How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

How much is Medicare Part B deductible?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020.

How is the premium calculated for Medicare Part B?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

What is the Medicare penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers. Find out who to call about Medicare options, claims and more. Talk to Someone

How is Medicare penalty calculated?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

How do you calculate the Part B penalty?

Calculating Lifetime Penalty Fees Calculating your Part B penalty is fairly straightforward. You simply add 10% to the cost of your monthly premium for each year-long period you didn't have Medicare. It's simple to get a snapshot of what you will have to pay each month.

How do I get rid of Medicare Part B penalty?

You can appeal to remove the penalty if you think you were continuously covered by Part B or job-based insurance. You can also appeal to lower the penalty amount if you think it was calculated incorrectly. Call your former employer or plan and ask for a letter proving that you were enrolled in coverage.

Is there a limit on the Medicare Part B penalty?

As of now, there is no cap when calculating the Medicare Part B late enrollment penalty. However, legislation has been introduced to cap the Medicare Part B penalty at 15% of the current premium, regardless of how many 12-month periods the beneficiary goes without coverage.

How is late enrollment calculated?

The late enrollment penalty amount typically is 1% of the “national base beneficiary premium” (also called the base beneficiary premium) for each full, uncovered month that the person didn't have Medicare drug coverage or other creditable coverage. The national base beneficiary premium for 2022 will be $33.37.

What is the penalty for Part B?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you'll have to pay this penalty for as long as you have Part B.

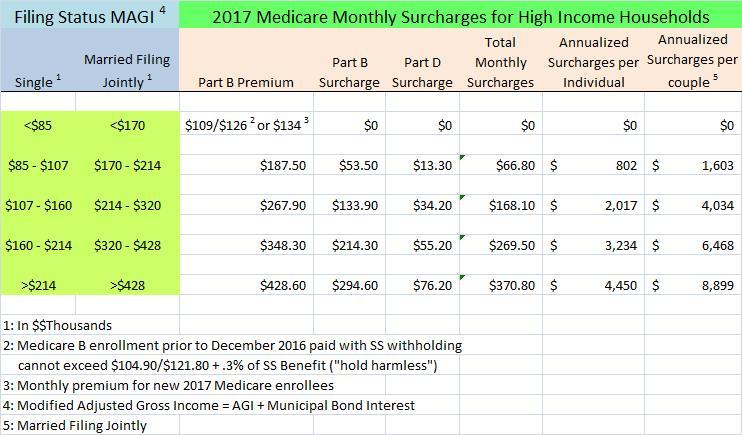

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How long is a member responsible for a late enrollment penalty for Medicare?

63 daysMedicare beneficiaries may incur a late enrollment penalty (LEP) if there is a continuous period of 63 days or more at any time after the end of the individual's Part D initial enrollment period during which the individual was eligible to enroll, but was not enrolled in a Medicare Part D plan and was not covered under ...

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Can Medicare penalties be waived?

You may qualify to have your penalty waived if you were advised by an employee or agent of the federal government – for example by Social Security or 1-800-MEDICARE – to delay Part B. Asking for the correction is known as requesting equitable relief.

What will Irmaa be in 2021?

The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

Can you stop and restart Medicare Part B?

In the event that you lose this insurance in the future, you won't incur a late penalty as long as you sign up for Part B again within eight months of retiring or otherwise stopping work.

Special Enrollment Periods For Medicare Part A And Part B

Some beneficiaries qualify for Special Enrollment Periods , in certain situations. If you qualify for an SEP, you can enroll in Medicare Part A or Part B during your SEP without having to pay a late-enrollment penalty.

How Will I Know How Much My Medicare Part B Premium Will Be

The Social Security Administration or the Railroad Retirement Board, if that applies to you will tell you how much your Part B premium will be. Heres a table that may help you to know what to expect, particularly if your income is above a certain level.

Medicare Part A Late Enrollment Penalties

The late enrollment penalty for Medicare Part A , is 10% of your monthly premium if you miss your Medicare enrollment deadline. This is applied no matter how long the delay is, and the penalty is added to your premium cost for twice the number of years you waited to enroll.

Medicare Prescription Drug Plan Late

If you dont enroll in a Medicare Prescription Drug Plan during the Initial Enrollment Period for Part D, you may have to pay a late-enrollment penalty if you enroll in a Part D plan later. You wont have to pay this penalty if you:

What Is The Late Enrollment Penalty For Medicare Part B

Medicare Part B enrollment is complicated, and the wrong decision can leave you without health coverage for months and lead to lifetime premium penalties. Part B premiums increase 10 percent for every 12-months you were eligible for Part B but not enrolled.

Medicare Part C Premiums

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

How Much Is The Medicare Part B Penalty

The penalty for late enrollment in Part B is an additional 10% for each 12-month period that you delay it.

How much is the penalty for Medicare Part B?

For each 12-month period you delay enrollment in Medicare Part B, you will have to pay a 10% Part B premium penalty, unless you have insurance based on your or your spouse’s current work (job-based insurance) or are eligible for a Medicare Savings Program (MSP) .

How much is the Part B penalty for 2021?

Since the base Part B premium in 2021 is $148.50, your monthly premium with the penalty will be $252.45 ($148.50 x 0.7 + $148.50). Note: Although your Part B premium amount is based on your income, your penalty is calculated based on the base Part B premium. The penalty is then added to your actual premium amount.

