Can I still work and get Medicare coverage?

You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance. A period of time when you can join or leave a Medicare-approved plan.

How are drugs covered by Medicare?

Medicare said it needed more information about the drug’s efficacy and safety and said it would ... policy, and life science coverage and analysis. Our award-winning team covers news on Wall Street, policy developments in Washington, early science ...

How to Check my Medicare coverage?

Step by step through the online process

- To sign up. Click the Apply for Medicare Only button.

- You’ll need to accept the terms of service. After you’ve done that, click Next. ...

- On the next screen

- If you have an online Social Security account

- After you’ve logged in

- On the next screen

- If you want to sign up for Part B

- Now provide information

- After you’ve answered those questions. ...

What does Medicare cover and how does it work?

While Original Medicare insurance covers 80 percent of medical and hospital expenses, beneficiaries are responsible for the remaining 20 percent, as well as copayments, coinsurance, and deductibles. And, unless you have additional coverage through a prescription drug (Part D) plan, you end up paying for all your medications out of pocket.

How does the Medicare Part D work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What are the 4 stages of prescription drug coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What percentage does Medicare pay for prescription drugs?

Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs.

Is Medicare Part D worth getting?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Does Medicare Part D have a maximum out-of-pocket?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

How do I avoid the Medicare Part D donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

How much does Medicare Part D cost in 2021?

If your filing status and yearly income in 2019 was:File individual tax returnFile joint tax returnYou pay each month (in 2021)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 and above$77.90 + your plan premium4 more rows

What drugs are not covered by Medicare?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about generic vs. brand-name medications.

Are you automatically enrolled in Medicare Part D?

Enrollment in a Part D prescription drug plan is not automatic, and you still need to take steps to sign up for a plan if you want one. Part D late penalties could apply if you sign up too late. If you want a Medicare Advantage plan instead, you need to be proactive. Pay attention to the Medicare calendar.

How many stages do Part D plans have?

four different phasesThere are four different phases—or periods—of Part D coverage: Deductible period: Until you meet your Part D deductible, you will pay the full negotiated price for your covered prescription drugs. Once you have met the deductible, the plan will begin to cover the cost of your drugs.

What are Tier 4 and 5 drugs?

Level or Tier 4: Nonpreferred brand-name drugs and some nonpreferred, highest-cost generic drugs. Level or Tier 5: Highest-cost drugs including most specialty medications.

What is the initial coverage stage?

You start in this stage after you have met any deductibles associated with your prescription drug plan. In 2021, you remain in this stage until the total cost of your prescription drugs, which includes your copay and the amount your Medicare Part D insurance provider pays for your drugs, reaches $4,130.

What is coverage gap stage?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

What is Medicare Part A?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage. Transplant drugs can be very costly. If you’re worried about paying for them after your Medicare coverage ends, talk to your doctor, nurse, or social worker.

What happens if you get a drug that Part B doesn't cover?

If you get drugs that Part B doesn’t cover in a hospital outpatient setting, you pay 100% for the drugs, unless you have Medicare drug coverage (Part D) or other drug coverage. In that case, what you pay depends on whether your drug plan covers the drug, and whether the hospital is in your plan’s network. Contact your plan to find out ...

How long does Medicare cover after kidney transplant?

If you're entitled to Medicare only because of ESRD, your Medicare coverage ends 36 months after the month of the kidney transplant. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage. Transplant drugs can be very costly.

What is Part B in medical?

Prescription drugs (outpatient) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under limited conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

What is a prodrug?

A prodrug is an oral form of a drug that, when ingested, breaks down into the same active ingredient found in the injectable drug. As new oral cancer drugs become available, Part B may cover them. If Part B doesn’t cover them, Part D does.

What is Part B covered by Medicare?

Here are some examples of drugs Part B covers: Drugs used with an item of durable medical equipment (DME) : Medicare covers drugs infused through DME, like an infusion pump or a nebulizer, if the drug used with the pump is reasonable and necessary.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

What is the next phase of Medicare coverage?

The next phase of your coverage is called your initial coverage phase.

What is the tier 3 drug coverage?

Tier three includes non-preferred, brand-name drugs with a higher copayment than tier two. The initial coverage phase has a limit of $4,020.00 as of 2020. If you reach this amount you move into the next phase. The coverage gap phase begins when you reach the dollar limit set in your initial coverage phase as mentioned above.

How much does Medicare Advantage cost in 2020?

In the case of a standalone plan, you also pay a set annual deductible. As of 2020, the amount can be no more than $435.00 per year.

Is it cheaper to take prescription drugs at home?

Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions and illnesses than ever before. If you are considering getting a Medicare Part D plan to help with the expense of prescription drugs, you may want to know how these plans work.

Does Medicare cover prescriptions?

Original Medicare benefits do not cover prescription drug costs unless the drugs are part of inpatient hospital care or are certain drugs that your health care provider administers in a medical facility. Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions ...

How much does Grace's prescription cost?

It'll cost her around $60 a month. She gives them her prescription and her Medicare Plus Blue PPO ID card. Grace has a $360 pharmacy deductible with her plan. So she'll have to pay the full price for her medication until she's reached $360.

What is Medicare Plus Blue?

