Full Answer

How much will Medicare cuts affect you?

According to the Congressional Budget Office (CBO), this 4% cut amounts to $36 billion for Medicare providers, which could have a substantial impact on the delivery of care to our patient community. These Medicare cuts could increase by an additional potential 4% if Congress fails to waive PAYGO on any additional spending packages passed this year.

How did tax reform affect Medicare tax treatment?

While the recently passed Tax Cuts and Jobs Act (TCJA) did repeal the individual health coverage mandate under the Affordable Care Act, it left in place the 0.9% Additional Medicare tax on high-income individuals. The takeaway here is that there were no changes to the tax treatment of Medicare benefits or rules due to tax reform.

How would a payroll tax cut affect social security and Medicare?

Full details on how the Trump administration could implement a payroll tax cut are still not known. Particularly, it’s unclear how that cut would affect levies for Social Security or Medicare or both. Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare.

Are providers facing Medicare reimbursement cuts this year?

Providers are currently facing the potential of up to a 10% cut to Medicare reimbursement at the end of the year, barring Congressional action. These cuts stem from the following:

What of taxes go to Medicare?

FICA taxes include money taken out to pay for older Americans' Social Security and Medicare benefits. Both you and your employer pay the Medicare Tax as a part of FICA. Your total FICA taxes equal 15.3 percent of your wages — 2.9 percent for Medicare and 12.4 percent for Social Security.

Will I have to pay back the payroll tax cut?

IRS Notice 2020-65PDF allowed employers to defer withholding and payment of the employee's Social Security taxes on certain wages paid in calendar year 2020. Employers must pay back these deferred taxes by their applicable dates.

Is Social Security still being taken out of paychecks?

The Social Security taxable maximum is $142,800 in 2021. Workers pay a 6.2% Social Security tax on their earnings until they reach $142,800 in earnings for the year. READ: How Much You Will Get From Social Security. ]

What is Medicare tax Why is it taken from an employee's earnings?

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee's income.

Why is Social Security taxed twice?

The rationalization for taxing Social Security benefits was based on how the program was funded. Employees paid in half of the payroll tax from after-tax dollars and employers paid in the other half (but could deduct that as a business expense).

Will I have to pay back Social Security deferral?

If you separate or retire prior to the deferred Social Security tax being collected in full, the unpaid balance will either be collected from your final pay or you may receive a letter with instructions for repayment. Collection will occur through the debt management process.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

What is the Medicare tax rate for 2021?

1.45%FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

What is the Medicare tax rate for 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

Who pays additional Medicare tax 2021?

An employer must withhold Additional Medicare Tax from wages it pays to an individual in excess of $200,000 in a calendar year, without regard to the individual's filing status or wages paid by another employer.

What is Ryan's idea for Medicare?

One of Ryan’s ideas to change the existing system is to introduce fixed premium support payments to Medicare beneficiaries to purchase plans. He wants to restrain the program’s growth to reduce its costs, and there is the possibility of increasing the age of eligibility.

Did the Affordable Care Act go broke?

In November 2016, House Speaker Paul Ryan said that the Affordable Care Act was causing Medicare to “ go broke. ” While his assertion that Medicare was spending at an unsustainable level is true, it is incorrect to suggest the program is in any long-term financial difficulty. In reality, the Affordable Care Act helped extend its life significantly. According to a Medicare trustees report published in 2016, Medicare can now pay all of its bills until 2028. Compare this to the gloomy 2009 forecast that suggested the program would run out of money in 2016.

Is the ACA repealing?

Plans to repeal and replace the ACA are on hold for now, but ultimately, the current administration is adamant that changes are necessary, especially to the Medicare program, which it says is in need of trimming. The President promised not to touch Medicare, and for the sake of the over 57 million beneficiaries, we hope he remains true to his word.

How much will Medicare be reduced?

It’s estimated that would create an annual reduction of $25 billion in Medicare spending, starting next year.

What percentage of medical expenses are deducted in the tax cut?

This provision allows families to deduct extraordinary medical expenses that eat up more than 10 percent of their income. The original House bill proposed eliminating this deduction.

Why is the ACA mandate necessary?

Experts have told Healthline that the mandate is necessary because it forces healthier consumers into the insurance pool overseen by ACA marketplaces.

