How does the revised Medicare Shared Savings Program work?

- Promote beneficiary engagement by offering incentives to maintain good health

- Develop a method for linking quality and financial performance and report regularly on both quality and cost

- Provide coordinated care within the ACO

Full Answer

Why is primary care matters in Medicare Shared Savings Program?

Within the Medicare Shared Savings Program, primary care doctors would be required to monitor a patient's medical costs when making referrals. However, this is a very complex request when considering the current health care delivery system. The problem revolves around the lack of cost transparency.

Can Medicare take my savings?

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) deductibles, coinsurance, and copayments if you meet certain conditions.

What is shared savings healthcare?

Shared savings is a payment strategy that offers incentives for providers to reduce health care spending for a defined patient population by offering them a percentage of net savings realized as a result of their efforts. The concept has attracted great interest, in part fueled by Affordable Care Act provisions that create accountable care ...

Does a Medicare Advantage plan replace original Medicare?

When enrolled in Medicare Advantage, you will receive your Part A and Part B benefits through your Medicare Advantage plan except for hospice care, which you will continue to receive through Part A. In this sense, Medicare Advantage does “replace” Original Medicare, because almost all of your Original Medicare benefits will be obtained through your Medicare Advantage plan.

How does the shared savings program work?

The Shared Savings Program is a voluntary program that encourages groups of doctors, hospitals, and other health care providers to come together as an ACO to give coordinated, high quality care to their Medicare beneficiaries. To learn more about ACOs, visit the Accountable Care Organizations webpage.

How does ACO shared savings work?

When an ACO achieves a certain level of savings, an ACO can “share” in the savings with its payer, whether it be Medicare, Medicaid, and/or a commercial insurer. Shared savings payouts are generally contingent upon quality performance to ensure that ACOs are not withholding needed services in order to retain savings.

Do Medicare beneficiaries need to be notified that their physician is participating in a Medicare Shared savings Program ACO?

Individuals enrolled in Medicare Advantage plans under Part C, an eligible HMO organization under section 1876, or a PACE program cannot be assigned to an ACO. Medicare ACOs must notify patients that they are participating in an ACO.

When did the shared savings program start?

2012MSSP began in 2012 with two participation options, Track 1 and 2. MSSP Track 3 was added in 2016, and Track 1+ was added in 2018. CMS created a new program structure for MSSP in 2019 that the agency calls "Pathways to Success".

How do ACOs get reimbursed?

ACOs take value-based reimbursement to a new level by not only tying payments to quality, but also holding providers financially accountable for the care costs of their patient population. Financial risk in ACO contracts can be “upside” or “downside.”

Do ACOs save patients money?

When an ACO succeeds both in delivering high-quality care and spending health care dollars more wisely, the ACO may be eligible to share in the savings it achieves for the Medicare program. In certain instances, an ACO may owe a portion of losses if it increases costs or does not meet certain quality metrics.

What is the intent of an ACO?

The purpose of an ACO is to enable care coordination that allows a patient to receive the right care at the right time while reducing the risk of medical errors and duplicate services.

How do I opt out of Medicare ACO?

Can I opt out of having my health information shared with the ACO? Yes. If you don't want CMS to share your information with the ACO, you can contact CMS at 1-800-Medicare and ask to opt out of data sharing.

What happens if an ACO meets quality targets for less than the payment?

If the ACO meets its targets for less than the payment, it keeps the difference. Depending on the type of contract, ACOs can be responsible for any difference beyond the predetermined amount required to meet its quality targets. There are a variety of risk contracts ACOs can negotiate with payers.

Is ACO an effective method to save money for Medicare?

Program savings in previous years have not been as impressive, according to CMS data. In 2018, for example, ACOs in the program only saved Medicare about $739 million after CMS paid out shared savings. The year before, ACOs saved Medicare just $314 million.

How does Medicare determine which patients will be assigned to the ACO?

Under the Medicare Shared Savings Program Accountable Care Organization (MSSP ACO), beneficiaries will be automatically assigned based on where they receive their primary care.

What is the Medicare Shared savings Program MSSP?

The Affordable Care Act (ACA) established the Medicare Shared Savings Program (MSSP) to facilitate coordination and cooperation among healthcare providers, in order to improve the quality of care for Medicare Fee-For-Service (FFS) beneficiaries and reduce unnecessary costs.

How much Medicare Part B do you have to pay for incentive payments?

To be eligible for incentive payments under MIPS, physicians must receive 25% of their Medicare Part B payments or see 20% of their patients through the advanced APM.

What is MSSP in healthcare?

Medicare Shared Savings Program (MSSP) Provide high-quality, coordinated care to improve outcomes and reduce costs. That’s the primary goal of the Medicare Shared Savings Program (MSSP). The MSSP is an alternative payment model in which eligible providers, hospitals, and suppliers are rewarded for achieving better health for individuals, ...

What is track 1 in ACO?

