Some services Medicare Part A may cover in a nursing home environment include:

- dietary counseling and nutrition services

- medical supplies and equipment

- medications

- meals

- occupational therapy

- physical therapy

- semi-private room

- skilled nursing care, such as wound dressing changes

- social work services related to needed medical care

- speech-language pathology

Full Answer

Is nursing home care covered by Medicare?

Medicare only covers home care nursing for a short period of time. If you qualify for hospice care and choose hospice benefits under Part A, Medicare pays for part-time home care nursing for as long as you receive hospice care. What are the requirements for Medicare nursing home coverage?

How many days will Medicare cover SNF?

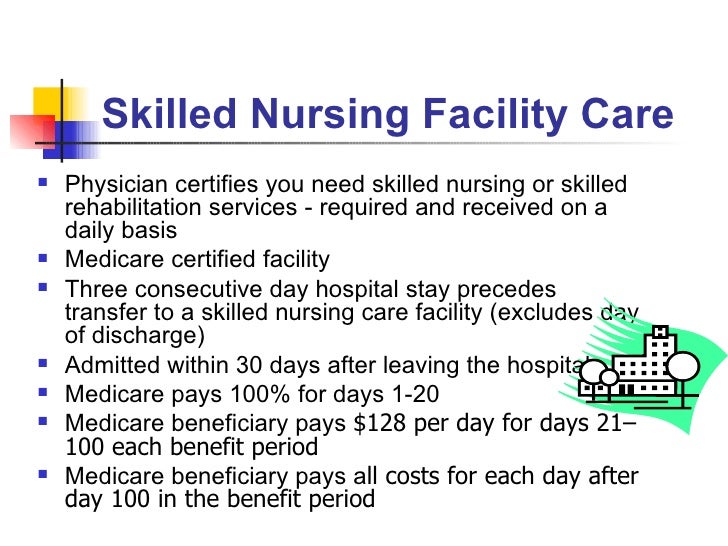

each day. After 100 days, the SNF coverage available during that benefit period is “exhausted,” and the beneficiary pays for all care, except for certain Medicare Part B services. A benefit period begins the day the Medicare beneficiary is admitted to a hospital or SNF as an inpatient and . ends after the beneficiary has not been in a hospital (or received skilled care in a SNF) for 60 consecutive days.

What is nursing home coverage under Medicare?

Medicare and Nursing Home Care . Medicare Part A covers up to 100 days of skilled nursing facility care per benefit period when the stay is medically necessary and follows a qualifying three-day inpatient hospital stay.Keep in mind that this is different from nursing home care that is considered custodial care, where a person is assisted with daily tasks such as dressing and bathing.

When does the 100 day Medicare period restart?

You must be released from the hospital to a facility or Medicaid will not pay. There must be 60 days between hospital cases for the 100 days to reset. A limited amount of days left for Medicare to pay and the facility anticipates the patient stay being longer than the dollars allow.

Which of the three types of care in the nursing home will Medicare pay for?

Original Medicare and Medicare Advantage will pay for the cost of skilled nursing, including the custodial care provided in the skilled nursing home for a limited time, provided 1) the care is for recovery from illness or injury – not for a chronic condition and 2) it is preceded by a hospital stay of at least three ...

How many days will Medicare pay 100% of the covered costs of care in a skilled nursing care facility?

100 daysMedicare covers up to 100 days of care in a skilled nursing facility (SNF) for each benefit period if all of Medicare's requirements are met, including your need of daily skilled nursing care with 3 days of prior hospitalization. Medicare pays 100% of the first 20 days of a covered SNF stay.

Does Medicare pays most of the costs associated with nursing home care?

If you qualify for short-term coverage in a skilled nursing facility, Medicare pays 100 percent of the cost — meals, nursing care, room, etc.

What is the 100 day rule for Medicare?

Medicare pays for post care for 100 days per hospital case (stay). You must be ADMITTED into the hospital and stay for three midnights to qualify for the 100 days of paid insurance. Medicare pays 100% of the bill for the first 20 days.

What can a nursing home take for payment?

We will take into account most of the money you have coming in, including:state retirement pension.income support.pension credit.other social security benefits.pension from a former employer.attendance allowance, disability living allowance (care component)personal independence payment (daily living component)

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

What is the average stay in a nursing home before death?

The average length of stay before death was 13.7 months, while the median was five months. Fifty-three percent of nursing home residents in the study died within six months. Men died after a median stay of three months, while women died after a median stay of eight months.

How can I pay for assisted living with no money?

Your Options to Pay for Assisted LivingReverse Mortgages. A loan is accessible to people over 62 years of age. ... Equity Key Agreement. ... Equity Lines of Credit. ... Life Insurance Conversion. ... Viatical settlements. ... Life settlements. ... Long-term Care Insurance. ... Assisted Living Loans.More items...

How Long Will Medicare pay for home health care?

Medicare pays your Medicare-certified home health agency one payment for the covered services you get during a 30-day period of care. You can have more than one 30-day period of care. Payment for each 30-day period is based on your condition and care needs.

What will Medicare not pay for?

Medicare doesn't provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500.