Who is this for? If you're a Medicare Plus Blue℠ PPO member, this information will tell you how to use your pharmacy coverage when you need a prescription. If you purchase your own insurance and you have a Medicare Plus Blue PPO plan, you have Part D prescription drug coverage. It's included in your monthly payment and your benefits.

How long does it take to get a refill for a prescription?

You may be able to get a 90-day refill of your prescription, reducing the number of times you have to order your medication or stop by the pharmacy. If you have Medicare Plus Blue PPO Signature or Assure, you can also save money on 90-day refills.

Does Medicare Plus Blue PPO cover Express Scripts?

Medicare Plus Blue PPO has you covered. You can use any pharmacy in the Express Scripts network. Most chain pharmacies are in this network. But if you have to go to an independent pharmacy, just show them your Blue Cross ID card and ask if you're covered.

Does Grace have PPO?

Grace has Medicare Plus Blue PPO Vitality. Her doctor just prescribed the first medication she's needed this year. Her doctor wants her to take alendronate sodium—you might know it by its brand name, Fosamax—for osteoporosis. Grace looks it up in her plan's drug list.

Does Medicare Plus Blue PPO work?

Filling a prescription with a Medicare Plus Blue PPO plan works pretty much like traditional health insurance. But there are some differences. We'll help you understand how your drug coverage works to avoid surprises when it comes time to pay.

How much does Medicare cover after deductible?

A person must meet their deductible before Medicare pays for any medical costs. After meeting the deductible, a person pays a 25% coinsurance and Medicare funds the remaining costs. Once Medicare and an individual have paid $4,020 for prescription drugs in a membership year, the coverage gap begins. In the coverage gap, a person pays 25% of total ...

What is the formulary for Medicare?

Medicare requires that a formulary covers different tiers of medications. Each formulary must have at least two drugs in the most common drug categories, such as diabetes and blood pressure medications. Generic drugs are usually the lowest-cost drugs and serve as an alternative to name-brand drugs.

How to view Medicare Advantage plans?

A person can view available Medicare Advantage plans in their area by using Medicare’s Find a Medicare Plan function. This function allows a person to search by area for available plans that offer prescription drug coverage. If desired, a person can enter the names, dosages, and quantity of medications they regularly take to see how plans cover ...

What happens if you meet your Medicare deductible?

This includes the time they spend in the coverage gap once a person and their plan have met a spending limit for prescription medications. This applies to Part D and many Medicare Advantage plans also.

How much is the deductible for Medicare Advantage?

Medicare Advantage plans have different deductibles. The average deductible for prescription drug plans under Medicare Advantage is $121, according to the KFF. This amount is lower than the standard Medicare Part D plan in 2020, for which the average deductible is $435.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare Advantage?

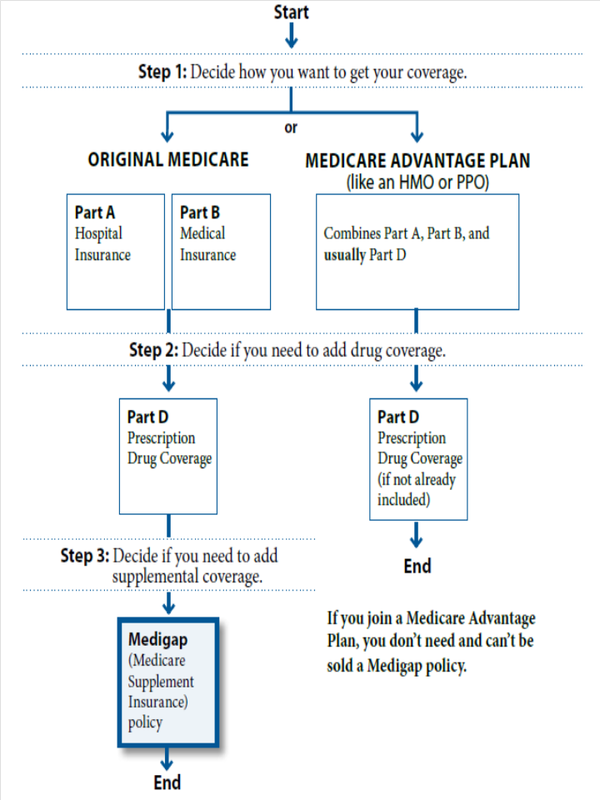

Medicare Advantage is an alternative to Original Medicare, also known as Medicare Part C. Medicare Advantage is a bundled plan incorporating coverage from Medicare Parts A and B. Often, Medicare Advantage plans cover Medicare Part D or prescription drug benefits, and sometimes include vision, dental, and hearing care.

Part D Plans

If you have Original Medicare, not Medicare Advantage, you'll want to look into Part D plans.

Medicare Advantage Plans

Medicare Advantage (Part C) plans offer a simple way to roll prescription coverage into your health insurance plan. Medicare Advantage combines Hospital (Part A), Medical (Part B), and Prescriptions (Part D) into one package. This option offers predictable out-of-pocket costs with low monthly plan premiums.

Disclaimer

BlueCross BlueShield of South Carolina is a Medicare Advantage PPO and HMO plan with a Medicare contract. BlueCross Essential, Rx Value and BlueCross Rx Plus are stand-alone prescription drug plans with a Medicare contract.