What are the key Medicare provisions in the ACA and how would repeal affect Medicare spending and beneficiaries?

- Payments to Health Care Providers. The ACA reduced updates in Medicare payment levels to hospitals, skilled nursing...

- Payments to Medicare Advantage Plans. Prior to the ACA, federal payments to Medicare Advantage plans per enrollee were...

How does ACA affect Medicare?

- “Keep your hands off my Medicare.”. There is perhaps no quote more memorable – nor more contentious – from the battle over the Affordable Care Act (aka Obamacare ).

- Cost savings through Medicare Advantage. ...

- Focus on prescription drugs. ...

- Higher premiums for higher-income enrollees. ...

- Free preventive services. ...

- New funding for Medicare. ...

- Cost containment. ...

How did ACA affect Medicare?

- Payments to Health Care Providers. ...

- Payments to Medicare Advantage Plans. ...

- Medicare Benefit Improvements. ...

- Revenues to the Medicare Trust Funds. ...

- Medicare Part B and Part D Premiums for Higher-Income Beneficiaries. ...

- Payment and Delivery System Reforms and New Quality Incentives. ...

- Independent Payment Advisory Board. ...

How will ACA repeal affect Medicare?

Here are three key effects that a repeal of the ACA would have: Higher spending on Medicare Part A and Part B, leading to higher premiums, deductibles and copayments for beneficiaries. The Congressional Budget Office estimates that the ACA reduced Medicare spending by $350 billion over 10 years just by changing how providers are paid.

What are the pros and cons of ACA?

The ACA Has 10 Sections in All, and Most Do More Than Provide Insurance

- It created the National Prevention Council that coordinates all federal health efforts to promote active, drug-free lifestyles.

- It funds scholarships and loans to double the number of healthcare providers in five years.

- It cuts down on fraudulent doctor/supplier relationships.

How will ACA repeal affect Medicare?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund.

What did the ACA do for Medicare Advantage?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare.

Is Medicare considered under the Affordable Care Act?

Obamacare's expanded Medicare preventive coverage applies to all Medicare beneficiaries, whether they have Original Medicare or a Medicare Advantage plan.

How is the Affordable Care Act different from Medicare?

Main Differences Between Medicare and the ACA (Obamacare) In the simplest terms, the main difference between understanding Medicare and Obamacare is that Obamacare refers to private health plans available through the Health Insurance Marketplace while Original Medicare is provided through the federal government.

Is Medicare Advantage the same as ObamaCare?

Medicare isn't part of the Affordable Care Act (ObamaCare) neither is supplemental Medigap insurance nor Medicare Advantage plans. You won't shop for your coverage through the marketplace. Instead, you'll want to follow the instructions under the “how to sign up for Medicare Advantage” section below.

Was ObamaCare a good thing?

Benefits of the Affordable Care Act The Affordable Care Act has both increased the number of insured Americans and improved the coverage offered by health insurance companies. Millions of previously uninsured Americans have been able to obtain health insurance because of the ACA.

How did the Affordable Care Act affect Medicare?

The Affordable Care Act also affected Medicare by adding coverage for a "Wellness Visit" and a “Welcome to Medicare” preventative visit. It also eliminated cost-sharing for almost all of the preventive services covered by Medicare.

What is the Affordable Care Act?

The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How long will the Medicare Trust fund be extended?

The Affordable Care Act Ensures the Protection of Medicare for Future Years. Under the Affordable Care Act, the Medicare Trust fund will be extended to at least the year 2029. This is a 12-year extension that is primarily the result of a reduction in waste, fraud, and abuse, as well as Medicare costs.

What are the initiatives under the Affordable Care Act?

Under these initiatives, your doctor may get additional resources that will help ensure that your treatment is consistent. The Affordable Care Act provides ways for hospitals, doctors and other health care providers to coordinate their care for Medicare beneficiaries. As a result, health care quality is improved and unnecessary spending is reduced.

How much does Medicare pay for generic drugs?

