The Medicare secondary payment is determined by a series of calculations and comparisons. The primary insurer’s claim processing details on their explanation of benefits (EOB) is needed to determine the secondary payment amount. Three calculations are made per procedure.

How much does Medicare pay as a secondary payer?

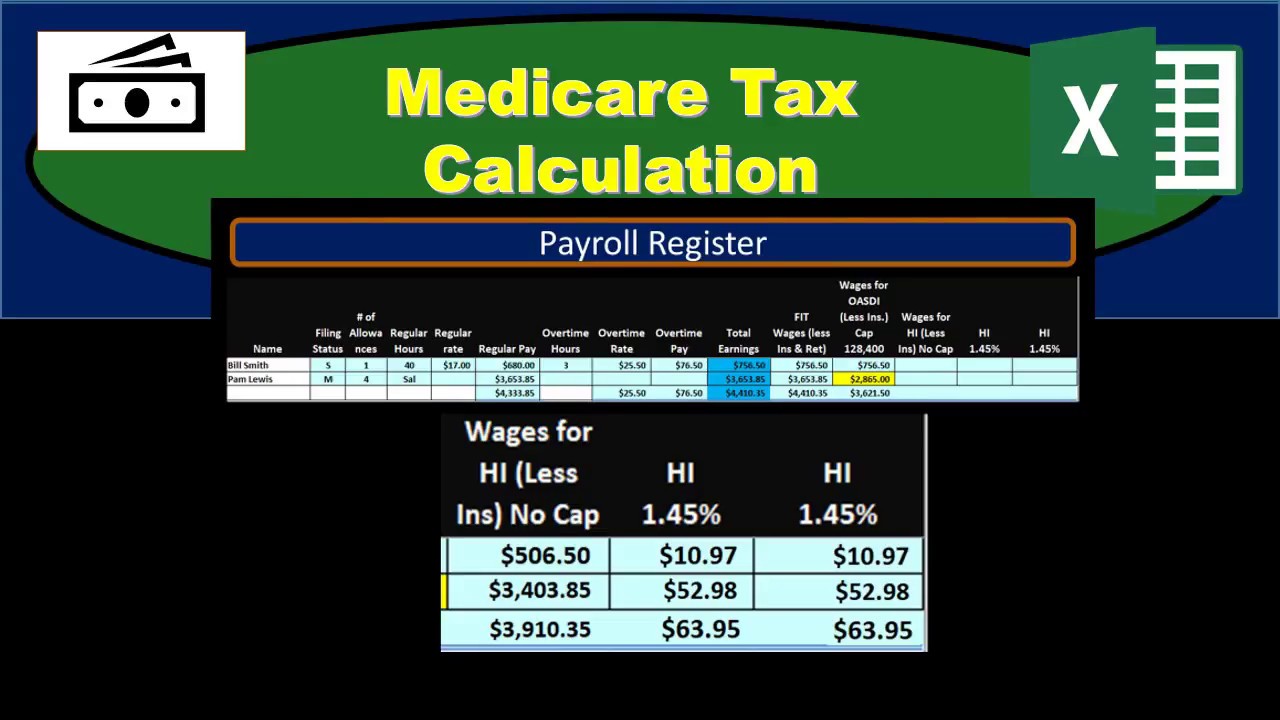

How to Determine the Medicare Secondary Payment Amounts Actual charge by physician minus primary payer’s payment $175 - $120 = $55 Usual Medicare payment determination 80% x $125 = $100 Highest allowed amount minus amount paid by primary $150 - $120 = $30

How do you calculate Medicare payment to providers?

May 23, 2018 · Medicare Secondary Payer (MSP) Calculator 1. The lower the billed amount or the OTAF amount minus the other plan payment. Calculate 1 table Billed Amount The... 3. The higher of the Medicare or other plan allowed charge minus the other plan payment.

How do you calculate the secondary payment?

Dec 01, 2021 · Medicare pays Primary, GHP pays secondary Individual is age 65 or older, is covered by a GHP through current employment or spouse’s current employment AND the employer has 20 or more employees (or at least one employer is a multi-employer group that employs 20 or more individuals): GHP pays Primary, Medicare pays secondary

What is the secondary payment for Medicare Part D?

Jan 13, 2022 · The Medicare secondary payment is determined by a series of calculations and comparisons. The primary insurer’s claim processing details on their explanation of benefits (EOB) is needed to determine the secondary payment amount. Three calculations are made per procedure. The lowest of the three is the secondary payment. Calculation 1

How Does Medicare pay as secondary payer?

If the employer has 100 or more employees, then your family member's group health plan pays first, and Medicare pays second. If the employer has less than 100 employees, but is part of a multi-employer or multiple employer group health plan, your family member's group health plan pays first and Medicare pays second.

How does Medicare process secondary claims?

The primary insurer must process the claim in accordance with the coverage provisions of its contract. If, after processing the claim, the primary insurer does not pay in full for the services, submit a claim via paper or electronically, to Medicare for consideration of secondary benefits.Feb 10, 2021

What is the standardized software for calculating secondary payments?

Medicare Secondary Payer (MSP) Calculator.May 23, 2018

How are Medicare payments calculated?

