sep 10, 2021

Do private insurers generally pay much less than Medicare?

Private health care insurers pay at least 25% more for the same hospital services than Medicare, according to a new study from the National Bureau of Economic Research (NBER).Aug 11, 2020

How do Medicare physician fees compare with private payers?

Under the new fee schedule, Medicare physician fees are 76 percent of private fees. Consistent with the intent of payment reform, Medicare physician fees more closely approximate private fees for visits (93 percent) than for surgery (51 percent) and in rural areas as compared with large metropolitan areas.

What are the disadvantages of a Medicare?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What are the disadvantages of going to a Medicare Advantage Plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Do doctors lose money on Medicare patients?

Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

How is Medicare reimbursed?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

Which of the following expenses would be paid by Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services.Sep 11, 2014

How do hospitals negotiate prices with Medicare?

Medicare sets reimbursement rates for hospitals every year using the same formula that multiplies a base rate by a case mix adjustment and a hospital type adjustment then adding the outlier payments. Private payers, on the other hand, must negotiate hospital prices with providers, and the process is quite complex.May 13, 2019

Does Medicare pay more than billed charges?

Consequently, the billed charges (the prices that a provider sets for its services) generally do not affect the current Medicare prospective payment amounts. Billed charges generally exceed the amount that Medicare pays the provider.

Do commercial payers pay more than Medicare?

We subsequently compare, on average, the prices paid for professional services with what Medicare would have paid for the same services per the Physician Fee Schedule (Medicare rates). We find that commercial prices for professional services were, on average, 122% of Medicare rates nationally in 2017.Aug 13, 2020

What is the difference between Medicare and private insurance?

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents. Not only does Medicare provide many coverage combinations to choose from, ...

How much is Medicare Part A deductible?

The Medicare Part A deductible is $1,484. The Medicare Part B deductible is $203. 4. On average, an employer insurance plan will have an annual deductible of $1,400. 6. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

What is Medicare Supplement?

Medicare Supplement plans are designed to cover the out-of-pocket costs left over from Original Medicare. For example, these plans can cover coinsurance amounts, copays, or deductibles. Original Medicare + Medicare Supplement + Prescription Drug.

How much is the deductible for bronze health insurance?

It is best to use your plan information to make comparisons. On average, a bronze-level health insurance plan will have an annual medical deductible of $1,730. 7. This is a national average and may not reflect what you actually pay in premiums. It is best to use your plan information to make comparisons.

Does Medicare negotiate with private insurance companies?

Medicare has leverage to negotiate with healthcare providers as a national program, while private health insurance plans negotiate as individual companies. This negotiation lowers the amount that a healthcare provider can charge you. You’ll see these negotiated prices reflected in lower copays and coinsurance charges.

Does Medicare Advantage include dental?

In addition to Part A and Part B coverage, many Medicare Advantage plans include prescription drug plan coverage. These plans also often include dental, vision, and hearing coverage. Because these plans have differing networks and familiar coverage, they may be the most similar to private health insurance plans.

How does Medicare work?

Medicare works with private insurance companies to provide Medicare benefits. The types of Medicare coverage you can get from Medicare-approved private insurance companies include: 1 Medicare Part D prescription drug coverage 2 Medicare Supplement (Medigap) insurance to help cover out-of-pocket Medicare costs, such as deductibles, copayments, and coinsurance 3 Medicare Advantage plans, which include your Part A (hospital) and Part B (medical) insurance in one convenient plan. Medicare Advantage plans also might include added benefits, like prescription drugs, routine vision, routine hearing, and routine dental coverage.

What is Medicare Supplement?

Medicare Supplement ( Medigap) insurance to help cover out-of-pocket Medicare costs, such as deductibles , copayments, and coinsurance. Medicare Advantage plans, which include your Part A (hospital) and Part B (medical) insurance in one convenient plan.

Is Medicare Part A the same as Medicare Part B?

The Medicare Part A and Medicare Part B premiums are the same regardless of your location in the USA. If you get any type of Medicare coverage from a private insurance company, such as Medicare prescription drug coverage, a Medicare Supplement plan, or a Medicare Advantage plan, these premiums may vary from location to location.

Is Medicare a private insurance?

Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

Does Medicare Supplement Plan K have out-of-pocket limits?

