Monthly Medicare Premiums for 2022

| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount | Prescription drug coverage monthly premi ... |

| Individuals with a MAGI of less than or ... | 2022 standard premium = $170.10 | Your plan premium |

| Individuals with a MAGI above $91,000 up ... | Standard premium + $68.00 | Your plan premium + $12.40 |

| Individuals with a MAGI above $114,000 u ... | Standard premium + $170.10 | Your plan premium + $32.10 |

| Individuals with a MAGI above $142,000 u ... | Standard premium + $272.20 | Your plan premium + $51.70 |

What income is used to determine Medicare premiums?

Nov 27, 2021 · In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income . This further limits the number of people who can deduct their premiums. Most of Medicare Part B about 7% is funded through U.S. income tax revenue.

What percentage of gross income is deducted for Medicare?

Oct 11, 2021 · Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

How much will I pay for Medicare premiums?

Mar 07, 2022 · Medicare has set income limits for people filing individual tax returns, joint tax returns and individuals who are married or living with their spouse at any time during the year and file separate tax returns. These limits are then used to determine adjusted costs for Medicare Part B and Part D premiums. Depending on how much you make, you may have to …

Are Medicare premiums based on income?

Dec 11, 2018 · The cost of Medicare B and D (prescription drug coverage) premiums are based on your modified adjusted gross income (MAGI). If your MAGI is above $87,000 ($174,000 if filing a joint tax return), then your premiums will be subject to the income-related monthly adjustment amount (IRMAA).

How does Medicare calculate your income?

We use your modified adjusted gross income (MAGI) from your federal income tax return to determine your income-related monthly adjustment amounts. Your MAGI is the total of your adjusted gross income and tax-exempt interest income.

How is modified adjusted gross income for Medicare premiums calculated?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.Oct 10, 2021

What income is included in MAGI for Medicare premiums?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

How much can you make before your Medicare premium goes up?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.Nov 16, 2021

