If you're shopping around for a Medicare Advantage Plan in your area and Aetna comes up as one of your options, we definitely encourage you to look into it. Their premiums are reasonable, and the company has a solid reputation with the BBB and with agents alike. Aetna is a trustworthy provider of Medicare Advantage policies.

Full Answer

What insurances does Aetna offer?

Apr 13, 2021 · Based on the most recent year of data, Aetna’s 2022 Medicare Advantage plans (Part C) get an average rating of 3.9, and the company’s prescription drug plans (Part D) get an average score of 3.8,...

What is the best Aetna plan?

5 rows · Mar 29, 2022 · For 2022, Aetna’s Medicare Advantage plans with drug coverage received an overall average ...

Is Aetna a good insurance provider?

Mar 29, 2022 · If you're shopping around for a Medicare Advantage Plan in your area and Aetna comes up as one of your options, we definitely encourage you to look into it. Their premiums are reasonable, and the company has a solid reputation with the BBB and with agents alike. Aetna is a trustworthy provider of Medicare Advantage policies. See Plans

What are Medicare supplement plans does Aetna offer?

For 2022, Aetna Medicare Advantage Prescription Drug (MAPD) plans earned an overall weighted average rating of 4.29 out of 5 stars. The majority of Aetna Medicare plan members are in a plan rated 4.5 stars or higher out of 5 stars. 2 These reviews rate Medicare Advantage plans based on: Staying healthy Member complaints Health plan customer service

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Is Aetna Medicare Advantage the same as Medicare?

Both terms refer to the same thing. Instead of Original Medicare from the federal government, you can choose a Medicare Advantage plan (Part C) offered by a private insurance company. These plans include all of the benefits and services of Parts A and B. They may include prescription drug coverage as part of the plan.Oct 1, 2021

What is the rating for Aetna?

2-rated Medicare Advantage plan in the J.D. Power 2021 U.S. Medicare Advantage Survey, with a score of 834 out of 1,000 compared with Aetna's 795....Competition: Aetna vs. Highmark.AetnaHighmarkAM Best RatingA (Excellent)A+ (Excellent)Average CMS Star Rating3.74.23 more rows

Does Aetna have a good network?

Financially, Aetna ranks among the strongest health insurance providers. The company has received an A.M. Best Financial Strength Rating of A (excellent). This means the company is financially strong and has the ability to pay out claims in the future.Mar 30, 2022

What benefits does Aetna offer?

Take care of body and mind with online fitness classes, health coaching, weight-loss programs and mental health services at lower or even no cost. Aetna members may also receive discounts on prescriptions, medical supplies, vision and hearing products, and vitamins and supplements.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Who owns Aetna insurance company?

CVS HealthAetnaTypeSubsidiaryParentCVS Health (2018–present)SubsidiariesCoventry Health Care Healthagen Active Health Management Aetna International First Health PPO Network Unite Health Care MinistriesWebsitewww.aetna.comFootnotes / references10 more rows

Who owns Aetna Medicare?

CVS Health CorporationAetna agrees to be acquired by CVS Health Corporation in a transaction valuing Aetna at about $69 billion.

How do I fight Aetna denial?

You or your doctor may ask for an "expedited" appeal. Call the toll-free number on your Member ID card or the number on the claim denial letter. If your plan has one level of appeal, we'll tell you our decision no later than 72 hours after we get your request for review.

What is out-of-pocket maximum Aetna?

In-network: Individual $7,000 / Family $14,000. Out-of-network: Individual Unlimited / Family Unlimited. The out-of-pocket limit is the most you could pay during a coverage period (usually one year) for your share of the cost of covered services. This limit helps you plan for health care expenses.

What does maximum out-of-pocket mean Aetna?

The out-of-pocket limit is the most you could pay in a year for covered services. If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met.Jan 1, 2017

Do copays count towards deductible Aetna?

You must also pay any copayments, coinsurance and deductibles under your plan. No dollar amount above the "recognized charge" counts toward your deductible or out-of-pocket maximums. To learn more about how we pay out-of-network benefits visit Aetna.com.

What is Medicare Advantage?

Medicare Advantage Plans are a way of getting your Medicare Part A and Part B coverage through private companies approved by Medicare. These insure...

Who is eligible to get a Medicare Advantage plan?

If you have Medicare Part A and Part B, and there's a plan that is available where you live, you're eligible for Medicare Advantage. Bear in mind t...

Are there any deadlines I should be aware of?

Yes! You can enroll in a Medicare Advantage plan either when you first sign up for Medicare A & B or during the yearly enrollment period from Octob...

What's the difference between Advantage and Medigap?

There are many differences between these two types of additional Medicare coverage. Medicare Supplement Plans, or Medigap, are designed to pay the...