Two Medicare Supplement plans, Medicare Supplement Plan K and Plan L, have out-of-pocket limits. Other Medicare Supplement plans may still help you cover Medicare’s out-of-pocket costs. All Medicare Advantage plans are required to have an out-of-pocket limit, protecting you from devastating financial responsibility if you have a serious health ...

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

Does Medicare cover physical therapy?

Private insurance and original Medicare plans provide varying benefits and coverage. Most of both types of plans cover hospital care and outpatient medical services, including doctor’s visits, physical therapy, and diagnostic tests. However, Medicare may have gaps in coverage that private insurers cover.

Does Medicare cover copays?

A Medigap policy cover costs such as deductibles and copays, but the monthly premium for Medigap policies varies. Medicare premiums only cover one person. However, private insurers may extend coverage to other family members, such as dependents. Other factors affecting the cost of private insurance include:

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

What is private insurance?

Private insurance plans are responsible for covering at least your preventative healthcare visits. If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

Which has the lowest deductible?

Platinum plans cover 90 percent of your healthcare costs. Platinum plans have the lowest deductible, so your insurance often pays out very quickly, but they have the highest monthly premium.

What is the difference between bronze and silver?

Bronze plans have the highest deductible of all the plans but the lowest monthly premium. Silver plans cover 70 percent of your healthcare costs . Silver plans generally have a lower deductible than bronze plans but with a moderate monthly premium.

Do all health insurance plans have a premium?

Almost all health insurance plans, private or otherwise, have costs such a premium, deductible, copayments, and coinsurance. We’ll take a look at what these are for each type of plan.

Does Medicare Advantage have a monthly premium?

Part C. In addition to paying Part A and Part B costs, a Medicare Advantage plan may also have its own monthly premium, yearly deductible, drug deductible, coinsurance, and copayments. These amounts vary based on the plan you choose. Part D.

How does Medicare work?

Examples of how coordination of benefits works with Medicare include: 1 Medicare recipients who have retiree insurance from a former employer or a spouse’s former employer will have their claims paid by Medicare first and their retiree insurance carrier second. 2 Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second. 3 Medicare recipients who are under 65 years of age and disabled with health insurance coverage through employers with less than 100 employees will have their claims paid by Medicare first and by their employer’s health plan second.

What is Medicare coordination?

Coordination of Benefits with Private Insurance Plan. When a Medicare recipient had private health insurance not related to Medicare, Medicare benefits must be coordinated with that plan provider in order to establish which plan is the primary or secondary payer.

How old do you have to be to get Medicare?

Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second.

Does Medigap cover foreign travel?

For certain plans, Medigap adds a few new benefits, such as foreign travel coverage. The monthly premium for one of these plans is separate from the premium paid for Original Medicare. In order to make identifying Medigap plans easier, they follow a letter-name standardization in most states.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. or a. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.

What percentage of Americans have private health insurance?

Others include Medicaid and Veteran’s Affairs benefits. According to a 2020 report from the U.S. Census Bureau, 68 percent of Americans have some form of private health insurance. Only 34.1 percent have public health insurance, including 18.1 percent who are enrolled in Medicare. In certain cases, you can use private health insurance ...

What is health insurance?

Health insurance covers much of the cost of the various medical expenses you’ll have during your life. Generally speaking, there are two basic types of health insurance: Private. These health insurance plans are offered by private companies.

What age do you have to be to get Medicare?

are age 65 or older. have a qualifying disability. receive a diagnosis of ESRD or ALS. How Medicare works with your group plan’s coverage depends on your particular situation, such as: If you’re age 65 or older. In companies with 20 or more employees, your group health plan pays first.