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

Medicare Part B Part D Irmaa Premium Brackets

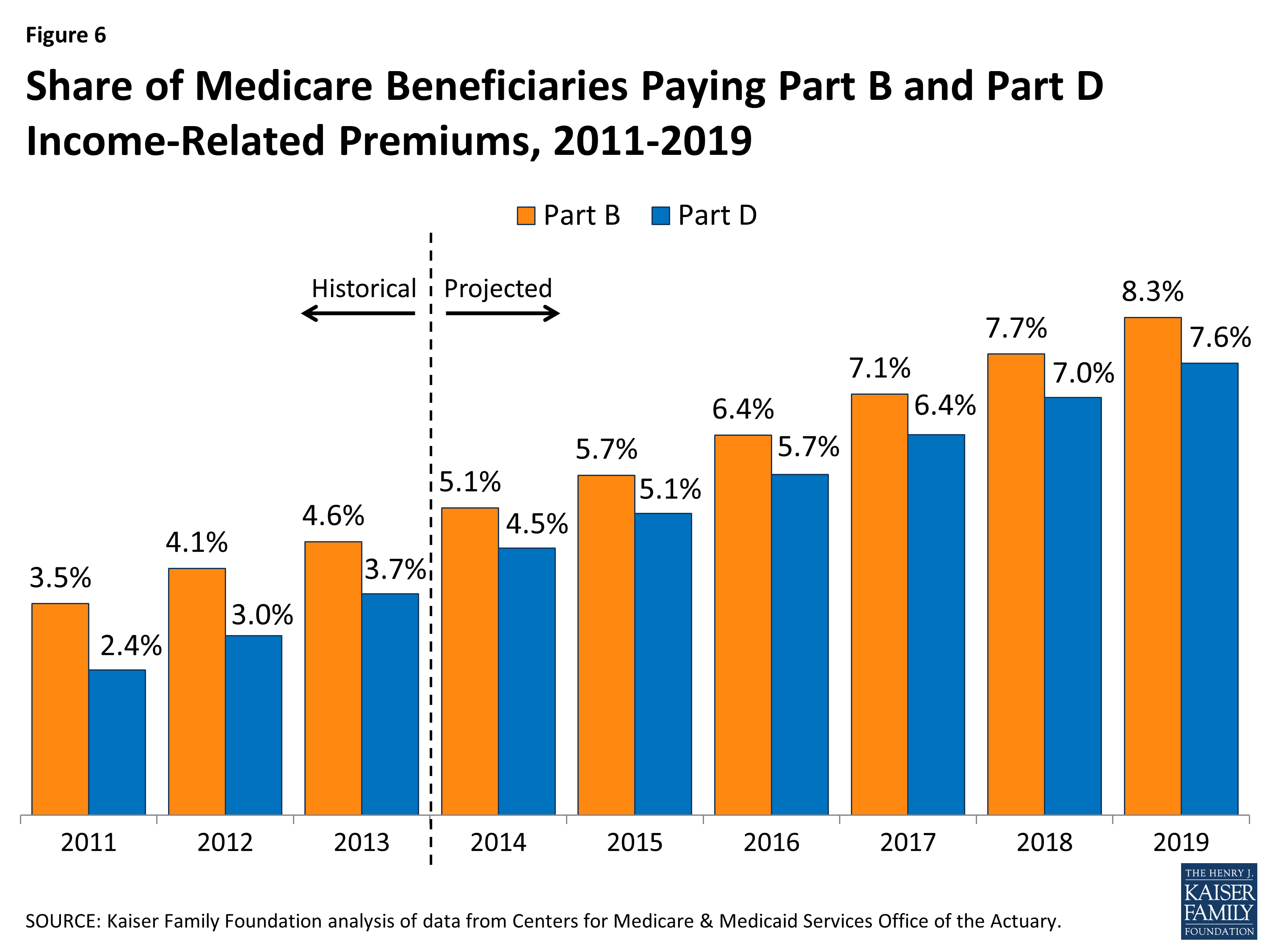

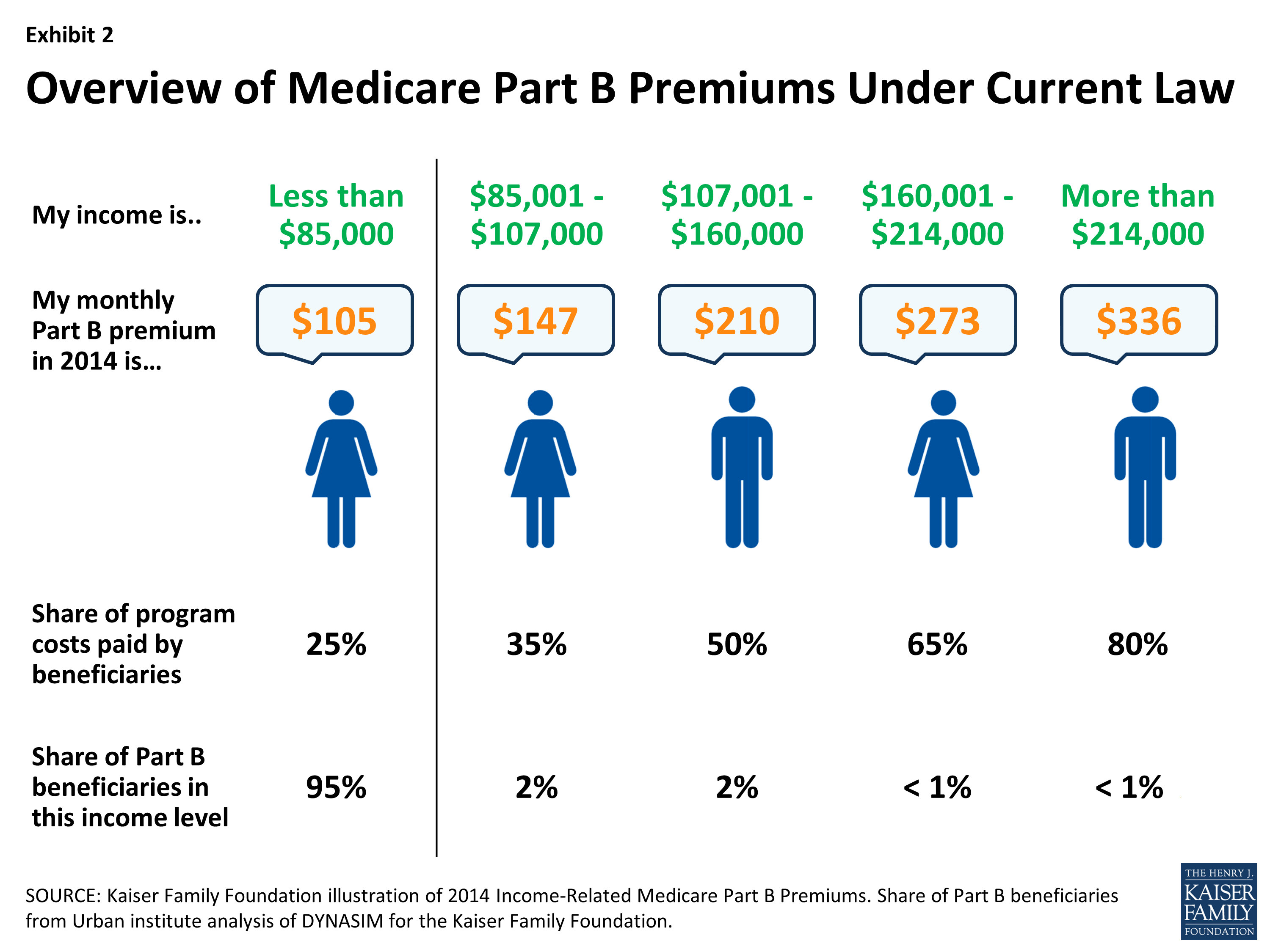

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How To Calculate Medicare Premiums

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

How Much Are My Premiums?

The Social Security Administration (SSA) determines whether an Income-Related Monthly Adjustment Amount (IRMAA) applies to your Medicare Part B and D premiums based on your Modified Adjusted Gross Income (MAGI) from two years prior.

My Income has Changed: What can I do?

The SSA states that if life-changing events altered your income in a way that would impact your IRMAA surcharge, you can complete form SSA-44 ( Medicare Income-Related Monthly Adjustment Amount-Life-Changing Event ). After entering your name and social security number, follow these step-by-step directions on how to complete the form:

Summary

Dealing with Medicare-related items can be difficult. If you receive a determination letter that you feel does not reflect your current financial standing, utilize the tools afforded by the government to mitigate your premium expenditures.

Schedule a Consultation

We have helped our clients answer these questions and more. If you want a clear understanding of your financial future, and need help making changes to reach your goals, schedule a consultation and we can get started.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

Do you have to factor in Medicare tax?

When you become eligible for Medicare and look at how much to budget for your annual health care costs, you’ll need to also factor in your tax-reported income.

How much is Medicare Part B 2020?

Most beneficiaries enrolled in Part B in 2020 will have a premium of $144.60/month. Medicare Part B premiums are calculated as a share of Part B program costs.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). Medicare coverage is broken down into different parts.

When is Medicare 2020?

