How does Medicare determine your income?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

Are Medicare costs based on your income?

The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

Is the Medicare premium taxable?

Monthly premiums and out-of-pocket costs of Medicare programs are tax-deductible. When a person has a high accumulation of medical expenses, they may wish to itemize them on their tax return. The Internal Revenue Service (IRS) permits a person to deduct costs that exceed a certain percentage of their income.

What income is counted for Medicare premiums?

modified adjusted gross incomeThe cost of Medicare B and D (prescription drug coverage) premiums are based on your modified adjusted gross income (MAGI). If your MAGI is above $87,000 ($174,000 if filing a joint tax return), then your premiums will be subject to the income-related monthly adjustment amount (IRMAA).

Is Medicare calculated on gross or net income?

The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

Is Medicare tax based on gross or taxable income?

taxable wagesThe tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.

Why are my Medicare wages higher than my regular wages?

Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax. In other words, the amount in Box 5 typically represents your entire compensation from your job.

How much is Medicare Part B insurance?

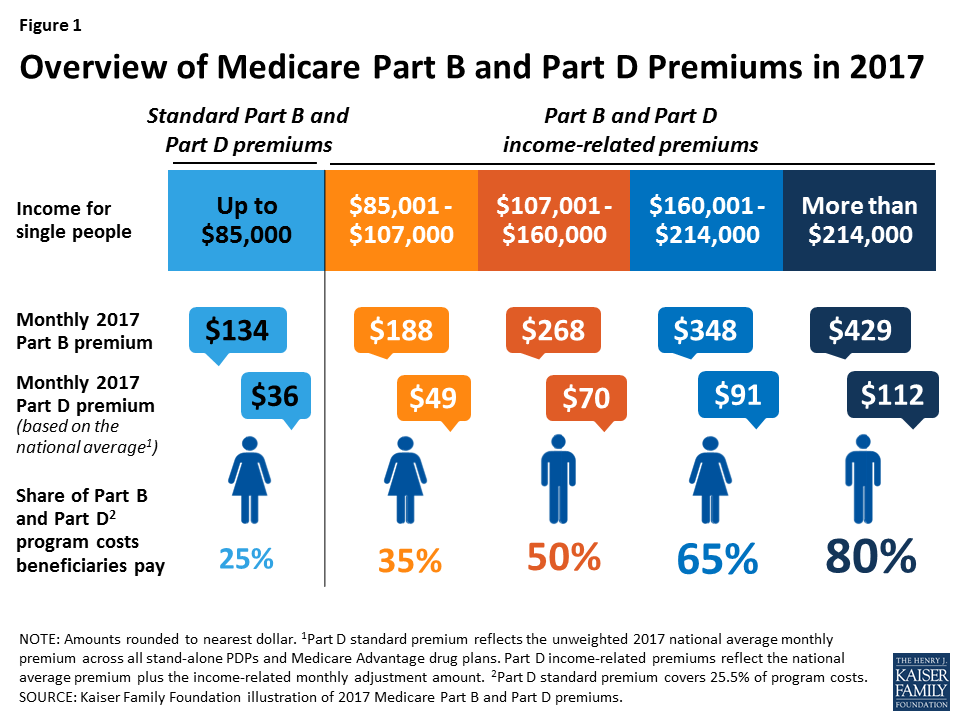

For 2020, the rate is $144.60 per month. Medicare charges higher premiums to people across different income ranges.

How many years prior to the effective date of the new Medicare rate?

The basis for where you fall within these ranges is your tax return two years prior to the effective date of the new rate. As an example, the IRS provides Social Security with 2018 tax return data on which to evaluate individual premiums due for Medicare coverage in 2020.

Do Medicare beneficiaries pay taxes?

The majority of Medicare beneficiaries qualify for Medicare Part A coverage at no cost, depending their contribution through taxes while working over a period of time. For those who have paid Medicare taxes for under 40 quarters, a monthly premium is charged.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

Do you have to factor in Medicare tax?

When you become eligible for Medicare and look at how much to budget for your annual health care costs, you’ll need to also factor in your tax-reported income.

Although Medicare eligibility has nothing to do with income, your premiums may be higher or lower depending on what you claim on your taxes

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits.

Who Has to Pay the Medicare Surcharge?

Higher-income beneficiaries face the IRMAA surcharge. In this case, "high earner" refers to anyone who claimed an income greater than $91,000 per year (filing individually OR married filing separately) or $182,000 per year (married filing jointly).

The Medicare Part B Premium

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2022 is $170.10. This accounts for around 25 percent of the monthly cost for Part B, with the government (i.e. the Medicare program) paying the remaining 75 percent.

The Medicare Part D Premium

Original Medicare (Parts A and B) does not include prescription drug coverage. These benefits are available via a Medicare Part D prescription drug plan.

How Does Social Security Determine Whether You Pay Extra?

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

What Does Modified Adjusted Gross Income Include?

According to Investopedia, your modified adjusted gross income is "your household's adjusted gross income with any tax-exempt interest income and certain deductions added back."

What If Your Income Went Down?

Income levels often fluctuate due to life-changing events, particularly once we retire. If one of the following applies to you AND it caused a permanent reduction in income, inform Social Security. (Temporary changes do not qualify as "life-changing events.")

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

What is a household in the marketplace?

For most people, a household consists of the tax filer, their spouse if they have one, and their tax dependents, including those who don’t need coverage. The Marketplace counts estimated income of all household members. Learn more about who’s counted in a Marketplace household.

Does MAGI include SSI?

Tax-exempt interest. MAGI does not include Supplemental Security Income (SSI) See how to make an estimate of your MAGI based on your Adjusted Gross Income. The chart below shows common types of income and whether they count as part of MAGI.

Is Marketplace Savings based on income?

Marketplace savings are based on total household income, not the income of only household members who need insurance. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application.