Can Medicare benefits be exhausted?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Does Medicare cover ICU costs?

(Medicare will pay for a private room only if it is "medically necessary.") all meals. regular nursing services. operating room, intensive care unit, or coronary care unit charges.

What type of insurance covers long term care?

Long-term care insurance. This type of insurance policy can help pay for many types of long-term care, including both skilled and non-skilled care. Long -term care insurance can vary widely. Some policies may cover only nursing home care, while others may include coverage for a range of services, like adult day care, assisted living, ...

How to find out if you have long term care insurance?

If you have long-term care insurance, check your policy or call the insurance company to find out if the care you need is covered. If you're shopping for long-term care insurance, find out which types of long-term care services and facilities the different policies cover.

Do nursing homes accept Medicaid?

Most, but not all, nursing homes accept Medicaid payment. Even if you pay out-of-pocket or with long-term care insurance, you may eventually "spend down" your assets while you’re at the nursing home, so it’s good to know if the nursing home you chose will accept Medicaid. Medicaid programs vary from state to state.

Can federal employees buy long term care insurance?

Federal employees, members of the uniformed services, retirees, their spouses, and other qualified relatives may be able to buy long-term care insurance at discounted group rates. Get more information about long-term care insurance for federal employees.

Does Medicare cover nursing home care?

Medicare generally doesn't cover Long-term care stays in a nursing home. Even if Medicare doesn’t cover your nursing home care, you’ll still need Medicare for hospital care, doctor services, and medical supplies while you’re in the nursing home.

Advantages Of A Nursing Home

Even if you live with loved ones, they might not be able to provide the level of care you need. Whether you need medical help or custodial help , it can be demanding for loved ones to give this constant care and to do it right.

Contributing Factors To Ratings

Experts recommend that you dig deeply into the reasons behind the rating. Each report contains a great deal of useful information. It may be difficult to find a nursing home with a flawless rating that is in your preferred area and within your budget. Therefore, you may need to prioritize your concerns.

Does Medicare Pay For Long

Long-term care is a range of services and support for your personal-care needs. Most long-term care isn’t medical care, but rather help with basic personal tasks of everyday life , such as dressing and bathing.

Does Medicare Cover Care In A Skilled Nursing Facility Or Nursing Home

Medicare Part A covers up to 100 days in a skilled nursing facility after a qualifying hospital stay. The Part A deductible covers the first 20 days per benefit period. After that, you pay a share of the cost for each additional day of your stay. You would start paying the full cost after 100 days.

How Do I Apply For Va Long

An application for VA long-term care is separate from the application to enroll in VA medical care coverage. To apply for nursing home or other long-term care, a veteran or veterans caregiver must fill out a special application for extended care services.

What Kind Of Care Do Nursing Homes Provide

How Does the Medicare Elder Care Process Work? Medicare Home Health Care

How Your Assets Impact Eligibility

Besides income, your assets will be counted toward meeting eligibility requirements. Countable assets include checking and savings account balances, CDs, stocks, and bonds.

How long does Medicare pay for skilled nursing?

Usually, Medicare Part A may pay for up to 100 days in a skilled nursing facility. A skilled nursing facility must admit the person within 30 days after they left the hospital, and they must admit them for the illness or injury the person was receiving hospital care for.

What is swing bed in Medicare?

Medicare may also cover something called “swing bed services.”. This is when a person receives skilled nursing facility care in an acute-care hospital.

What is Medicare Part D?

Medicare Part D is prescription drug coverage that helps pay for all or a portion of a person’s medications. If a person lives in a nursing home, they’ll typically receive their prescriptions from a long-term care pharmacy that provides medications to those in long-term care facilities like a nursing home.

How much does a nursing home cost in 2019?

They found the average 2019 cost of a private room in a nursing home is $102,200 per year, which is a 56.78 percent increase from 2004.

What age do you buy nursing home insurance?

Many people will purchase these policies at a younger age, such as in their 50s, as the premiums usually increase in cost as a person ages. Medicaid. Medicaid, the insurance program that helps cover costs for those in low-income households, has state and national programs that help pay for nursing home care.

How early can you enroll in Medicare?

If you have a loved one who is reaching age 65, here are some tips on how you can help them enroll: You can start the process 3 months before your loved one turns age 65. Starting early can help you get needed questions answered and take some stress out of the process.

Does Medicare cover nursing home care?

Medicare doesn’t cover care in a nursing home when a person needs custodial care only. Custodial care includes the following services: bathing. dressing. eating. going to the bathroom. As a general rule, if a person needs care that doesn’t require a degree to provide, Medicare doesn’t cover the service.

How much does Medicare pay for skilled nursing?

For the next 100 days, Medicare covers most of the charges, but patients must pay $176.00 per day (in 2020) unless they have a supplemental insurance policy. 3 .

How long do you have to transfer assets to qualify for medicaid?

The transfer of assets must have occurred at least five years before applying to Medicaid in order to avoid ...

How does Medicaid calculate the penalty?

Medicaid calculates the penalty by dividing the amount transferred by what Medicaid determines is the average price of nursing home care in your state. 12 . For example, suppose Medicaid determines your state's average nursing home costs $6,000 per month, and you had transferred assets worth $120,000.

