Should You Choose Medicare supplement plan F or Plan G?

Nov 18, 2021 · Plan F covers more than Plan G, as it includes the Medicare Plan B deductible. Plan F prices have also jumped substantially since the introduction of the act that discontinued their availability to new Medicare beneficiaries. However, Plan G is also a comprehensive plan.

Is Medigap Plan G better than Plan F?

Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible (the Part B deductible for 2018 is $183). This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for Plan G is paid for, you essentially have Plan F.

What are the benefits of Medicare Plan F?

Apr 07, 2021 · Plan G Medicare Rates are Lower You see, most savvy seniors have already figured out that Plan G Medicare premiums are lower than Plan F, and that cost difference adds up to more than the Part B deductible (in most areas). So, for these seniors, a Medigap Plan G policy is better than Plan F because they save money.

Is Medicare Plan F the best?

Dec 07, 2020 · The Difference Between Plan F and Plan G is $233 It really is quite that simple. The difference between F and G is the annual Part B deductible. In 2022, the Part B deductible is $233. After the deductible is met, Plan G benefits are exactly the same as Plan F. Plan F benefits include coverage for all copays, deductibles and coinsurance.

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.18 Feb 2021

Can I switch from Plan F to Plan G without underwriting?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.14 Jan 2022

Is Plan G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Is Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.9 Jul 2020

Does Plan G have a deductible?

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you don't have Plan G, then you'll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.24 Jan 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the deductible for Plan F in 2022?

What is the Deductible for High Deductible Plan F in 2022? In 2022, the deductible is $2,490. Therefore, you would have to pay $2,490 out-of-pocket on this plan before it covers 100% of your costs.17 Mar 2022

which is better medicare plan f vs plan g?

The better plan will depend on your coverage goals and budget. Plan F makes sense if you want to simply pay a monthly premium and all of your Medic...

should i switch from plan f to plan g?

This will be a personal decision and will depend on your coverage goals. If you want to save some money each year, then a Plan G is a great option....

can i switch from medicare plan f to plan g?

Yes you can switch from Medicare Plan F to Plan G. However, you may be subjected to medical underwriting. This will be determined by the Medicare S...

What Is The Difference Between Plan F and G

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible...