What are the provisions that will have the biggest impact on the healthcare industry?

Without a doubt, the provisions that will have the biggest impact on the healthcare industry are the repeal of the individual mandate and the potential cuts in Medicare spending. The individual mandate is a key component of the Affordable Care Act (ACA). It requires everyone to have health insurance.

What is the deduction for 2017?

During those tax years, the deduction will kick in at 7.5 percent of a household’s annual income. After that, it returns to the 10 percent threshold.

Why is the American Hospital Association opposing the tax waiver?

The bill keeps the tax waiver for reduced tuition for graduate students. Medical schools had pushed to preserve this break because it helps make graduate medical studies more affordable.

What programs are exempt from the 2010 tax cuts?

Programs such as Social Security and unemployment benefits are exempt from the cuts.

When will Medicare run out of money?

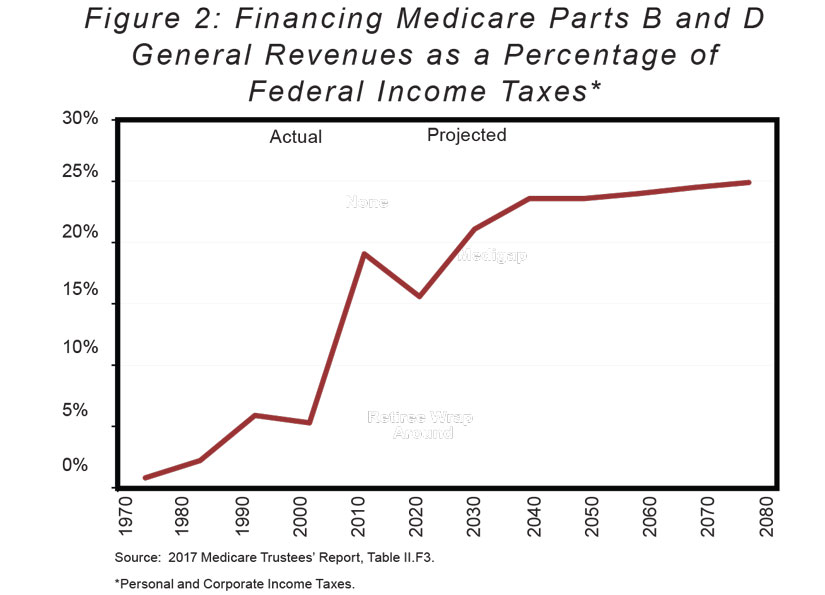

The Medicare Part A trust fund is projected to run out of money in 2026. Meanwhile, the latest estimate projects Social Security’s trust funds will be insolvent in 2035.

Why is payroll tax cut important?

A payroll tax cut is one idea President Donald Trump is considering in response to the negative effects of coronavirus on the U.S. economy. Experts say such a move would not necessarily be a magic bullet. One reason why: It could impair funding to Medicare and Social Security, which rely on payroll taxes for funding and are already facing looming ...

How much tax do you pay on Social Security?

Currently, employees and employers are each subject to a 6.2% tax for Social Security and 1.45% for Medicare. Self-employed individuals, meanwhile, make the full contributions on their own, 12.4% for Social Security and 2.9% for Medicare. In addition, if you earn over $200,000 individually, or $250,000 if you’re married and file jointly, ...

When was the last time there was a payroll tax cut?

That could be accomplished as it was the last time there was a payroll tax cut, in 2011, when money was moved from the general fund to the trust funds. However, halting payroll taxes for up to a year, which has been mentioned as a potential strategy, would be very expensive.

Will people who lose their jobs get a payroll tax cut?

Those who lose their jobs because of the negative impacts of the coronavirus will not benefit from a payroll tax cut. “They’re the ones who are going to have the biggest drops in income, and yet they’re not going to get anything from a payroll tax holiday,” Greszler said.

Does the pullback in consumer spending affect Social Security?

Plus, because the pullback in consumer spending is related to health concerns, not financial worries, it might not result in increased spending, experts say.

Is payroll tax regressive?

The other problem is that payroll taxes are regressive, so it’s a bigger chunk for people with low or moderate incomes than high income workers. And big earners are unlikely to spend that extra cash. “We know when high -income people get a tax cut, they don’t spend as much as low-income people do,” Gleckman said.