October 16, 2020 at 8:07 AM. If you’re currently on Medicare or reaching the age where you are considering Medicare, it’s important to understand the basics. Furthermore, you should consider how premiums are calculated in order to have an idea of what kind of premium you’ll be looking at. Here is a quick guide showing you what Medicare is, ...

Does Medicare cover hospice?

Medicare Part A is free to most beneficiaries and covers hospital stays, care in a skilled nursing facility, hospice care, and some health care. However, premiums for Part B and Part D depend on a beneficiary’s income. In other words, beneficiaries with higher incomes pay higher premiums.

How is Medicare Part B calculated?

Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior. This means your 2021 Medicare Part B premium may be calculated using the income you reported on your 2019 taxes. If your reported income was higher ...

How much will Medicare pay in 2021?

If you paid Medicare taxes for fewer than 30 quarters, you will pay $471 per month for Part A in 2021.

How does Medicare Advantage work?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs. A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

What is the late enrollment penalty for Medicare?

The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didn’t sign up. Medicare Part B. Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how ...

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

Do high income people pay higher Medicare premiums?

Learn about other Medicare costs and how they are calculated. If you are a high-income earner, you could potentially pay higher premiums for Medicare Part B (medical insurance) and Medicare prescription drug coverage.

Does Medicare Part D have IRMAA?

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next. As with Medicare Part B premiums, Part D plans also calculate premiums based on your income from two years prior and may charge an IRMAA. The table below illustrates how much you can expect to pay ...

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.