Medigap Plan G vs F Benefit Details

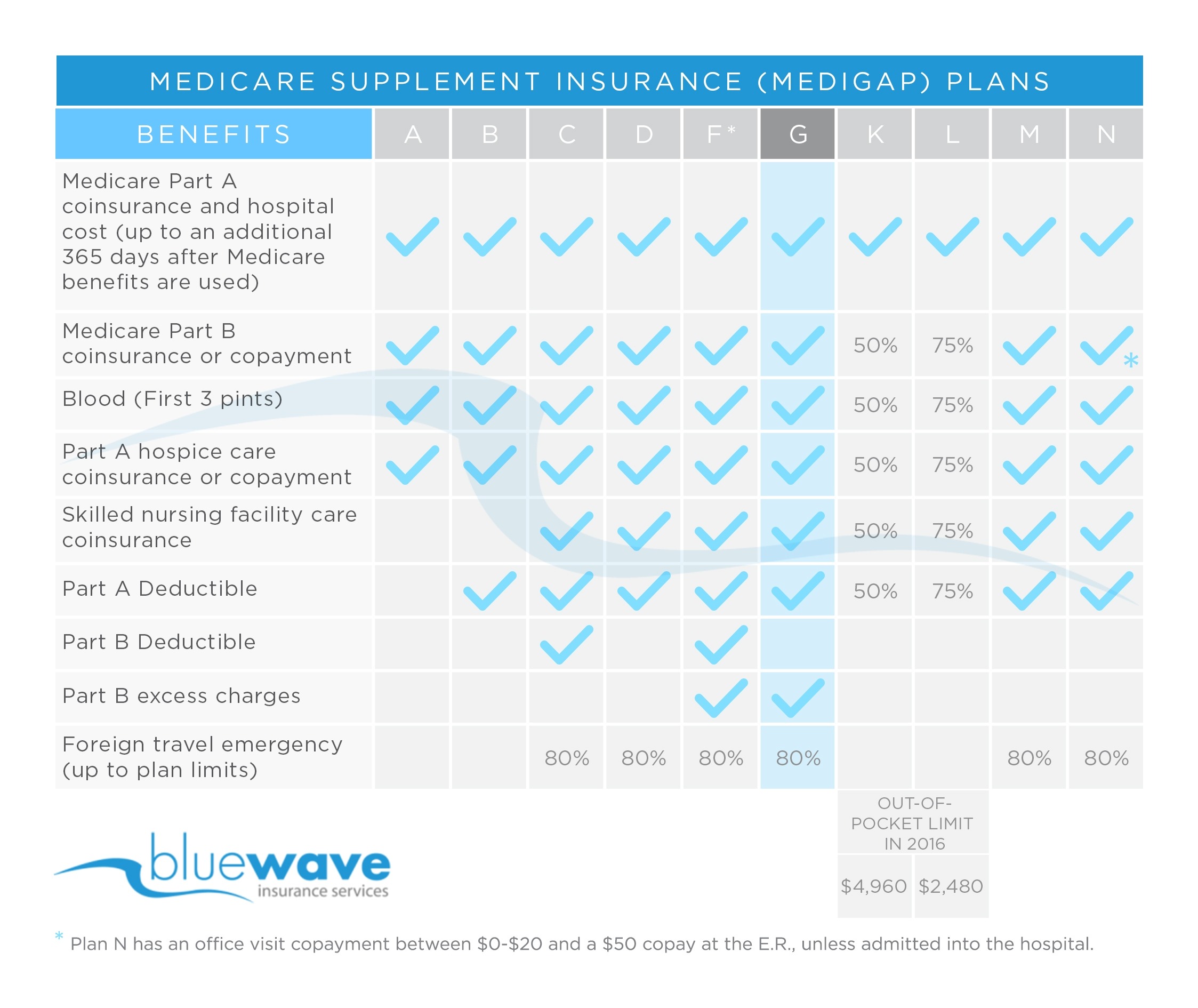

Below is a chart we put together with the main benefits covered by Medicare Supplement Plans G and F. As you will see, they mirror each other in al...

Who Should Choose Medigap F?

Everyone looking into Medigap policies should consider Plan F since it offers the most benefits. But who should pick F over G? 1. Anyone who can fi...

Who Should Choose Medigap G?

Everyone consider enrolling in Medicare Supplement Insurance who does not fall under the three bullets above should consider Plan G. Basically if y...

What About Plan F Going away?

First of all, Plan F is not going away. Anyone who is Medicare eligible before 2020 can purchase it at any time in the future and those currently o...

What does Medicare Supplement Plans F and G cover?

Medicare Supplement Plans F and G are the only Medigap insurance plans that cover 100% of Medicare Part B “excess charges,” which are the costs a doctor can charge for a service or procedure, if they don’t accept assignment.

What is the difference between Medicare Supplement Plans F & G?

Medicare Supplement Plans F and G are identical with the exception of one thing: Plan G does not cover the Part B deductible (the Part B deductible for 2018 is $183). This means that you will have to pay $183 annually before Plan G begins to cover anything. However, once the Part B deductible for Plan G is paid for, you essentially have Plan F.

Should I buy Medicare Supplement Plan F or G?

Your unique health insurance needs, budget, and individual quote will help you determine if Plan F, G – or a different Medigap plan – is right for you. Each Medigap insurance company has different rates, which are often based on gender, age, zip code, and tobacco status.

What else do I need to know about Medigap?

All Medigap policies of the same letter offer the same basic benefits, but some offer additional benefits and different rates. Medicare beneficiaries must be enrolled in Original Medicare (Part A and Part B) to qualify and cannot purchase a Medigap policy in addition to their Medicare Advantage Plan (Part C).

What is Medicare Supplement Plan F?

For decades, Medicare Supplement Plan F. Medicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services....

