How Does Medicare Work?

- The basics. Established in 1965, Medicare is a federal health insurance program that provides benefits to seniors and those with disabilities and certain illnesses.

- Medicare eligibility. You or your spouse worked enough years to be eligible for Social Security or Railroad Retirement benefits.

- Enrolling in Medicare. ...

- Medicare costs. ...

Full Answer

What is the Medicare process and how does it work?

You generally pay a set amount for your health care ( deductible ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share ( coinsurance / copayment ) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. You usually pay a monthly premium for Part B.

How can you tell if someone has Medicare?

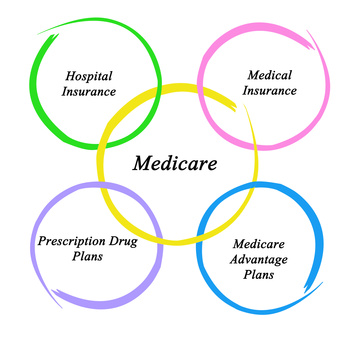

Medicare has four parts. Parts A and B are called Original Medicare. They're run by the federal government. Medicare Part C is called Medicare Advantage. You buy Medicare Advantage plans from private health insurance companies that contract with the government. They work with Original Medicare coverage. Part D covers prescription drugs.

What are the pros and cons of Medicare?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs.

How do I get Started with Medicare?

How does Medicare work? With Medicare, you have options in how you get your coverage. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage. There are 2 main ways: Original Medicare. Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). You pay for services as you get them.

How does Medicare work in simple terms?

Medicare is our country's health insurance program for people age 65 or older and younger people receiving Social Security disability benefits. The program helps with the cost of health care, but it doesn't cover all medical expenses or the cost of most long-term care.Oct 24, 2019

Do you have to pay for Medicare?

Most people don't have to pay a monthly premium for their Medicare Part A coverage. If you've worked for a total of 40 quarters or more during your lifetime, you've already paid for your Medicare Part A coverage through those income taxes.

Do you automatically get Medicare with Social Security?

You automatically get Medicare because you're getting benefits from Social Security (or the Railroad Retirement Board). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. when you applied for benefits.

How is Medicare paid?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is the cost of Medicare Part D for 2021?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Are you automatically enrolled in Medicare Part A when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Does Medicare make a profit?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).Aug 20, 2019

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover health care?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it. Whether you have other health insurance that works with Medicare.

How much does Medicare pay for coinsurance?

When you have Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for most medical services covered under Part B. Medicare Advantage plans use copays more than coinsurance. Which means you pay a fixed cost. You might have a $15 copay for doctor office visits, for example.

What is Medicare Advantage?

You buy Medicare Advantage plans from private health insurance companies that contract with the government. They work with Original Medicare coverage. Part D covers prescription drugs. Many Medicare Advantage plans combine Parts A, B and D in one plan. And each Medicare plan only covers one person.

Why are Medicare Advantage plans so popular?

Medicare Advantage plans are popular because of their convenience. Most plans combine medical and prescription coverage on one card. Some offer dental and vision coverage, too. And you're able to predict your out-of-pocket costs better than you can with Original Medicare.

What happens if you don't have a Medicare Advantage plan?

That means that if you don't have a Part D plan through an employer or union, you may face a penalty if you don't buy one on your own. And supplement plans don' t come with the extra benefits you often get with Medicare Advantage, like dental and vision coverage.

Can Medicare Supplement replace Original Medicare?

In a way, Medicare Advantage replaces Original Medicare and connects all the pieces together on one plan. Supplement plans don't replace Original Medicare. It's more like an extra you can add on top of Original Medicare.

Does Medicare cover prescription drugs?

Medicare Part D covers prescription drugs. You get it through a Part D prescription drug plan or through a Medicare Advantage plan. But it works differently from prescription coverage that comes with other health insurance plans. Medicare Part D prescription coverage has something called the coverage gap, or donut hole.

Does Medicare have a cap?

That means once you spend a certain amount of money on health care each year, your plan pays 100 percent of the cost of services it covers. Original Medicare doesn't have this cap. So if you get really sick, you'll end up paying a lot.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is Medicare for?

Medicare is the federal health insurance program for: 1 People who are 65 or older 2 Certain younger people with disabilities 3 People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What are the requirements for Medicare?

Certain individuals under 65 are eligible for Medicare as well -- namely: 1 Anyone who's permanently disabled and has received disability benefits for at least two years. 2 Those with end-stage renal disease (ESRD). 3 Those with ALS (Lou Gehrig's disease).

Who is eligible for Medicare?

Certain individuals under 65 are eligible for Medicare as well -- namely: Anyone who's permanently disabled and has received disability benefits for at least two years. Those with end-stage renal disease (ESRD). Those with ALS (Lou Gehrig's disease).

What is Medicare Advantage?

Established in 1965, Medicare is a federal health insurance program that provides benefits to seniors and those with disabilities and certain illnesses. Medicare has several parts. Part A covers hospitals, nursing facilities, and home health services. Part B covers preventative services like doctor visits, diagnostic tests, and medical equipment. Part D covers prescription drugs, and Part C, also known as Medicare Advantage, offers its own additional benefits. While Part A is typically free, Parts B, C, and D come with premiums.

How old do you have to be to qualify for Medicare?

Medicare eligibility. If you're a U.S. citizen or have been a permanent legal resident for at least five years, your Medicare eligibility starts at age 65 provided you meet these requirements: You or your spouse worked enough years to be eligible for Social Security or Railroad Retirement benefits.

What happens if you miss your enrollment period?

If you fall into the latter category and fail to sign up during your initial enrollment period, you may be hit with a penalty. If you miss your initial enrollment period, you'll be able to sign up during the general enrollment period, which runs from Jan. 1 to March 31 each year.

Who is Maurie Backman?

Maurie Backman is a personal finance writer who's passionate about educating others. Her goal is to make financial topics interesting (because they often aren't) and she believes that a healthy dose of sarcasm never hurt anyone. In her somewhat limited spare time, she enjoys playing in nature, watching hockey, and curling up with a good book.

Who manages Medicare?

The Centers for Medicare & Medicaid Services (CMS) manages the national Medicare program. Governing the enrollment process is a joint effort between CMS and the Social Security Administration (SSA). When you apply for Medicare benefits, the SSA is the entity that processes your application.

What is Social Security Statement?

The “Your Social Security Statement,” which is a personalized report the SSA updates annually for U.S. workers, informs individuals if they have enough credits to qualify for Medicare when turning 65. These credits reflect income earned with the potential to accrue four credits per year.

What is Lou Gehrig's disease?

Are younger than 65 and have certain permanent disabilities. Have ALS (amyotrophic lateral sclerosis), which is commonly referred to as Lou Gehrig’s disease. If you do not fall into one of the above scenarios, an application is required.

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.