It can only benefit from the shared savings that are generated. Track 1 is often viewed as a stepping stone to help the ACO ‘test the waters’ and initiate best practices and integration necessary to achieve and sustain lower costs. Savings are limited to a maximum of 50% each year.

Is an ACO higher than MSSP?

In other words, the ACO’s actual costs will be higher than the anticipated ones. Without complete and accurate HCC capture, ACOs may not be able to stay below the MSSP benchmark even when cost reduction efforts have been maximized. Another consideration is that joining or forming an ACO may require significant costs.

Can Medicare beneficiaries choose any provider?

Medicare beneficiaries can continue to choose any provider who accepts Medicare—even if that provider is not part of the ACO. However, beneficiaries benefit from seeing providers in the ACO network because these providers all have a vested interest in providing coordinated, high-quality care.

Is MSSP still in the spotlight?

As the industry continues to shift toward value-based payment models, the MSSP will likely continue to remain in the spotlight. By rewarding providers to improve outcomes and lower costs, the MSSP will gain even more traction. DUMMYTEXT.

Does MSSP require an ACO?

Another consideration is that joining or forming an ACO may require significant costs. MSSP ACOs that include separately recognized legal entities must establish a new legal entity for the combined participants. Each ACO must also create a governing body that represents providers, suppliers, and beneficiaries.

What is shared savings?

The Shared Savings Program is an important innovation for moving the Centers for Medicare & Medicaid Services' (CMS') payment system away from volume and toward value and outcomes. It is an alternative payment model that: 1 Promotes accountability for a patient population. 2 Coordinates items and services for Medicare FFS beneficiaries. 3 Encourages investment in high quality and efficient services.

When does the ACO share savings program start?

The following table summarizes participation options under the BASIC track and ENHANCED track for agreement periods of at least five years, beginning on July 1, 2019, and in subsequent years.

What is Medicare ACO?

The Medicare Shared Savings Program (Shared Savings Program) offers providers and suppliers (e.g., physicians, hospitals, and others involved in patient care) an opportunity to create an Accountable Care Organization (ACO). An ACO agrees to be held accountable for the quality, cost, and experience of care of an assigned Medicare fee-for-service ...

What is MSSP in healthcare?

The MSSP is open to qualifying Accountable Care Organizations (ACOs), which are groups of healthcare stakeholders that have reimbursement tied to quality and cost metrics. Under the MSSP, participating ACOs receive incentive payments for meeting certain benchmarks each year. The MSSP is a type of Alternative Payment Model (APM) ...

When was the MSSP overhauled?

To further increase Medicare savings, CMS overhauled the MSSP in 2018. The overall goal of the revised program, called Pathways to Success, is to reward providers willing to take on more risk by giving them more flexibility in delivering high-quality care. CMS finalized the rule authorizing the updated program on December 21, 2018.

When do ACOs receive incentive payments?

ACOs receive incentive payments when they exceed quality thresholds and spending falls below a minimum savings rate. If they don’t meet those goals, they are not penalized. In years three through five, BASIC-track ACOs take on increasing levels of risk, and share in both savings and losses up to a cap.

Can Medicare beneficiaries choose any provider?

Medicare beneficiaries can choose any Medicare-enrolled provider they wish, regardless of MSSP participation. Hospitals and physicians that participate in the MSSP are motivated to provide quality, coordinated care without excessive cost.

Can an ACO participate in MSSP?

If your organization is part of an ACO, it can participate in the MSSP. The MSSP encourages physicians, medical groups and other providers to join forces to form ACOs. Participating ACOs agree to be held accountable for assigned Medicare fee-for-service beneficiaries.

Does Medicare benefit from MSSP?

With that in mind, Medicare beneficiaries may benefit from choosing an MSSP-affiliated provider. CMS requires healthcare providers to display a poster that acknowledges their participation in the MSSP.

What is MSSP in healthcare?

The MSSP consists of three tracks, and the incentives vary across the trio. Providers willing to take more risk are capable of gaining greater rewards. Beneficiary assignment dictates who becomes an ACO patient and decides how much an organization earns.

How much do you have to save for ACO track 1?

Organizations must save a certain amount before they are eligible for rewards. For Track 1, you must save 2to3.9 percent of the cost benchmark ; the exact percentage depends on the number of patients you treat. The rate is lower for ACOs that treat a large number of patients. For Tracks 2 and 3, organizations can choose no savings limit, a range between 0.5 and 2 percent, or a range that depends on the number of patients seen.

What is the key tenet of MSSP?

