Recipients who are age 62 through 65 in 2016 will be docked $1 in benefits for every $2 in earnings they have above $1,310 a month ($15,720 a year). A worker who turns 66 in 2016 can earn up to $3,490 a month before his or her birthday, without losing benefits. Above that threshold, the worker will lose $1 in benefits for each $3 earned.

Full Answer

Will Medicare premiums and deductibles increase in 2016?

Those amounts generally rise from year to year. For instance, the Part B deductible went up $19 to $166 in 2016. For Part A hospital coverage, the deductible for …

How much does Medicare Part a cost in 2016?

Dec 08, 2015 · In 2016, Part D beneficiaries will have 26 prescription drug plans to choose from. You will want to pay attention to these changes, as many premiums are projected to go up by at least $10 per month. Deductibles will also go up by at least $40, and at the most, $360. Rate This Story No votes so far! Be the first to rate this post. About Scott Ridl:

Will Medicare Part B cost of living increase in 2016?

Nov 10, 2015 · The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How much will Medicare premium mitigation Save you in 2016?

Jan 05, 2016 · So far, the 2016 change getting the most attention is that Medicare will pay clinicians to counsel patients about options for care at the end of life. The voluntary counseling would have been authorized earlier by President Barack Obama's health care law but for the outcry fanned by former Republican vice presidential candidate Sarah Palin, who charged it …

How has Medicare changed?

Medicare has expanded several times since it was first signed into law in 1965. Today Medicare offers prescription drug plans and private Medicare Advantage plans to suit your needs and budget. Medicare costs rose for the 2021 plan year, but some additional coverage was also added.Feb 23, 2021

What are the major changes in Medicare for 2020?

In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A. The Medicare Part B premium will increase to $144.60, and the Medicare Part B deductible will rise to $198 in 2020.

When was Medicare changed?

1972In 1972, President Richard M. Nixon signed into the law the first major change to Medicare. The legislation expanded coverage to include individuals under the age of 65 with long-term disabilities and individuals with end-stage renal disease (ERSD).

What was Medicare Part B premium in 2015?

How much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.Sep 24, 2021

Are Medicare premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

When did Medicare Advantage start?

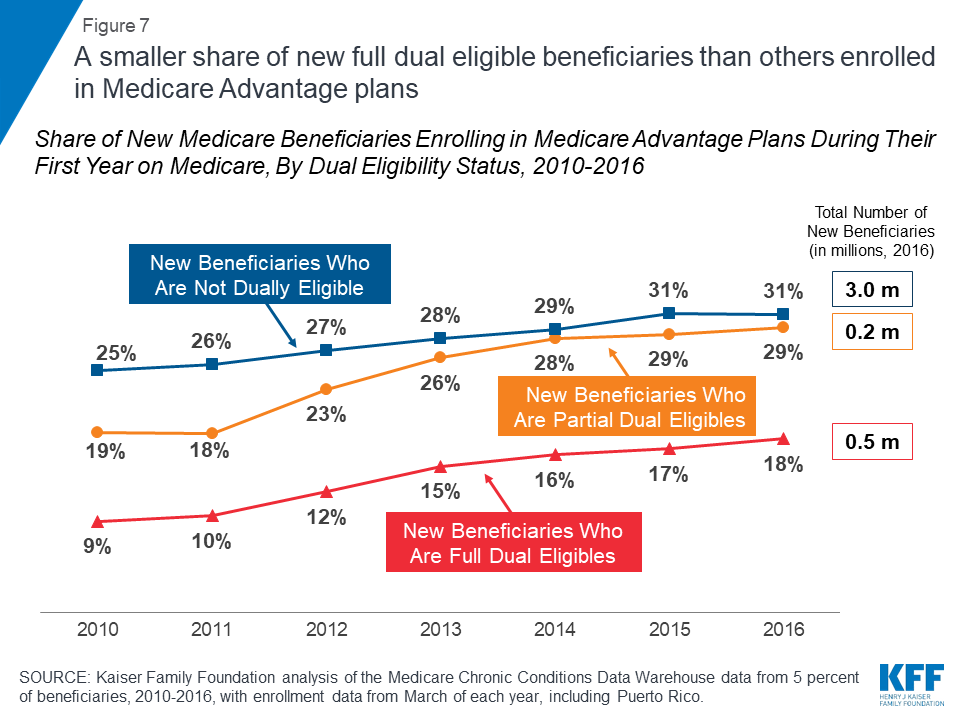

What is Medicare Advantage? Since 1997, Medicare enrollees have had the option of opting for Medicare Advantage instead of Original Medicare. Medicare Advantage plans often incorporate additional benefits, including Part D coverage and extras such as dental and vision as well as additionals supplemental benefits.

Which president is responsible for Medicare?

President Lyndon B. JohnsonOn July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security of our nation.Dec 1, 2021

How much did Medicare go up in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was the Medicare Part B premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.Oct 28, 2013

What changes were made to Medicare Part D drug policies?