In 2016, people with Medicare paid 45% for brand-name drugs and 58% for generic drugs while in the coverage gap. These percentages have shrunk over the last few years. Starting in 2020, however, you’ll pay only 25% for covered brand-name and generic drugs during the coverage gap.

How long does Medicare cover preventive visits?

This is a one-time visit. During the visit, your health care provider will review your health, as well as provide education and counseling about preventive services and other care.

When does Medicare Part B start?

Also, you are only permitted to enroll in Medicare Part B (and Part A in some cases) during the Medicare general enrollment period that runs from January 1 to March 31 each year. However, coverage will not begin until July of that year. This could create a gap in your insurance coverage.

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

Why did Medicare enrollment drop?

When the ACA was enacted, there were expectations that Medicare Advantage enrollment would drop because the payment cuts would trigger benefit reductions and premium increases that would drive enrollees away from Medicare Advantage plans.

How much does Medicare Part B cost in 2020?

Medicare D premiums are also higher for enrollees with higher incomes .

What is Medicare D subsidy?

When Medicare D was created, it included a provision to provide a subsidy to employers who continued to offer prescription drug coverage to their retirees, as long as the drug covered was at least as good as Medicare D. The subsidy amounts to 28 percent of what the employer spends on retiree drug costs.

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

How many Medicare Advantage enrollees are there in 2019?

However, those concerns have turned out to be unfounded. In 2019, there were 22 million Medicare Advantage enrollees, and enrollment in Advantage plans had been steadily growing since 2004.; Medicare Advantage now accounts for well over a third of all Medicare beneficiaries.

How many Medicare Advantage plans will be available in 2021?

For 2021, there are 21 Medicare Advantage and/or Part D plans with five stars. CMS noted that more than three-quarters of all Medicare beneficiaries enrolled in Medicare Advantage plans with integrated Part D prescription coverage would be in plans with at least four stars as of 2021.

What happened in the third year of the Affordable Care Act?

