How do Medicare and the VA work together?

They do not work together, but rather, alongside one another. While the VA’s plan provides veterans with benefits that Medicare does not offer, such as dental coverage and long-term nursing care, your medical costs are only covered if you receive care at a VA facility, or at a non-VA facility with prior authorization from a VA doctor.

What are the benefits of Medicare and VA benefits?

Having both Medicare and VA benefits greatly widens your coverage. VA coverage pays for medical services if you go to a VA hospital or doctor. If you need to go elsehwere, you'll probably end up having to pay the full cost yourself, even in emergencies. With Medicare, you're covered if you need to go to a non-VA provider.

What happens if you have both Medicare and VA health insurance?

If federal funding for VA health care drops or doesn't keep pace with costs, some vets in the lower priority groups may lose VA coverage entirely. Having both Medicare and VA benefits greatly widens your coverage. VA coverage pays for medical services if you go to a VA hospital or doctor.

How does the VA prescription drug plan compare to Medicare?

The VA’s prescription drug plan typically offers a more generous benefits package than Medicare Part D, the program's prescription drug benefit. The VA covers the cost of drugs that you get at VA pharmacies, while Part D covers those that you get at in-network pharmacies.

How do VA benefits and Medicare work together?

You can have both Medicare and Veterans Affairs (VA) benefits, but Medicare and VA benefits do not work together. Medicare does not pay for any care that you receive at a VA facility. In order for your VA coverage to cover your care, you must generally receive health care services at a VA facility.

Do I need a Medicare supplement if I have VA benefits?

If you have VA benefits, you do not have to enroll in Medicare in order to keep your VA benefits. That being said, the Veterans Administration actually recommends veterans enroll in Medicare when they become eligible.

Does VA follow Medicare guidelines?

If you have other forms of health care coverage (like a private insurance plan, Medicare, Medicaid, or TRICARE), you can use VA health care benefits along with these plans.

Is Medicare secondary to VA benefits?

Keep in mind, Medicare does not pay for care received at a VA facility. Likewise, VA benefits do not pay secondary to Medicare. This means VA benefits will not cover any Medicare cost-sharing expenses.

Is Medicare primary or secondary to VA?

The VA pays for VA-authorized services or items . For active-duty military enrolled in Medicare, TRICARE pays first for Medicare- covered services or items, and Medicare pays second . For inactive-duty military enrolled in Medicare, Medicare pays first and TRICARE may pay second .

Do veterans get free healthcare for life?

You can get free VA health care for any illness or injury that we determine is related to your military service (called “service connected”). We also provide certain other services for free.

What happens to my VA disability when I turn 65?

Even after veterans reach full retirement age, VA's disability payments continue at the same level. By contrast, the income that people receive after they retire (from Social Security or private pensions) usually is less than their earnings from wages and salary before retirement.

What disqualifies you from VA benefits?

If you've received an other than honorable, bad conduct, or dishonorable discharge, you may not be eligible for VA benefits.

What is the best Medicare plan for military retirees?

Military retirees with TRICARE For Life coverage may consider the AARP Medicare Advantage Patriot Plan. This plan provides the freedom to visit doctors and hospitals in our network for a $0 monthly premium and additional benefits that may include: Monthly credits applied to your Medicare Part B premium.

Will I lose my VA disability if I go to a nursing home?

The VA may pay all or part of the nursing home costs for disabled and elderly veterans. The Department of Veterans Affairs (VA) provides both short-term and long-term care in nursing homes to veterans who aren't sick enough to be in the hospital but are too disabled or elderly to take care of themselves.

Why do military retirees have to pay for Medicare?

By law, TRICARE Prime and TRICARE Select end at age 65. This requires service retirees to enroll in Medicare at age 65 to maintain a major health care plan and our TRICARE benefits. TRICARE For Life (TFL) acts as our Medicare supplement, and TFL allows us to continue using the TRICARE pharmacy.

What happens if you don't have Part B insurance?

If you are not already signed up for Part B (and don't have insurance through an employer or other source), you'll likely have to wait a while for coverage, and you could be liable for late penalties that are permanently added to your Part B premiums.

Can Medicare cover non VA?

With Medicare, you're covered if you need to go to a non-VA provider. This is an especially important point to consider if you live some distance from the nearest VA facility. You may be subject to penalties in the future.

Is VA coverage less expensive than Medicare?

VA coverage for prescriptions is typically less expensive than Medicare Part D drug plans, and you won’t be hit with late penalties if you lose VA coverage in the future, provided that you sign up with a Part D plan within two months of that coverage ending.

Is Medicare and VA separate?

The Medicare and VA systems are entirely separate, with no coordination of benefits between them. You would use your VA identity card at VA facilities and your Medicare card anywhere else. You'll find more information at the VA website on how VA care works with other insurance . Return to Medicare Q&A Tool main page >>.

Is VA health coverage the same for everyone?

VA health coverage isn’t set in stone and isn’t the same for everyone. The VA assigns enrollees to different priority levels according to various factors, such as income and whether they have any medical condition that derives from their military service.