Will dental, vision and/or hearing coverage be included?

That depends on the plan you select. However, one of the reasons Advantage plans are so attractive is because many of them do include dental, visio...

Will prescription drugs be covered?

That also depends on the plan you choose. Almost every Medicare Advantage plan will still have out-of-pocket costs for prescriptions. When getting...

How much will I likely pay in premiums?

Believe it or not, there are Medicare Advantage policies that have $0 monthly premiums. Of course, you get what you pay for - and if you want broad...

Should I buy my Medicare Advantage plan through a broker or directly from the insurer?

That's a matter of preference. But, it can be helpful to start your search by using a website that offers quotes from multiple insurers, so that yo...

What do Aetna Medicare Advantage Plans cover?

Aetna Medicare Advantage Plans are comparable in their scope of coverage to other Medicare Advantage Plans, offering all the benefits of Original Medicare, along with coverage for additional health services. Medicare Advantage Plans, also called Medicare Part C, often include prescription drug, vision, and dental coverage and wellness programs.

What are Aetna Medicare Advantage Plan options?

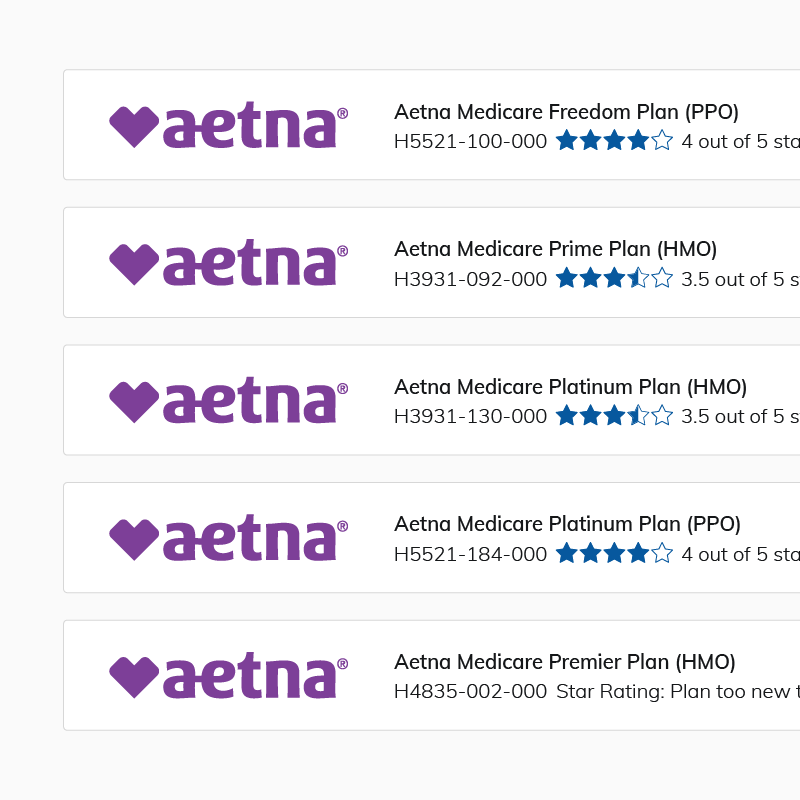

Aetna has five major Medicare Advantage Plans, although the options available to you may vary based on your location. Of these plans, four of them are PPOs, and one is an HMO. With HMOs, you’re required to choose a primary care physician and get health care services from in-network providers.

Aetna Medicare Advantage Plans reviews and ratings

Overall, Aetna’s customers give positive feedback regarding their experience with the company and the claims process. Aetna scores consistently well across various consumer review sites.

How to buy Medicare Advantage Plan?

There are two main approaches to buying a Medicare Advantage Plan: go directly to an insurance company or work with a broker. Buying your policy right from an insurer can feel more reliable, choosing a company you already know and trust, maybe even one that has been your healthcare insurance provider in the past.

How long has Aetna been in business?

Aetna. Not many providers of Medicare Advantage Plans can say that they've been in business for over 100 years. Aetna has been around for more than a century and a half! You'll often find their policies quoted by brokers and referral services, because their coverage area is very broad and their plans are quite popular.

Is Aetna a good Medicare provider?

Their premiums are reasonable, and the company has a solid reputation with the BBB and with agents alike. Aetna is a trustworthy provider of Medicare Advantage policies. See Plans.

How to contact Aetna Medicare Advantage?

Aetna makes it easy to find highly rated Medicare Advantage plans. A licensed insurance agent can help you compare Aetna Medicare Advantage plans that may be available in your area. Speak with a licensed insurance agent by calling. 1-877-890-1409. 1-877-890-1409 TTY users: 711 24 hours a day, 7 days a week.