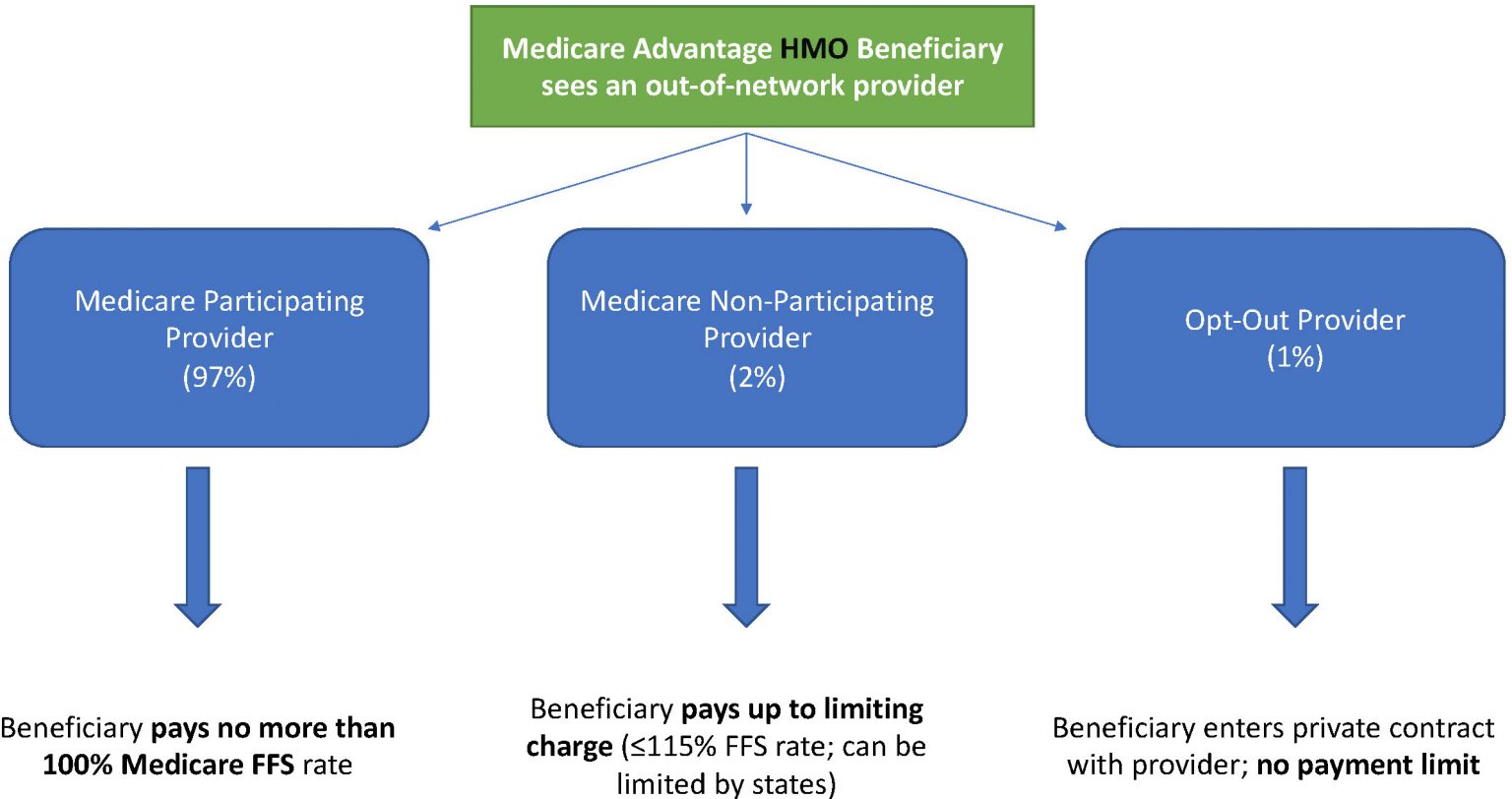

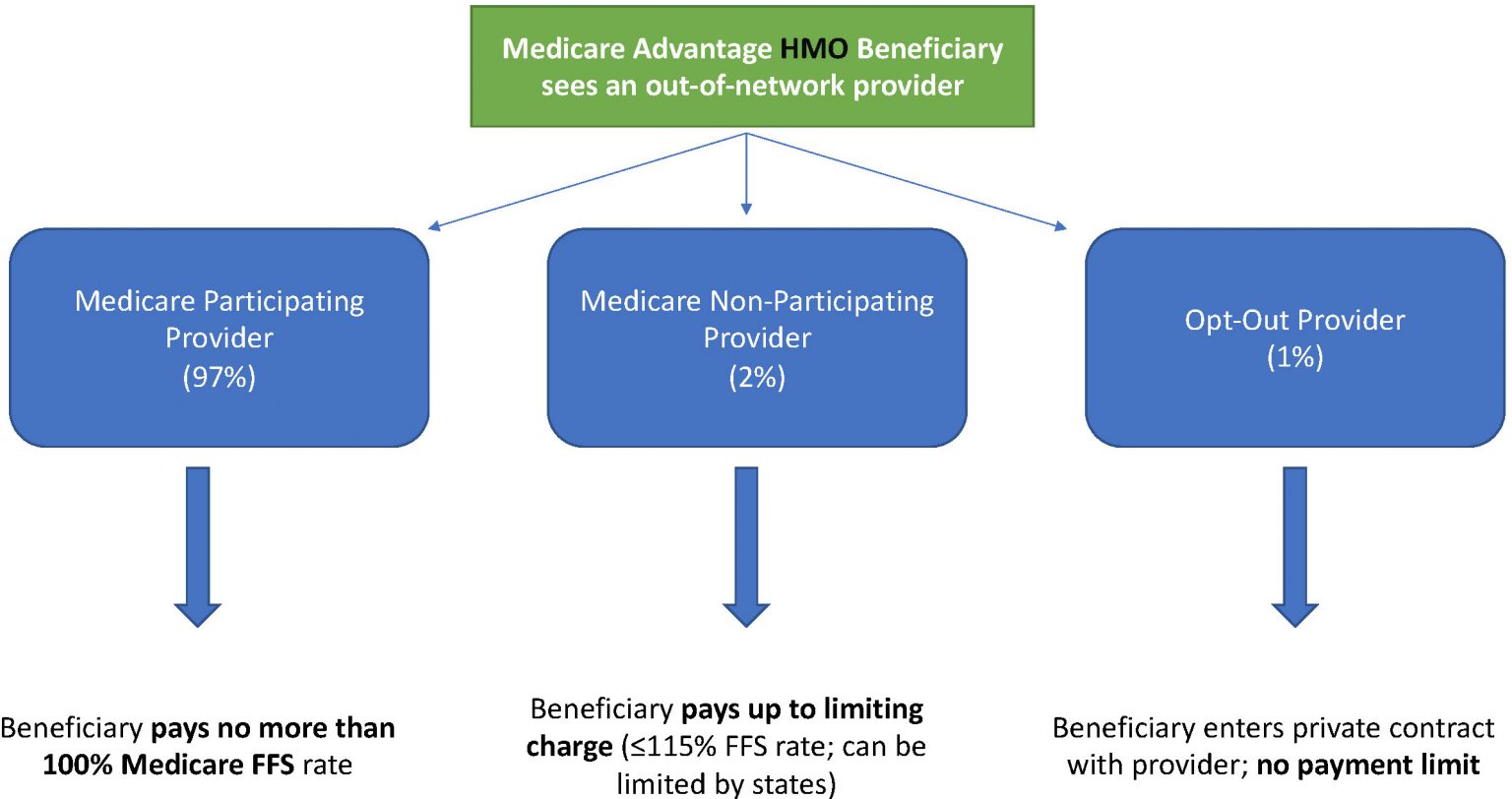

Is Medicare covered by HMO?

If this is the case with your group health plan and it pays first, you may not be covered by Medicare if you choose to use an out-of- network provider.

What is the number to contact for Cobra?

United States Department of Labor. If your employment has ended, you can contact the Department of Labor to learn more about COBRA coverage at 866-487-2365.

Does tricare pay for Medicare?

TRICARE pays first for any services that are covered by Medicare. TRICARE will also cover Medicare deductibles and coinsurance costs, as well as any services covered by TRICARE but not Medicare. If you’re not on active duty. Medicare pays first. TRICARE can pay second if you have TRICARE for Life coverage.

Is Medicare the primary or secondary payer?

In some cases, Medicare may be the primary payer — in others, it may be the secondary payer.

What percentage of Medicare beneficiaries have supplemental coverage?

But here’s the thing: most Medicare enrollees don’t go with the barebones coverage. Of Original Medicare beneficiaries, 18 percent have some sort of supplemental coverage (generally Medigap, employer-sponsored insurance, or Medicaid), according to a Kaiser Family Foundation analysis.

How much does Medicare cost in 2020?

If you want to add supplemental coverage, the average Part D Prescription Drug Plan costs about $42 per month in 2020.

Does Medicare Advantage cover vision?

Medicare Advantage plans can also include dental and vision coverage, which isn’t covered under Original Medicare. But Medicare Advantage plans have the same sort of provider network restrictions as other commercial health plans. This post will walk you through the pros and cons of Original Medicare versus Medicare Advantage for various scenarios.