- If you’re enrolled in Original Medicare, a Medicare Plan G policy lowers out-of-pocket costs.

- Plan G is a Medicare Supplement plan, or Medigap plan, that helps fill in the gaps of Original Medicare coverage. ...

- Medicare Plan G acts as a secondary plan. ...

- While you’ll save when you access services, keep in mind that you’ll have two monthly premiums. ...

Is Plan G the best Medicare supplement plan?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $233 in 2022.

Is Medicare Plan G better than Plan F?

Dec 03, 2021 · Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans. The big four are:

How much does Medicare Plan G cost?

What is Medicare Plan G? Medicare Part G – Known as Medicare Plan G – is now the most popular Medigap Plan Available. Medicare Supplement Plan G covers 100% of the gaps in Medicare Part A & B with only one small deductible to pay. More people will enroll in Medicare Plan G this year than any other Medigap plan.

Which is better Medicare Plan F or G?

Oct 31, 2021 · Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

Does Medicare Plan G include prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.Sep 29, 2021

How Does Medicare Plan G work?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is the difference between Medicare Plan D and Plan G?

Medigap Plan D It is very similar to Medigap Plan G, with only one benefit difference. Just like the difference in Plans F and C, the only difference in Plans G and D is the coverage of the Medicare Part B Excess charges. Whereas Plan G covers those at 100%, Plan D does not cover them at all.

What is Medicare Plan G include?

What does Medicare Part G cover? Plan G includes all the benefits of Medicare Supplement Plans A, B and C with the exception of the Medicare Part B deductible. It's a good fit for people who want some coverage for hospitalization, but are willing to pay the Medicare Part B deductible on their own.Aug 26, 2021

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much does G plan cost?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov.Jan 24, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does AARP Offer Plan G?

Medicare Supplement Insurance benefits are standardized by the federal government. That means Medigap Plan G purchased through AARP will feature the same basic benefits as a Plan G purchased through a different carrier.Sep 21, 2021