How long does the open enrollment period for Medicare last?

Your personal open enrollment window starts when you first enroll in Medicare Part B (the effective date of your coverage) and lasts for six months.

Which is better, Plan G or Plan F?

Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage.... Plan G is better than Plan F because it’s the most coverage the government will let us get.

Is Plan F the best?

This is why so many people, both insurance professionals, and policyholders alike, think Plan F is the best. Let’s face it, having first-dollar coverage offers complete peace of mind. In insurance terms, first-dollar coverage means that you don’t pay a dime out-of-pocket for any Medicare-approved service.

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

Is Plan G cheaper than Plan F?

Once it’s paid, then Plan G acts just like a Plan F policy and covers all Medicare-approved costs. But here’s the thing, for many people Plan G is actually cheaper overall. That’s what makes it better.

What is out of pocket medical?

Out-of-pocket costs (aka, out-of-pocket medical expenses) are costs that a beneficiary must pay because their health insurance does not cover them. Out-of-pocket costs are found in the deductibles, copayments, and coinsurance outlined in each health... : Medicare Part A Coinsurance & Hospital Costs.

What is the best Medicare supplement plan?

Plan F is the most comprehensive Medicare supplement plan. But as it’s been explained, Plan F is not necessarily the best value for your premium dollar. As always, our goal is to show you how to save significant amounts of money by choosing the best plan for your premium dollar.

Is Plan G the same as Plan F?

After the deductible is met , Plan G benefits are exactly the same as Plan F . Plan F benefits include coverage for all copays, deductibles and coinsurance. This type of coverage has made Plan F extremely popular among seniors on Medicare.

Which is better, Plan F or Plan G?

Plan F typically has a higher premium than Plan G. The higher the premium the bigger the agent’s commission. Some insurance carriers don’t sell Plan G, so the best plan they can offer is Plan F. There is only 1 difference between the plans, but it can save you hundreds of dollars now and potentially thousands over time.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Is there a charge for Senior65?

Compare prices for yourself. If you need assistance or are ready to enroll, give us a call. There is never a charge or hidden fee to work with Senior65.com. Since Medicare Insurance prices are regulated, no one can sell you the same plan for less than we can.

How much is the Part B deductible?

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. The current part B deductible cost is $203. This means Medigap Plan F pays the $203 while Plan G does not. The other difference is price, and it is a considerable one.

What are the benefits of Medicare?

More specifically, Medicare Plan G and Medicare Plan F cover: 1 Part A coinsurance and hospital costs 2 Part B coinsurance or copayments 3 First three pints of blood (for surgeries that require blood transfusions) 4 Part A hospice care coinsurance 5 Skilled nursing facility care coinsurance 6 Medicare Part A deductible 7 Up to 80% of the cost of medically necessary care while you’re traveling in a foreign country

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Who is Lisa Eramo?

Lisa Eramo is an independent health care writer whose work appears in the Journal of the American Health Information Management Association, Healthcare Financial Management Association, For The Record Magazine, Medical Economics, Medscape and more.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many Medigap policies are there?

There are 10 Medigap policies: A, B, C, D, F, G, K, L, M, and N. The plans offer standardized benefits to Medicare recipients and help pay coinsurance, deductibles, and copays that original Medicare may not cover. Medigap plans may also cover emergency healthcare if a person needs treatment while they are away from the United States.

Is Medigap Plan F the same as Plan G?

Medigap Plan F provides many of the same benefits as Plan G, with some differences. Medigap plans help a person pay their out-of-pocket Medicare expenses. A person can get a Medigap plan, which is optional health insurance, from private health insurance companies. Around 25% of people enrolled in Medicare had a Medigap plan in 2015, ...

What is Medigap Plan F?

Medigap Plan F provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, there are some restrictions on enrollment: A person newly enrolled in Medicare can no longer get Plan F.

How much is the deductible for Medicare 2021?

In addition to the basic Plan F, there is a high deductible version of Plan F available. In 2021, this has a deductible of $2,370. A person must reach the deductible before the plan starts to cover costs.