When was medicaid created?

Medicaid was created in 1965 as a social healthcare program to help people with low incomes receive medical attention. 1 Many seniors rely on Medicaid to pay for long-term nursing home care. “Most people pay out of their own pockets for long-term care until they become eligible for Medicaid.

What age can you transfer Medicaid?

Arrangements that are allowed include transfers to: 13 . Spouse of the applicant. A child under the age of 21. A child who is permanently disabled or blind. An adult child who has been living in the home and provided care to the patient for at least two years prior to the application for Medicaid.

Can you get Medicaid if you have a large estate?

Depending on Medicaid as your long-term care insurance can be risky if you have a sizeable estate. And even if you don't, it may not meet all your needs. But if you anticipate wanting to qualify, review your financial situation as soon as possible, and have an elder- or senior-care attorney set up your affairs in a way that will give you the money you need for now, while rendering your assets ineligible to count against you in the future.

Who can get medicaid?

In all states, Medicaid is available to low-income individuals and families, pregnant women, people with disabilities, and the elderly. Medicaid programs vary from state to state, and the Affordable Care Act (ACA) allows states to provide Medicaid to adults (under the age of 65) without minor children or a disability. 6 .

How long does Medicare cover nursing home care?

What parts of nursing home care does Medicare cover? Medicare covers up to 100 days at a skilled nursing facility. Medicare Part A and Part B cover skilled nursing facility stays of up to 100 days for older people who require care from people with medical skills, such as sterile bandage changes.

How much does a nursing home cost?

On average, annual costs for nursing homes fall between $90,000 and $110,000, depending on whether you have a private or semi-private room. This can burn through your personal funds surprisingly quickly. It’s best to pair your personal funds with other financial aid to help you afford nursing home care.

What is covered by Medicare Advantage?

Some of the specific things covered by Medicare include: A semiprivate room. Meals. Skilled nursing care. Physical and occupational therapy. Medical social services. Medications. Medical supplies and equipment. However, if you have a Medicare Advantage Plan, it’s possible that the plan covers nursing home care.

How many days do you have to be in hospital to qualify for Medicare?

Having days left in your benefit period. Having a qualifying hospital stay of three inpatient days. Your doctor determining that you need daily skilled care.

Does Medicare cover dementia care?

Does Medicare cover nursing home care for dementia? Medicare only ever covers the first 100 days in a nursing home, so nursing home coverage is not significantly different for people with dementia. Medicaid can help cover memory care units and nursing home stays beyond 100 days, though. Can older people rely on Medicare to cover nursing home costs? ...

Does Medicare cover nursing home room and board?

It also doesn’t cover room and board for any long-term nursing home stay, including hospice care or the cost of a private room. Lastly, Medicare won’t cover your skilled nursing facility stay if it’s not in an approved facility, so it’s important to know what institutions it has approved in your area.

Does long term care insurance cover nursing home care?

Similar to regular health insurance, long-term care insurance has you pay a premium in exchange for financial assistance should you ever need long-term care. This insurance can help prevent you from emptying your savings if you suddenly find yourself needing nursing home care. However, it’s important to note that these policies often have a daily or lifetime cap for the amount paid out. When you apply, you can choose an amount of coverage that works for you.

How much does nursing home care cost?

Nursing home care can cost tens of thousands of dollars per year for basic care, but some nursing homes that provide intensive care can easily cost over $100,000 per year or more. How Much Does Medicare Pay for Nursing Home Care?

How long does Medicare cover you?

If you have Original Medicare, you are fully covered for a stay up to 20 days. After the 20th day, you will be responsible for a co-insurance payment for each day at a rate of $176 per day. Once you have reached 100 days, the cost of care for each day after is your responsibility and Medicare provides no coverage.

Do skilled nursing facilities have to be approved by Medicare?

In order to qualify for coverage in a skilled nursing facility, the stay must be medically necessary and ordered by a doctor. The facility will also need to be a qualified Medicare provider that has been approved by the program.

Do you have to have Medicare to be a skilled nursing facility?

In addition, you must have Medicare Part A coverage to receive care in a residential medical facility. The facility must qualify as a skilled nursing facility, meaning once again that traditional residential nursing homes are not covered.

Is Medicare good or bad for seniors?

For seniors and qualifying individuals with Medicare benefits, there’s some good news and some bad news. While Medicare benefits do help recipients with the cost of routine doctor visits, hospital bills and prescription drugs, the program is limited in its coverage of nursing home care.

Can Medicare recipients get discounts on at home care?

At-Home Care as an Alternative. Some Medicare recipients may also qualify for discounts on at-home care provided by a nursing service. These providers often allow seniors to stay in their own homes while still receiving routine monitoring and basic care from a nurse who visits on a schedule.

Medicare Advantage and Nursing Home Care

In general, Medicare does not cover nursing home care—because it doesn't cover custodial care. According to the official U.S. government website for Medicare, most nursing home care is regarded as custodial care, which is defined as assistance with day-to-day activities like eating, dressing, bathing, and using the bathroom.

Get Started Now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.