Full Answer

How does Medicare work with my health insurance?

Aug 16, 2021 · Individual or Marketplace health insurance plan. Medicare pays first if you keep an individual health plan (bought directly from an insurer) or Affordable Care Act marketplace health insurance plan. However, there is no reason normally to keep an individual or marketplace plan once you have Medicare.

What is part a of Medicare?

How does Medicare work? With Medicare, you have options in how you get your coverage. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage. There are 2 main ways: Original Medicare. Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). You pay for services as you get them.

What is Original Medicare and how does it work?

Medicare Supplement plans work together with Original Medicare. First, Medicare pays for a percentage, usually 80 percent, of the Medicare-approved cost of your health care service. After this is paid, your supplement policy pays your portion of the remaining cost. This is …

What happens when you have Medicare and private insurance?

Specified Low-Income Medicare Beneficiary (SLMB) Program: Helps pay Part B premiums Qualifying Individual (QI) Program: Helps pay Part B premiums Qualified Disabled Working Individual (QDWI) Program: Pays the Part A premium for certain disabled and working beneficiaries who have disabilities For more information, refer to the

How does individual pay Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

How does Medicare work with pre existing conditions?

Medicare defines a pre-existing condition as any health problem that you had prior to the coverage start date for a new insurance plan. If you have Original Medicare or a Medicare Advantage plan, you are generally covered for all Medicare benefits even if you have a pre-existing condition.Jul 1, 2021

How does Medicare work in simple terms?

Medicare is our country's health insurance program for people age 65 or older and younger people receiving Social Security disability benefits. The program helps with the cost of health care, but it doesn't cover all medical expenses or the cost of most long-term care.Oct 24, 2019

What is Medicare individual?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What pre-existing conditions are not covered?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How does Medicare A and B work?

Medicare Part A covers hospital services, skilled nursing facility care, hospice, and some home health care. Medicare Part B covers medical services, including doctor visits, preventive screenings, certain vaccinations, lab tests, and durable medical equipment. Original Medicare doesn't cover everything.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the difference between medical and Medicare?

Medicare provides health coverage to individuals 65 and older or those with a severe disability regardless of income, whereas Medi-Cal (California's state-run and funded Medicaid program) provides health coverage to those families with very low income, as well as pregnant women and the blind, among others.Jan 25, 2017

What is the term for someone who is eligible for Medicare benefits?

BENEFICIARY. A person eligible for health insurance through the Medicare or Medicaid program.Feb 10, 2022

Who qualifies for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

How does Medicare work?

Here's how Medicare payments work if your employer covers you: 1 If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. 2 If you work for a larger company, your employer is primary and Medicare is secondary. 3 If Medicare is the secondary payer, it will reimburse based on what the employer paid, what is allowed in Medicare and what the doctor or provider charged. You will then have to pay what's left over.

How does Medicare work if you work for a company?

Here's how Medicare payments work if your employer covers you: If you work for a company with fewer than 20 employees, Medicare is usually considered primary and your employer is secondary. If you work for a larger company, your employer is primary and Medicare is secondary.

What is Cobra insurance?

COBRA. COBRA lets you keep your employer group health insurance plan for a limited time after your employment ends. This continuation coverage is meant to protect you from losing your health insurance immediately after you lose a job. If you're on Medicare, Medicare pays first and COBRA is secondary.

What is a cob policy?

It's called COB, which protects insurance companies from making duplicate payments or even reimbursing for more than the healthcare services cost. Insurance providers work together to coordinate benefits and they use COB policies ...

How to decide if you have dual health insurance?

When deciding whether to have dual health insurance plans, you should run the numbers to see whether paying for two plans would be more than offset by having two insurance plans paying for medical care. If you have further questions about Medicare and COB, call Medicare at 855-798-2627.

Does Medicare cover VA?

Medicare doesn't cover services within the VA. Unlike the other scenarios on this page, there is no primary or secondary payer when it comes to VA vs. Medicare. Having both coverage gives veterans the option to get care from either VA or civilian doctors depending on the situation.

Does Medicare pay a doctor if they are owed money?

The rest is on you if the doctor is still owed money. If Medicare is the secondary payer and the primary insurer doesn't pay swiftly enough, Medicare will make conditional payments to a provider when "there is evidence that the primary plan does not pay promptly.".

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

How does Medicare work with a group plan?