Does Medicare cover VA?

Having both Medicare and VA benefits greatly widens your coverage. VA coverage pays for medical services if you go to a VA hospital or doctor. If you need to go elsehwere, you'll probably end up having to pay the full cost yourself, even in emergencies. With Medicare, you're covered if you need to go to a non-VA provider.

Why is it important to understand VA and Medicare?

Because each offers different benefits, having both at your disposal will broaden your health insurance coverage options. If you’re a veteran, it’s important to understand how VA benefits and Medicare work in tandem before you make the choice.

How long do you have to enroll in Medicare if you lose your VA benefits?

If you lose your VA benefits, you’ll have 63 days to enroll in a Part D plan before that penalty kicks in.

What is Medicare Supplement Insurance?

A veteran may choose to supplement their Medicare coverage with a privately administered Medigap Insurance plan (also called Medicare Supplement Insurance), which helps cover the out-of-pocket costs associated with Medicare, such as deductibles, copayments, coinsurance and other fees.

How much is the VA deductible for 2021?

In addition to the 2021 Medicare Part A deductible of $1,484 per benefit period, coinsurance for hospital stays lasting longer than 60 days starts at $371 per day in 2021. Moreover, after meeting your 2021 Part B deductible ...

What is the priority number for veterans?

All veterans who qualify for VA health benefits are assigned to a priority group numbered 1 through 8, with 1 being the highest and 8 being the lowest. Your priority number, which depends on factors such as your income level and if you have a service-connected disability, determines everything from copayments to out-of-pocket costs to ...

What happens if you don't enroll in Part B?

If you don’t enroll in Part B when you’re first eligible and later change your mind, you will likely have to pay an ongoing late-enrollment Part B premium penalty of 10% for every 12-month period that you didn’t have it.

How long do you have to serve in the military to get VA benefits?

The minimum duty requirements for VA benefits call for 24 months of continuous service, which also applies to members of the National Guard and the Reserves. But because there are many exceptions ...

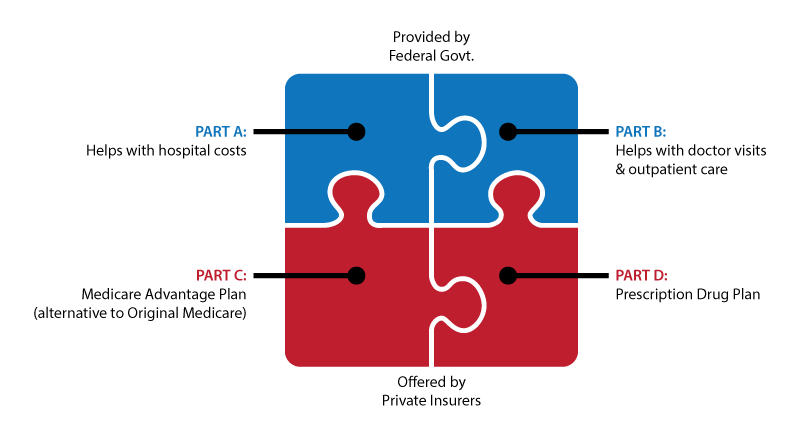

What is Medicare Advantage?

A Medicare Advantage plan, for example, usually allows affordable and convenient access to a plan network of medical service providers that includes hospitals, doctors, and therapists. In some cases, MA plans also include Part D prescription coverage that helps control drug costs.

Do both Medicare and the VA pay for the same services?

Typically, both health plans will not pay for the same services. Additionally, Medicare.gov says that veterans are also free to join a Part D drug program, but the VA and Medicare typically will not pay for the same prescriptions. Retired veterans actually have more choices than most other Medicare beneficiaries.

Does the VFW have Medicare?

In fact, the VFW organization even recommends a Medicare Advantage plan on their website, but there is no one-size-fits-all senior health insurance option. Veterans are free to shop around for the best plan for their needs. Medicare supplements work differently, and they supplement Medicare Part A and B to fill in coverage gaps for things ...

Do Medicare Supplements work?

Medicare supplements work differently, and they supplement Medicare Part A and B to fill in coverage gaps for things that Part A and B do not cover. Understanding Medicare options. Most retired Americans do not have to pay a Part A premium and do have to pay a premium for Part B. MA plans may have little or no additional premium, ...

Does Medicare pay for copay?

You simply present your required health card, pay your copay (if any), and receive services. However, you might be interested in the way that Medicare.gov tells us that the VA and Medicare coordinate coverage: If you receive Medicare-covered services, Medicare pays. If you receive VA authorized services, the VA pays.

Do veterans get health insurance?

After serving our country in a branch of the US military, many veterans are entitled to health benefits through the VA. However, VA doctors and hospitals are not always convenient options.

Should veterans decline Medicare?

In fact, according to a press release from Blue Cross, veterans should not decline Medicare benefits just because they get VA health benefits. Their reasoning includes: The VA actually recommends that veterans enroll in both Part A and Part B of Medicare because they are entitled to these benefits and they may complement VA benefits.