Is Plan G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

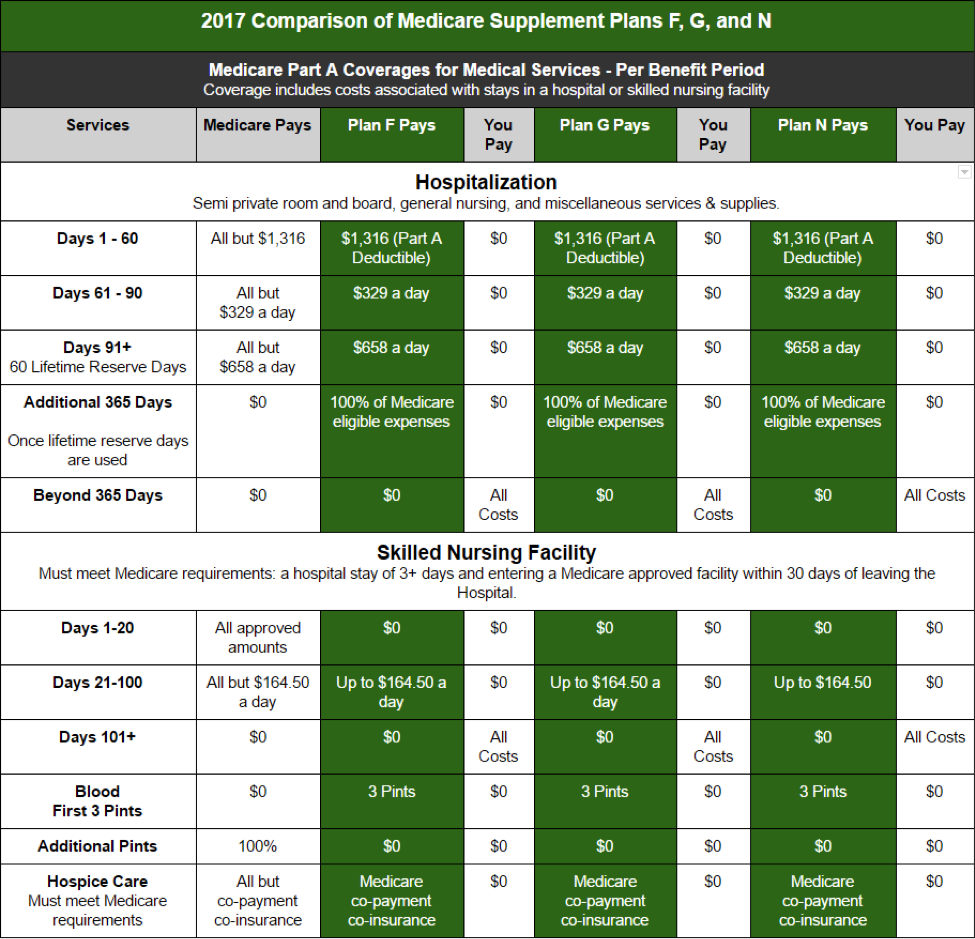

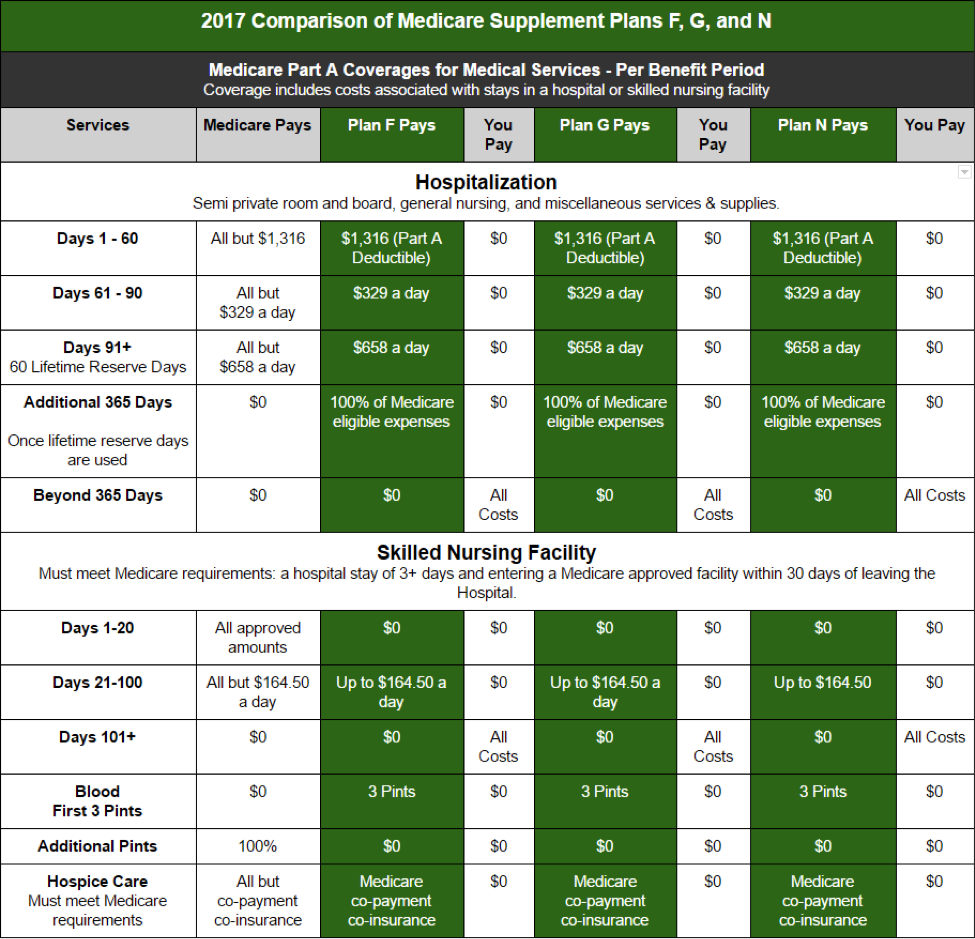

What is the difference between Plan G and Plan N?

When you compare Medicare Supplement Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Medicare supplement Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

What is the out-of-pocket maximum for Medigap Plan G?