Medicare primary payment is $375 × 80% = $300.Primary allowed of $500 is the higher allowed amount.Primary allowed minus primary paid is $500 - $400 = $100.The lower of Step 1 or 3 is $100. ( Medicare will pay $100)Nov 19, 2021

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

How do you know if Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

What is Medicare Bcrc?

Benefits Coordination & Recovery Center (BCRC), formerly known as COBC. The Benefits Coordination & Recovery Center (BCRC) consolidates the activities that support the collection, management, and reporting of other insurance coverage for Medicare beneficiaries.

What are the MSP codes?

Medicare Secondary Payer (MSP) Occurrence CodesOccurrence CodeReport with Date of01Accident - Medical Coverage02Accident - No-fault03Accident - Liability04Accident - Employment-related6 more rows•Feb 15, 2016

How is OTAF amount calculated?

This may have to be manually calculated, by taking the billed amount minus the discounts/adjustments to calculate the OTAF. Example: When the allowable billed amount is $100, the primary insurance pays $45, the provider OTAF amount is $50, and then Medicare would pay $5 as secondary.

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $222,000 but less than or equal to $276,000$297.00More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.9012 more rows•Dec 6, 2021

How does Medicare Part B reimbursement work?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.Dec 3, 2021

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

How old do you have to be to be covered by a group health plan?

Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization that shares a plan with other employers with more than 20 employees between them.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

Is ESRD covered by COBRA?

Diagnosed with End-Stage Renal Disease (ESRD) and covered by a group health plan or COBRA plan; Medicare becomes the primary payer after a 30-day coordination period. Receiving coverage through a No-Fault or Liability Insurance plan for care related to the accident or circumstances involving that coverage claim.

What happens if you don't accept Medicare Part B deductible?

If there is no "obligated to accept" amount from the primary insurance the provider cannot collect more than the higher amount of either the Medicare physician fee schedule or the allowed amount of the primary payer when the beneficiary's Medicare Part B deductible has been met (see examples 1 and 2).

What is MSP payment?

MSP Payment Calculation Examples. The Medicare Secondary Payer (MSP) process may pay secondary benefits when a physician, supplier, or beneficiary submits a claim to the beneficiary's primary insurance and the primary insurance does not pay the entire charge. Medicare will not make a secondary payment if the physician/supplier accepts, ...

What is an allowed amount?

Allowed Amount (SA): The allowed amount is the amount the primary insurance company allowed for the submitted charges. This may also be referred to on an EOB as eligible charges. This amount should equal the OTAF amount.

What can a provider collect when a provider accepts assignment?

What Can the Provider Collect When a Provider Accepts Assignment? Providers cannot collect more than the "obligated to accept" amount of the primary insurance if the physician/supplier accepts, or is obligated to accept, the primary insurance payment as full payment.

Is Medicare a supplemental insurance?

Important: Medicare is not a supplemental insurance, even when secondary, and Medicare's allowable is the deciding factor when determining the patient's liability. The payment information received from the primary insurer will determine the amount Medicare will pay as secondary payer.

What is the Medicare secondary payment?

The Medicare payment is $30. (e) Services reimbursed on a basis other than fee schedule, reasonable charge, or monthly capitation rate. The Medicare secondary payment is the lowest of the following: (1) The gross amount payable by Medicare (that is, the amount payable without considering the effect of the Medicare deductible and coinsurance or ...

How much was Medicare deductible in 1987?

The provider's charges for Medicare -covered services were $4,000 and the gross amount payable was $3,500.

What is the lowest Medicare payment?

The Medicare secondary payment is the lowest of the following: (1) The actual charge by the supplier (or the amount the supplier is obligated to accept as payment in full if that is less than the charges) minus the amount paid by the primary payer . (2) The amount that Medicare would pay if the services were not covered by a primary payer .

How much is the secondary payment for Medicare?

The Medicare secondary payment is $100. When Medicare is the secondary payer, the combined payment made by the primary payer and Medicare on behalf of the beneficiary is $3,000. The beneficiary has no liability for Medicare -covered services since the primary payment satisfied the $520 deductible.

What does "obligated to accept" mean?

Obligated. to AcceptThe amount the provider or supplier is either obligated to accept, or voluntarily accepts, as full payment, a primary payment that is less than its chargesObligated to Accept Field (OTAF): There is not a specific column or area on an EOB that indicates the OTAF amount.

What is the primary allowed amount?

AllowedThe amount the primary insurance allowedThe primary allowed amount is the amount the primary insurance company allowed for the submitted charges. This may also be referred to on an EOB as eligible charges. This amount should equal the OTAF amount. Primary.

What is CDT used for?

Use of CDT is limited to use in programs administered by Centers for Medicare & Medicaid Services (CMS). You agree to take all necessary steps to ensure that your employees and agents abide by the terms of this agreement. You acknowledge that the ADA holds all copyright, trademark and other rights in CDT.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

What is included in W-2?

The annual W-2 Form that U.S. employees receive includes not only year-to-date earnings but also taxes paid toward Social Security and Medicare. Forty credits are required to be eligible for benefits. The requirements may be modified for young people claiming disability or survivor benefits.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.