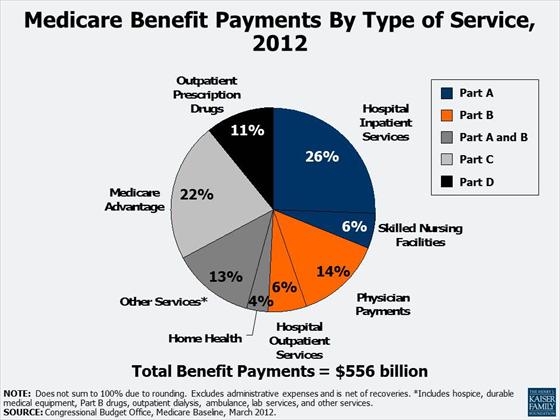

How is Medicare funded?

Medicare is funded by a payroll tax, premiums and surtaxes from beneficiaries, and general revenue.

What does Medicare Part B cover?

Medicare Part B helps cover: services from doctors and other health care providers; outpatient care; home health care; durable medical equipment; and some preventive services. Part B is optional and may be deferred if the beneficiary or their spouse is still working and has health coverage through their employer.

Who does the Social Security Administration provide health insurance to?

It provides health insurance for Americans aged 65 and older who have worked and paid into the system through the payroll tax. It also provides health insurance to younger people with some disability status as determined by the Social Security Administration.

Did Medicare change tax form?

The takeaway here is that there were no changes to the tax treatment of Medicare benefits or rules due to tax reform. While there are no changes to Medicare rules because of tax form, understanding how Medicare works can be helpful in understanding your overall financial picture.

Medicare PAYGO Cuts

The American Rescue Plan Act of 2021, signed into law by President Biden in March, increased spending without offsets to other federal programs. Under statutory Pay-As-You-Go (PAYGO) rules, any increases to the federal deficit automatically triggers an additional series of acrossthe-board deductions to federal programs.

Medicare Sequester Delay Extension

At the onset of the COVID-19 pandemic, Congress delayed the automatic 2% Medicare sequestration cuts as providers were struggling to keep their doors open to their communities. Various delays were enacted during this public health emergency, with the last pause setting to expire on January 1, 2022.

Changes to the Medicare Conversion Factor

Last year, due to a temporary patch approved by Congress, the Centers for Medicare & Medicaid Services (CMS) increased all providers’ payments by 3.75% to offset a change in the Medicare conversion factor that CMS implemented as part of a change to Evaluation and Management (E/M) codes designed to increase support for primary care services.

When did cancer deaths drop in 2020?

23, 2018 file photo, a doctor, center, directs a special camera to look at a patient's tumor at a hospital in Philadelphia. According to research released on Wednesday, May 13, 2020, cancer deaths have dropped more in states that expanded Medicaid coverage under the Affordable Care Act ...

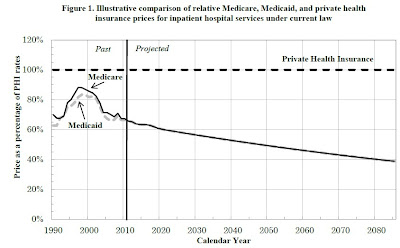

Do surgeons have to pay higher fixed costs?

Surgeons contend with high fixed costs and debt, and now face plummeting revenue. Over the last 20 years, the costs of being a surgeon have increased while Medicare’s surgical payments have not only failed to keep up with inflation but have actually declined in nominal terms.

Is telehealth a replacement for surgical care?

But telehealth is no replacement for surgical care, and the health care system simply cannot absorb cuts of this magnitude right now.

What services are being cut under Medicare?

That's because the Centers for Medicare & Medicaid Services (CMS) recently proposed cuts to certain Medicare services, including breast cancer screening, radiation oncology and physical therapy, along with other medical specialties.

Is Medicare a long delay?

Millions will wake up to a Medicare system that operates with long delays for previously routine services; conditions that are normally treatable with early detection will thrive undetected. Read More. This is unconscionable, and it's worse because there's an easy fix.

Can CMS suspend Medicare cuts?

Congress can direct the CMS to suspend these cuts by waiving the requirement that changes to Medicare must be budget-neutral. That would allow CMS a one-time reprieve from balancing its budget, and it would give the medical profession an opportunity to recover and rebuild.