What is the average rating for Aetna?

For 2020, Aetna Medicare Advantage Prescription Drug (MAPD) plans earned an overall weighted average rating of 4.3 out of 5 stars. The majority of Aetna Medicare plan members are in a plan rated 4.5 stars or higher out of 5 stars. 2.

Does Aetna offer Medicare Advantage?

Aetna offers several Medicare Advantage plan (also called Medicare Part C) options. If several Aetna Medicare Advantage plans are offered where you live, you can use the Medicare Star Ratings as an easy tool to help you compare plans.

What is Aetna health insurance?

What to Know about Aetna. Aetna is one of the nation’s oldest and leading healthcare insurance providers. The company was founded in 1853 and is headquartered in Hartford, Connecticut. Aetna was acquired by CVS Health Corp. in 2018, and is the third-largest provider of health insurance and services.

What is Aetna website?

Aetna’s website provides extensive tools, resources, and support for members. From the website, health insurance customers can shop for a plan. The Aetna member website allows health, dental, and vision members to do the following. Aetna also offers its members a mobile app that allows them to do the following.

What is the Aetna Attain app?

What’s more, a separate mobile app called Attain by Aetna is available to help members stay healthy. Designed in collaboration with Apple, the Attain app combines a member’s health history with Apple Watch activity to offer personalized goals, achievable actions, and rewards for hitting certain milestones.

How to contact Aetna insurance?

Aetna Customer Service. To learn more about Aetna insurance products or to receive a quote, visit the Aetna website or call 1-800-US-AETNA (1-800-872-3862) between the hours of 7:00 a.m. and 7:00 p.m. ET. Members can contact Aetna in the following ways. Contact the Member Services phone number on your ID card.

How many employees does Aetna have?

Aetna has over 35,000 employees nationwide with revenue in excess of $35 billion. Aetna is rated A (excellent) by AM Best, and has high ratings from several other financial ratings services. AM Best is a credit rating firm that assesses the creditworthiness of and/or reports on over 16,000 insurance companies worldwide.

Why did Aetna stop offering health insurance?

The company stopped offering individual health insurance plans in 2018 due to revenue losses on the healthcare marketplace.

Does Aetna work with independent insurance?

Does not work with independent insurance agents. Aetna Pros: Aetna is a well-established and financially strong company with high ratings from AM Best and numerous other financial ratings bureaus. Offers nationwide coverage, HSAs, and wellness programs with its health plans. Excellent customer service options via online account.

Aetnas Medicare Plans: Medicare Advantage Plan Types

Aetnas Medicare Advantage plans include a wide variety to suit different needs and preferences. Aetnas Medicare health plan options vary by location and may include all or some of the following types:

What Medicare Advantage Plans Does Aetna Have

You may have heard that Medicare Advantage plans are an alternative way to get your Medicare benefits from a private insurance company. As the name suggests, Medicare Advantage plans may have some advantages that Original Medicare doesnt have, including additional benefits and coverage.

Reason : You Are More Likely To See A Nurse Practitioner Than A Doctor

In many cases this is true. HMO and PPO health plans use a method called capitation to pay providers. A capitated contract pays a provider in the plans network a flat fee for each patient it covers.

Competition: Aetna Vs Highmark

Highmark is the No. 2-rated Medicare Advantage plan in the J.D. Power 2021 U.S. Medicare Advantage Survey, with a score of 834 out of 1,000 compared with Aetna’s 795.

Switch Your Plan Not Your Doctor

Though you have a new plan option, chances are you may be able to continue seeing your doctors. This is because this plan is the Aetna Medicare Plan with an extended service area . This is a type of Medicare Advantage plan.

Health Maintenance Organization Point Of Service Plans

HMO-POS plans are very similar to HMO plans as they require individuals to have a primary care provider and are cost-efficient. However, they often provide greater flexibility when it comes to getting referrals for specialists or seeing providers that are out-of-network.

What Are Aetna Medicare Advantage Plan Options

Aetna has five major Medicare Advantage Plans, although the options available to you may vary based on your location. Of these plans, four of them are PPOs, and one is an HMO. With HMOs, youre required to choose a primary care physician and get health care services from in-network providers.

What is Medigap insurance?

A Medigap policy is supplemental insurance that offers help paying out-of-pocket expenses for Original Medicare. The Aetna Medicare Supplement plan options vary by service area, so be sure to review the Aetna Medigap plan options available in your state.

What is Medicare Part A and Part B?

Medicare Part A and Part B are managed by Centers for Medicare & Medicaid Services, a federal agency. Medicare Part A covers care received in hospitals or care facilities. Medicare Part B covers other medical treatment, like medical tests and doctor visits. To enroll in these programs, Medicare beneficiaries work through the Social Security office.