Changes were made to Medicare Part D drug policies, resulting in higher prescription costs for many seniors. If you were one of these seniors who found their prescription costs went up, you most likely decided to get enrolled in a more affordable drug plan.

What is Medicare Part B?

Medicare Part B is what covers things like occupational therapy, speech therapy, and physical therapy, as long as they are deemed medically necessary. Most outpatient health care providers have limits on these services, which are referred to as “therapy caps” or “therapy cap limits”.

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

Can an organization apply for a contract with CMS in 2017?

An organization can, however, apply to contract with CMS in 2017 to operate in CY 2018. CMS understands that there are a variety of reasons that an organization may decide to terminate or to non-renew a contract, and subsequently want to re-enter the program.

Does automatic delivery apply to new prescriptions?

The automatic delivery program only applies to prescription refills and does not apply to new prescriptions that are e-prescribed, faxed, mailed, or phoned-in directly to the pharmacy, even if the new prescription is a continuation of existing therapy. 159 . 3.

When will Medicare be 67?

That trend, which results in higher program costs, will almost certainly continue. This option would raise the age of eligibility for Medicare by two months each year, starting in 2020 (people born in 1955 will turn 65 that year), until it reaches 67 for people born in 1966 (who would become eligible for Medicare benefits in 2033).

How much will Medicare be delayed in 2026?

By calendar year 2026, the benefits of 3.7 million people would be delayed by 14 months. Total spending on Medicare as a result would be $55 billion lower between 2020 and 2026 than under current law. CBO anticipates that most people who become eligible for Medicare after age 65 under this option would continue their existing coverage ...

How much of the Medicare savings will be offset by Social Security?

On the basis of its estimates for 2020 through 2026, CBO projects that roughly three-fifths of the long-term savings from Medicare under this option would be offset by changes in federal outlays for Social Security, Medicaid, and subsidies for coverage through the marketplaces as well as by reductions in revenues.

Why is the CBO predicting retirement benefits to be less linked to Medicare eligibility age?

CBO also expects future decisions about claiming retirement benefits to be less linked to Medicare’s eligibility age than has historically been the case because of greater access to health insurance through Medicaid and through the nongroup market.

How many people will be eligible for Medicare in 2020?

In calendar year 2020, when this option would take effect, about 3.4 million people will become eligible for Medicare coverage on the basis of their age, CBO estimates. Under this option, that group would see its benefits delayed by two months. By calendar year 2026, the benefits of 3.7 million people would be delayed by 14 months.

How much will Social Security be reduced in 2026?

The option also would reduce outlays for Social Security retirement benefits by an estimated $5 billion over the 2020–2026 period because raising the eligibility age for Medicare would induce some people to delay claiming retirement benefits. In CBO’s estimation, the reduction in Social Security spending would be fairly small because raising ...

How many people will be uninsured in 2026?

About 300,000 more people would be uninsured under this option in 2026, CBO estimates, and they thus might receive lower quality care or none at all; others would end up with a different source of insurance and might pay more for care than they would have as Medicare beneficiaries.

How did Obamacare and Medicare help Americans?

Obamacare and the 50th Anniversary of Medicaid and Medicare ] But the programs did more than cover millions of Americans. They removed the racial segregation practiced by hospitals and other health care facilities, and in many ways they helped deliver better health care. By ensuring access to care, Medicare has contributed to a life expectancy ...

When did Medicare start giving rebates?

In 1988 the Medicare Catastrophic Coverage Act included an outpatient prescription drug benefit, and in 1990 the Medicaid prescription drug rebate program was established, requiring drugmakers to give "best price" rebates to states and to the federal government.

What is the Affordable Care Act?

The Affordable Care Act aims to discover ways to pay for care that would improve quality while lowering spending, through its creation of the Center for Medicare and Medicaid Innovation. "We're in the 'third era' of payment reform," Rowland says.

What law made adjustments to Medicare?

A series of budget reconciliation laws continued to make adjustments. The Omnibus Budget Reconciliation Act of 1989 reimbursed doctors through Medicare by estimating the resources required to provide the services. The Omnibus Budget Reconciliation Act of 1993 modified payments to Medicare providers.

Why is the government investing billions in healthcare?

Since that time, the government has poured billions into health care each year. That has led to better care , but also resulted in the need for constant re-evaluation so the government can ensure people continue to get coverage. Medicare and Medicaid aimed to reduce barriers to medical care for America's most vulnerable citizens – aging adults ...

What law imposed a ceiling on Medicare payments?

The Tax Equity and Fiscal Responsibility Act of 1982 imposed a ceiling on the amount Medicare would pay for hospital discharge and the Social Security Amendments of 1983 paid hospitals a fixed fee for types of cases. "Once they got a fixed amount they figured out how to take care of them in less time," Davis says.

How many Americans take prescription drugs?

Today, nearly 7 in 10 Americans take a prescription drug, and half take at least two. As people age, they tend to take more medications. When Medicare first was signed into law it included only coverage for hospital and doctor services.