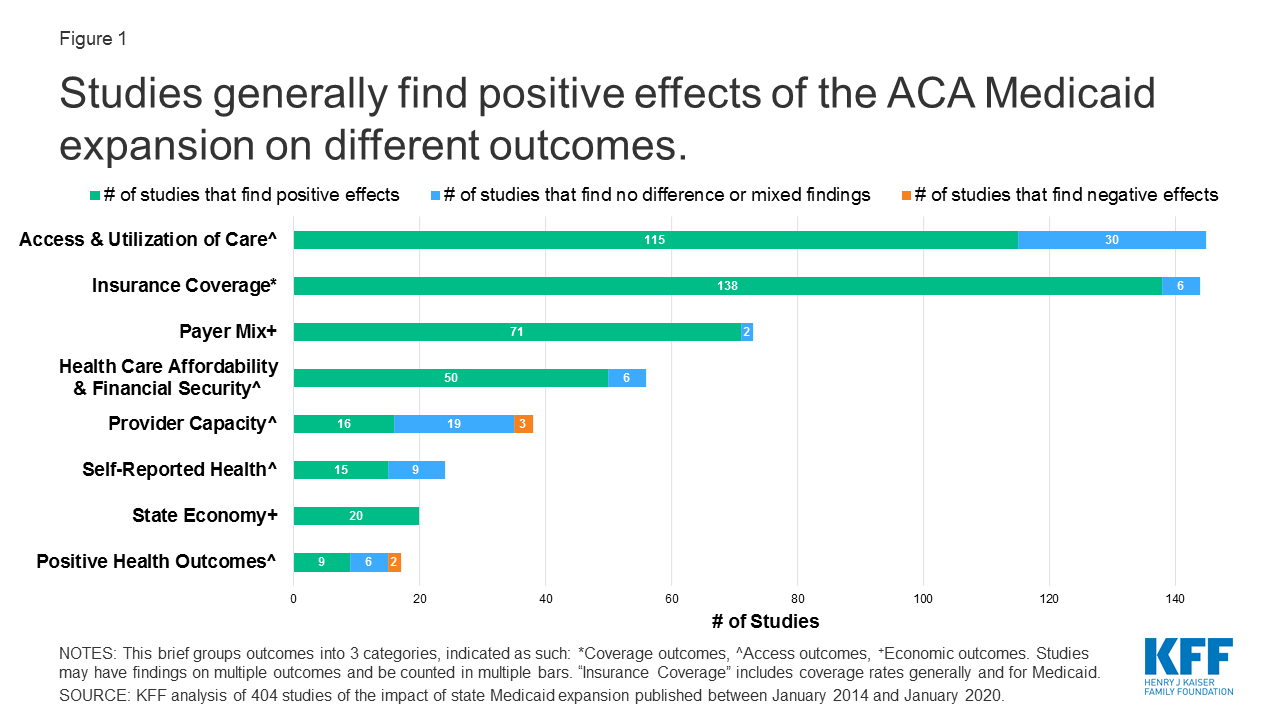

Second, an improvement in the probability of reporting excellent health emerged in the third year, with the effect being largely driven by the non-Medicaid expansions components of the policy.

How long did the Affordable Care Act last?

While the Affordable Care Act (ACA) increased insurance coverage and access to care after 1 (2014) or 2 (2014-2015) postreform years, the existing causally interpretable evidence suggests that effects on self-assessed health outcomes were not as clear after 2 years.

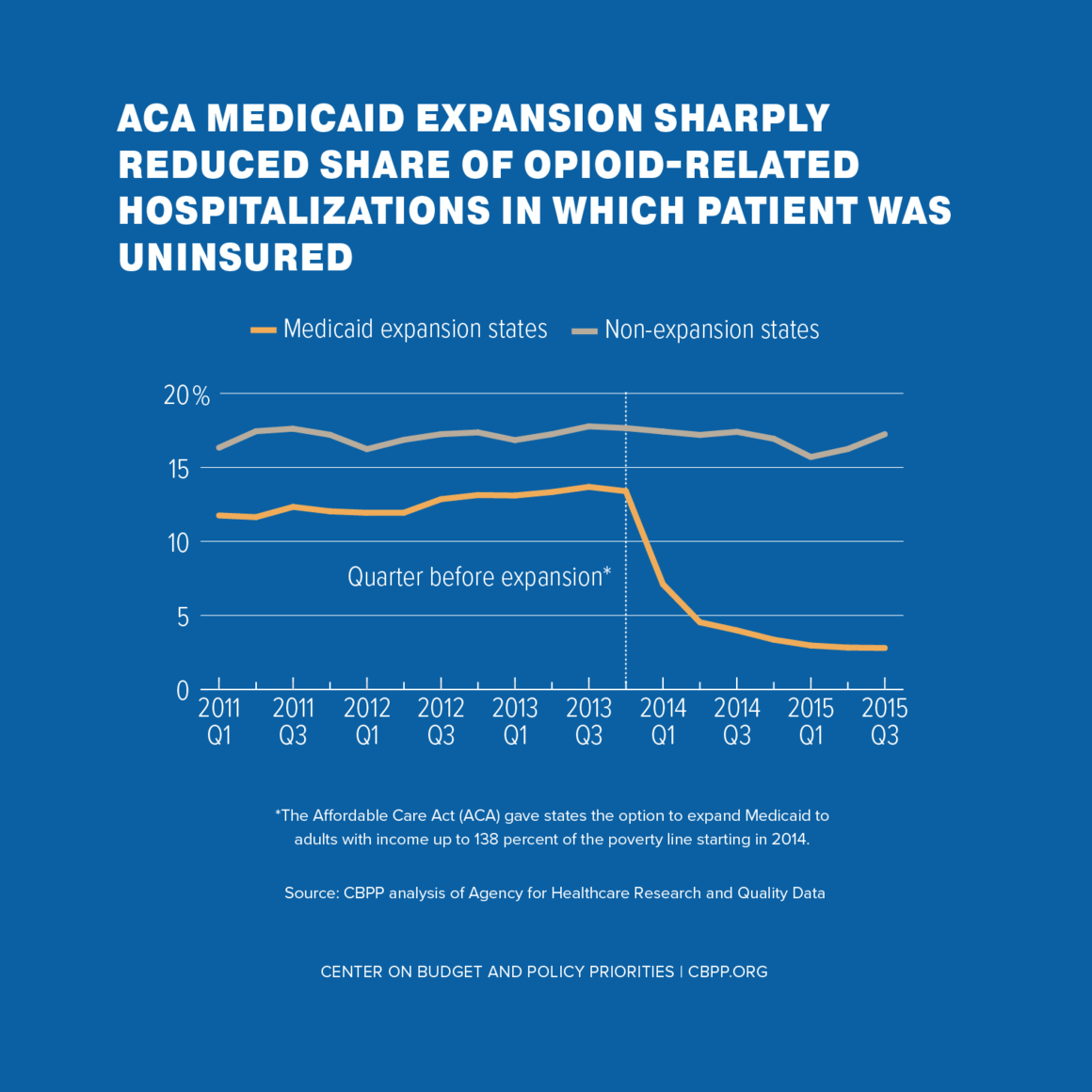

Which states have expanded Medicaid?

Pennsylvania, Indiana, and Alaska expanded Medicaid in January, February, and September of 2015, respectively. Montana and Louisiana expanded Medicaid in January and July of 2016, respectively. States are classified as part of the Medicaid expansion treatment group beginning the month/year of their expansion.

How does the Medicare law affect hospitals?

It also penalizes hospitals with too many readmissions of Medicare patients who have heart attacks , heart failure or pneumonia within 30 days of a hospital stay.

How much will Medicare be reduced?

The nonpartisan Congressional Budget Office estimated that Medicare spending would be reduced by $716 billion over 10 years, mainly because the law puts the brakes on annual increases in Medicare reimbursement for Medicare Advantage, hospital costs, home health services, hospices and skilled nursing services.

How many states have Medicare cut doctors?

The American Medical Association says that in at least 11 states, Medicare Advantage plans have cut thousands of physicians. Critics worry that more doctors may stop taking Medicare patients or that patients will face lengthy waits for appointments or other changes.

How much less will Medicare get in 2022?

Other cuts include $66 billion less for home health, $39 billion less for skilled nursing services and $17 billion less for hospice care — all by 2022. Medicare costs will still grow, just more slowly than they would without the ACA. But some experts predict that beneficiaries will feel ...

What is Medicare Advantage?

About three in 10 Medicare beneficiaries are enrolled in Medicare Advantage options, which are premium insurance plans that often include dental, vision and drug insurance. These plans have been subsidized by the federal government for years. The ACA is simply aiming to equalize costs, according to its proponents.

Can Medicare Advantage plan reduce dental insurance?

There are only a few ways Medicare Advantage plans can cope with reductions in payments, says Wilensky, the former Medicare chief. "They can reduce some of the optional benefits, such as vision or dental coverage. They can raise premiums. And they can also tighten their physician networks," she says.

Did Medicare change before the law?

Insurers changed Medicare Advantage plans before the law, and they're still changing them, he says. "Overall, seniors are not paying that much more, and more people are still enrolling in Medicare Advantage plans," says Gruber, who advised the Obama administration on the ACA.

How did the ACA affect Medicare?