Does VA health care meet the ACA?

If I’m signed up for the VA health care program, does that mean I meet the requirements to have health care under the Affordable Care Act (ACA)? Yes. Being signed up for VA health care meets your Affordable Care Act health coverage requirement of having “minimum essential health coverage.”.

Does VA pay deductible?

Your private insurer may apply your VA health care charges toward your annual deductible (the amount of money you pay toward your care each year before your insurance starts paying for care).

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.

Does Medicare pay for group health insurance?

Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You'll have to pay any costs Medicare or the group health plan doesn't cover.

When can veterans enroll in Medicare?

Like other Americans, veterans become eligible for Medicare at age 65. (Those with a qualifying disability may enroll earlier.) The best time to sign up is during your initial enrollment period. That begins 3 months before the first day of your birthday month and lasts for 7 months.

Do you have to enroll in Medicare if you have VA benefits?

You don’t. But without Medicare coverage, you’ll be uninsured for any treatment you get at non-VA facilities or care from providers not authorized in advance by the VA. You’ll be billed for the full cost of those services, at serious risk to your net worth. That’s why the VA recommends that veterans sign up for Medicare as soon as they can.

What are the benefits of combining Medicare and VA benefits?

Enrolling in Medicare could fill in gaps in the coverage you get through the VA benefits. That’s because you’ll be able to go either to VA facilities for treatment (covered under VA benefits) or to Medicare-approved doctors and facilities (covered by Medicare). Also, VA benefits are not guaranteed, so your coverage could change in the future.

Which areas of Medicare coverage and VA benefits can you combine?

Medicare and VA benefits do not work together. But they can sometimes complement each other. For example, if the VA pre-authorizes treatment at a non-VA hospital but not certain services you get during the hospital stay, Medicare may pay for those services. For specifics, contact your Medicare plan.

How does VA disability affect Medicare?

VA benefits — including disability payments — don’t affect Medicare. At age 65, you are eligible for Medicare regardless. Before that, you may receive Social Security Disability Insurance (SSDI) while you’re on VA disability. After 2 years of SSDI payments, you can enroll in Medicare. Your VA disability benefits remain in place.

What do you have to do to manage Medicare and VA benefits?

You will have to pay the premiums for Medicare Part B or Medicare Advantage as well as any cost-sharing copayments. For VA benefits, there typically aren’t enrollment fees, monthly premiums, or deductibles. But some veterans may have copayments for healthcare or prescription drugs.

Where can you get help coordinating Medicare and VA benefits?

Various government-supported offices have staffers to help you combine and manage your health plans:

Is VA coverage good for Medicare?

Enrollment in the VA health care system is considered creditable coverage for Medicare Part D purposes. This means VA prescription drug coverage is at least as good as the Medicare Part D coverage. Since only Veterans can enroll in the VA health care system, dependents and family members do not receive credible coverage under the Veteran’s enrollment.

Can veterans use private health insurance?

Veterans with private health insurance may choose to use these sources of coverage as a supplement to their VA health care benefits. Veterans are not responsible for paying any remaining balance of VA’s insurance claim not paid or covered by their health insurance.

Do veterans have to provide information on their health insurance?

All Veterans applying for VA medical care are required to provide information on their health insurance coverage, including coverage provided under policies of their spouses. Any payment received by VA may be used to offset “dollar for dollar” a Veteran’s VA copay responsibility.

Can veterans get prescription drugs from community physicians?

For example, Veterans enrolled in both programs would have access to community physicians (under Medicare Part A or Part B) and can obtain prescription drugs not on the VA formulary if prescribed by community physicians and filled at their local retail pharmacies (under Medicare Part D).

How much is the VA benefit for Medicaid?

Once approved for Medicaid, though, the VA benefit is reduced to $90/month for most recipients. The exception to this reduction is: if the well spouse (or community spouse living somewhere other than a nursing home) has recurring, unreimbursed medical expenses.

How much does the VA pay for home care?

It pays a set maximum amount to the wartime veteran or surviving spouse of a wartime veteran; currently the maximum ranges from $1,176-$1,830/month.

Does VA consider Medicaid?

Any asset protection planning that is done for VA Benefits must also consider Medicaid eligibility rules. Anyone seeking an asset plan to qualify for VA benefits must also consider Medicaid eligibility rules so that a person can access Medicaid later, if needed.

Do you need Medicaid for VA nursing home?

In such a situation, the VA benefits may be enough when added to existing income to pay for the total cost of the long-term care expenses in a nursing home, and the person may not need Medicaid. We have seen this happen for a few clients over the years.

Can Medicaid be used for long term care in Georgia?

Medicaid can be used to pay for long-term care expenses as well. In Georgia, Medicaid is mostly used to pay for long-term care in a nursing home, but Georgia does have some home and community based services that will provide in-home care or care in a personal care home (perhaps you have heard of our Elderly and Disabled Waiver Programs, or SOURC and CCSP). Our home and community based services have a long waiting list and other barriers to be used, so most Georgia Medicaid beneficiaries needing long-term services and supports receive care in a nursing home.