Does Aetna have a fitness program?

Most also include qualifying prescription drug coverage, which means you don't have to buy a separate prescription drug plan to cover medications. Aetna offers a fitness program, 24/7 nurse access, and support for social and home life with most of its Medicare Advantage plans.

Is Aetna Medicare a negative company?

Since there are so few reviews, a full recommendation based on the customer experience is not available. Unfortunately, most of Aetna Medicare reviews are negative.

Does Aetna offer HMO?

Aetna's Medicare Advantage plans include HMO, HMO-POS, and PPO network and payment structure options. Some Aetna Medicare Advantage plans include dental, eye glasses, and hearing aids benefits. Review the coverage and costs of each plan to fully understand the value of the Medicare benefits offered.

Does Aetna offer Medicare?

Aetna offers Medicare Advantage, Part D, Medigap, and combined Medicare Advantage and Medicaid plans. It does not offer Original Medicare because those plans are administered by the federal government. Original Medicare is also referred to as traditional Medicare. Those purchasing Medicare insurance can choose between a private option ...

Can you contact a nurse at Aetna?

A nurse is available via phone 24/7. Members can contact the nurse regarding medical questions. The nurses can help patients understand their treatment options and manage their care. You'll benefit from these additional perks when you choose an Aetna Medicare Advantage plan.

How does Medicare Advantage PPO work?

How do Medicare Advantage PPO plans work? Preferred provider organization (PPO) plans let you choose any provider who accepts Medicare. You don’t need a referral from a primary care physician for specialist or hospital visits. However, using providers in your plan’s network may cost less.

Does seeing out of network providers cost more?

But seeing out-of-network providers generally costs more. Yes, unless it's an emergency. Varies by plan. Seeing out-of-network providers generally costs more. Requires you to have a primary care physician (PCP) Usually no PCP required. Yes, in many plans. Yes. Requires referral to see a specialist.

Does Aetna have a meal at home program?

Yes. Meals-at-home program. (meals delivered to your home after a hospital stay) Yes, in many plans. Yes, in many plans. Yes, in many plans. Aetna Medicare Advantage plans at a glance. Our PPO plans. Requires you to use a provider network.

Does a dental plan have RX coverage?

Yes, if plan has Rx coverage. Yes, if plan has Rx coverage . Yes. Dental, vision and hearing coverage. Yes, in many plans. Yes, in most plans. Yes. ER and urgent care coverage worldwide. Yes.

Does Aetna offer Medicare Advantage?

Medicare Advantage plans for every need. In addition to PPO plans, Aetna offers you other Medicare Advantage plan options — many with a $0 monthly plan premium. We can help you find a plan that’s right for you.

What are the disadvantages of Medicare Advantage?

A possible disadvantage of a Medicare Advantage plan is you can’t have a Medicare Supplement plan with it. You may be limited to provider networks. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

What is the out of pocket limit for Medicare Advantage?

Once you meet this limit, your plan covers the costs for all Medicare-covered services for the rest of the year. In 2021 the out of pocket limit is $7,550, according to the Kaiser Family Foundation.

What is Pro 7 Medicare?

Pro 7: Lower out of pocket costs. Under Medicare Advantage, each plan negotiates its own rates with providers. You may pay lower deductibles and copayments/coinsurance than you would pay with Original Medicare. Some Medicare Advantage plans have deductibles as low as $0.

Can you use any provider under Medicare Advantage?

Many Medicare Advantage plans have networks, such as HMOs (health maintenance organizations) or PPOs* (preferred provider organization). Many Medicare Advantage plans may have provider networks that limit the doctors and other providers you can use. Under Original Medicare, you can use any provider that accepts Medicare assignment.

What are the benefits of a syringe?

Other extra benefits may include: 1 Meal delivery for beneficiaries with chronic illnesses 2 Transportation for non-medical needs like grocery shopping 3 Carpet shampooing to reduce asthma attacks 4 Transport to a doctor appointment or to see a nutritionist 5 Alternative medicine such as acupuncture

Is Medicare Advantage regulated by Medicare?

If you’re new to Medicare, you may be curious about Medicare Advantage. Here are some pros and cons of enrolling in a Medicare Advantage plan. For starters, Medicare Advantage plans are offered by private insurance companies but are regulated by Medicare. Regardless if the Medicare Advantage plan you choose has a monthly premium or not, ...

Does Medicare have an out-of-pocket maximum?

You may not know that Original Medicare (Part A and Part B) has no out-of- pocket maximum. That means that if you face a catastrophic health concern, you may be responsible to pay tens of thousands of dollars out of pocket.