How Medicare works with your group plan’s coverage depends on your particular situation, such as: If you’re age 65 or older. In companies with 20 or more employees, your group health plan pays first. In companies with fewer than 20 employees, Medicare pays first. If you have a disability or ALS.

What is the process called when you have both insurance and a primary?

When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer. Once the payment order is determined, coverage works like this: The primary payer pays for any covered services until the coverage limit has been reached.

What is the difference between Cobra and tricare?

COBRA allows you to temporarily keep private insurance coverage after your employment ends. You’ll also keep your coverage if you’re on your spouse’s private insurance and their employment ends. TRICARE. TRICARE provides coverage for active and retired members of the military and their dependents.

How to contact the SSA about Medicare?

Contacting the SSA at 800-772-1213 can help you get more information on Medicare eligibility and enrollment. State Health Insurance Assistance Program (SHIP). Each state has its own SHIP that can aid you with any specific questions you may have about Medicare. United States Department of Labor.

What is health insurance?

Health insurance covers much of the cost of the various medical expenses you’ll have during your life. Generally speaking, there are two basic types of health insurance: Private. These health insurance plans are offered by private companies.

What age do you have to be to be enrolled in Medicare?

are age 65 or over and enrolled in Medicare Part B. have a disability, end stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS) and are enrolled in both Medicare Part A and Part B. have Medicare and are a dependent of an active duty service member with TRICARE.

What percentage of Americans have private health insurance?

Others include Medicaid and Veteran’s Affairs benefits. According to a 2020 report from the U.S. Census Bureau, 68 percent of Americans have some form of private health insurance. Only 34.1 percent have public health insurance, including 18.1 percent who are enrolled in Medicare. In certain cases, you can use private health insurance ...

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

What is a small group health plan?

Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan. If your employer’s insurance covers more than 20 employees, Medicare will pay secondary and call your work-related coverage a Group Health Plan (GHP).

Does Medicare pay second to employer?

Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance ...

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

Can an employer refuse to pay Medicare?

The first problem is that your employer can legally refuse to make any health-related medical payments until Medicare pays first. If you delay coverage and your employer’s health insurance pays primary when it was supposed to be secondary and pick up any leftover costs, it could recoup payments.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

Why is it important to check deductibles each year?

It’s important to check each year to see if the deductible and copayments have changed, so you can know what to expect. According to a 2019 retrospective study. Trusted Source. , benefit periods are meant to reduce excessive or unnecessarily long stays in a hospital or healthcare facility.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

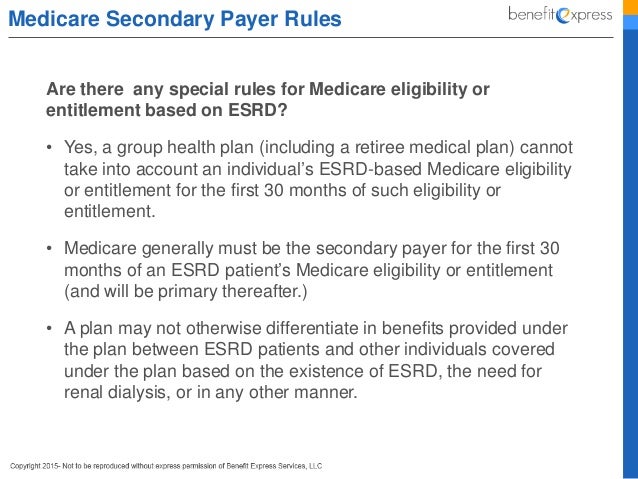

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

What are the responsibilities of an employer under MSP?

As an employer, you must: Ensure that your plans identify those individuals to whom the MSP requirement applies; Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer; and.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

What age is Medicare?

Retiree Health Plans. Individual is age 65 or older and has an employer retirement plan: Medicare pays Primary, Retiree coverage pays secondary. 6. No-fault Insurance and Liability Insurance. Individual is entitled to Medicare and was in an accident or other situation where no-fault or liability insurance is involved.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Can my spouse and kids be on my Medicare?

Most health plans allow for family coverage, however Medicare isn’t like most health plans. Therefore your children and spouse cannot enroll in your Medicare plan. But, the Affordable Care Act says that all children up to 26 can stay on their parents’ plan -you might be thinking. But Medicare doesn’t fall into that category.

Is Medigap a no go?

, so therefore you wouldn’t be able to extend this to your family. Medicare Advantage replaces Original Medicare. , so once again, a no go.