Do you have to pay Medicare premium penalty every month?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay premium penalties, once you turn 65 you will no longer have to pay the premium penalty.

How to avoid Medicare Part B late enrollment penalty?

How to Avoid the Medicare Part B Late Enrollment Penalty. The best way to avoid Part B penalties is to plan ahead. You have several Medicare options to choose from, including Original Medicare plus a Medigap Plan. MedicareFAQ can help you through these decisions by answering your questions and helping you prepare for Medicare.

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

How long do you have to wait to sign up for Part B?

Usually, you will be allowed to sign up for Part B right away, during a “ Special Enrollment Period .”. This is an eight-month period beginning when the employment coverage ends. If you do not enroll during this period, you’ll have to pay a Part B penalty for each full 12 months you wait, beyond the date, the SEP began.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

Is there a cap on Part B late enrollment?

As of now, there is no cap on Part B late enrollment penalty. There has been a bill introduced called the “Medicare Part B Fairness Act” or H.R.1788. This bill would cap the amount at 15% for the current premium.

How long do you have to sign up for Medicare after you return?

Instead, you get a special enrollment period of up to three months after your return to the U.S. to sign up. If you enroll at that time, you are not liable for Part A or Part B late penalties. Return to Medicare Q&A Tool main page >>.

What happens if you miss the enrollment deadline?

If you miss your enrollment deadline but sign up during the next GEP, and in the meantime fewer than 12 full months have elapsed, you will not pay a penalty. For example, if your IEP ends on May 31, only 10 months will have passed before the end of the GEP (March 31). If you are under age 65 and have Medicare due to disability, ...

Why is the penalty clock reset?

At that point the penalty clock is reset because you become eligible for Medicare based on age instead of disability. If you have Medicaid as well as Medicare, your state pays your Part B premiums and any late penalties are waived. If you qualify for assistance from your state in paying Medicare costs under a Medicare Savings Program, ...

Can I enroll in Medicare Part B abroad?

If you qualify for assistance from your state in paying Medicare costs under a Medicare Savings Program, the state pays your Part B premiums and any late penalties are waived. If you live outside the United States and are not entitled to premium-free Part A benefits, you cannot enroll in Part A or Part B abroad.

Do I have to sign up for Part B?

Part B (which covers doctors’ services, outpatient care and medical equipment) is a voluntary benefit. You don’t have to sign up if you don’t want to. However, to avoid late penalties, you need to meet your personal enrollment deadline.

Can you get Cobra if you don't meet the enrollment deadline?

If the standard premium increases or decreases in any year, your penalty would change accordingly. It’s important to understand that having retiree health benefits or COBRA extended coverage from a former employer after age 65 will not save you from Part B late penalties if you don’t meet your enrollment deadline.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the penalty for Medicare Part A?

Medicare Part A Late Enrollment Penalties. The late enrollment penalty for Medicare Part A (for those who are not automatically enrolled), is 10% of your monthly premium if you miss your Medicare enrollment deadline. This is applied no matter how long the delay is, and the penalty is added to your premium cost for twice the number ...

What is the late enrollment penalty for Medicare Part D?

The late enrollment penalty for Medicare Part D is 1% of the average national base monthly premium, rounded to the nearest 10 cents for each month you did not enroll. This penalty is added to your premium each month you are enrolled, and generally lasts for as long as you have Medicare drug coverage.

How long does Medicare Part A last?

Additionally, for those that have to pay for Medicare Part A, there is also a late enrollment penalty for not signing up when first eligible, which is typically when you turn 65. The penalties for Parts B and D will last for your lifetime. For Part A, the maximum number of years the penalty can last is four.

What is Medicare late enrollment penalty?

What is a Medicare Late Enrollment Penalty? A Medicare Late Enrollment Penalty (LEP) is an additional monthly amount you will be required to pay to Medicare if you did not enroll in Medicare Part B and/or D when you first became eligible.

How much is Part B insurance in 2021?

So for 2021, the base cost would be $148.50, multiplied by 50%, and would equal $74.25, which would be added to your Part B monthly premium costs.

Can you speculate on the amount of your Medicare penalty?

You can speculate on the amount of your penalty; however, you will be notified of the actual amount when you formally apply for Medicare Parts A, B or D. Once the government is aware of your enrollment into these parts of Medicare, they will calculate your penalty and send you, in writing, the actual amount you owe for the upcoming year. ...

How is Medicare Part B calculated?

Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior. This means your 2021 Medicare Part B premium may be calculated using the income you reported on your 2019 taxes. If your reported income was higher ...

What is the late enrollment penalty for Medicare?

The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didn’t sign up. Medicare Part B. Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how ...

How does Medicare Advantage work?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs. A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

How much will Medicare pay in 2021?

If you paid Medicare taxes for fewer than 30 quarters, you will pay $471 per month for Part A in 2021.

What is the penalty for not enrolling in Part A?

The Part A late enrollment penalty is 10 percent ...

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

Do high income people pay higher Medicare premiums?

Learn about other Medicare costs and how they are calculated. If you are a high-income earner, you could potentially pay higher premiums for Medicare Part B (medical insurance) and Medicare prescription drug coverage.