Does Medigap cover Part B?

Each Medigap plan must offer the same benefits as all other plans with the same letter, though plan premiums may be different. However, eligibility rules changed in January 2020, and Plan F is no longer available to new enrollees in Medicare. Plan G coverage is similar to that of Plan F but does not cover the Medicare Part B deductible.

Which is better, Plan G or Plan F?

Plan G is not too far behind. Is Plan F the best Medicare Supplement plan? Plan F is the plan that will give you the most comprehensive coverage. So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Medicare cover Plan G?

This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out of pocket is the Part B deductible. After you’ve met the deductible, Plan G will cover the rest, just like Plan F.

Can you change your Medicare plan without underwriting?

But, you may need to answer health questions first. There are times when you’re eligible for Guarantee Issue Rights, in which case you could change plans without underwriting. The plans you’re eligible to enroll in, depend on when you became Medicare eligible.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

Medicare Supplement Plan C

Medicare Supplement Plan C covers most Medicare-approved out-of-pocket expenses. However, this Medigap insurance plan has been phased out. Those who were eligible for Medicare after January 1, 2020, will no longer be able to purchase Medicare Supplement Plan C.

Medicare Supplement F Plan

Medicare Supplement F plan is considered one of the most popular Medicare Supplement plans because it provides the most comprehensive coverage. Like Plan C, the Medicare Supplement F plan is no longer available to Medicare beneficiaries who were not eligible for Medicare before January 1, 2020.

Medicare Supplement Plan G

Medicare Supplement Plan G provides all of the same benefits offered by Medicare Supplement F Plan, except for the Part B deductibles, which cost $198 in 2020.

Medicare Supplement Plan N

Medicare Supplement Plan N keeps growing in popularity because it has excellent coverage with little fewer benefits than Plan F and G.

What are the benefits of Medicare Supplement?

Important Facts About Medicare Plan F: 1 It’s important to note that Medicare supplements are not standalone policies. You must have both Medicare Parts A and B to qualify. 2 You pay for your Medicare Part B and Medigap separately. If you or your spouse did not work the full 40 quarters (10 years) required, you will also pay for your Part A coverage. 3 Each person needs their own Medicare supplement policy. These policies only cover one person. However, many companies offer a household discount. 4 Medicare Plan F is offered through private insurance companies and only those authorized to sell in your state can provide this policy. 5 Health problems do not disqualify you from a Medigap policy if you enroll during your 6-month individual enrollment period. During this period, you have guaranteed issue rights and cannot be turned down. You may continue to renew these indefinitely if you pay the monthly premium. 6 If you have a Medicare Advantage plan it is illegal for an insurance company to sell you a Medigap plan. The only exception is if you are going back to Original Medicare.

What is Medicare Plan F?

Medicare Plan F provides the same healthcare coverage from state to state. In general, you can use it to cover the copayment for all medical costs (e.g., doctor visits, specialists, lab tests, diagnostics, etc.) and even the Medicare Part B deductible.

How much does Medicare Plan F cost?

The price of a Medicare Plan F policy is determined based on your age, location, gender, and use of tobacco. National averages are around $300 per month, but in many areas, rates start as low as $125 per month. For the high deductible version, you may pay as little as $68.

Which is better, Medicare Supplement Plan F or G?

Medicare Supplement Plan F and Plan G are nearly identical. Technically, Plan F is better because it offers first-dollar coverage. However, the one cost that Plan G does not cover, the Part B deductible, is often less than the annualized premium difference between the two plans.

When will Medicare Supplement Plan F be available?

As a result, anybody who becomes eligible for Medicare on or after 1 January 2020 will not be able to purchase a Medicare Supplement Plan F policy.

What is Medicare Part B excess charge?

A Medicare Part B excess charge is the difference between a health care provider’s actual charge and Medicare’s approved amount for payment. ... . These occur when your doctor or specialist does not accept the standard Medicare payment for a service.

How does Medigap work?

With a Medigap plan, you pay for most of your medical services in advance through your monthly premiums. A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ...