Medicare is available to all Americans who are age 65 or older, regardless of income. However, your income can impact how much you pay for coverage. If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

How your income may affect your Medicare costs?

coverage is through your employer. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is more than $85,000 (individuals and married individuals filing separately) and $170,000 (married individuals filing jointly), you’ll have to pay extra for your Medicare prescription drug coverage. This extra amount is called the income-related monthly adjustment amount.

How can your income affect your Medicare premiums?

- death of a spouse

- divorce

- marriage

- working fewer hours

- retiring or losing your job

- loss of income from another source

- loss or reduction of pension

How much income can a person have on Medicaid?

Finally, candidates can take advantage of spousal protection law that allow income (or assets) to be allocated to a non-applicant spouse. While persons residing in nursing homes paid for by Medicaid are permitted to have monthly incomes as high as $2,349 (in most states), those individuals are not permitted to keep that income.

How do changes in income affect Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

Does your income affect how much you pay for Medicare?

Medicare is available to all Americans who are age 65 or older, regardless of income. However, your income can impact how much you pay for coverage. If you make a higher income, you'll pay more for your premiums, even though your Medicare benefits won't change.

Does Medicare look at income every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

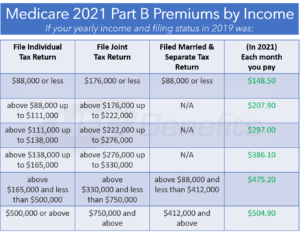

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.

Who will have to pay the extra amount?

When you sign up for Social Security, you’ll also want to sign up for Medicare. As long as you meet the age and work history qualifications, you’ll get Medicare Part A for free. But you’ll also want Part B, which covers your doctor’s visits and other specific medically necessary services . For Part B, you’ll pay monthly premiums.

How will the extra amount be collected?

If you pay Part B premiums, the amount automatically comes out of your Social Security payments each month. If you aren’t receiving Social Security, a bill will arrive in the mail. You can pay this online, through your bank’s bill pay service, or by mailing a check.

What if my income has changed?

If you’re wondering how Medicare is calculated, it’s based on your tax return from two years ago. That means if your income suddenly increases this year, you won’t have to worry about paying extra until a couple of years down the road.

Final Thoughts

Are Medicare advantage premiums based on income? Yes, but in many cases, you’ll pay the lowest premium. This is the standard premium, and it applies to you unless you earn more than the Medicare cut off income, at which point you’ll pay a surcharge.

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

Do you have to factor in Medicare tax?

When you become eligible for Medicare and look at how much to budget for your annual health care costs, you’ll need to also factor in your tax-reported income.

How Much Will Your Medicare Part B Premium Be?

The tables below show Part B premiums for 2021 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

How much extra could you pay for Medicare Part D?

With Part D, the extra amount you pay is determined by Medicare based on your tax-reported income, but your total costs will depend on the Part D plan you have. Part D plans are only provided by private insurance companies, so premium amounts will vary.

Paying for Medicare Premiums Tips: Your HSA and Employer Health Plan

From the above, you can see you may face higher costs for Medicare than you originally thought. That’s why you should consider two things – a health savings account plan (HSA) and if you have employer health coverage.