“The direct effects of the ACA on Medicare payments, Medicaid spending on the newly eligible, and federal subsidies for Marketplace coverage can be reasonably well described and understood. The Congressional Budget Office estimated the direct effects of these changes on the federal budget repeatedly throughout the past decade in projecting the costs of ACA repeal, and it found that the on-budget costs of greater coverage were larger than the payment-related savings in Medicare—although not by much per year in the context of overall health spending. Similarly, there were other major changes in health spending that observers can agree were not triggered by the ACA or that were at most distally related. These changes include innovations in drug therapies, which have a development pipeline as long as or longer than our experience with the ACA to date; higher deductibles for consumers; and higher reimbursement rates for providers as the economy has recovered and providers have consolidated. Research indicates that provider consolidation predated the ACA’s value-based payment models. 55#N#“In the gray area between changes directly related to and unrelated to the ACA lie other reasons for slow growth in health care costs facilitated by the ACA. The most important of these factors may be spillovers from the value-based care initiatives described above and changes in investment decisions. Every day since the passage of the ACA, thousands of decisions have been made by health care providers with a greater awareness that their financial success will depend on delivering value. In our opinion, the increased attention paid to value-based payment by non-Medicare payers—namely, states and private insurers—is likely a key contributor to the slower rate of per capita cost growth that we’ve seen over the past decade.”

How did the ACA affect health insurance?

“The ACA produced broad gains in insurance coverage. A general pattern was that coverage increased most among groups whose members were most likely to be uninsured before the reforms. Initial research, based on the first few years after the ACA reforms took effect, found larger coverage gains for members of racial/ethnic minority groups than for whites. 1,8 Our analysis, which used data through 2017, found that this pattern had become even more pronounced by 2017, causing a further reduction in coverage disparities related to race/ethnicity. Other recent research has found that the ACA significantly reduced disparities in coverage related to other individual characteristics, such as income, age, marital status, and geographic location. 29,30#N#“ACA-related gains in insurance coverage coincided with improvements in standard measures of health care access. Here, too, compared to whites, we saw greater improvements for blacks and Hispanics—who before the ACA were substantially more likely to go without care for financial reasons and lack a usual source of care.”

How did the ACA impact the health care system?

“Collectively, the ACA’s coverage expansions and market reforms generated substantial and widespread improvements in reducing financial barriers to coverage, improving access to health care , and lowering the financial risks of illness. The coverage expansions reduced uninsurance rates, especially relative to earlier forecasts; improved access to health care; and led to measurable gains in the financial well-being of poor Americans. The law’s market reforms reduced the burden of maintaining continuous eligibility for coverage and ensured that people with insurance had true risk protection.#N#“But subsequent court decisions, along with congressional and executive branch actions, have limited the ACA’s reach. The Supreme Court decision in NFIB v. Sebelius has left more than four million of the poorest Americans uninsured six years after the major coverage expansions.#N#“Congress and the administration of President Donald Trump have also chipped away at the law’s market reforms. Congress’s repeal of the individual mandate penalty, which took effect in 2019, is projected to increase the number of uninsured people by seven million over the next decade. 42 The repeal of the mandate penalty dove-tailed with the Trump administration’s loosening of restrictions on insurance alternatives that are not required to comply with the ACA rules, such as short-term plans with risk rating and association health plans that do not cover all benefits. 43 “

How did the ACA affect women?

“The ACA is responsible for some of the most significant advances for women’s health in recent decades through its increased access to health insurance and health care for women. 6,47 These advances affect the health not only of women but also of their families. After the ACA, women were more likely to be insured, to be able to afford health insurance and care, and to receive preventive care. 1,19,26 Expanded coverage of contraception improved its affordability and use. 40–42 The ACA’s Medicaid and insurance expansions were also associated with increased use of prenatal care 6 and improved neonatal outcomes. 50 Nonetheless, health care disparities persist—especially among members of racial/ethnic minority groups and low-income women. 16,18#N#“To expand the ACA-related gains to all women, the ACA’s insurance coverage expansions must be strengthened. This includes expanding Medicaid in all states, maintaining the ACA Marketplace subsidies, and finding a legal way to institute an individual mandate. 1,51 The variability in state requirements for coverage of specific medications and mental health services should be reduced by ensuring broader coverage at the federal level. The standardization of essential health benefits should include coverage for comprehensive reproductive health care. The debate continues regarding employer exemptions from the ACA policy that requires contraception coverage without cost sharing. 52 In 2018 the federal government proposed rules to expand exemptions for employers to include moral objections rather than just religious beliefs. 53 The rules are under a nationwide preliminary injunction, but conflicting federal court decisions are limiting the contraceptive policy’s enforceability. 52 “

What happens if you miss your window to switch to Medicare?

