How Does the Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

How much does it cost for Medicare Part D?

The Medicare Part D deductible is the amount you pay for your prescription drugs before your Part D drug plan pays its share. Medicare puts a limit on how much a plan can charge for a deductible. The limit can change each year. For 2021, the …

How much will Medicare Part D cost me?

Oct 10, 2021 · The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020. But not all plans have deductibles, and some have deductibles that are lower than the maximum allowed . After the deductible is met, PDP policyholders pay copays or coinsurance during their initial coverage period until the total of their prescription drug costs …

What you should know about Medicare Part D?

Apr 16, 2020 · A Medicare Part D deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to pay its share of your medications that are covered. This is for a calendar year and resets every January 1.

How do I know if I have Medicare Part D?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can’t be greater than $445 a year. In 2021, the Medicare Part D deductible can’t be greater than $445 a year.

How does deductible work with Medicare Part D?

Deductible phase Most Medicare part D plans have a deductible, or a certain amount of money before the plan kicks in. So, that means you'll pay 100% of your prescription costs until you reach your deductible.

How much is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

Do Medicare Part D plans have deductibles?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

How does a prescription drug deductible work?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.Mar 9, 2021

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is a Part D deductible?

Your Medicare Part D deductible is determined by your plan. It's the amount you spend per year before your plan pays its share of covered prescriptions. Medicare sets a limit on the total Part D deductible amount. The maximum Medicare Part D deductible in 2022 is $480.Dec 30, 2021

What is the Part D deductible for 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Can you use GoodRx If you have Medicare Part D?

So let's get right to it. While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.Aug 31, 2021

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Do you pay full price before deductible?

All Marketplace health plans pay the full cost of certain preventive benefits even before you meet your deductible. Some plans have separate deductibles for certain services, like prescription drugs.

Does medication go towards deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount. This doesn't mean your prescriptions will be free, though.Jan 19, 2022

Do I Need A Medicare Part D Plan?

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

What is deductible in Medicare?

You may have various out of pocket costs with Medicare insurance, including copayments, coinsurance, and deductibles. “Deductible” is a common term in insurance. Generally the lower the deductible, the less you are responsible for paying out-of-pocket before your insurance coverage kicks in.

What are the tiers of Medicare Part D?

Medicare Part D plan prescription drug tiers are usually set such that the lower the tier number , the less expensive the drug, as in the following example:: Tier 1: preferred generic, generally the lowest cost tier. Tier 2: generic, generally cost more than tier 1. Tier 3: preferred brand, generally cost more than tier 2.

How much is Medicare Part D 2020?

According to 2020 eHealth research, the average deductibles for stand-alone Medicare Part D plans in the study increased from $335 in 2019 to $405 in 2020.*. Some Medicare Part D plans have $0 deductibles, which means you are only responsible for a set copayment or coinsurance amount when you pick up your prescription drugs.

What is tier 5?

Tier 5: specialty tier, generally cost more than tier 4. Tier 6: select care drugs. If you only take generic prescription drugs, for example, you may not be subjected to the deductible in certain plans.

What happens when you reach your Part A or Part B deductible?

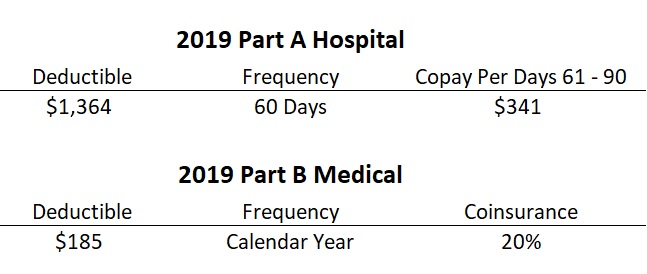

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

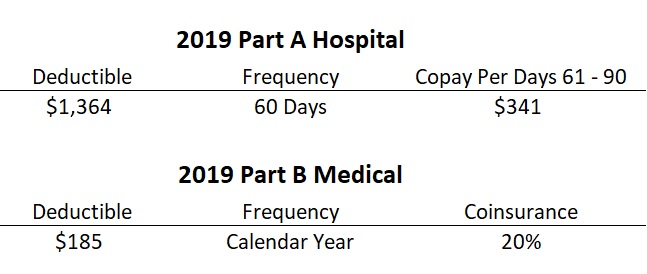

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...