The key tenet of the MSSP is the use of quality performance measures by ACOs. It is certainly a tricky task as providers are expected to link financial performance with quality. The CMS says that quality measures must focus on continuous improvement, and it revolves around these three goals:

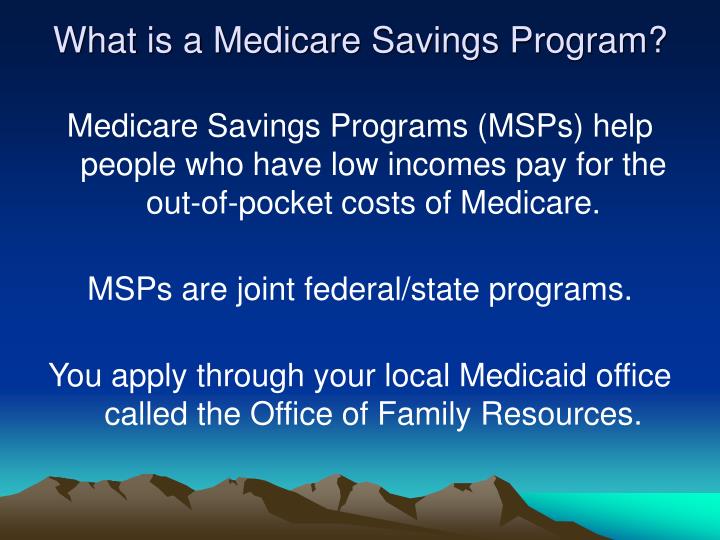

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.

What is shared savings program?

Under the Shared Savings Program, the ACO providers and suppliers will continue to be paid for services rendered to fee-for-service Medicare beneficiaries in the same manner as they would otherwise. In addition, the participating ACO will be eligible to receive a shared savings payment if the ACO meets the quality performance standards and has generated shareable savings under the performance-based payment methodology described in the rule.

What is Medicare ACO?

20, 2011, the Centers for Medicare & Medicaid Services (CMS), an agency within the Department of Health and Human Services (HHS), finalized new rules under the Affordable Care Act to help doctors, hospitals, and other health care providers better coordinate care for Medicare patients through Accountable Care Organizations (ACOs). ACOs create incentives for health care providers to work together to treat an individual patient across care settings – including doctor’s offices, hospitals, and long-term care facilities. The Medicare Shared Savings Program (Shared Savings Program) will reward ACOs that lower their growth in health care costs while meeting performance standards on quality of care and putting patients first. Provider participation in an ACO is purely voluntary.

What is the difference between ACO and MSR?

Under the one-sided model, the MSR varies with the size of the ACO’s assigned population such that ACOs with smaller populations (that have more variation in expenditures) have a larger MSR and ACOs with larger populations (that have less variation in expenditures) have a smaller MSR.

Medicare Shared Savings Program

Coming Together to Effect Change

- In the MSSP, teamwork is paramount. To participate, providers must be part of an Accountable Care Organization (ACO), a patient-centered network that shares financial and medical responsibilities with the goal of improving patient care while limiting unnecessary spending. The MSSP requires ACOs to promote evidence-based medicine, engage beneficiaries, report internall…

Financial Risk and The MSSP

- To understand truly understand the role of ACOs in the MSSP, one must understand the concept of financial risk. It’s the idea that ACOs in the MSSP can—and should—take on some degree of responsibility for lowering costs (i.e., ensuring that actual expenditures don’t exceed updated historical benchmark data). When they don’t accomplish this goal, they may be penalized. Howe…

Quality and The MSSP

- To be eligible for any shared savings that are generated, ACOs must also meet the established quality performance standards for 31 quality measures(29 individual measures and one composite that includes two individual component measures). These MSSP quality measures span the following four quality domains: 1. Patient/caregiver experience 2. Care coordination/pa…

The MSSP from The Beneficiary’S Perspective

- Medicare beneficiaries can continue to choose any provider who accepts Medicare—even if that provider is not part of the ACO. However, beneficiaries benefit from seeing providers in the ACO network because these providers all have a vested interest in providing coordinated, high-quality care.

Important Considerations in The MSSP

- There are several other important concepts to consider when joining an ACO as part of the MSSP. The article, What is an Accountable Care Organization (ACO), provides great insights into some overlying concerns with ACOs today. “Since the inception of ACOs in 2012, many are reaching the limit of their no-risk contracts and are considering whether they want to continue with the Medic…

The Role of The Medicare Shared Savings Program

How Do Providers earn?

- First, only ACOs that serve a minimum of 5,000 Medicare beneficiaries are eligible. All providers must: 1. Promote beneficiary engagement and evidence-based medicine. 2. Provide internal reports on quality and cost metrics. 3. Provide coordinated care across and among specialists, primary care physicians, and acute/post-acute providers. Here are a few things for providers to n…

MSSP Performance and Quality Measures

- The key tenet of the MSSP is the use of quality performance measures by ACOs. It is certainly a tricky task as providers are expected to link financial performance with quality. The CMS says that quality measures must focus on continuous improvement, and it revolves around these three goals: 1. Improved care for patients 2. Improved health for populations 3. A reduction in expendi…

Final Words

- The MSSP will continue to evolve, although it is important to note that setting up an ACO costs an average of $1.6 million. The government has actively sought to improve the programover the last few years; we are interested to see whether the new administration will continue along this path.