There is no limit on how much your plan pays each year. You can't “use up” your benefits. Plan G pays 100% of your out-of-pocket costs (except for the Part B deductible), regardless of the cost of your medical care.Sep 22, 2021

What is the most comprehensive Medicare supplement plan?

Overview. Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

The Medicare Supplement Plan G is a Medigap insurance policy. Medigap plans can fill in the gaps in Original Medicare coverage. For example, when y...

What Is Medigap insurance?

Medigap, or Medicare supplement plans, are additional policies that can cover some or all of the gaps in Original Medicare. This includes copayment...

Is it Medicare Part G or Plan G?

The correct name is “Plan G.”

What Does Plan G Not Cover?

Medicare Plan G coverage is robust, but it doesn’t cover everything. The most notable thing Plan G doesn’t cover is the Part B deductible.

What is the Difference Between Medicare Supplement Plan F and Plan G?

Plan F and Plan G are the most comprehensive Medigap policies. Both plans will cover most of the gaps in your Medicare coverage, but you can’t purc...

How Much is the Monthly Premium for Plan G?

Medigap plans like Plan G are offered by private insurance agencies. Unlike Original Medicare, there’s not a federally mandated price tag. Instead,...

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

What is a Part D plan?

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

What is the deductible for diabetes without Plan G?

Without Plan G, your yearly cost for all that care would be the Part B deductible of $203 plus all the copays and coinsurance required for your diabetes supplies and care. With Plan G, once you pay the deductible, you are 100% covered for those costs; you never pay another dollar that year.

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

What is a Part B coinsurance?

Part B coinsurance or copayment. Part B excess charges. Blood (the first three pints needed for a transfusion) Skilled nursing facility coinsurance. Foreign travel emergency care (up to plan limits of $50,000) The only thing that Plan G does not cover that Plan F does is the Part B deductible.

Medicare Plan G Coverage

Probably the easiest way to explain what Medicare Plan G covers, is to simply explain what it doesn’t cover. Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible.

Medicare Supplement Plan G – What it Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Plan G vs Plan F

Medicare plan F used to be the plan with the highest coverage. It paid 100% of all your medical bills for you, including the Medicare Part B deductible.

Medicare Part G Cost

Medicare Plan G varies in cost based on where you live, your age, gender, tobacco use, and if you qualify for a household discount or not. The cost for Plan G Medicare ranges from $85 – $120 per month.

What It Will Cost You

Nationwide, the average premium for the most popular Medigap F plan costs roughly $326 a month. There is also a high-deductible F plan , and that premium averages about $68 a month. Premiums are based on three pricing systems and vary widely based on where you live.

Compare Medigap Plan G With Other Medicare Supplement Plans

All 10 Medigap policies must follow federal and state laws designed to protect the policy holder. Basic benefit details of each plan letter must be the same no matter where the plan is purchased. Cost is generally the only difference between Medigap policies of the same letter, as the insurance companies may charge different rates for these plans.

Supplemental Insurance Will Cover Some Deductibles And Copays

En español | If you decide to enroll in Original Medicare, one way you can help pay the extra costs the program doesnt cover is to buy a supplemental or Medigap insurance policy.

Finding Medicare Supplement Plan G

Remember, like other Medicare Supplement insurance plans, basic benefits are standardized across each letter category. So Plan G basic benefits are exactly the same, no matter which insurance company you purchase the policy from.

Medicare Plan G What You Need To Know

If you are a recent Medicare Part B enrollee and want to switch plans, Plan G is the way to go. There are no co-pays or deductibles with Plan G, and you can take advantage of its generous coverage. If you are not sure whether you qualify for Medicare plan F, you can call eHealths licensed insurance agents to learn more about your options.

How To Shop For Medicare Plan G

The most important thing to consider when shopping for Medigap insurance is the fact that every company has identical coverage, but they all charge different rates for it.

What Does Medicare Supplement Plan G Cover

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

Key Takeaways

If you’re enrolled in Original Medicare, a Medicare Plan G policy lowers out-of-pocket costs.

What is Medicare Plan G?

