Aetna offers a few more options than Mutual of Omaha, such as Plan B and Plan D. However, Mutual of Omaha sells both the standard and the high-deductible versions of Plan F, which has long been the most popular Medicare Supplement Insurance plan.

Full Answer

Which is better Aetna or United Healthcare?

- The Policyholder's name and address.

- The patient's name and age.

- The number stated on your ID card.

- The name and address of the provider of the service (s).

- The name and address of any ordering Physician.

- A diagnosis from the Physician.

What is Aetna select plan?

- Aetna offers $0 premium Medicare part A plans with a $0 deductible

- Easy to get a quote and enroll in a Medicare plan online

- Good dental insurance plans with a large network of 120,000 providers

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the best supplement for Medicare?

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for ...

Is Mutual of Omaha the same as Aetna?

Mutual of Omaha sells Plans A, F (and high-deductible Plan F), G (and high-deductible G) and N....Aetna vs. Mutual of Omaha: Medigap Plan Selection.AetnaPlanMutual of OmahaHigh-deductible F✔✔G✔✔High-deductible G✔K8 more rows•Feb 15, 2022

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Is Mutual of Omaha a good Medicare provider?

The company has been involved with Medicare since it was first introduced, and was selected to administer Original Medicare (Part A and Part B) in 1966. With such an impressive track record, it's no surprise that Mutual of Omaha's reputation as a Medicare plan provider is among the best.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

How does Mutual of Omaha rate?

The ratings agency AM Best gives Mutual of Omaha an A+ for financial stability, which is the second-highest rating and means the company has a “superior” ability to take care of its contractual insurance obligations, like paying claims.

Is Mutual of Omaha expensive?

In many states, it's one of the cheapest providers of Medigap Plan G, which provides some of the most comprehensive coverage. Across all Medigap plan letters, Mutual of Omaha's monthly rates average between $87 and $161 for a 65-year-old. Policyholders frequently complain about annual rate increases.

Does Mutual of Omaha pick up Medicare deductible?

Mutual of Omaha has you covered It's a great option to add to your existing Medicare Part A and B plans, as Medicare supplement insurance helps cover some out-of-pocket costs that Part A and Part B may leave you with. These include expenses like copays, coinsurance, and deductibles.

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the most popular Medigap plan for 2021?

Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Is Mutual of Omaha the same as Aetna?

Mutual of Omaha solely provides Prescription Drug Plans (PDP) and Medicare Supplement Insurance (Medigap). In addition to Medicare Advantage progra...

Is Aetna a part of Mutual of Omaha?

SilverScript Choice and SilverScript Plus are Aetna's prescription drug plans. Mutual of Omaha Rx Value and Mutual of Omaha Rx Plus are two Mutual...

Is Mutual of Omaha a good company for Medicare supplements?

A Mutual of Omaha insurance is a terrific choice if you want to buy a Medicare Supplement plan from a financially sound firm with excellent custome...

Is WellCare owned by Aetna?

Aetna's standalone Medicare Part D Prescription Drug Plans have been bought by WellCare Health Plans (PDP). This implies you are now a WellCare mem...

Medicare Advantage

Aetna offers several types of Medicare Advantage plans. Its plan network structures include HMO plans with only in-network coverage and PPO plans that offer both in- and out-of-network coverage. Its HMO-POS plan primarily offers in-network coverage and has some flexibility to see out-of-network providers for specified services.

Prescription Drug Plans

If you have Original Medicare and need to buy a prescription drug plan, both Aetna and Mutual of Omaha have two options and both offer home delivery. Aetna's options are SilverScript Choice and SilverScript Plus. Mutual of Omaha's are Mutual of Omaha Rx Value and Mutual of Omaha Rx Plus.

Medicare Supplement Insurance

Medigap plans help control your out-of-pocket costs for Original Medicare. What each plan covers is standardized throughout the United States even though private companies sell the plans. Mutual of Omaha offers Plan F, High-Deductible Plan F, Plan G, and Plan N. Aetna's Medigap offerings vary by state.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is INA insurance?