If you miss your window to switch to Medicare, the federal government will catch up to you soon enough. When it finds that you should have moved to Medicare at age 65, it will assess you a fine to make you pay back any subsidy dollars that you have received toward your ACA coverage since you turn 65.

What happens if you don't enroll in Medicare at 65?

Even worse, if you fail to enroll in Medicare at age 65 because you choose to keep your Obamacare plan instead, you will later owe a Part B late enrollment penalty that will stay with you for as long as you remain enrolled in Medicare. It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65).

How long do you have to wait to cancel ACA?

Don’t be tempted to gamble with your health by cancelling your ACA plan early. If you have more than a 63-day window between when your ACA plan ends and your Medicare begins, then when you enroll in a Medigap plan, they can impose a waiting period for pre-existing conditions.

How much is the penalty for Medicare if you wait two years?

It’s a 10% penalty per year for every year that you could have been enrolled in Medicare (at 65). So if you waited two years, your would pay a 20% higher monthly premium for Part B for the rest of your life. This can be disappointing news if you’ve been getting your ACA plan very inexpensively due to a subsidy.

Does ACA cover Medicare?

Your ACA coverage was never meant to replace Medicare. If you do not sign up for Medicare during your Initial Enrollment Period, you will be subject to substantial penalties when you later enroll in Medicare.

Can you cancel ACA coverage once you join Medicare?

So if you are enrolled in either an ACA plan or a short term medical plan, you’ll likely want to cancel that coverage once you join Medicare. Many people use short-term health insurance plans to bridge the gap between when their employer coverage ends and when they turn 65 and become eligible for Medicare.

Can I cancel my ACA plan if I am on Medicare?

If I am on Medicare, do I need to do anything to avoid an ACA penalty? Once you enroll in Medicare, you should simply cancel your ACA plan. You do not need both coverages. Cancellation is not automatic, though, so you need to actively cancel your ACA coverage by calling the Healthcare Exchange and requesting cancellations.

When does Medicare coverage take effect?

If you complete the enrollment process during the three months prior to your 65th birthday, your Medicare coverage takes effect the first of the month you turn 65 ( unless your birthday is the first of the month ). Your premium subsidy eligibility continues through the last day of the month prior to the month you turn 65.

What happens if you don't sign up for Medicare?

And if you keep your individual market exchange plan and don’t sign up for Medicare when you first become eligible, you’ll have to pay higher Medicare Part B premiums for the rest of your life, once you do enroll in Medicare, due to the late enrollment penalty.

How long does it take to get Medicare if you are not receiving Social Security?

If you’re not yet receiving Social Security or Railroad Retirement benefits, you’ll have a seven-month window during which you can enroll in Medicare, which you’ll do through the Social Security Administration. Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, ...

When does Medicare subsidy end?

If you enroll in Medicare during the final three months of your initial enrollment period, your premium subsidy will likely end before your Part B coverage begins, although your Part A coverage should be backdated to the month you turned 65.

When will Medicare be enrolled in Social Security?

Here are the details: If you’re already receiving retirement benefits from Social Security or the Railroad Retirement Board, you’ll automatically be enrolled in Medicare with an effective date of the first of the month that you turn 65. As is the case for people who enroll prior to the month they turn 65, premium subsidy eligibility ends on ...

When will Medicare be sent to you?

Your Medicare card will be sent to you after you enroll. Your enrollment window starts three months before the month you turn 65, includes the month you turn 65, and then continues for another three months. (Note that you’ll need to enroll during the months prior to your birth month in order to have coverage that takes effect the month you turn 65.

When will Medicare be sent out to my 65 year old?

If you’re already receiving Social Security or Railroad Retirement benefits, the government will automatically enroll you in Medicare Part A the month you turn 65, with your Medicare card arriving in the mail about three months before you turn 65. If you’re not yet receiving Social Security or Railroad Retirement benefits, ...