The Medicare Supplement Plan G is a Medigap Insurance policy. Medigap plans can fill in the gaps in Original Medicare coverage. For example, when you access healthcare, Medicare Part B steps in and covers 80% of the cost. However, you’re left with 20% of the bill. That’s where Medicare Plan G coverage comes in handy.

Medicare Plan G Coverage

Plan G is one of the most comprehensive Medigap plans you’ll find. If you’re enrolled in a Plan G, most of your healthcare services will be completely covered.

What is the Difference Between Medicare Supplement Plan F and Plan G?

Medicare Plan F and Plan G are the most comprehensive Medigap policies. Both plans will cover most of the gaps in your Medicare coverage. Let’s take a closer look.

How Much is the Monthly Premium for Plan G?

Medigap plans like Plan G are offered by private insurance agencies. Unlike Original Medicare, there’s not a federally mandated price tag. Instead, each insurance agency can set their own monthly premiums. Your monthly costs vary depending on your state, your provider, and the policy you choose.

How Does Medicare Plan G Compare to Medicare Advantage

You can’t have Medicare Plan G and a Medicare Advantage plan, so choose wisely.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

Does Medicare pay your portion?

It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a popular and comprehensive MedSup plan. Here's why it may be the best MedSup plan for you. Medicare Part G — or Plan G — is one of the most popular Medicare Supplement plans available. Plan G sits just behind Plan F in terms of popularity among American Medicare enrollees who want a bit more coverage.

How much does Medicare Supplement Plan G cover?

Up to three pints of blood for medical procedures each year. Medicare Supplement Plan G also covers 80% of medical care you receive while traveling outside the U.S., up to your plan’s limits.

What is the difference between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cover that cost. Of course, the Part B deductible is just $198 this year, but a buck is a buck, right? However, MedSup Plan G premiums tend to be cheaper than Plan F premiums.

Why do people choose Medicare Supplement Plan G over Plan F?

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees. Thanks to the Medicare Access and CHIP Reauthorization Act of 2015, insurers can’t sell MedSup Plan F to people who became eligible for Medicare on or after Jan. 1, 2020.

What is the deductible for Medicare Part B 2020?

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, you’ll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy. Also, Plan G usually doesn’t cover prescription drugs.

Do you pay Medicare Part B premium?

You pay your monthly Medicare Part B premium. If you receive benefits from Social Security, the Railroad Retirement Board or the Office of Personnel Management, your premium will be automatically deducted from your benefit payment. You also pay the monthly premium for your Plan G policy.

Does Medsup cover Medicare Part B?

Although MedSup Plan G helps you pay most of the healthcare costs Original Medicare, or Medicare Part A and Part B, doesn’t cover, it doesn’t help you pay all of them. For example, MedSup Plan G doesn’t cover the Medicare Part B deductible. You’ll pay for all medical services or supplies until your out-of-pocket costs reach ...

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

What is the second most comprehensive Medicare supplement plan?

The plans are named by letter, ranging from A to N. Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity. 1.

Why do people call Medicare Supplement Plans “Medigap”?

Some people call Medicare supplement plans “Medigap” because they “fill in the gaps” that exist in Medicare. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. The plans are named by letter, ranging from A to N.

How to contact Debra from Medicare?

Call a Licensed Agent: 833-271-5571. Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesn’t accept Medicare assignment.

Does Debra have a Medigap Plan G?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

What does Plan G cover?

Plan G covers Skilled Nursing and rehab facility stays and also Hospice care.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G – What does it cover? Plan G is a great option if you’re looking for a plan that has comprehensive benefits and low out of pocket costs.#N#All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company.

Does Plan G save you money?

Even though Plan F covers the Part B deductible, it’s usually at a much higher cost each month for Plan F premiums . The insurance company charges you much more to pay that deductible for you.

How it works

After Medicare pays its approved portion of medical costs, Medigap Plan G helps pay for remaining out-of-pocket expenses. You must pay a separate monthly premium for Medigap coverage.

Compare alternative plans

For those who are eligible, Plan F covers everything in Plan G, plus the Part B deductible; however, plans covering the Part B deductible can’t be sold to most new Medicare members anymore.