The Insurance Company of North America (INA) began in 1792 as the first Marine insurer of the United States. INA would eventually become the company we know today as Cigna, one of the most renowned health insurance carriers offering Medicare Supplement policies. Both AM Best and S&P rate Cigna at an A.

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

Mutual of Omaha has you covered

Since 1909, we’ve existed as a Mutual company serving for the benefit and protection of our customers. Which means we don’t answer to Wall Street, we answer to you.

Ready to take the next step?

See what our customers are saying about us or get a quote from the products available in your state.

Does Plan D cover Part B?

Plan D - Though this includes most of the same benefits as plan C, it does not cover the Part B deductible. Plan F - Less expensive than other plans, F covers all the same benefits as C, with the addition of 100% of Part B's excess charges.

Does Mutual of Omaha have a vision plan?

Furthermore, those who purchase a Medigap Plan from Mutual of Omaha get a complementary eye vision plan. Thus, Mutual of Omaha Medicare Supplement Plans should definitely be on your comparison list.

Is Mutual of Omaha a Medigap carrier?

As a standardized Medigap carrier, Mutual of Omaha is a top choice with additional benefits ...

Is Mutual of Omaha a good choice?

Mutual of Omaha has a lower than average NAIC complaint ratio and proven financial strength. That along with the customers' ability to effortlessly request and immediately receive an online quote make Mutual of Omaha a top choice for people looking to purchase a Medigap Plan. Additionally, consumers can speak with a licensed agent who can answer all Medigap-related questions and help them make the right choice.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of Omaha offers all Medicare Supplement Plans that feature the same standard benefits of all Medigap Plans. Every policy is guaranteed renewable and is accepted nationwide. Also, with all Medigap policies a complementary vision care program is included. Availability, like with other carriers, varies by state.

Do you have to speak to someone to finalize Medicare?

However, because Medicare rules state that all plans have to be sold in person or on the phone, you'll eventually have to speak with someone to finalize your Medicare Supplement Plan. TopConsumerReviews.com has reviewed and ranked the best Medicare Supplement Plans available today.

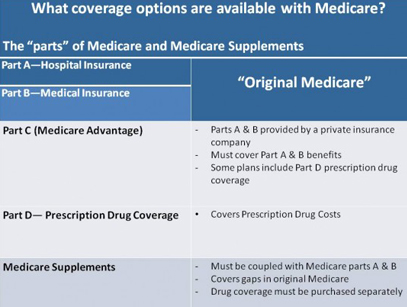

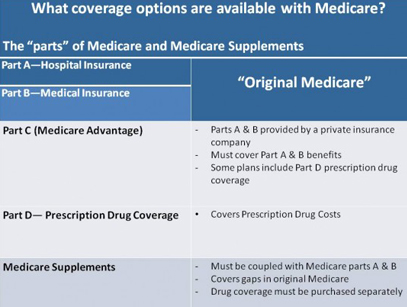

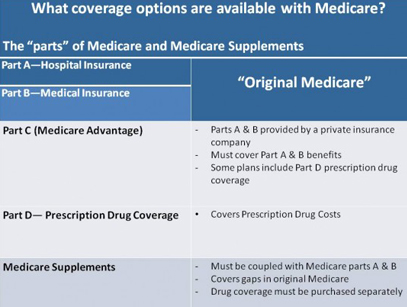

Does Medicare pay for most of your medical expenses?

You are probably already aware that your Medicare insurance pays for most of your costs - but not all. That's why Medicare Supplement plans are often known as "Medigap": they close the distance between the 80% that's covered and the 20% that isn't, so that you have fewer or no out-of-pocket costs. Continue reading below.

Is Aetna a Medigap?

They have a strong reputation and their plans were quoted as the lowest-priced premiums by many of the brokers we surveyed. It's hard to go wrong when choosing Aetna for your Medigap coverage.